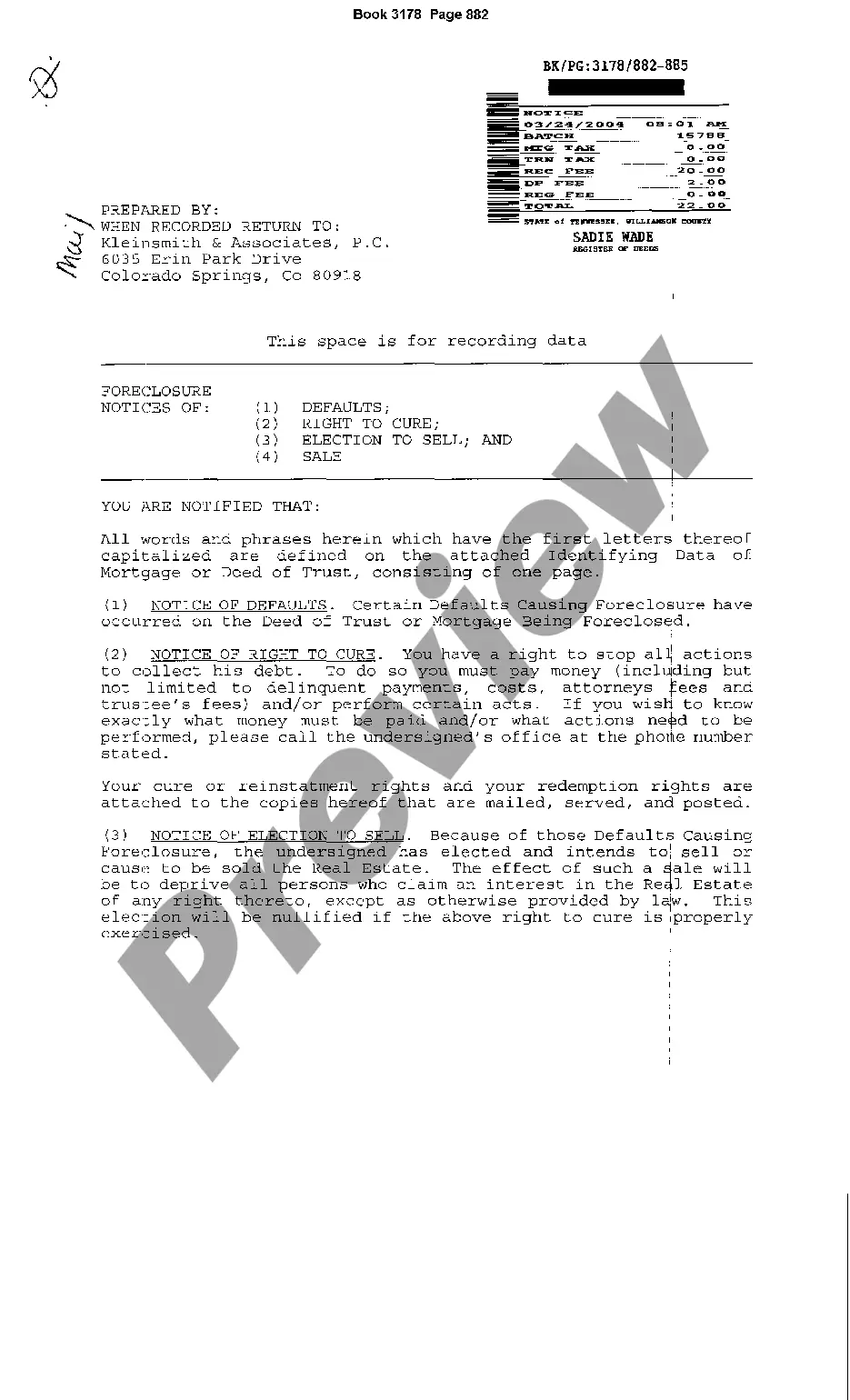

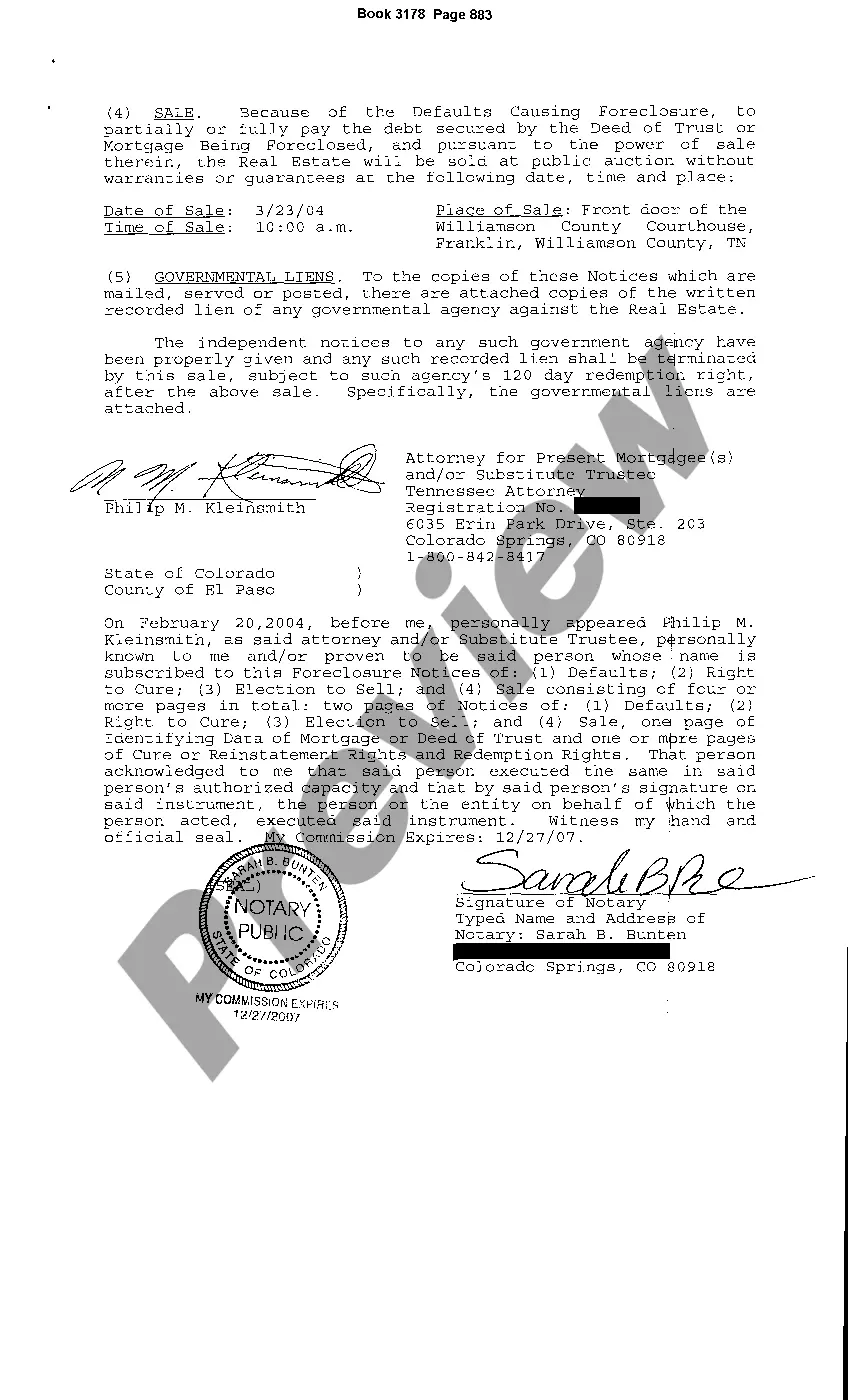

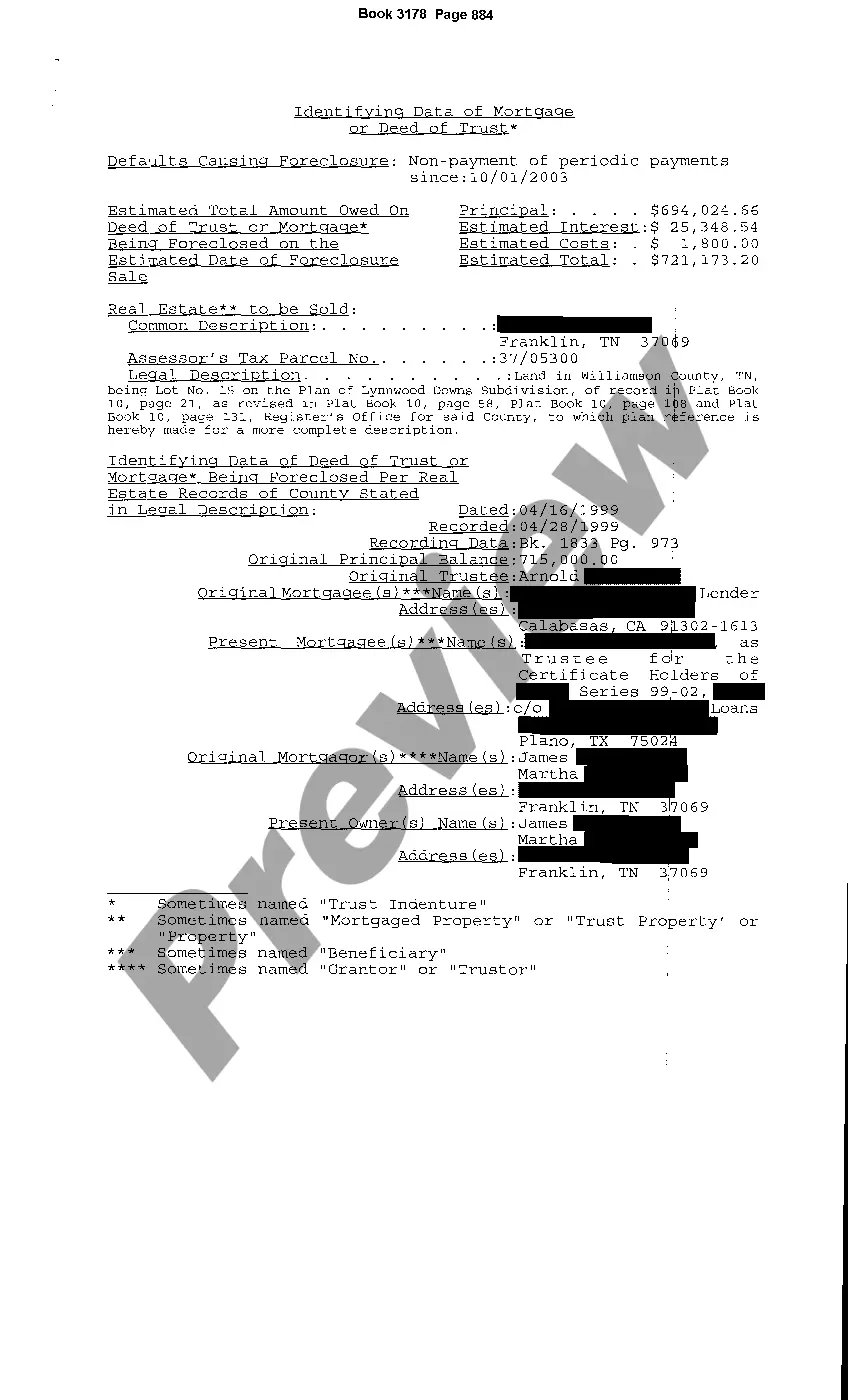

Murfreesboro Tennessee Foreclosure Notice of Default is a legal document that serves as a formal notification to a property owner that they have defaulted on their mortgage payments, leading to the initiation of foreclosure proceedings. This notice outlines the necessary steps to be taken by the property owner to rectify the situation and prevent further legal action. Keywords: Murfreesboro Tennessee, foreclosure, notice of default, property owner, mortgage payments, legal action. Different types of Murfreesboro Tennessee Foreclosure Notice of Default: 1. Judicial Foreclosure Notice: In cases where the mortgage agreement includes a power of sale clause, the lender is required to file a lawsuit against the property owner. The judicial foreclosure notice is a legal filing that initiates the court process seeking to recover the outstanding loan amount. 2. Non-judicial Foreclosure Notice: If the mortgage agreement does not have a power of sale clause, Tennessee law allows for the non-judicial foreclosure process. In this scenario, the lender is not required to file a lawsuit but must follow specific protocols outlined in the state statutes. The notice of default is still served to the property owner, providing them an opportunity to resolve the default. 3. Li's Pendent (Pending Lawsuit) Notice: A Li's Pendent notice may be issued by the lender to officially declare that a foreclosure lawsuit has been filed or is pending. It serves as a public notice that there is a legal claim on the property. 4. Acceleration Notice: Upon default, the lender may issue an acceleration notice, demanding the immediate repayment of the entire outstanding loan balance. This notice often precedes the formal foreclosure notice, giving the property owner a last chance to rectify the financial situation before foreclosure proceedings commence. It is important for property owners in Murfreesboro, Tennessee, to understand the significance of receiving a Notice of Default. Seeking legal advice and exploring available options, such as loan modification or a repayment plan, may help in resolving the default and avoiding the long-term implications of foreclosure.

Murfreesboro Tennessee Foreclosure Notice of Default

State:

Tennessee

City:

Murfreesboro

Control #:

TN-E388

Format:

PDF

Instant download

This form is available by subscription

Description

Foreclosure Notice of Default

Murfreesboro Tennessee Foreclosure Notice of Default is a legal document that serves as a formal notification to a property owner that they have defaulted on their mortgage payments, leading to the initiation of foreclosure proceedings. This notice outlines the necessary steps to be taken by the property owner to rectify the situation and prevent further legal action. Keywords: Murfreesboro Tennessee, foreclosure, notice of default, property owner, mortgage payments, legal action. Different types of Murfreesboro Tennessee Foreclosure Notice of Default: 1. Judicial Foreclosure Notice: In cases where the mortgage agreement includes a power of sale clause, the lender is required to file a lawsuit against the property owner. The judicial foreclosure notice is a legal filing that initiates the court process seeking to recover the outstanding loan amount. 2. Non-judicial Foreclosure Notice: If the mortgage agreement does not have a power of sale clause, Tennessee law allows for the non-judicial foreclosure process. In this scenario, the lender is not required to file a lawsuit but must follow specific protocols outlined in the state statutes. The notice of default is still served to the property owner, providing them an opportunity to resolve the default. 3. Li's Pendent (Pending Lawsuit) Notice: A Li's Pendent notice may be issued by the lender to officially declare that a foreclosure lawsuit has been filed or is pending. It serves as a public notice that there is a legal claim on the property. 4. Acceleration Notice: Upon default, the lender may issue an acceleration notice, demanding the immediate repayment of the entire outstanding loan balance. This notice often precedes the formal foreclosure notice, giving the property owner a last chance to rectify the financial situation before foreclosure proceedings commence. It is important for property owners in Murfreesboro, Tennessee, to understand the significance of receiving a Notice of Default. Seeking legal advice and exploring available options, such as loan modification or a repayment plan, may help in resolving the default and avoiding the long-term implications of foreclosure.

Free preview

How to fill out Murfreesboro Tennessee Foreclosure Notice Of Default?

If you’ve already used our service before, log in to your account and download the Murfreesboro Tennessee Foreclosure Notice of Default on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Make sure you’ve located an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to find the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Murfreesboro Tennessee Foreclosure Notice of Default. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!