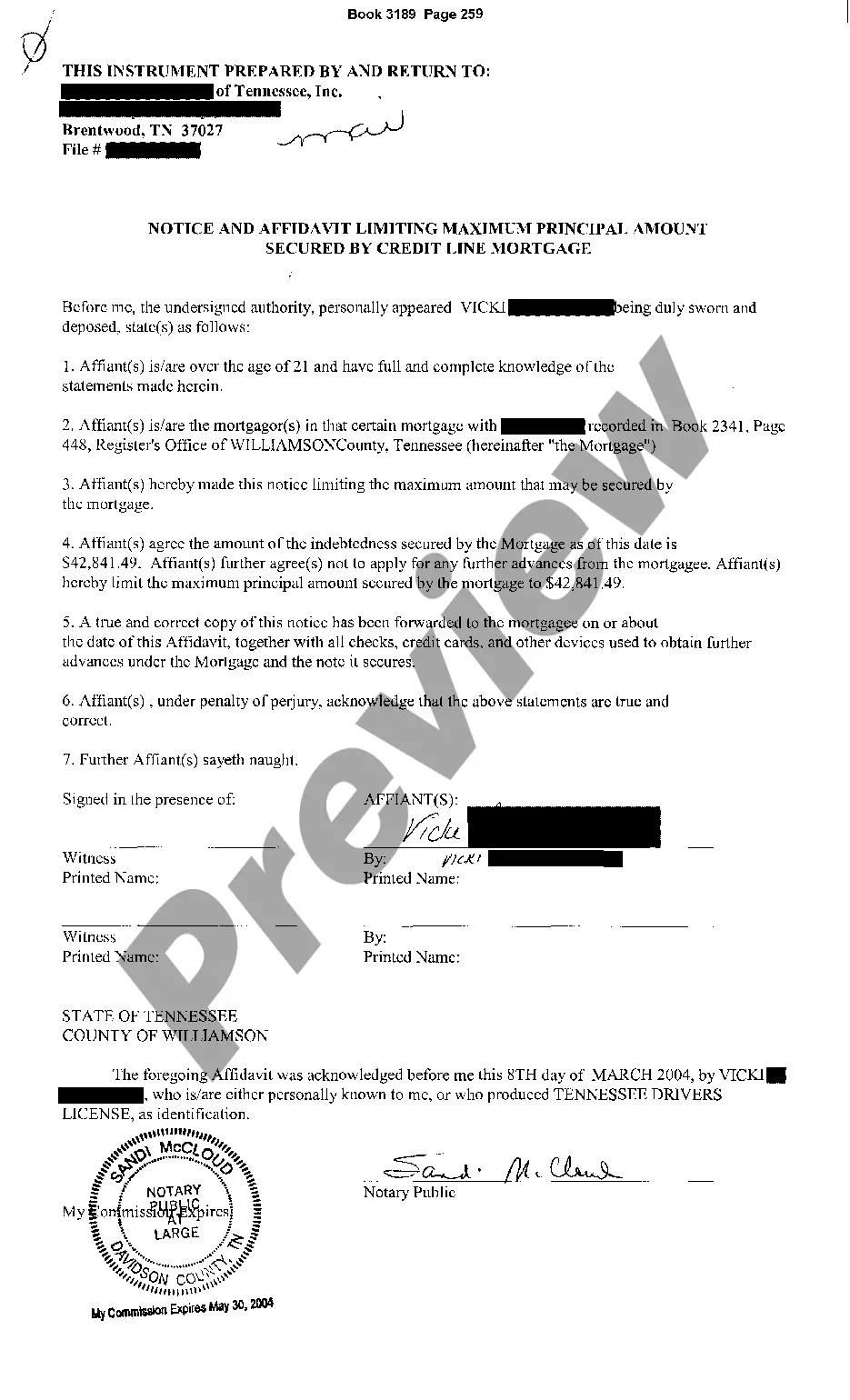

Knoxville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage is a legal document used in Knoxville, Tennessee, to impose restrictions on the maximum principal amount that can be secured by a credit line mortgage. This legal tool aims to protect both the borrower and the lender by setting an upper limit on the borrowed amount. The Notice and Affidavit document is a crucial part of the credit line mortgage process in Knoxville, Tennessee, as it ensures transparency and regulates the terms and conditions of the credit line. By specifying the maximum principal amount, borrowers are informed about their borrowing limits, preventing excessive borrowing and potential financial strain. Lenders are also safeguarded against excessive loan amounts, reducing the risk of defaulted payments. There are different types of Knoxville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage, which include: 1. Residential Credit Line Mortgage: This type is specifically designed for residential properties in Knoxville, Tennessee, and sets a maximum principal amount that can be secured against the property. 2. Commercial Credit Line Mortgage: Aimed at commercial properties, this affidavit limits the maximum principal amount that can be borrowed against a commercial property in Knoxville. 3. Refinancing Credit Line Mortgage: This variation is used when refinancing an existing mortgage in Knoxville, Tennessee, and the Notice and Affidavit serve to restrict the maximum principal amount that can be secured during the refinancing process. 4. Equitable Credit Line Mortgage: This type of affidavit is applicable when a credit line mortgage is being secured based on the equity value of the property. The document sets a maximum principal amount, ensuring the loan does not exceed a certain limit based on equity. In summary, the Knoxville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage play a vital role in regulating credit line mortgages in the area. By imposing a maximum principal amount, this legal document aims to protect both borrowers and lenders by establishing clear borrowing limits and avoiding excessive indebtedness.

Knoxville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage

Description

How to fill out Knoxville Tennessee Notice And Affidavit Limiting Maximum Principal Amount Secured By Credit Line Mortgage?

Are you looking for a reliable and affordable legal forms provider to get the Knoxville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage? US Legal Forms is your go-to option.

No matter if you need a simple arrangement to set rules for cohabitating with your partner or a set of documents to move your separation or divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and frameworked in accordance with the requirements of specific state and county.

To download the document, you need to log in account, locate the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Knoxville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage conforms to the laws of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is good for.

- Start the search over in case the template isn’t good for your legal scenario.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Knoxville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage in any provided format. You can get back to the website at any time and redownload the document without any extra costs.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting your valuable time researching legal papers online for good.