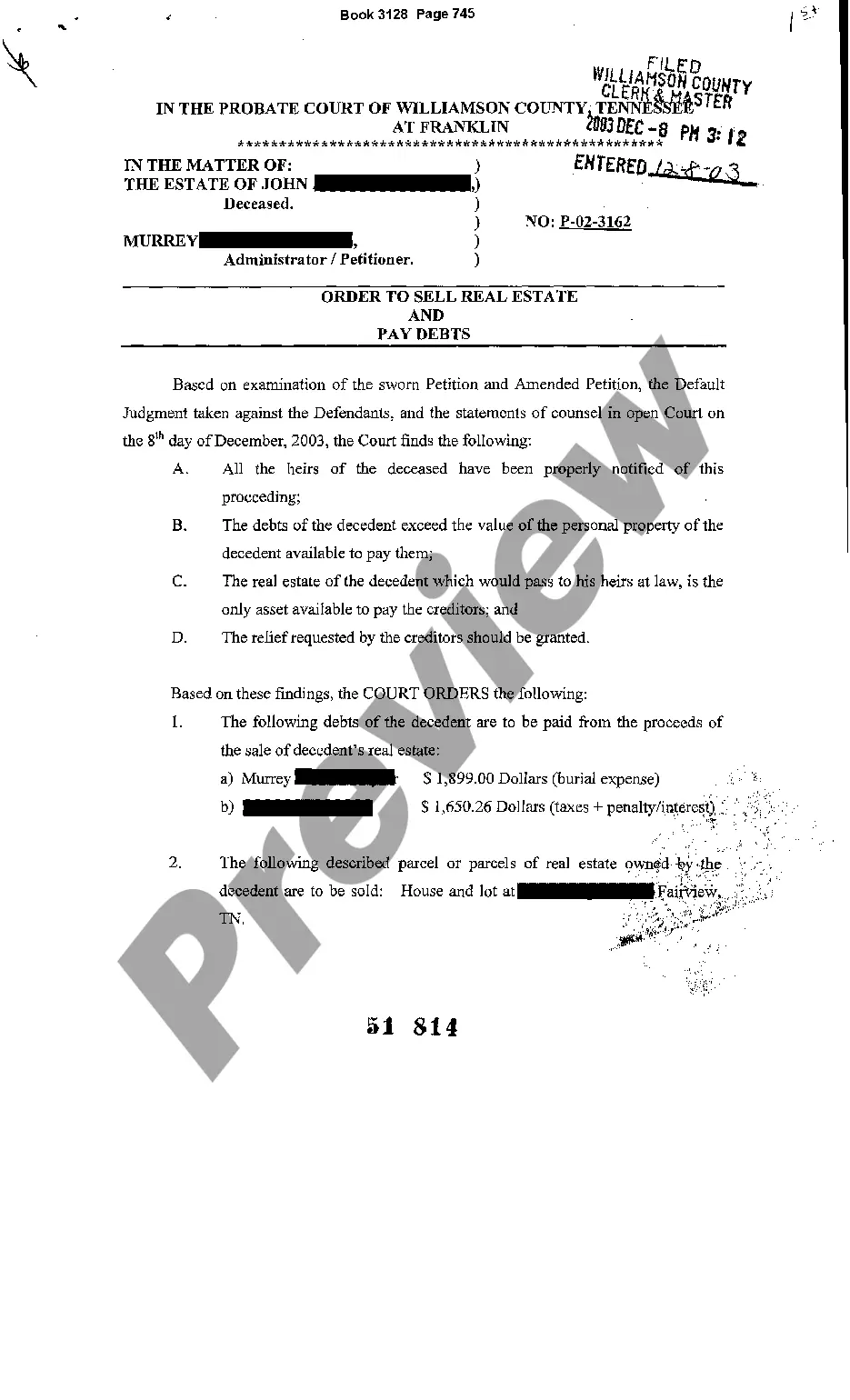

Chattanooga Tennessee Order to Sell Real Estate to Pay Debts is a legal process that allows a creditor to force the sale of a debtor's real estate property in order to recover the owed debts. It is an unfortunate but necessary action taken when other attempts to collect the debts have failed. In this article, we will explore the details of Chattanooga Tennessee Order to Sell Real Estate to Pay Debts, including its types and key aspects. Types of Chattanooga Tennessee Order to Sell Real Estate to Pay Debts: 1. Forced Sale: This type of order is typically initiated by a creditor who has obtained a judgment against a debtor. The creditor may request the court to force the sale of the debtor's real estate property to satisfy the outstanding debts. 2. Foreclosure: Often used when a debtor defaults on their mortgage payments, foreclosure is a legal action taken by a lender to repossess the property and subsequently sell it in order to recover the unpaid mortgage balance. 3. Probate Sale: In situations where a deceased person leaves behind debts and insufficient assets to cover these debts, the court may order the sale of the deceased's real estate to pay off these obligations. Key Aspects of Chattanooga Tennessee Order to Sell Real Estate to Pay Debts: 1. Court Approval: Before a property can be sold to pay off debts, the creditor must obtain a court order granting them the authority to sell the real estate. This process involves filing a formal legal petition, providing evidence of the debt owed, and justifying the need for the sale. 2. Valuation: An accurate valuation of the property is crucial to determine the fair market value and potential proceeds from the sale. This valuation is usually conducted by an independent appraiser or real estate expert to ensure a fair selling price. 3. Notice and Public Auction: Once the court approves the order to sell real estate, the creditor is required to give notice to all interested parties, including the debtor. Typically, a public auction or foreclosure sale is then conducted, allowing interested buyers to bid on the property. The highest bidder will secure the property by paying the offered amount. 4. Distribution of Proceeds: After the sale, the proceeds are used to satisfy the debts owed. Any remaining funds are distributed among other lien holders or, in some cases, returned to the debtor. It is essential to consult legal counsel to understand the priority order of debt payments and potential surplus distribution. 5. Redemption Rights: In certain cases, the debtor may have the right to redeem the property by paying off the debt in full before the completion of the sale. Redemption rights vary depending on specific circumstances and the type of Chattanooga Tennessee Order to Sell Real Estate to Pay Debts. In summary, Chattanooga Tennessee Order to Sell Real Estate to Pay Debts is a legal process designed to recover outstanding debts by forcing the sale of a debtor's property. Whether through forced sale, foreclosure, or probate sale, this process involves court approval, property valuation, public auction, and distribution of proceeds. When facing such a situation, it is crucial to consult with a legal professional who can guide you through the process and protect your rights.

Chattanooga Tennessee Order to Sell Real Estate to Pay Debts

Description

How to fill out Chattanooga Tennessee Order To Sell Real Estate To Pay Debts?

Are you looking for a trustworthy and inexpensive legal forms supplier to get the Chattanooga Tennessee Order to Sell Real Estate to Pay Debts? US Legal Forms is your go-to solution.

No matter if you require a simple arrangement to set rules for cohabitating with your partner or a package of forms to move your divorce through the court, we got you covered. Our website provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of separate state and county.

To download the document, you need to log in account, find the required template, and click the Download button next to it. Please remember that you can download your previously purchased form templates anytime from the My Forms tab.

Is the first time you visit our website? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Chattanooga Tennessee Order to Sell Real Estate to Pay Debts conforms to the regulations of your state and local area.

- Go through the form’s details (if provided) to find out who and what the document is good for.

- Restart the search in case the template isn’t good for your legal scenario.

Now you can create your account. Then pick the subscription option and proceed to payment. Once the payment is done, download the Chattanooga Tennessee Order to Sell Real Estate to Pay Debts in any provided file format. You can return to the website at any time and redownload the document free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting hours researching legal paperwork online for good.