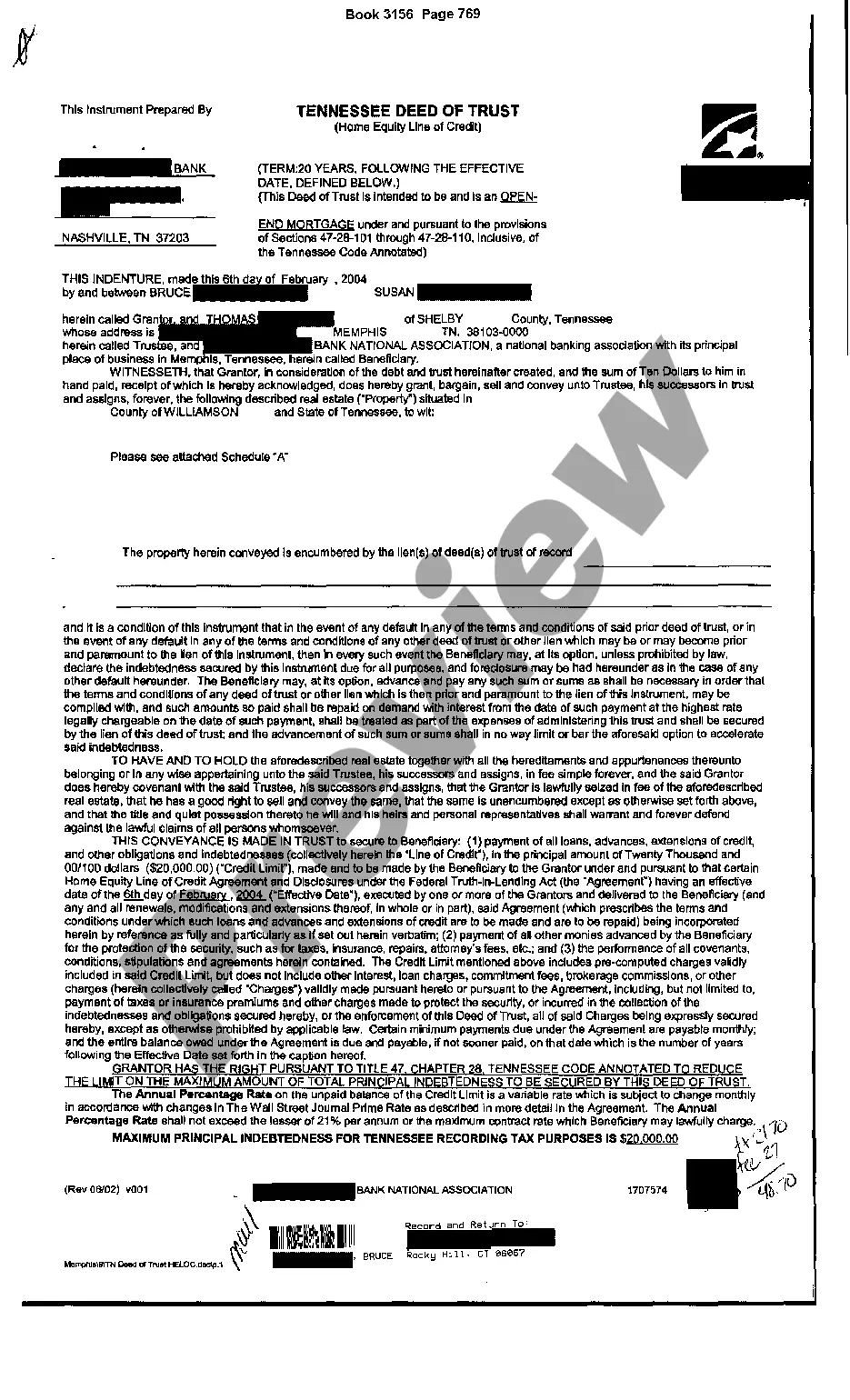

A Knoxville Tennessee Deed of Trust Home Equity is a legal document that serves as collateral for a home loan or mortgage in the city of Knoxville, Tennessee. It establishes an agreement between the borrower (homeowner) and the lender (financial institution) that allows the lender to have a secured interest in the property until the loan is fully repaid. The Deed of Trust is typically filed in the county where the property is located, and it outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment schedule, and any additional fees or charges. It also grants the lender the right to foreclose on the property if the borrower fails to make timely mortgage payments. One of the key benefits of a Knoxville Tennessee Deed of Trust Home Equity is that it enables homeowners to access the equity built in their property. As the property value increases or the mortgage balance decreases over time, homeowners may be able to borrow against the equity to fund home improvements, education expenses, medical bills, or other financial needs. Different types of Knoxville Tennessee Deed of Trust Home Equity may include: 1. Traditional Home Equity Loan: This type of loan allows homeowners to borrow a lump sum of money based on the equity in their home. The loan is typically repaid in fixed monthly installments over a specific term, often at a fixed interest rate. 2. Home Equity Line of Credit (HELOT): A HELOT operates like a credit card, where the homeowner can borrow up to a predetermined credit limit over a specified period. The borrower can make multiple withdrawals as needed, repay, and borrow again during the draw period. Interest is charged only on the amount borrowed, and the interest rate may be variable. 3. Cash-out Refinance: With a cash-out refinance, homeowners can replace their existing mortgage with a new one, borrowing more than the remaining balance on the original loan. The excess amount is paid out to the homeowner as cash, which can be used for various purposes. Irrespective of the type, it is important for homeowners to carefully review the terms and conditions of Knoxville Tennessee Deed of Trust Home Equity loans, conduct thorough research, compare offerings from different lenders, and consider seeking professional advice to ensure they make the best financial decision for their specific needs and circumstances. Ultimately, this legal agreement allows Knoxville homeowners to leverage their property's equity while providing lenders with a level of security.

Knoxville Tennessee Deed of Trust Home Equity

Description

How to fill out Knoxville Tennessee Deed Of Trust Home Equity?

Utilize the US Legal Forms and gain immediate access to any form you desire.

Our efficient platform with a vast assortment of templates streamlines the process to locate and acquire almost any document sample you may need.

You can download, fill out, and verify the Knoxville Tennessee Deed of Trust Home Equity in merely a few minutes rather than spending hours online seeking a suitable template.

Leveraging our catalog is an excellent approach to enhance the security of your form submissions.

- Our experienced attorneys frequently assess all documents to ensure that the forms are applicable for a specific area and adhere to new rules and regulations.

- How can you access the Knoxville Tennessee Deed of Trust Home Equity.

- If you have an account, simply sign in to your profile. The Download button will show on all templates you view.

- Additionally, you can access all previously saved files in the My documents section.

- If you do not have an account yet, follow the instructions below.

Form popularity

FAQ

In Tennessee, a deed can generally be prepared by anyone, but it is often advisable to use a legal professional. Attorneys, title companies, or reputable online services can ensure that all legal requirements are met. Utilizing platforms like uslegalforms can provide you with reliable tools and templates for preparing your deed correctly, especially if it relates to a Knoxville Tennessee Deed of Trust Home Equity.

Tennessee is indeed a deed state, meaning property ownership is conveyed through deeds rather than titles. This entails the need for accurate documentation when buying or selling property. Understanding the intricacies of deeds, such as the deed of trust, is essential for maintaining home equity in Knoxville. You can explore various deed options through platforms like uslegalforms.

Yes, Tennessee recognizes the use of a life estate deed. This type of deed allows a person to hold a property for their lifetime, after which ownership passes to another party. Life estate deeds can be a strategic way to manage property while maximizing home equity for beneficiaries. For detailed information on this process, uslegalforms can provide necessary templates.

Transferring ownership of property in Tennessee typically involves drafting and executing a deed, such as a warranty deed or quitclaim deed. After completion, the new deed must be recorded with the local county office to make the transfer official. If you are looking to understand this process better, platforms like uslegalforms can guide you through the steps. This is particularly important when dealing with a Knoxville Tennessee Deed of Trust Home Equity.

To transfer property to a trust in Tennessee, you will need to execute a new deed that names the trust as the new owner. This process involves preparing a deed that complies with Tennessee law and then recording it with the county register. You can find resources on uslegalforms that may help you with the necessary documentation. A clear title ensures that your home equity is managed effectively.

When considering Knoxville Tennessee Deed of Trust Home Equity, you may wonder if a deed of trust is better than a traditional mortgage. A deed of trust can offer certain advantages, such as a potentially quicker foreclosure process, which can benefit both lenders and borrowers. Additionally, a deed of trust often involves three parties—the borrower, the lender, and a trustee—providing a unique layer of security. Ultimately, your choice should reflect your financial situation and long-term goals, so exploring your options through US Legal Forms can provide you with valuable insights.

In Tennessee, a deed must include specific elements to be valid, particularly when dealing with Knoxville Tennessee Deed of Trust Home Equity. First, it should clearly identify the parties involved, such as the grantor and grantee. Next, a legal description of the property must be included to establish the precise location and boundaries. Additionally, the deed must be signed by the grantor and must also be notarized to ensure its acceptance in the courts.

To obtain a copy of a deed in Tennessee, you can contact the local county register of deeds where your property is located. You will need to provide specific property details, such as the owner's name and property address, to facilitate your request. Additionally, the Knoxville Tennessee Deed of Trust Home Equity document often requires access to the official deed, so knowing how to retrieve it is crucial. Online platforms like uslegalforms simplify this process by guiding you through the necessary steps to obtain your deed efficiently.

The Home Equity Line of Credit (HELOC) rates in Knoxville, Tennessee, can vary based on several factors including credit score and market conditions. Typically, you may find competitive rates that make HELOCs an attractive choice for accessing your home equity. Consider how the Knoxville Tennessee Deed of Trust Home Equity can benefit you by providing flexible access to funds as needed. Always check with local lenders to get the most current rates available.

Yes, Knoxville, Tennessee, offers home equity loans. Many financial institutions in the area provide various options for those seeking to tap into their home equity. When you explore home equity loans, consider how a Knoxville Tennessee Deed of Trust Home Equity can help you secure the funding you need for renovations, debt consolidation, or unexpected expenses. Always compare rates and terms to find the best option for your financial situation.