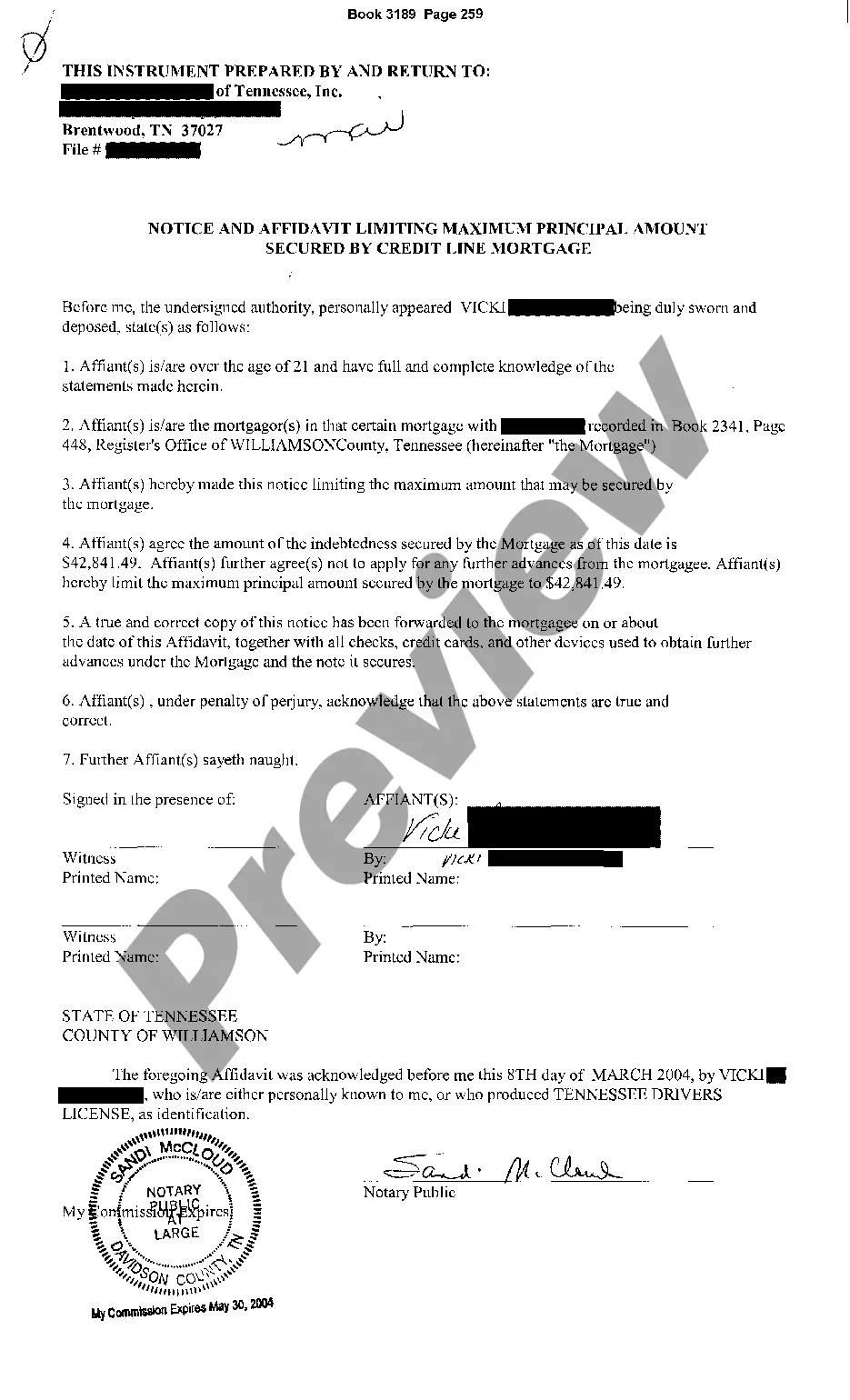

Chattanooga Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage is a legal document that sets limitations on the maximum principal amount that can be secured by a credit line mortgage in Chattanooga, Tennessee. This document is essential for both lenders and borrowers to ensure compliance with the applicable laws and regulations. The purpose of the Chattanooga Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage is to protect the interests of both the lender and the borrower. It ensures that the borrower does not borrow more than what is allowed by law, and it provides the lender with recourse in case of default. By signing this notice and affidavit, the borrower acknowledges the maximum principal amount as specified in the credit line mortgage agreement. This ensures that the borrower is aware of the restrictions and agrees to abide by them. The lender, on the other hand, is protected from potential losses by enforcing a limit on the principal amount that can be secured by the credit line mortgage. Different types of Chattanooga Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage may vary in terms of the principal amount restrictions they impose. Some versions may set a fixed maximum principal amount that cannot be exceeded, while others may set a percentage limit based on the value of the property or the borrower's income. Keywords: Chattanooga Tennessee, Notice and Affidavit, Limiting Maximum Principal Amount, Secured by Credit Line Mortgage, legal document, lenders, borrowers, compliance, laws and regulations, protect, interests, acknowledge, restrictions, abide, enforcement, restrictions, fixed maximum, percentage limit, property value, borrower's income.

Chattanooga Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage

State:

Tennessee

City:

Chattanooga

Control #:

TN-E387

Format:

PDF

Instant download

This form is available by subscription

Description

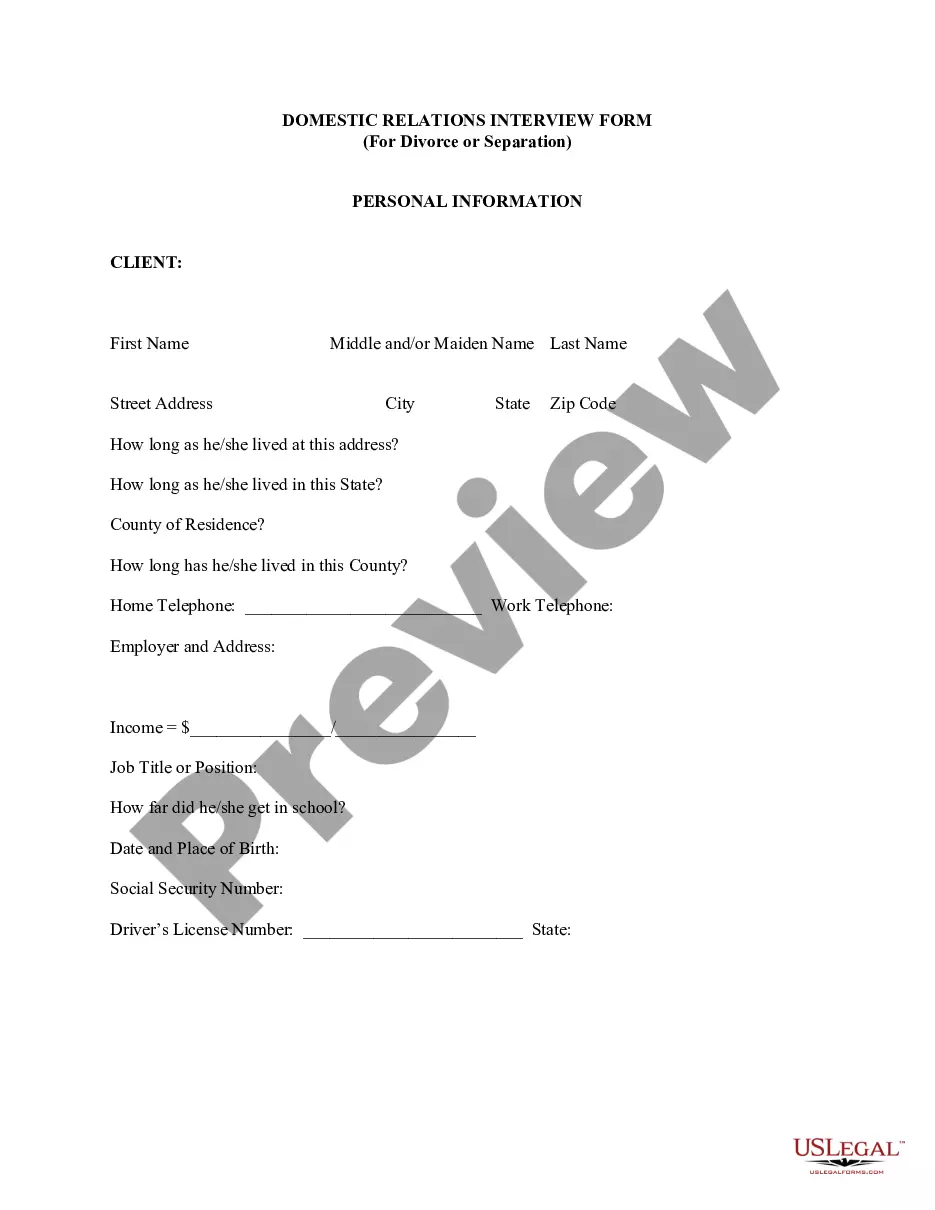

Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage

Chattanooga Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage is a legal document that sets limitations on the maximum principal amount that can be secured by a credit line mortgage in Chattanooga, Tennessee. This document is essential for both lenders and borrowers to ensure compliance with the applicable laws and regulations. The purpose of the Chattanooga Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage is to protect the interests of both the lender and the borrower. It ensures that the borrower does not borrow more than what is allowed by law, and it provides the lender with recourse in case of default. By signing this notice and affidavit, the borrower acknowledges the maximum principal amount as specified in the credit line mortgage agreement. This ensures that the borrower is aware of the restrictions and agrees to abide by them. The lender, on the other hand, is protected from potential losses by enforcing a limit on the principal amount that can be secured by the credit line mortgage. Different types of Chattanooga Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage may vary in terms of the principal amount restrictions they impose. Some versions may set a fixed maximum principal amount that cannot be exceeded, while others may set a percentage limit based on the value of the property or the borrower's income. Keywords: Chattanooga Tennessee, Notice and Affidavit, Limiting Maximum Principal Amount, Secured by Credit Line Mortgage, legal document, lenders, borrowers, compliance, laws and regulations, protect, interests, acknowledge, restrictions, abide, enforcement, restrictions, fixed maximum, percentage limit, property value, borrower's income.

Free preview

How to fill out Chattanooga Tennessee Notice And Affidavit Limiting Maximum Principal Amount Secured By Credit Line Mortgage?

If you’ve already utilized our service before, log in to your account and download the Chattanooga Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make sure you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Chattanooga Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!