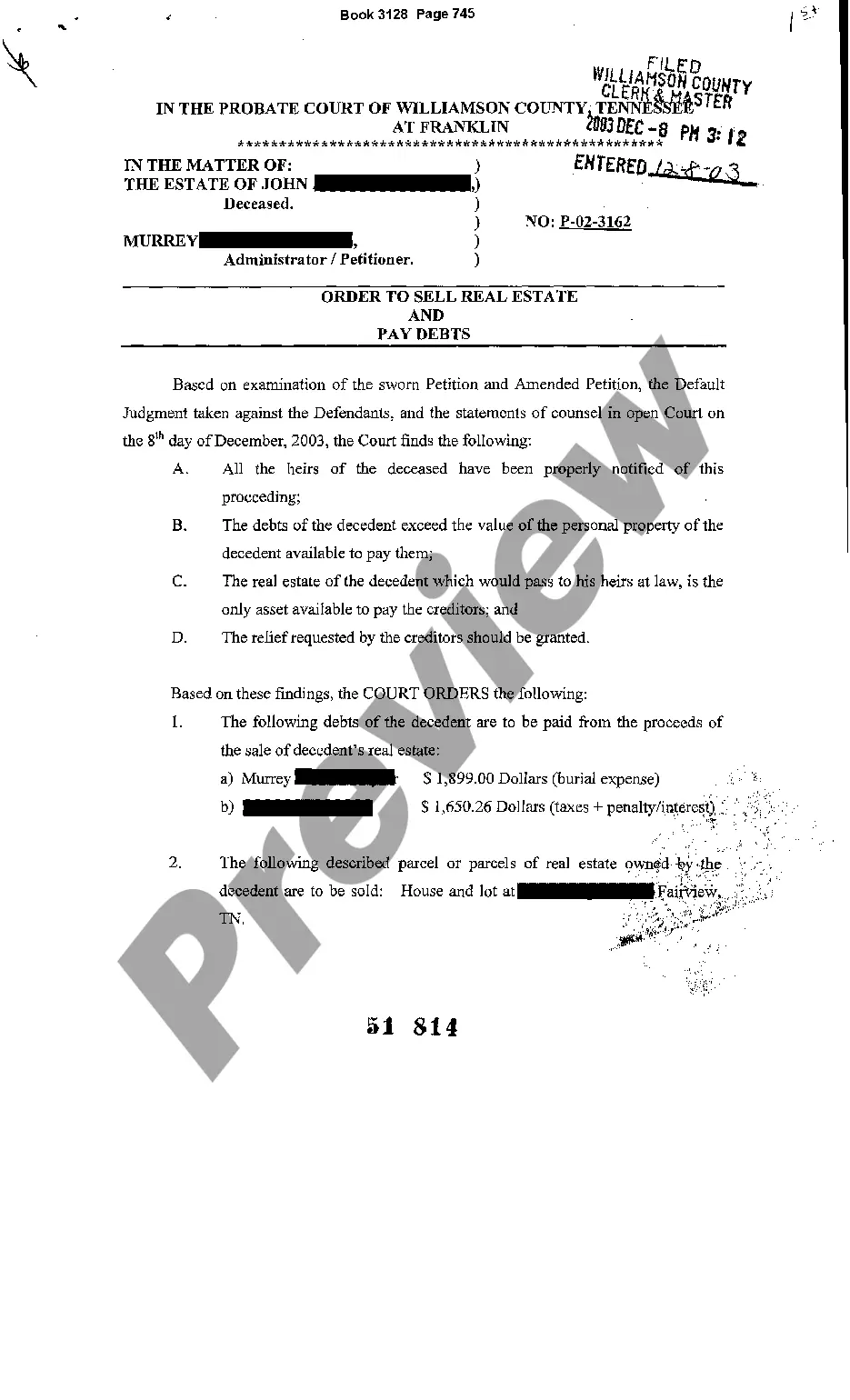

In Murfreesboro, Tennessee, an Order to Sell Real Estate to Pay Debts is a legal process that allows individuals or entities to sell their property to settle outstanding debts. This order is typically sought when the property owner is unable to meet their financial obligations and needs to liquidate assets to pay off creditors. One type of Order to Sell Real Estate to Pay Debts in Murfreesboro, Tennessee is known as a foreclosure. Foreclosure occurs when a homeowner fails to make mortgage payments, resulting in the lender taking legal action to repossess and sell the property. The proceeds from the sale are then used to satisfy the outstanding debt. Another type of Order to Sell Real Estate to Pay Debts is a court-ordered sale. In this situation, a creditor who has obtained a judgment against a debtor can request the court to order the sale of the debtor's property to satisfy the debt. This process typically involves obtaining a judgment lien on the property, followed by a legal proceeding to auction or sell the property. In Murfreesboro, Tennessee, there may also be instances where individuals or estates seek an Order to Sell Real Estate to Pay Debts as part of the probate process. When a person passes away and leaves behind debts, the executor or administrator of the estate may need to sell real estate assets to settle these obligations. This process involves obtaining approval from the probate court and ensuring that the property is sold at fair market value to maximize the proceeds for debt repayment. It is important to note that the specific requirements and procedures for obtaining an Order to Sell Real Estate to Pay Debts in Murfreesboro, Tennessee may vary depending on the circumstances and the type of debt involved. It is advisable to seek legal counsel to navigate these processes effectively and ensure compliance with state laws and regulations. So, if you find yourself in a situation where you are unable to pay your debts in Murfreesboro, Tennessee, exploring an Order to Sell Real Estate to Pay Debts might be an option worth considering. By understanding the different types of orders available and seeking professional assistance, you can work towards resolving your financial obligations and achieving a fresh start.

Murfreesboro Tennessee Order to Sell Real Estate to Pay Debts

Description

How to fill out Murfreesboro Tennessee Order To Sell Real Estate To Pay Debts?

If you are looking for a valid form, it’s difficult to choose a more convenient place than the US Legal Forms site – one of the most extensive libraries on the web. With this library, you can find thousands of document samples for business and personal purposes by categories and states, or keywords. With the high-quality search feature, finding the newest Murfreesboro Tennessee Order to Sell Real Estate to Pay Debts is as easy as 1-2-3. Additionally, the relevance of every record is confirmed by a group of professional lawyers that on a regular basis review the templates on our platform and update them in accordance with the most recent state and county laws.

If you already know about our platform and have a registered account, all you need to receive the Murfreesboro Tennessee Order to Sell Real Estate to Pay Debts is to log in to your profile and click the Download option.

If you utilize US Legal Forms for the first time, just follow the guidelines listed below:

- Make sure you have opened the form you require. Check its explanation and make use of the Preview option to check its content. If it doesn’t meet your requirements, use the Search option near the top of the screen to get the needed document.

- Confirm your choice. Click the Buy now option. After that, select the preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Utilize your credit card or PayPal account to complete the registration procedure.

- Receive the template. Indicate the file format and download it on your device.

- Make modifications. Fill out, revise, print, and sign the acquired Murfreesboro Tennessee Order to Sell Real Estate to Pay Debts.

Each and every template you add to your profile does not have an expiry date and is yours forever. You always have the ability to gain access to them using the My Forms menu, so if you want to have an extra copy for editing or printing, feel free to come back and download it once more at any moment.

Make use of the US Legal Forms extensive collection to gain access to the Murfreesboro Tennessee Order to Sell Real Estate to Pay Debts you were seeking and thousands of other professional and state-specific samples in one place!