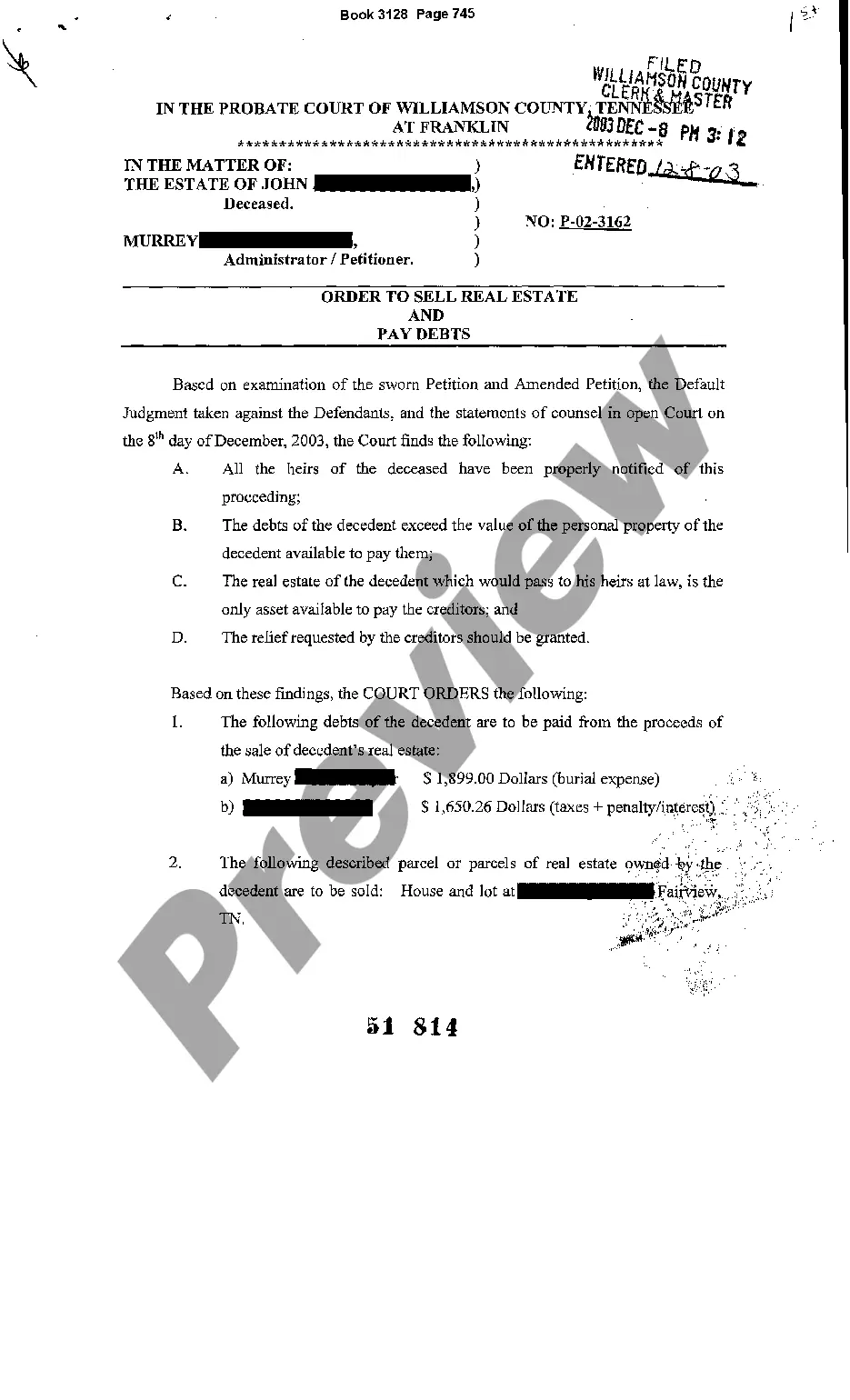

Clarksville Tennessee Order to Sell Real Estate to Pay Debts is a legal process in which a court orders the sale of a property to settle outstanding debts owed by the property owner. This type of order is typically issued when an individual or entity has accumulated significant debts and is unable to repay them through other means. The Clarksville Tennessee Order to Sell Real Estate to Pay Debts may be pursued in various situations, including bankruptcy proceedings, foreclosure cases, or when an individual is facing insurmountable financial difficulties. It may also be applicable in cases where a property owner has outstanding tax or mortgage debts. In Clarksville, Tennessee, there are different types of orders to sell real estate to pay debts, depending on the specific circumstances: 1. Bankruptcy Order to Sell Real Estate: When an individual files for bankruptcy in Clarksville, Tennessee, the court may issue an order to sell the debtor's real estate assets to satisfy outstanding debts. This process is typically overseen by a bankruptcy trustee who will assess the property's value and determine the best course of action to maximize the recovery for creditors. 2. Foreclosure Order to Sell Real Estate: When a property owner in Clarksville fails to make mortgage payments, the lender may initiate foreclosure proceedings. As part of this process, a court-ordered sale of the property may be authorized to pay off the outstanding debts. The foreclosure order to sell real estate is typically carried out by a court-appointed trustee or a foreclosure auction. 3. Tax Lien Order to Sell Real Estate: In cases where a property owner in Clarksville has delinquent property taxes, the local government may obtain a tax lien on the property. To recoup the unpaid taxes, the government can seek an order to sell the real estate through a tax lien sale. This type of order is commonly used when a property owner has repeatedly failed to pay their tax obligations. 4. Creditor Order to Sell Real Estate: In situations where a property owner has significant debts owed to various creditors, one or more of these creditors may seek an order from the court to sell the real estate. This allows the creditors to claim their portion of the proceeds from the sale, effectively satisfying the outstanding debts owed to them. In Clarksville, Tennessee, the process of obtaining an order to sell real estate to pay debts involves filing a petition with the appropriate court, providing evidence of the debts owed, and demonstrating that the sale of the property is necessary to settle these debts. The court will then review the case, assess the validity of the debts, and make a determination on whether to issue the order. It's important to note that each situation involving a Clarksville Tennessee Order to Sell Real Estate to Pay Debts is unique, and the specific legal procedures and requirements may vary depending on the circumstances involved. It's advisable for property owners facing this situation to seek qualified legal counsel to navigate the process effectively and protect their rights and interests.

Clarksville Tennessee Order to Sell Real Estate to Pay Debts

State:

Tennessee

City:

Clarksville

Control #:

TN-E427

Format:

PDF

Instant download

This form is available by subscription

Description

Order to Sell Real Estate to Pay Debts

Clarksville Tennessee Order to Sell Real Estate to Pay Debts is a legal process in which a court orders the sale of a property to settle outstanding debts owed by the property owner. This type of order is typically issued when an individual or entity has accumulated significant debts and is unable to repay them through other means. The Clarksville Tennessee Order to Sell Real Estate to Pay Debts may be pursued in various situations, including bankruptcy proceedings, foreclosure cases, or when an individual is facing insurmountable financial difficulties. It may also be applicable in cases where a property owner has outstanding tax or mortgage debts. In Clarksville, Tennessee, there are different types of orders to sell real estate to pay debts, depending on the specific circumstances: 1. Bankruptcy Order to Sell Real Estate: When an individual files for bankruptcy in Clarksville, Tennessee, the court may issue an order to sell the debtor's real estate assets to satisfy outstanding debts. This process is typically overseen by a bankruptcy trustee who will assess the property's value and determine the best course of action to maximize the recovery for creditors. 2. Foreclosure Order to Sell Real Estate: When a property owner in Clarksville fails to make mortgage payments, the lender may initiate foreclosure proceedings. As part of this process, a court-ordered sale of the property may be authorized to pay off the outstanding debts. The foreclosure order to sell real estate is typically carried out by a court-appointed trustee or a foreclosure auction. 3. Tax Lien Order to Sell Real Estate: In cases where a property owner in Clarksville has delinquent property taxes, the local government may obtain a tax lien on the property. To recoup the unpaid taxes, the government can seek an order to sell the real estate through a tax lien sale. This type of order is commonly used when a property owner has repeatedly failed to pay their tax obligations. 4. Creditor Order to Sell Real Estate: In situations where a property owner has significant debts owed to various creditors, one or more of these creditors may seek an order from the court to sell the real estate. This allows the creditors to claim their portion of the proceeds from the sale, effectively satisfying the outstanding debts owed to them. In Clarksville, Tennessee, the process of obtaining an order to sell real estate to pay debts involves filing a petition with the appropriate court, providing evidence of the debts owed, and demonstrating that the sale of the property is necessary to settle these debts. The court will then review the case, assess the validity of the debts, and make a determination on whether to issue the order. It's important to note that each situation involving a Clarksville Tennessee Order to Sell Real Estate to Pay Debts is unique, and the specific legal procedures and requirements may vary depending on the circumstances involved. It's advisable for property owners facing this situation to seek qualified legal counsel to navigate the process effectively and protect their rights and interests.

Free preview

How to fill out Clarksville Tennessee Order To Sell Real Estate To Pay Debts?

If you’ve already utilized our service before, log in to your account and download the Clarksville Tennessee Order to Sell Real Estate to Pay Debts on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your document:

- Make sure you’ve located the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t fit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Clarksville Tennessee Order to Sell Real Estate to Pay Debts. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!