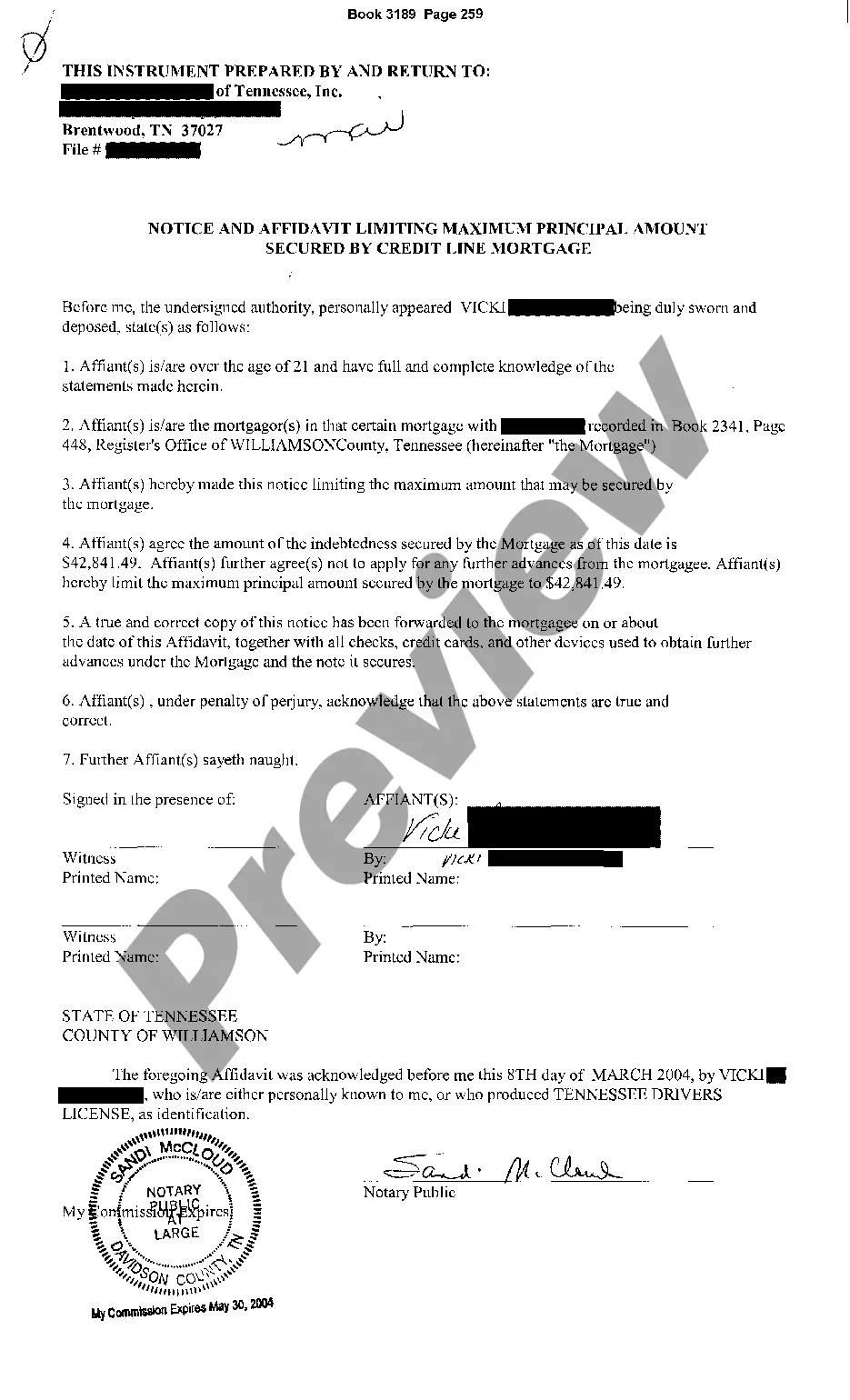

The Murfreesboro Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage is a legal document designed to ensure compliance and limit the maximum principal amount that can be secured by a credit line mortgage in Murfreesboro, Tennessee. The purpose of this notice and affidavit is to provide transparency and protect both lenders and borrowers involved in credit line mortgage transactions. By outlining specific limits on the principal amount, this document serves as a safeguard against excessive borrowing and potential financial risks. Keywords: Murfreesboro Tennessee, Notice and Affidavit, Limiting, Maximum Principal Amount, Secured, Credit Line Mortgage. Different types of Murfreesboro Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage may include: 1. Residential Credit Line Mortgage: This type of notice and affidavit specifically pertains to credit line mortgages secured against residential properties in Murfreesboro, Tennessee. It outlines the maximum principal amount allowed for such mortgages, ensuring responsible lending practices in the residential real estate market. 2. Commercial Credit Line Mortgage: For commercial properties in Murfreesboro, Tennessee, this notice and affidavit sets limits on the maximum principal amount that can be secured by a credit line mortgage. It is particularly important for protecting both lenders and borrowers in commercial real estate transactions. 3. Agricultural Credit Line Mortgage: This category focuses on credit line mortgages secured against agricultural properties in Murfreesboro, Tennessee. The notice and affidavit in this context establish specific limitations on the maximum principal amount, considering the unique nature and risks associated with agricultural lending. 4. Construction Credit Line Mortgage: When it comes to credit line mortgages directly related to construction projects in Murfreesboro, Tennessee, this notice and affidavit presents guidelines and restrictions on the maximum principal amount that can be secured. It ensures responsible lending practices and helps manage the risks associated with construction financing. 5. Investment Property Credit Line Mortgage: This type of notice and affidavit addresses credit line mortgages secured against investment properties, such as rental properties or vacation homes, in Murfreesboro, Tennessee. It outlines the maximum principal amount that can be secured, ensuring financial prudence in real estate investment transactions. Overall, the Murfreesboro Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage serves as an important legal instrument to protect both lenders and borrowers, promoting responsible borrowing and lending practices in various sectors of the real estate market.

Murfreesboro Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage

Description

How to fill out Murfreesboro Tennessee Notice And Affidavit Limiting Maximum Principal Amount Secured By Credit Line Mortgage?

We always strive to reduce or avoid legal issues when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney solutions that, usually, are extremely expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based collection of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without using services of an attorney. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Murfreesboro Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is equally effortless if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Murfreesboro Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Murfreesboro Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage is suitable for your case, you can choose the subscription plan and proceed to payment.

- Then you can download the form in any suitable format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!