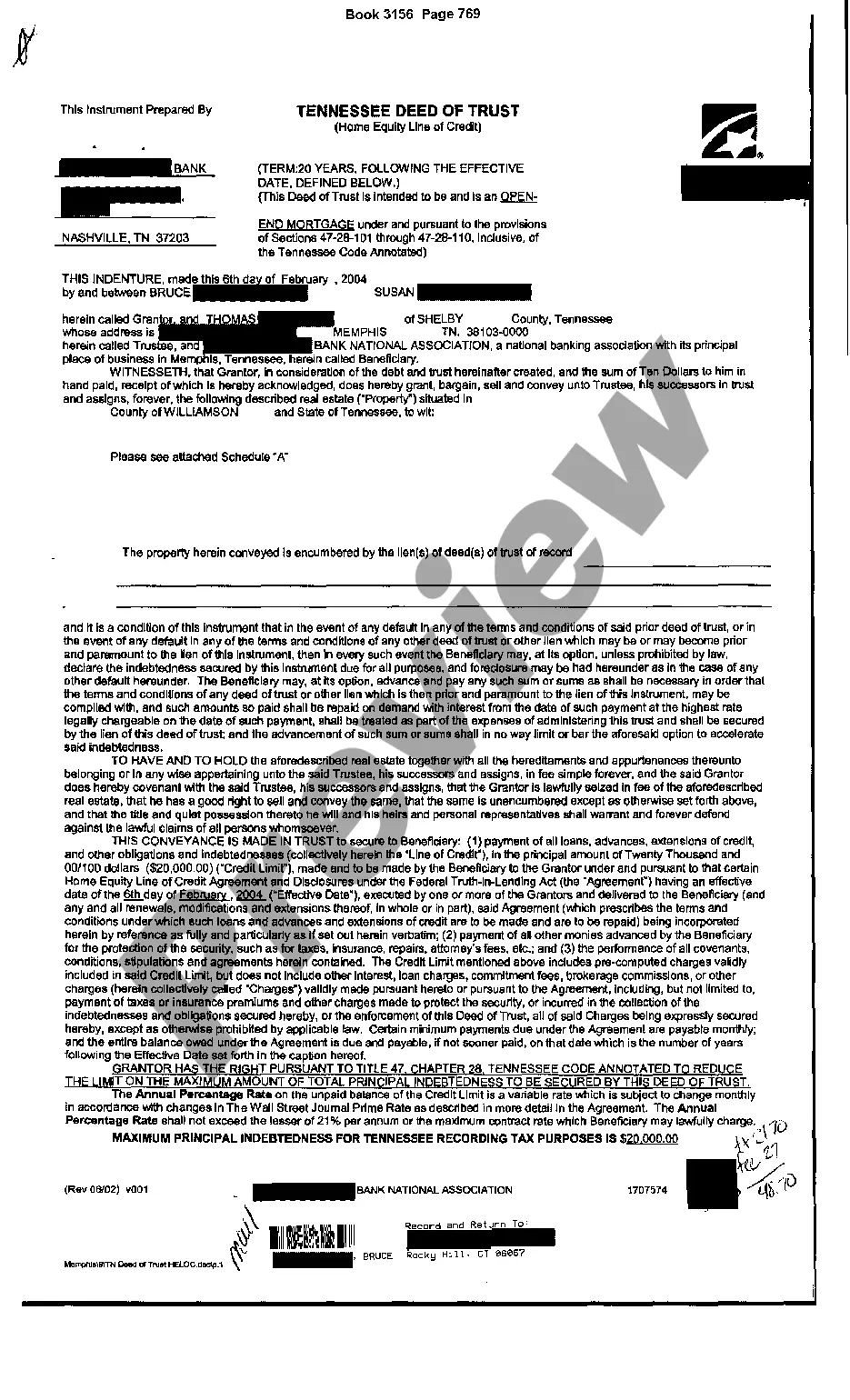

The Clarksville Tennessee Deed of Trust Home Equity is a legal document that outlines the terms and conditions for utilizing the equity in a property located in Clarksville, Tennessee. This deed of trust allows homeowners to secure a loan against the value of their property by using it as collateral. It provides the lender with a legal claim on the property in case the borrower defaults on the loan payments. Clarksville, Tennessee is a vibrant city known for its rich history, thriving economy, and beautiful landscapes. The deed of trust home equity is a popular financial instrument in Clarksville due to its potential for helping homeowners unlock the value of their property and access funds for various purposes. There are different types of Clarksville Tennessee Deed of Trust Home Equity that cater to the diverse needs of homeowners. Some common variations include: 1. Fixed-Rate Deed of Trust Home Equity: This type of deed of trust offers a fixed interest rate throughout the loan term, providing borrowers with predictable and steady monthly payments. 2. Adjustable-Rate Deed of Trust Home Equity: In this variation, the interest rate can fluctuate over time based on market conditions. Borrowers may benefit from initially lower interest rates, but they should be prepared for potential rate adjustments in the future. 3. Home Equity Line of Credit (HELOT): This type of deed of trust allows homeowners to access a revolving line of credit based on their equity. Borrowers can withdraw funds as needed, making it a flexible option for ongoing expenses or projects. 4. Cash-Out Refinance Deed of Trust Home Equity: This variation involves refinancing the existing mortgage with a new loan that has a higher principal amount. Homeowners can access the additional equity as cash, which can be used for various purposes like debt consolidation or home improvements. It is important for homeowners considering a Clarksville Tennessee Deed of Trust Home Equity to carefully review the terms and conditions, understand the potential risks, and consult with legal and financial professionals to make informed decisions.

Clarksville Tennessee Deed of Trust Home Equity

Description

How to fill out Clarksville Tennessee Deed Of Trust Home Equity?

Take advantage of the US Legal Forms and have instant access to any form sample you want. Our helpful website with a large number of document templates allows you to find and obtain almost any document sample you want. You are able to export, complete, and sign the Clarksville Tennessee Deed of Trust Home Equity in just a matter of minutes instead of browsing the web for many hours looking for an appropriate template.

Using our catalog is a wonderful strategy to increase the safety of your document filing. Our experienced legal professionals regularly check all the records to ensure that the forms are appropriate for a particular state and compliant with new acts and regulations.

How can you obtain the Clarksville Tennessee Deed of Trust Home Equity? If you already have a subscription, just log in to the account. The Download option will be enabled on all the documents you view. In addition, you can find all the previously saved documents in the My Forms menu.

If you don’t have an account yet, follow the tips below:

- Find the form you need. Make certain that it is the form you were hoping to find: examine its headline and description, and use the Preview function when it is available. Otherwise, utilize the Search field to find the needed one.

- Launch the downloading process. Click Buy Now and select the pricing plan you like. Then, create an account and process your order using a credit card or PayPal.

- Save the file. Pick the format to get the Clarksville Tennessee Deed of Trust Home Equity and edit and complete, or sign it according to your requirements.

US Legal Forms is one of the most extensive and reliable document libraries on the internet. Our company is always happy to help you in virtually any legal procedure, even if it is just downloading the Clarksville Tennessee Deed of Trust Home Equity.

Feel free to take advantage of our platform and make your document experience as efficient as possible!