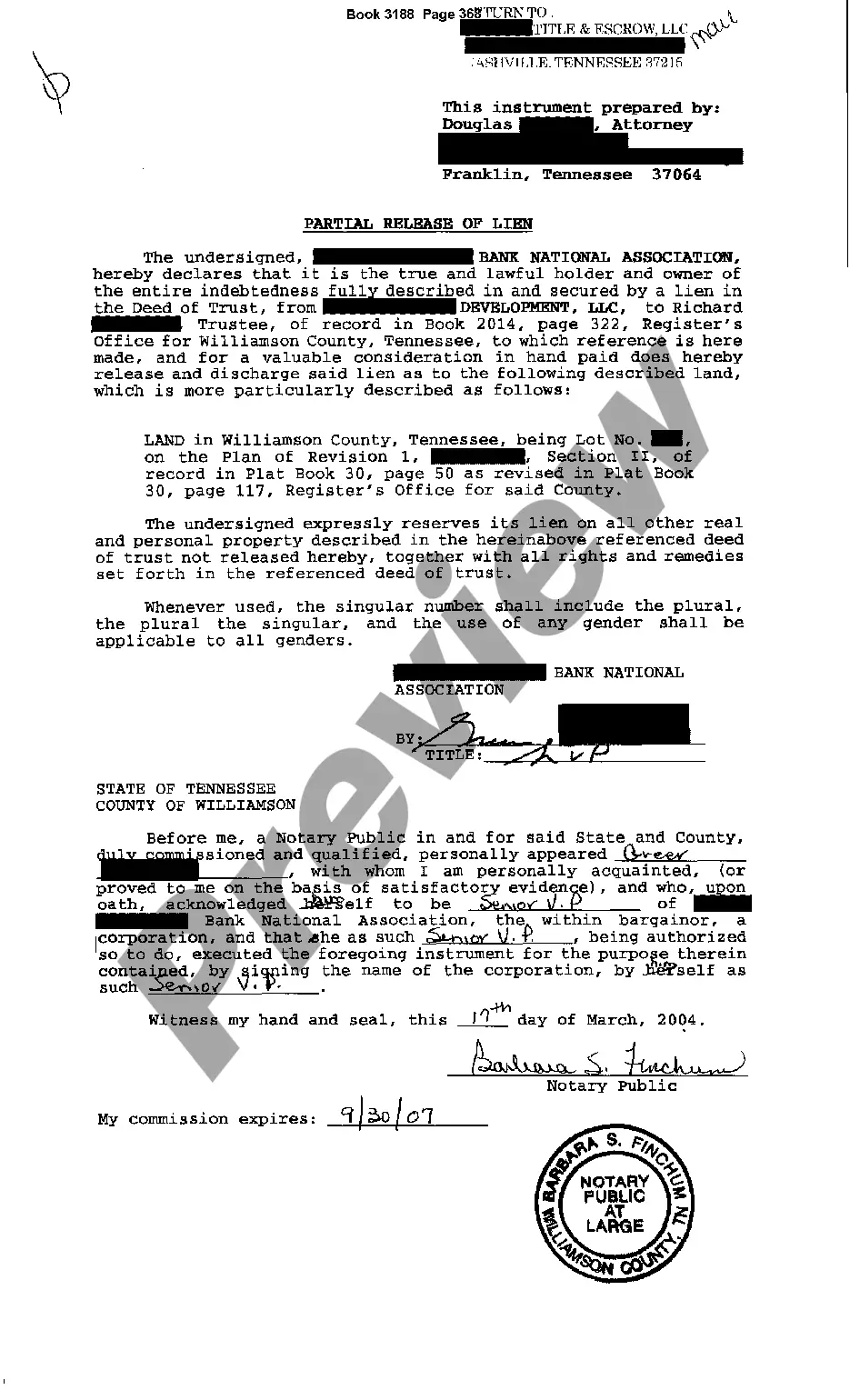

A Memphis Tennessee Partial Release of Lien refers to a legal document that serves to release a specific portion or property from the encumbrance of a previously filed lien. A lien is typically placed on a property by a party, often a contractor or supplier, to secure payment for services rendered or materials provided. However, in certain circumstances, it may become necessary to release a portion of the property from the lien, such as when partial payment has been made or if the lien was filed in error. There are different types of Memphis Tennessee Partial Release of Lien, primarily based on the reason for the release. These include: 1. Partial Release of Lien for Partial Payment: This type of release occurs when a property owner has made a partial payment towards the outstanding debt, and the lien holder agrees to release a portion of the property accordingly. 2. Partial Release of Lien due to Error: If a lien was erroneously filed against the wrong property or for an incorrect amount, a partial release may be necessary to rectify the situation and release the unaffected portion of the property. 3. Partial Release of Lien for Subdivision or Parcel Release: In cases where a property is being divided or subdivided, it may be necessary to release a specified section or lot from the lien to facilitate the transfer of ownership or secure financing. 4. Partial Release of Lien for Release of Collateral: If a lien extends beyond the property itself and includes additional collateral, such as equipment or other assets, a partial release of lien may be required if the borrower or debtor pays off or satisfies part of the debt associated specifically with that collateral. It is important to note that a Memphis Tennessee Partial Release of Lien must be properly executed, typically following the guidelines and requirements set forth by state and local laws. This may involve preparing a release document, obtaining all necessary signatures, and recording the release with the appropriate county recorder's office or other designated entity. It is advisable to consult with a qualified attorney or legal professional familiar with lien laws in Memphis Tennessee to ensure compliance with the necessary procedures and documentation.

A Memphis Tennessee Partial Release of Lien refers to a legal document that serves to release a specific portion or property from the encumbrance of a previously filed lien. A lien is typically placed on a property by a party, often a contractor or supplier, to secure payment for services rendered or materials provided. However, in certain circumstances, it may become necessary to release a portion of the property from the lien, such as when partial payment has been made or if the lien was filed in error. There are different types of Memphis Tennessee Partial Release of Lien, primarily based on the reason for the release. These include: 1. Partial Release of Lien for Partial Payment: This type of release occurs when a property owner has made a partial payment towards the outstanding debt, and the lien holder agrees to release a portion of the property accordingly. 2. Partial Release of Lien due to Error: If a lien was erroneously filed against the wrong property or for an incorrect amount, a partial release may be necessary to rectify the situation and release the unaffected portion of the property. 3. Partial Release of Lien for Subdivision or Parcel Release: In cases where a property is being divided or subdivided, it may be necessary to release a specified section or lot from the lien to facilitate the transfer of ownership or secure financing. 4. Partial Release of Lien for Release of Collateral: If a lien extends beyond the property itself and includes additional collateral, such as equipment or other assets, a partial release of lien may be required if the borrower or debtor pays off or satisfies part of the debt associated specifically with that collateral. It is important to note that a Memphis Tennessee Partial Release of Lien must be properly executed, typically following the guidelines and requirements set forth by state and local laws. This may involve preparing a release document, obtaining all necessary signatures, and recording the release with the appropriate county recorder's office or other designated entity. It is advisable to consult with a qualified attorney or legal professional familiar with lien laws in Memphis Tennessee to ensure compliance with the necessary procedures and documentation.