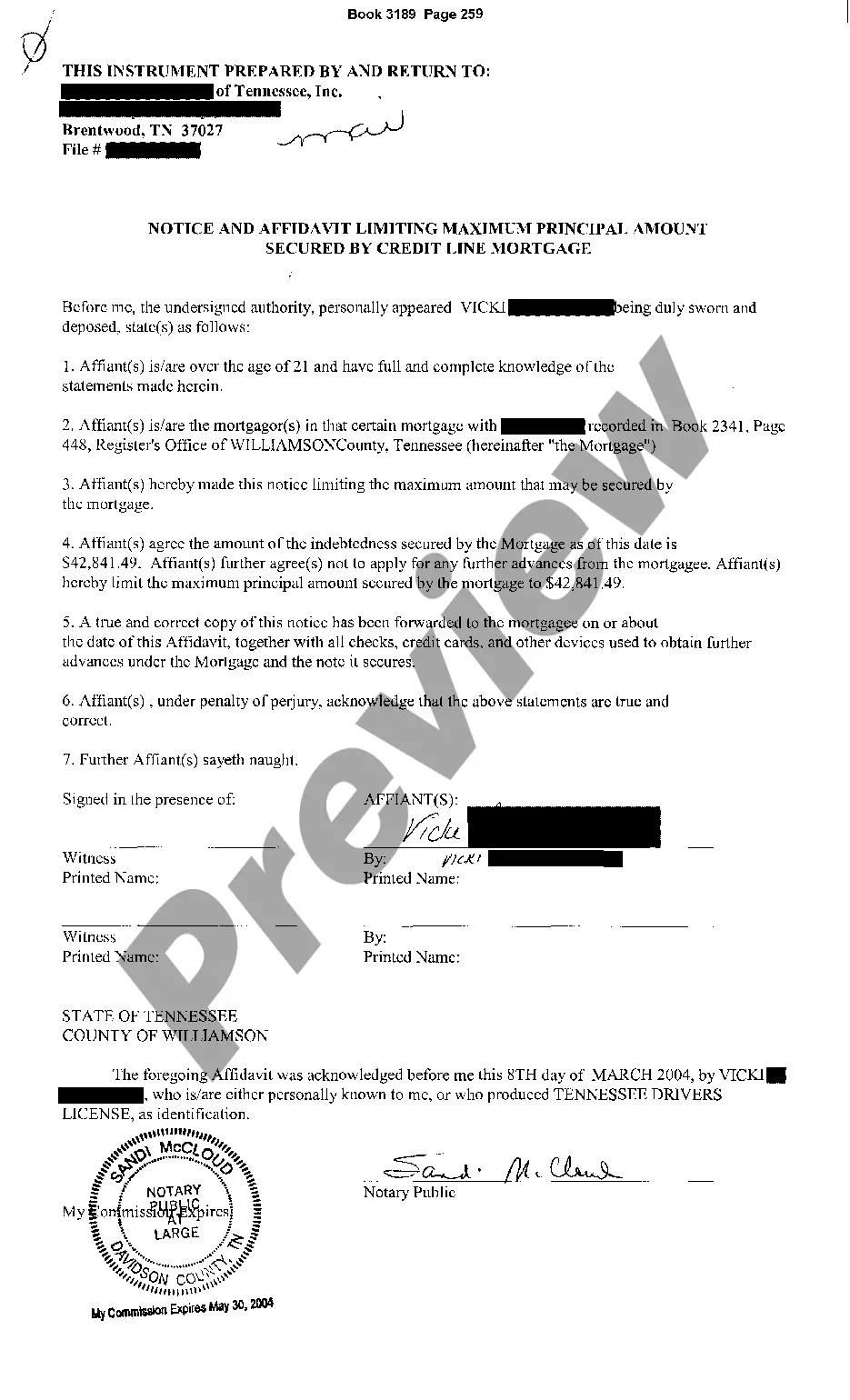

Nashville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage is a legal document that outlines the terms and conditions for a credit line mortgage in the city of Nashville, Tennessee. It serves to restrict the maximum principal amount that can be secured by this type of mortgage. This notice and affidavit play a crucial role in protecting the rights of both the lender and the borrower involved in a credit line mortgage transaction. The purpose of this document is to establish clear boundaries and limitations on the amount of money that can be borrowed against the credit line mortgage. By setting a maximum principal amount, it ensures that the borrower cannot exceed a certain limit. This is crucial for maintaining financial stability and minimizing the risks associated with excessive borrowing. The Nashville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage include several key components: 1. Identification: The document includes the names, addresses, and contact information of both the creditor (lender) and the debtor (borrower). 2. Credit Line Mortgage Details: It provides specific details about the credit line mortgage, such as the property address, legal description, and recording information. 3. Maximum Principal Amount: The notice explicitly states the maximum principal amount that can be secured by the credit line mortgage. This ensures that both the lender and the borrower are aware of the borrowing limit. 4. Affidavit: The document includes an affidavit section where the borrower confirms their understanding of the limitations and agrees to abide by them. This ensures that the borrower acknowledges their responsibilities and prevents any future disputes. Different types of Nashville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage may vary based on factors such as the lender's requirements, the borrower's creditworthiness, and the specific terms and conditions agreed upon by both parties. However, the core purpose of limiting the maximum principal amount remains consistent across all variations of this legal document. In conclusion, the Nashville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage is a crucial document in credit line mortgage transactions in Nashville, Tennessee. It establishes boundaries and restrictions, protecting the interests of both lenders and borrowers involved. By clearly outlining the maximum principal amount that can be secured, this document ensures responsible borrowing practices and minimizes financial risks for all parties involved.

Nashville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage

Description

How to fill out Nashville Tennessee Notice And Affidavit Limiting Maximum Principal Amount Secured By Credit Line Mortgage?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both individual and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Nashville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Nashville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few more actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make sure you’ve picked the right one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Nashville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Take advantage of the US Legal Forms library to always have essential document templates for any demands just at your hand!