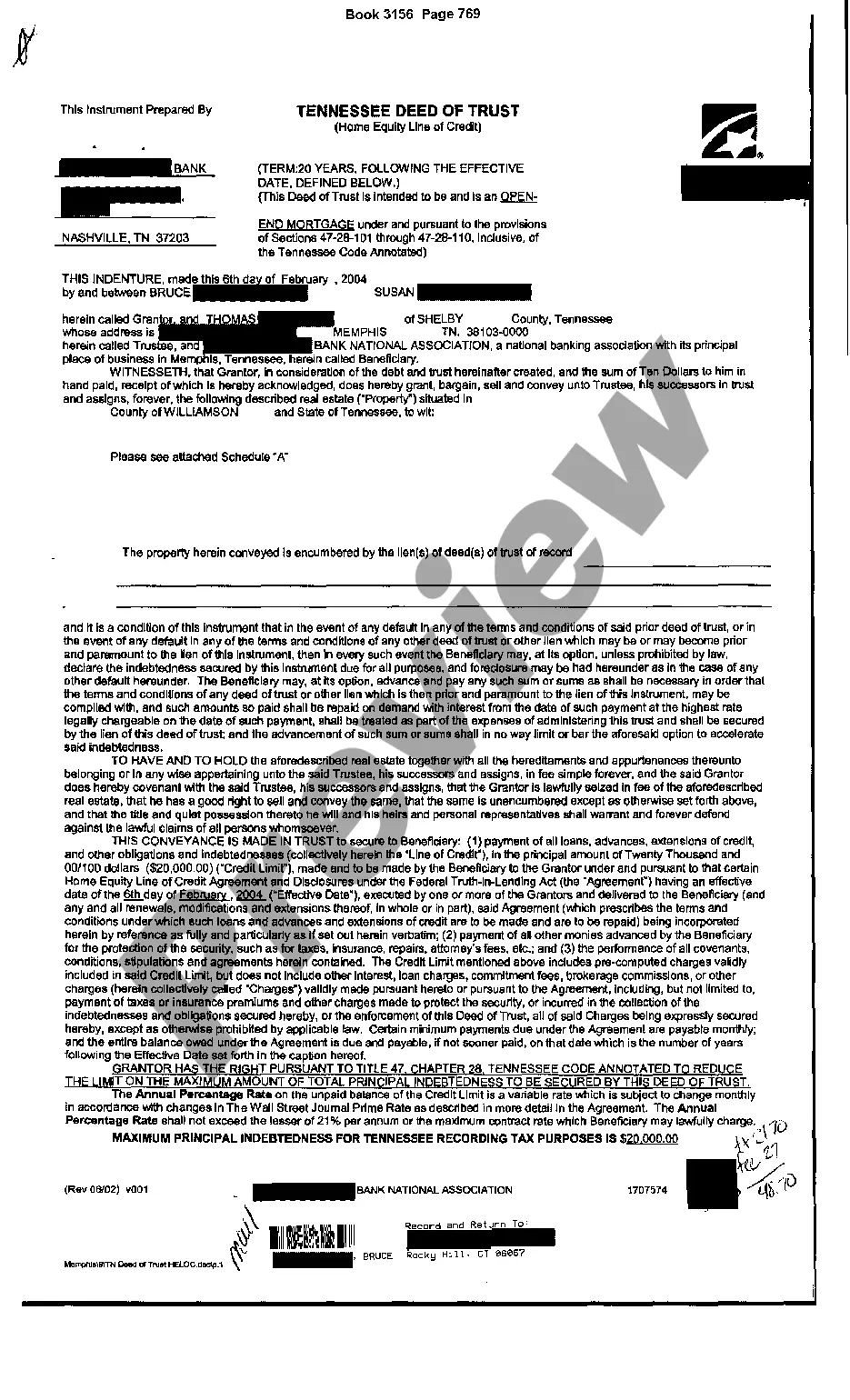

In Memphis, Tennessee, a Deed of Trust Home Equity is a legal document that serves as a type of mortgage securing a loan against a property. It is used when a homeowner wants to borrow against the equity they have built up in their home. This document outlines the terms and conditions of the loan, the rights and obligations of the borrower (the homeowner) and the lender, and acts as evidence of the debt. The Deed of Trust Home Equity in Memphis, Tennessee, includes specific keywords that are crucial to understanding the document. These keywords include: 1. Deed of Trust: A legal agreement that transfers the title or a stake in a property to a trustee as security for a loan. This trustee holds the title until the debt is fully paid. In Memphis, Tennessee, the trustee is typically a neutral third party. 2. Home Equity: The difference between the market value of a property and the outstanding mortgage or liens against it. It represents the homeowner's ownership interest in the property and is used as collateral for the loan. 3. Loan Agreement: A binding contract between the borrower and the lender that sets out the terms of the loan, including the loan amount, interest rate, repayment schedule, and any other relevant provisions. 4. Trustee: The neutral third party designated to hold the title to the property until the loan is repaid. In Memphis, Tennessee, a trustee is commonly a title company or attorney. There are various types of Deed of Trust Home Equity in Memphis, Tennessee that may cater to different borrowing needs. These may include: 1. Fixed-Rate Home Equity Loan: A loan where the interest rate remains fixed for the entire term of the loan. This type of loan provides stability for borrowers who prefer predictable monthly payments. 2. Variable-Rate Home Equity Line of Credit (HELOT): A line of credit that allows homeowners to borrow against their equity as needed. The interest rate on a HELOT can vary over time based on market conditions and terms outlined in the loan agreement. 3. Balloon Payment Loan: A loan that requires smaller monthly payments over the loan term, with a large final payment (balloon payment) due at the end. This option may be suitable for borrowers who anticipate a significant influx of funds in the future. It is important for homeowners in Memphis, Tennessee, to carefully review and understand the terms and conditions of the Deed of Trust Home Equity before signing, as it serves as a legal agreement with financial implications. Seeking legal advice or consulting with a qualified professional is recommended to ensure that homeowners fully comprehend their rights and responsibilities.

Memphis Tennessee Deed of Trust Home Equity

State:

Tennessee

City:

Memphis

Control #:

TN-E514

Format:

PDF

Instant download

This form is available by subscription

Description

Deed of Trust Home Equity

In Memphis, Tennessee, a Deed of Trust Home Equity is a legal document that serves as a type of mortgage securing a loan against a property. It is used when a homeowner wants to borrow against the equity they have built up in their home. This document outlines the terms and conditions of the loan, the rights and obligations of the borrower (the homeowner) and the lender, and acts as evidence of the debt. The Deed of Trust Home Equity in Memphis, Tennessee, includes specific keywords that are crucial to understanding the document. These keywords include: 1. Deed of Trust: A legal agreement that transfers the title or a stake in a property to a trustee as security for a loan. This trustee holds the title until the debt is fully paid. In Memphis, Tennessee, the trustee is typically a neutral third party. 2. Home Equity: The difference between the market value of a property and the outstanding mortgage or liens against it. It represents the homeowner's ownership interest in the property and is used as collateral for the loan. 3. Loan Agreement: A binding contract between the borrower and the lender that sets out the terms of the loan, including the loan amount, interest rate, repayment schedule, and any other relevant provisions. 4. Trustee: The neutral third party designated to hold the title to the property until the loan is repaid. In Memphis, Tennessee, a trustee is commonly a title company or attorney. There are various types of Deed of Trust Home Equity in Memphis, Tennessee that may cater to different borrowing needs. These may include: 1. Fixed-Rate Home Equity Loan: A loan where the interest rate remains fixed for the entire term of the loan. This type of loan provides stability for borrowers who prefer predictable monthly payments. 2. Variable-Rate Home Equity Line of Credit (HELOT): A line of credit that allows homeowners to borrow against their equity as needed. The interest rate on a HELOT can vary over time based on market conditions and terms outlined in the loan agreement. 3. Balloon Payment Loan: A loan that requires smaller monthly payments over the loan term, with a large final payment (balloon payment) due at the end. This option may be suitable for borrowers who anticipate a significant influx of funds in the future. It is important for homeowners in Memphis, Tennessee, to carefully review and understand the terms and conditions of the Deed of Trust Home Equity before signing, as it serves as a legal agreement with financial implications. Seeking legal advice or consulting with a qualified professional is recommended to ensure that homeowners fully comprehend their rights and responsibilities.

Free preview

How to fill out Memphis Tennessee Deed Of Trust Home Equity?

If you’ve already used our service before, log in to your account and download the Memphis Tennessee Deed of Trust Home Equity on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to obtain your file:

- Ensure you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Memphis Tennessee Deed of Trust Home Equity. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!