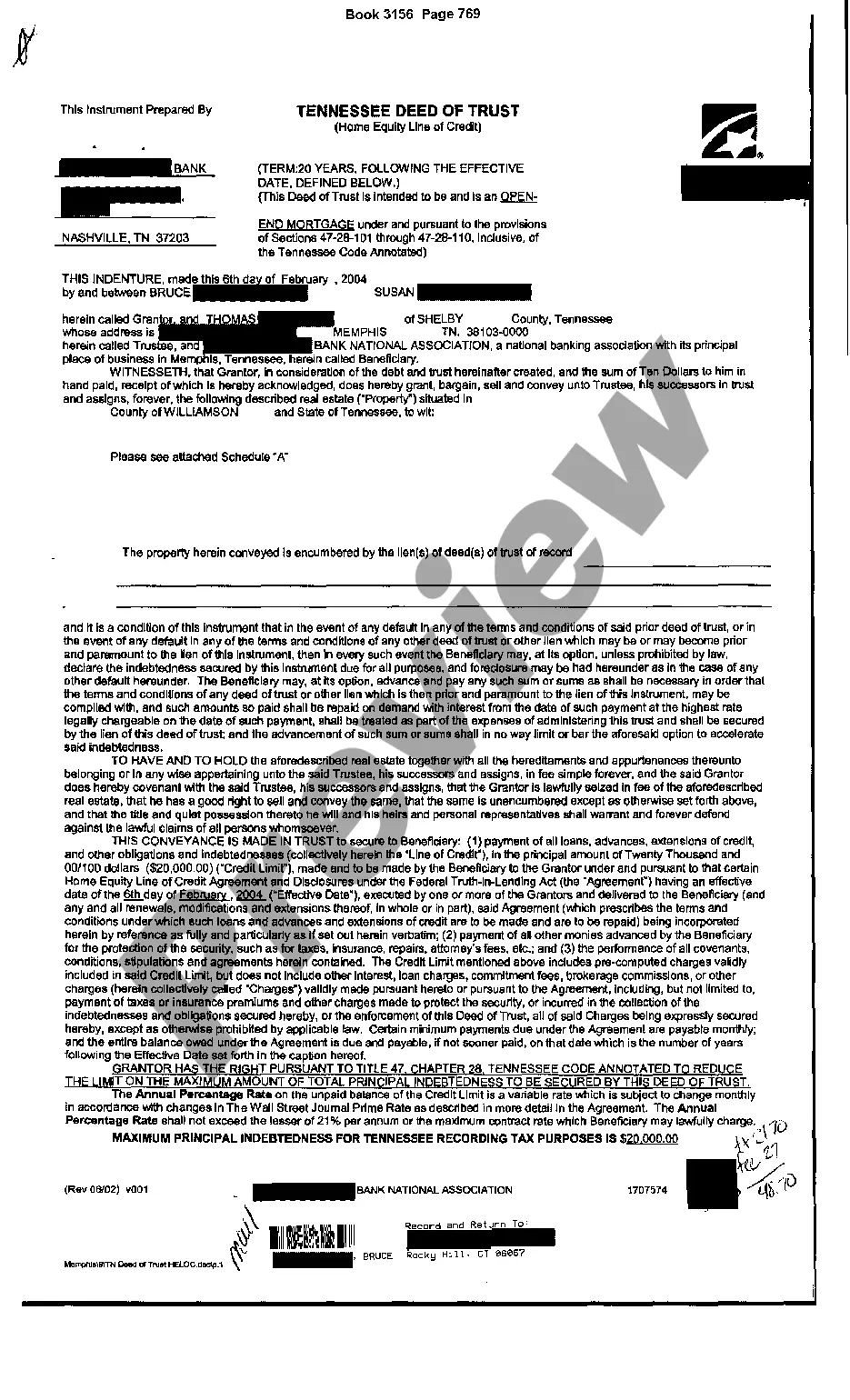

A Murfreesboro Tennessee Deed of Trust Home Equity refers to a legal document that establishes a lien on a property as collateral for a loan. This document, also known as a mortgage, involves three parties: the borrower (homeowner), the lender (usually a financial institution), and a trustee (often a title company or attorney) who oversees the process. By signing a Murfreesboro Tennessee Deed of Trust Home Equity, the homeowner pledges the property as security for a loan or line of credit, allowing them to tap into their home's equity. This type of deed serves as a guarantee that the lender will be repaid in the event of default. Different types of Murfreesboro Tennessee Deed of Trust Home Equity include: 1. Traditional Home Equity Loan: This is a fixed loan amount that allows homeowners to borrow against their property's equity. The borrower receives a lump sum and repays it over a specified period with fixed monthly installments and interest rates. 2. Home Equity Line of Credit (HELOT): Unlike a traditional loan, a HELOT allows homeowners to access a revolving line of credit. They can borrow and repay multiple times during the draw period, usually up to 10 years, and only pay interest on the amount withdrawn. 3. Cash-Out Refinance: This option involves refinancing an existing mortgage for an amount greater than what is owed. The excess equity is received in cash and can be used for various purposes such as home improvements, debt consolidation, or education expenses. 4. Second Mortgage: Also referred to as a home equity installment loan, a second mortgage provides homeowners with another loan on top of their primary mortgage. This type of debt is separate from the first mortgage and typically has its interest rate and repayment terms. It is important for homeowners in Murfreesboro, Tennessee, to understand that a Deed of Trust Home Equity adds a lien on their property, meaning that failure to repay the loan as agreed could result in foreclosure. Overall, a Murfreesboro Tennessee Deed of Trust Home Equity allows homeowners to leverage the equity in their property for financial flexibility, whether it be for necessary expenses, investments, or improving their quality of life.

Murfreesboro Tennessee Deed of Trust Home Equity

Description

How to fill out Murfreesboro Tennessee Deed Of Trust Home Equity?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for someone with no legal background to create this sort of papers from scratch, mainly because of the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes in handy. Our platform provides a massive catalog with over 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you require the Murfreesboro Tennessee Deed of Trust Home Equity or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Murfreesboro Tennessee Deed of Trust Home Equity in minutes using our reliable platform. In case you are presently a subscriber, you can go on and log in to your account to download the appropriate form.

However, in case you are unfamiliar with our platform, ensure that you follow these steps before downloading the Murfreesboro Tennessee Deed of Trust Home Equity:

- Ensure the template you have found is suitable for your location considering that the regulations of one state or county do not work for another state or county.

- Review the form and go through a brief outline (if available) of cases the paper can be used for.

- If the form you chosen doesn’t meet your needs, you can start again and search for the needed document.

- Click Buy now and pick the subscription plan you prefer the best.

- utilizing your login information or register for one from scratch.

- Pick the payment gateway and proceed to download the Murfreesboro Tennessee Deed of Trust Home Equity once the payment is completed.

You’re all set! Now you can go on and print the form or complete it online. If you have any issues getting your purchased documents, you can easily access them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.