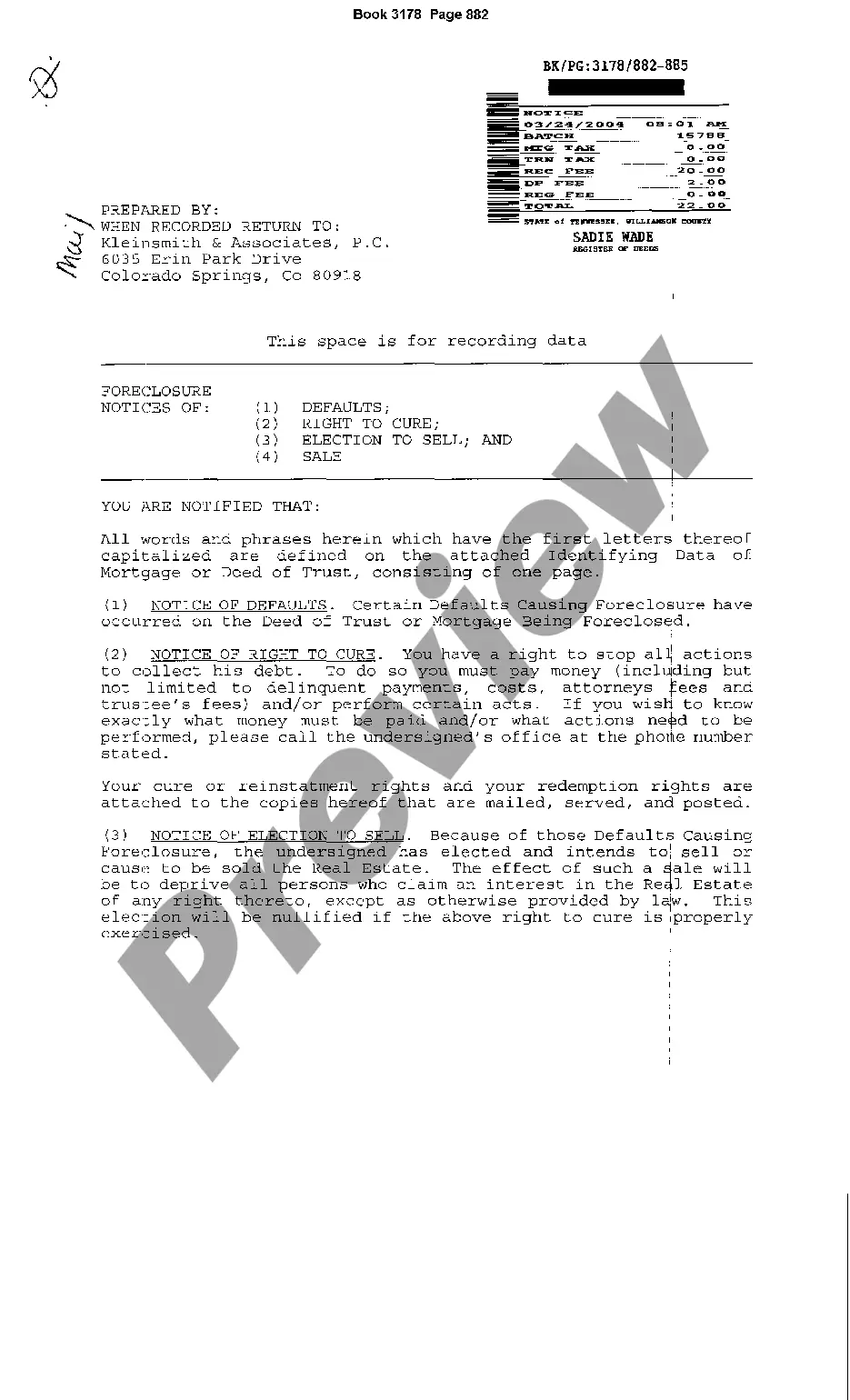

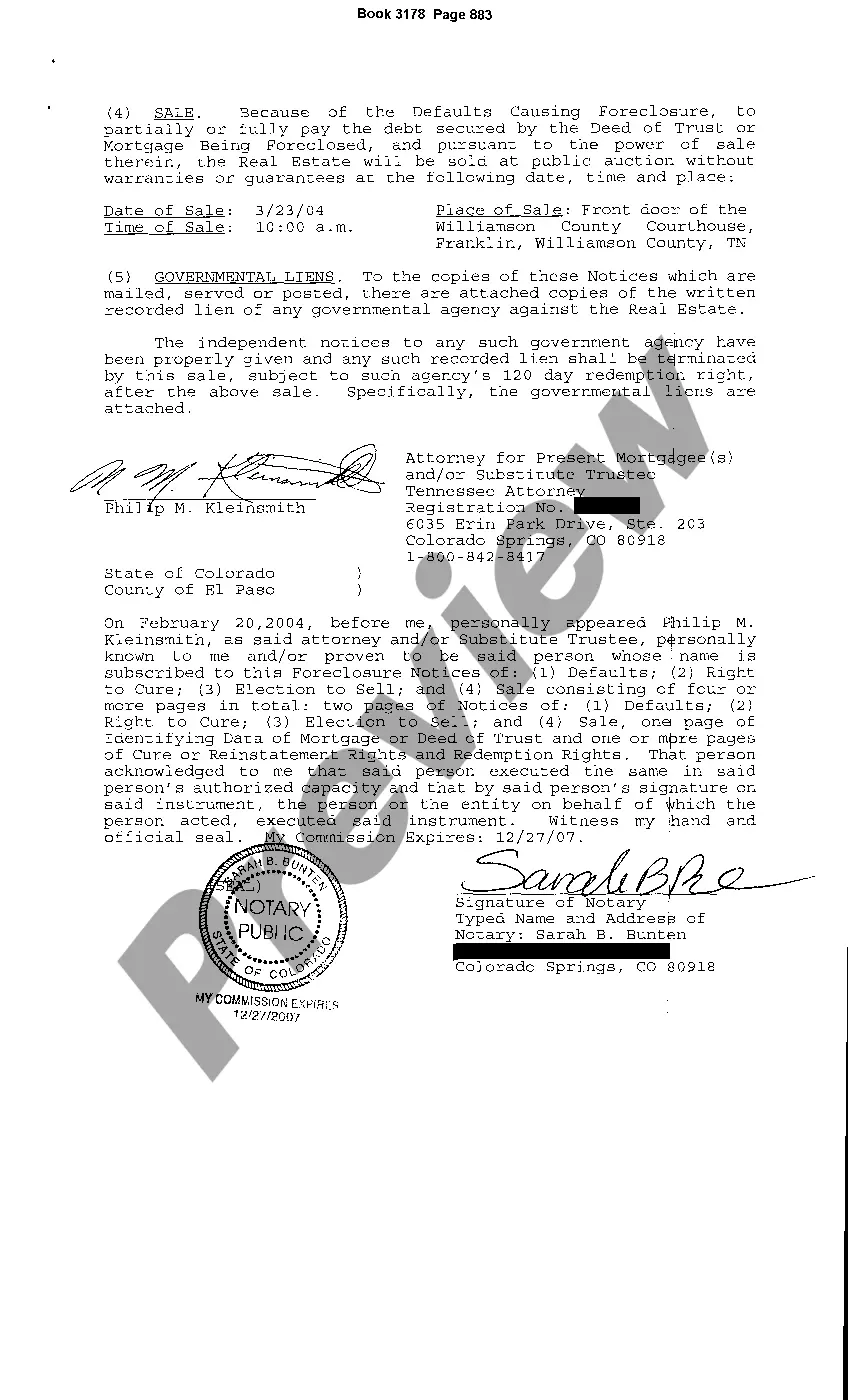

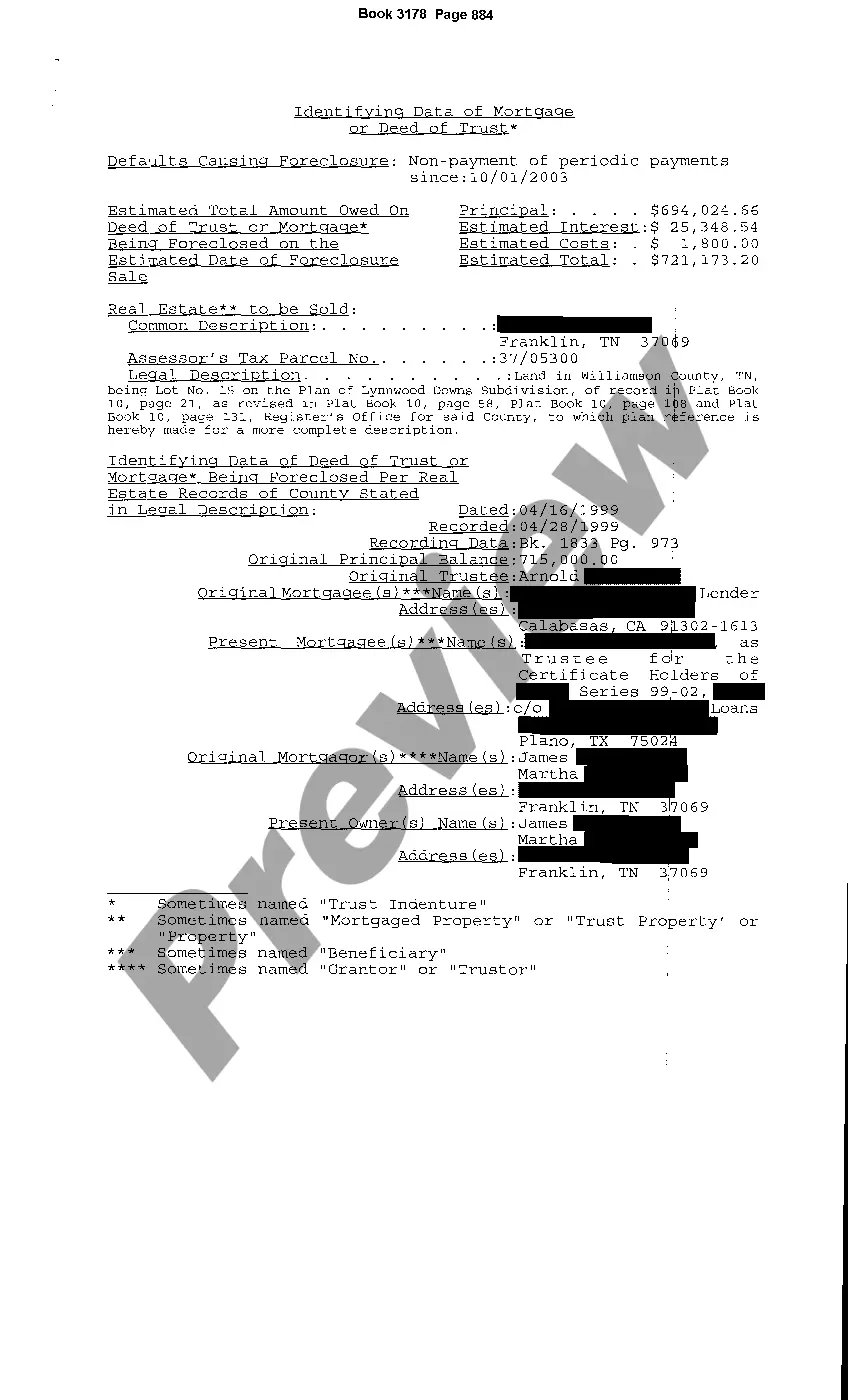

Title: Exploring Knoxville Tennessee Foreclosure Notice of Default: Types and Detailed Explanation Introduction: In Knoxville, Tennessee, foreclosure notice of default plays a crucial role in the foreclosure process. Individuals facing the risk of foreclosure should familiarize themselves with the different types and intricacies involved. This article will provide a detailed description of Knoxville Tennessee foreclosure notice of default, exploring its purpose, legal aspects, and potential types. 1. Understanding the Purpose of Foreclosure Notice of Default in Knoxville Tennessee: Foreclosure notice of default serves as a formal communication to the property owner, informing them of an impending foreclosure action due to loan default. It is the initial step in the foreclosure process, providing property owners an opportunity to address the defaults or negotiate with the lender. 2. Legal Aspects and Requirements: In Knoxville, Tennessee, foreclosure notice of default must comply with legal requirements set forth by state laws. The notice typically includes the property information, the amount owed, the default type, the lender's contact information, the borrower's rights, and a specific timeframe within which the owner can respond or take action. 3. Different Types of Knoxville Tennessee Foreclosure Notice of Default: a) Judicial Foreclosure Notice of Default: In this type, the lender files a civil lawsuit against the property owner, triggering the foreclosure process. This notice is typically issued to inform the borrower about the initiation of legal proceedings and provides time for redemption or filing a response. b) Non-Judicial Foreclosure Notice of Default: Tennessee also allows non-judicial foreclosures, which are expedited processes without court involvement. In this scenario, the lender serves a notice of default directly to the borrower, demanding they rectify the default within a specific period, usually 30 days. c) Notice of Intent to Accelerate: This notice alerts the borrower that unless the default is remedied within a designated time frame, the lender will accelerate the loan and demand full payment. d) Notice of Foreclosure Sale: This notice announces the foreclosure sale date and informs the borrower and other interested parties about the intended foreclosure auction. It provides an opportunity to the borrower or interested buyers to halt the foreclosure process by curing the default or purchasing the property. Conclusion: Understanding the Knoxville Tennessee foreclosure notice of default is crucial for property owners facing potential foreclosure. By staying informed about different types of notices and their legal requirements, borrowers can take proactive measures to address the default, negotiate with the lender, or seek legal assistance. Timely actions can potentially help residents in Knoxville, Tennessee, resolve their financial challenges and prevent loss of their property.

Knoxville Tennessee Foreclosure Notice of Default

Description

How to fill out Knoxville Tennessee Foreclosure Notice Of Default?

Are you looking for a reliable and affordable legal forms supplier to get the Knoxville Tennessee Foreclosure Notice of Default? US Legal Forms is your go-to choice.

Whether you need a basic arrangement to set rules for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our website offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked based on the requirements of specific state and county.

To download the document, you need to log in account, find the required template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account in minutes, but before that, make sure to do the following:

- Find out if the Knoxville Tennessee Foreclosure Notice of Default conforms to the laws of your state and local area.

- Read the form’s description (if available) to learn who and what the document is intended for.

- Start the search over if the template isn’t good for your legal situation.

Now you can register your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Knoxville Tennessee Foreclosure Notice of Default in any available format. You can return to the website when you need and redownload the document free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours researching legal paperwork online once and for all.