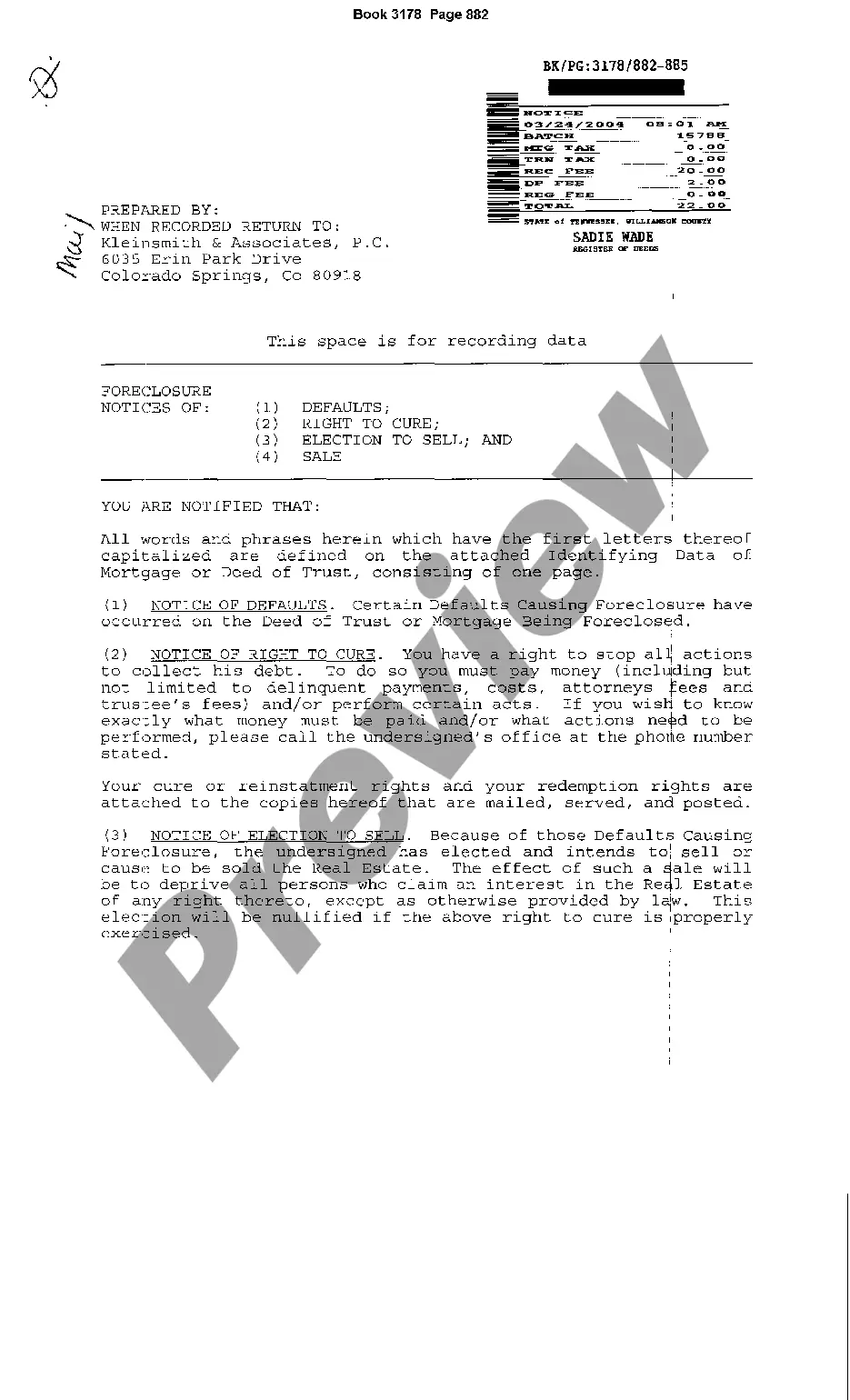

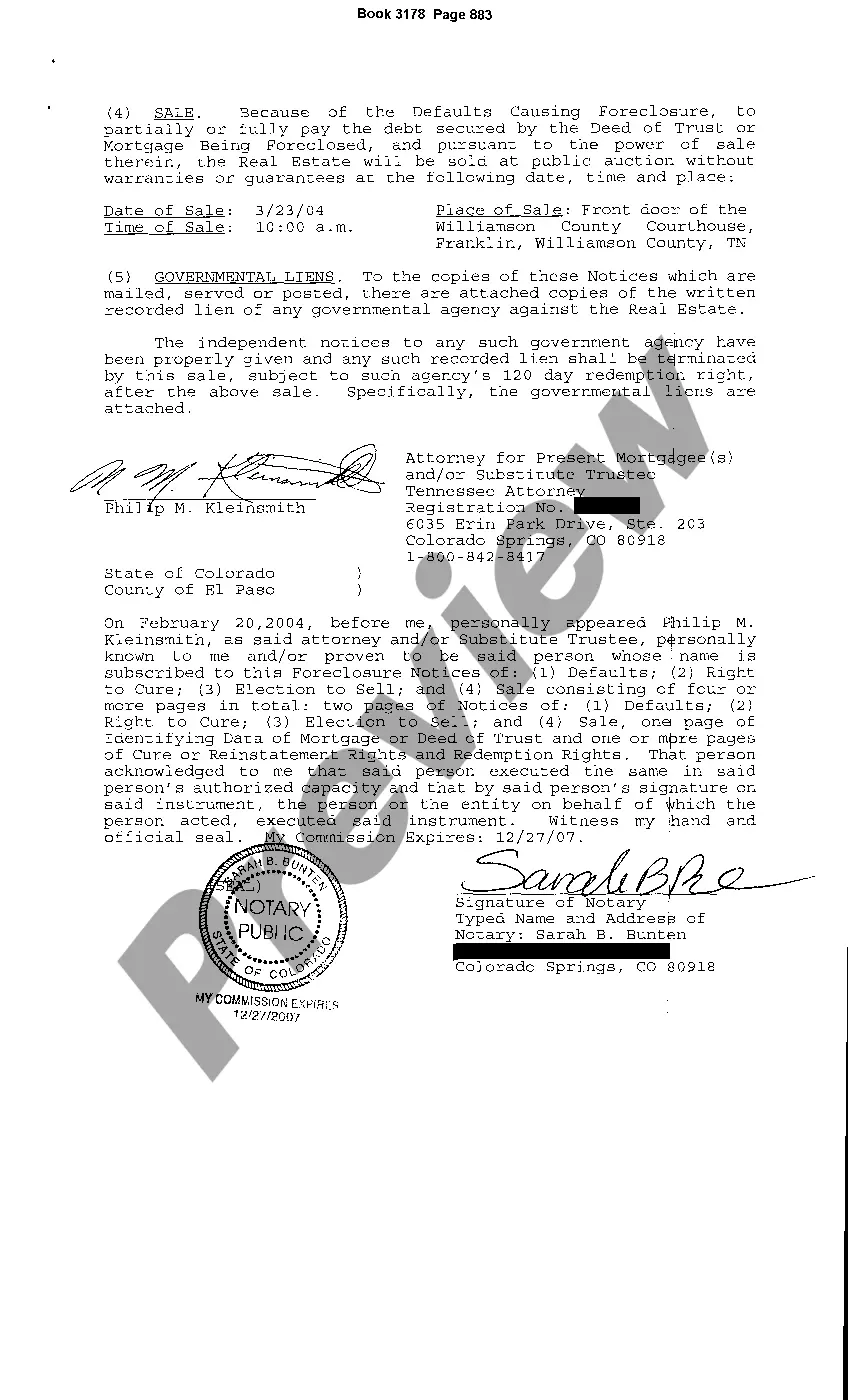

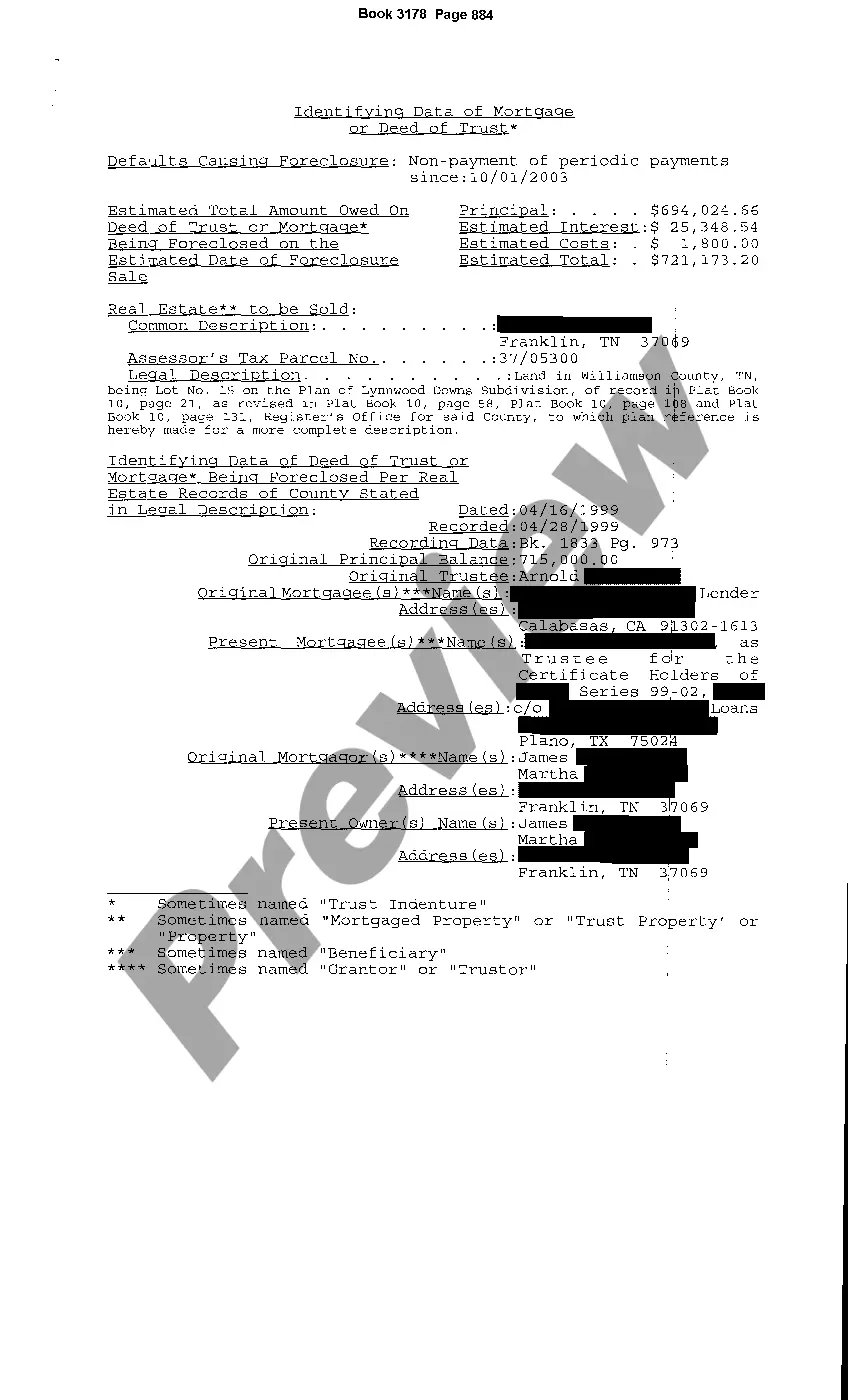

Chattanooga Tennessee Foreclosure Notice of Default is a legal document that is filed when a homeowner fails to make mortgage payments and is in default on their loan. It serves as a formal notification to the homeowner that the lender intends to proceed with foreclosure proceedings. Keywords: 1. Chattanooga Tennessee: Refers to the specific geographic location where the foreclosure is taking place. 2. Foreclosure: The legal process in which a lender takes ownership of a property due to the homeowner's failure to meet loan payments. 3. Notice of Default: A formal written notice served to the homeowner as a warning that they are in breach of their loan agreement. 4. Mortgage Payments: The periodic payments made by the homeowner to their lender to repay the loan used to purchase the property. Types of Chattanooga Tennessee Foreclosure Notice of Default: 1. Pre-Foreclosure Notice of Default: This is the initial notice served to the homeowner when they fall behind on their mortgage payments, informing them of their default status. 2. Formal Foreclosure Notice of Default: If the homeowner does not rectify the default within a specified time frame after receiving the pre-foreclosure notice, a formal Notice of Default is filed and recorded at the county courthouse. This begins the official foreclosure process. 3. Post-Foreclosure Notice of Default: In the event that the property goes through a foreclosure auction and is not sold, a post-foreclosure notice is issued to the homeowner, informing them that the property now belongs to the lender and providing instructions for vacating the premises. It is important for homeowners in Chattanooga, Tennessee, to understand the implications of receiving a Notice of Default on their property. Seeking legal counsel and exploring options for loan modification or reinstatement can help homeowners avoid foreclosure and potentially retain ownership of their homes.

Stop Foreclosure Chattanooga

Description

How to fill out Chattanooga Tennessee Foreclosure Notice Of Default?

We always want to minimize or avoid legal damage when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for legal services that, as a rule, are very expensive. However, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of a lawyer. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Chattanooga Tennessee Foreclosure Notice of Default or any other form easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is equally easy if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Chattanooga Tennessee Foreclosure Notice of Default complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Chattanooga Tennessee Foreclosure Notice of Default is suitable for you, you can choose the subscription option and proceed to payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!