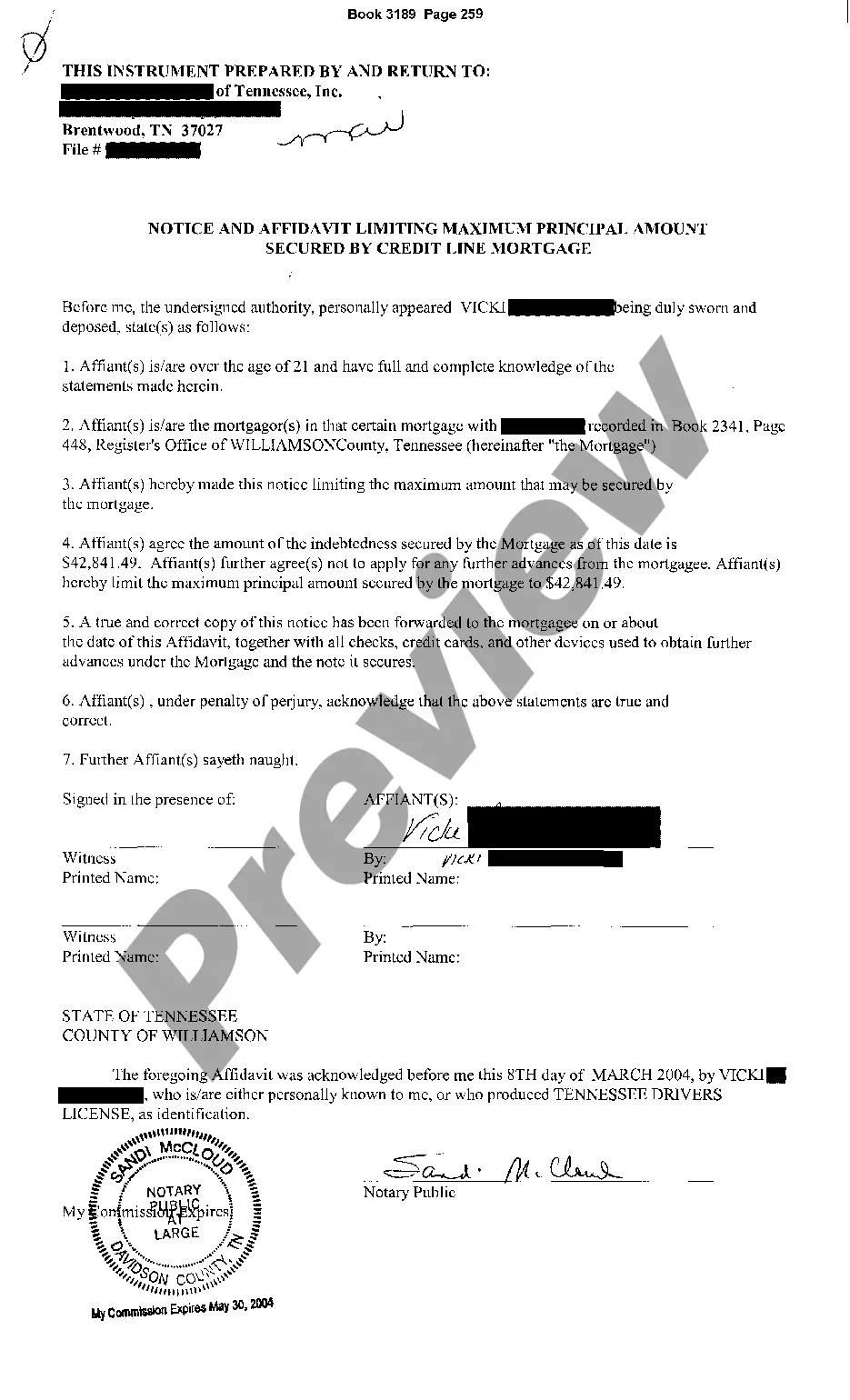

Memphis Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage is a legal document that pertains to mortgage loans secured by a credit line in the state of Tennessee, specifically in the city of Memphis. This notice and affidavit serve to establish limitations on the maximum principal amount that can be secured by such a credit line mortgage. This document is crucial in the mortgage lending process as it ensures compliance with regulations and provides important information to borrowers and lenders. It outlines the legal obligations and restrictions associated with credit line mortgages in Memphis, Tennessee, and helps protect the rights and interests of both parties involved. The Memphis Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage may come in different types or variations, depending on the specific circumstances or requirements. These variations could include: 1. Residential Credit Line Mortgage Notice and Affidavit: This type of notice is applicable to credit line mortgages secured by residential properties, such as single-family homes, townhouses, or condominiums. It ensures that the maximum principal amount is limited according to the regulations and ensures transparency in the lending process. 2. Commercial Credit Line Mortgage Notice and Affidavit: This variation is designed for credit line mortgages secured by commercial properties, such as office buildings, retail spaces, or industrial properties. It provides specific guidelines and restrictions for the maximum principal amount that can be secured by the credit line mortgage in commercial lending situations. 3. Investment Property Credit Line Mortgage Notice and Affidavit: This type applies to credit line mortgages secured by investment properties, including rental properties or properties acquired for investment purposes. It establishes the limitations on the maximum principal amount according to the specific characteristics of investment properties. These variations of the Memphis Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage ensure that the document is tailored to the specific context and property type involved. This helps in providing clarity, compliance, and legal protection for both borrowers and lenders in the mortgage lending process. Keywords: Memphis Tennessee, notice, affidavit, limiting, maximum, principal amount, secured, credit line mortgage, residential, commercial, investment property.

Memphis Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage

Description

How to fill out Memphis Tennessee Notice And Affidavit Limiting Maximum Principal Amount Secured By Credit Line Mortgage?

If you are looking for a valid form template, it’s impossible to find a better place than the US Legal Forms website – probably the most extensive online libraries. Here you can find a large number of templates for organization and individual purposes by categories and regions, or key phrases. Using our advanced search function, getting the newest Memphis Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage is as elementary as 1-2-3. Additionally, the relevance of each document is confirmed by a group of expert attorneys that regularly check the templates on our website and update them based on the newest state and county regulations.

If you already know about our platform and have a registered account, all you should do to receive the Memphis Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage is to log in to your account and click the Download button.

If you utilize US Legal Forms for the first time, just refer to the instructions below:

- Make sure you have chosen the sample you require. Read its information and use the Preview feature to explore its content. If it doesn’t suit your needs, utilize the Search option at the top of the screen to discover the proper file.

- Confirm your selection. Select the Buy now button. Following that, choose your preferred pricing plan and provide credentials to register an account.

- Make the purchase. Use your credit card or PayPal account to finish the registration procedure.

- Get the template. Pick the format and download it on your device.

- Make modifications. Fill out, revise, print, and sign the obtained Memphis Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage.

Every template you add to your account has no expiration date and is yours forever. It is possible to gain access to them via the My Forms menu, so if you need to have an extra duplicate for enhancing or creating a hard copy, you can come back and save it once again anytime.

Take advantage of the US Legal Forms extensive collection to gain access to the Memphis Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage you were looking for and a large number of other professional and state-specific templates on a single platform!