Title: Knoxville Tennessee Agreed Order for Chapter 13 Settlement with Claimants: A Comprehensive Overview Introduction: In Knoxville, Tennessee, individuals seeking debt relief may opt for Chapter 13 bankruptcy, a legal proceeding aimed at reorganizing and repaying their debts over a specified period. As part of this process, an Agreed Order for Chapter 13 Settlement with claimants is often formulated. This article delves into the details of what this order entails and explores any potential variations that may exist. Understanding the Agreed Order for Chapter 13 Settlement: An Agreed Order for Chapter 13 Settlement with claimants is a legally binding agreement reached between debtors and claimants (creditors) within the context of a Chapter 13 bankruptcy. It outlines the terms and conditions under which the claimants will receive repayment, providing a roadmap for the debtor's financial rehabilitation. Key Components of the Agreed Order for Chapter 13 Settlement: 1. Debt Repayment Plan: The agreement typically specifies a repayment plan outlining the allocated funds for each claimant, payment schedule, and duration of the plan, usually spanning three to five years. 2. Claim Prioritization: The order determines the priority of different types of claims in the repayment plan. Priority claims, such as alimony, child support, and some tax obligations, receive preferential treatment over general unsecured debts. 3. Claimant Confirmation: By signing the agreement, the claimant acknowledges and accepts the proposed terms for debt repayment and waives any further collection attempts, interest, or penalties, ensuring equitable treatment. 4. Trustee Oversight: The Agreed Order for Chapter 13 Settlement often designates a trustee responsible for overseeing the implementation of the settlement. They ensure compliance with the agreed terms, disburse funds, and address any potential disputes concerning the repayment plan. Potential Variations of Knoxville Tennessee Agreed Order for Chapter 13 Settlement: While the core elements of the Agreed Order for Chapter 13 Settlement remain consistent, some variations may arise based on specific circumstances or arrangements made between the debtor and claimants. These include: 1. Modified Repayment Plans: In some cases, debtors may propose modified repayment plans to claimants, seeking adjustments to the original terms due to unforeseen financial circumstances or changes in the debtor's situation. 2. Lump-Sum Settlements: Alternatively, debtors may negotiate lump-sum settlements with claimants, offering a one-time payment that is less than the total owed but can settle the debt entirely. This approach can be beneficial if the debtor has access to a significant sum of money and the claimant agrees to the reduced payment. 3. Interest and Penalties Waivers: Although uncommon, there might be instances where the debtor negotiates with claimants to waive a portion of the accumulated interest or penalties associated with the debt. This provision aims to alleviate the debtor's financial burdens and facilitate a smoother repayment process. Conclusion: The Knoxville Tennessee Agreed Order for Chapter 13 Settlement with claimants is an essential document that enables debtors to restructure their finances while providing a fair repayment system for creditors. Understanding the key components of this agreement and potential variations empowers those involved in Chapter 13 bankruptcy proceedings to make informed decisions and build a solid foundation for their financial recovery.

Knoxville Tennessee Agreed Order for Chapter 13 Settlement with claimants

State:

Tennessee

City:

Knoxville

Control #:

TN-E419

Format:

PDF

Instant download

This form is available by subscription

Description

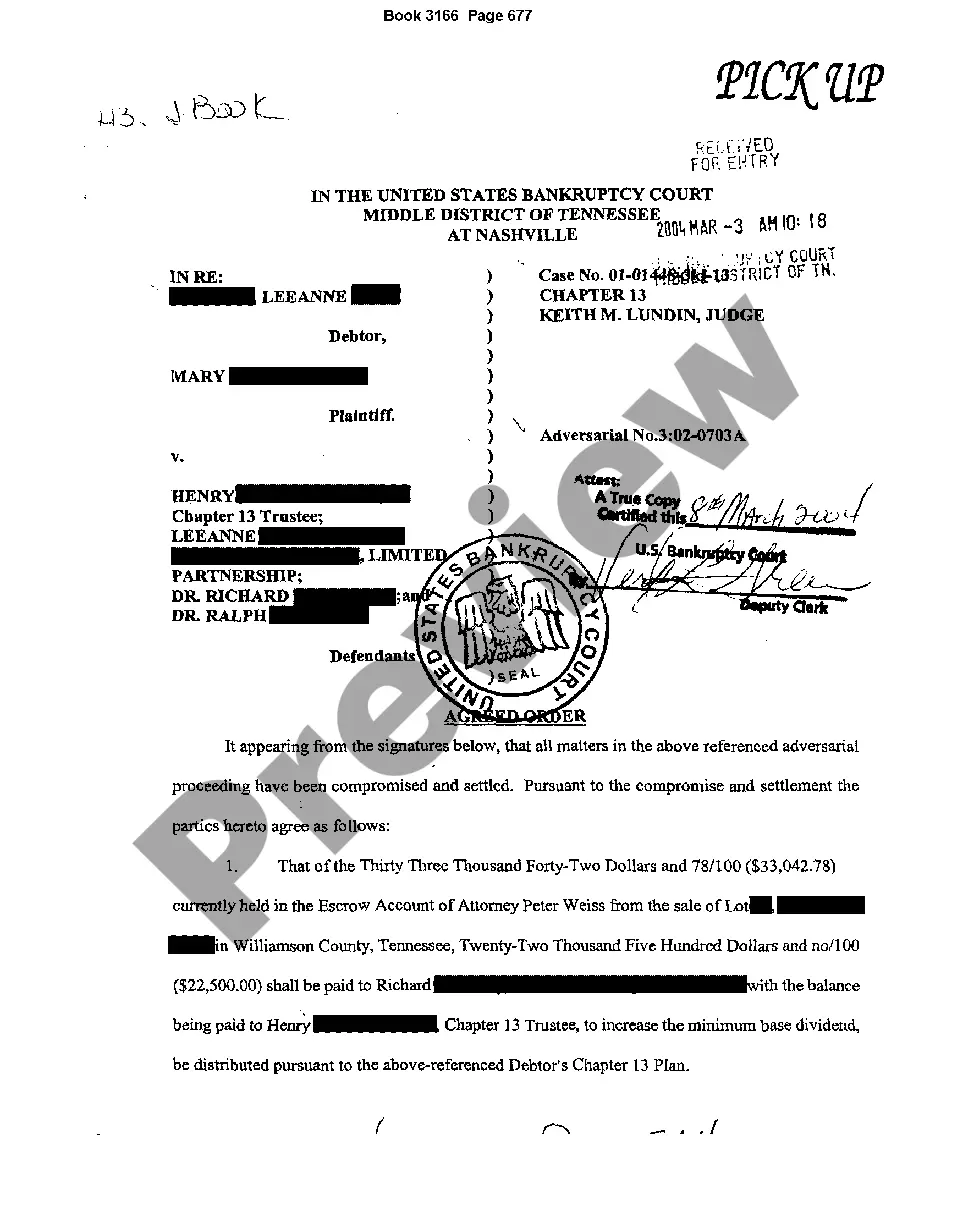

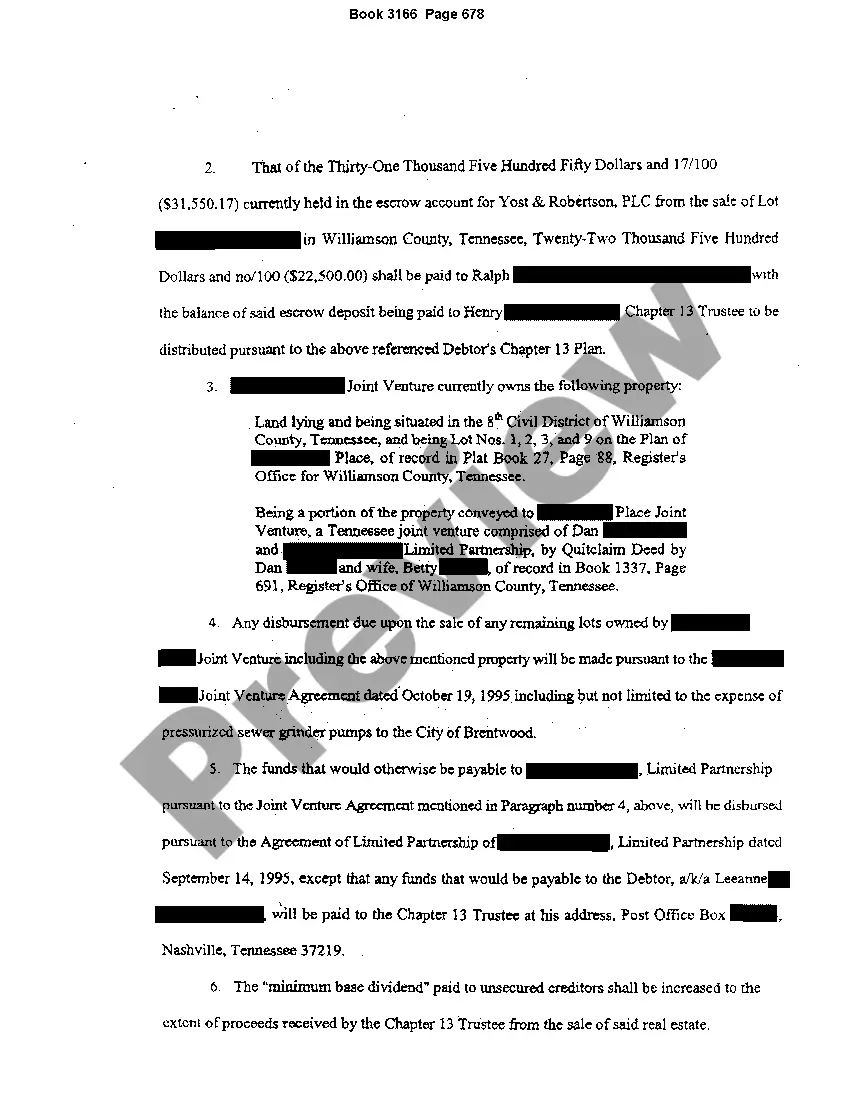

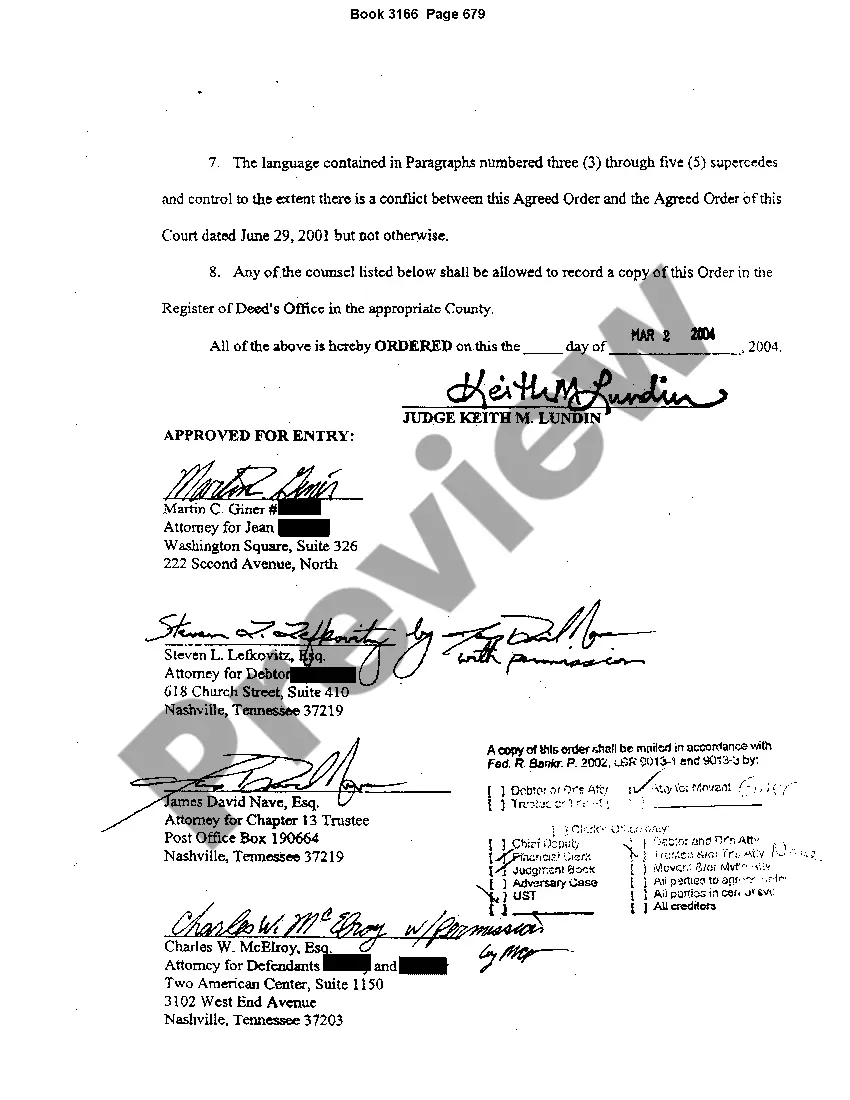

Agreed Order for Chapter 13 Settlement with claimants

Title: Knoxville Tennessee Agreed Order for Chapter 13 Settlement with Claimants: A Comprehensive Overview Introduction: In Knoxville, Tennessee, individuals seeking debt relief may opt for Chapter 13 bankruptcy, a legal proceeding aimed at reorganizing and repaying their debts over a specified period. As part of this process, an Agreed Order for Chapter 13 Settlement with claimants is often formulated. This article delves into the details of what this order entails and explores any potential variations that may exist. Understanding the Agreed Order for Chapter 13 Settlement: An Agreed Order for Chapter 13 Settlement with claimants is a legally binding agreement reached between debtors and claimants (creditors) within the context of a Chapter 13 bankruptcy. It outlines the terms and conditions under which the claimants will receive repayment, providing a roadmap for the debtor's financial rehabilitation. Key Components of the Agreed Order for Chapter 13 Settlement: 1. Debt Repayment Plan: The agreement typically specifies a repayment plan outlining the allocated funds for each claimant, payment schedule, and duration of the plan, usually spanning three to five years. 2. Claim Prioritization: The order determines the priority of different types of claims in the repayment plan. Priority claims, such as alimony, child support, and some tax obligations, receive preferential treatment over general unsecured debts. 3. Claimant Confirmation: By signing the agreement, the claimant acknowledges and accepts the proposed terms for debt repayment and waives any further collection attempts, interest, or penalties, ensuring equitable treatment. 4. Trustee Oversight: The Agreed Order for Chapter 13 Settlement often designates a trustee responsible for overseeing the implementation of the settlement. They ensure compliance with the agreed terms, disburse funds, and address any potential disputes concerning the repayment plan. Potential Variations of Knoxville Tennessee Agreed Order for Chapter 13 Settlement: While the core elements of the Agreed Order for Chapter 13 Settlement remain consistent, some variations may arise based on specific circumstances or arrangements made between the debtor and claimants. These include: 1. Modified Repayment Plans: In some cases, debtors may propose modified repayment plans to claimants, seeking adjustments to the original terms due to unforeseen financial circumstances or changes in the debtor's situation. 2. Lump-Sum Settlements: Alternatively, debtors may negotiate lump-sum settlements with claimants, offering a one-time payment that is less than the total owed but can settle the debt entirely. This approach can be beneficial if the debtor has access to a significant sum of money and the claimant agrees to the reduced payment. 3. Interest and Penalties Waivers: Although uncommon, there might be instances where the debtor negotiates with claimants to waive a portion of the accumulated interest or penalties associated with the debt. This provision aims to alleviate the debtor's financial burdens and facilitate a smoother repayment process. Conclusion: The Knoxville Tennessee Agreed Order for Chapter 13 Settlement with claimants is an essential document that enables debtors to restructure their finances while providing a fair repayment system for creditors. Understanding the key components of this agreement and potential variations empowers those involved in Chapter 13 bankruptcy proceedings to make informed decisions and build a solid foundation for their financial recovery.

Free preview

How to fill out Knoxville Tennessee Agreed Order For Chapter 13 Settlement With Claimants?

If you’ve already utilized our service before, log in to your account and download the Knoxville Tennessee Agreed Order for Chapter 13 Settlement with claimants on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make certain you’ve found a suitable document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Knoxville Tennessee Agreed Order for Chapter 13 Settlement with claimants. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!