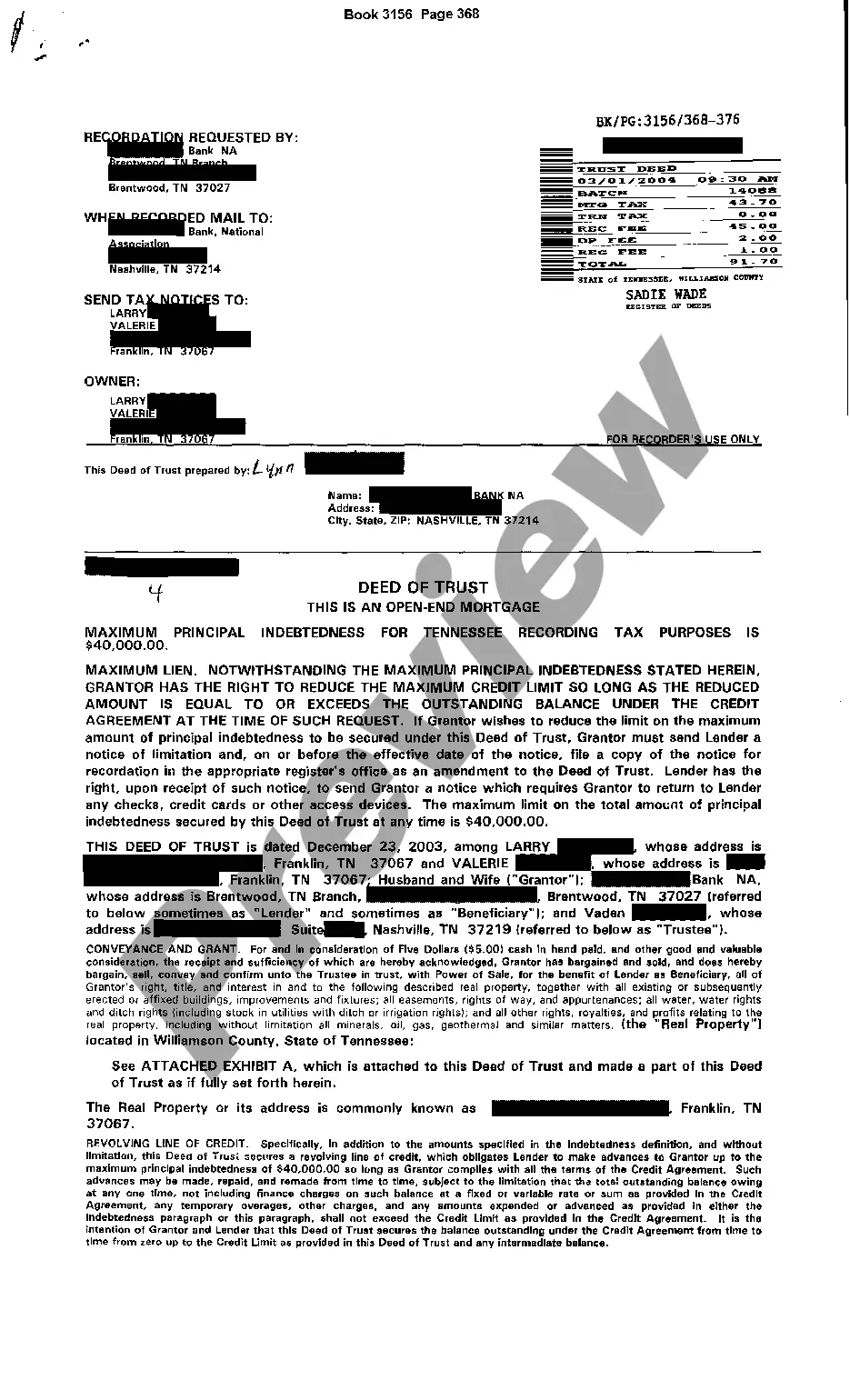

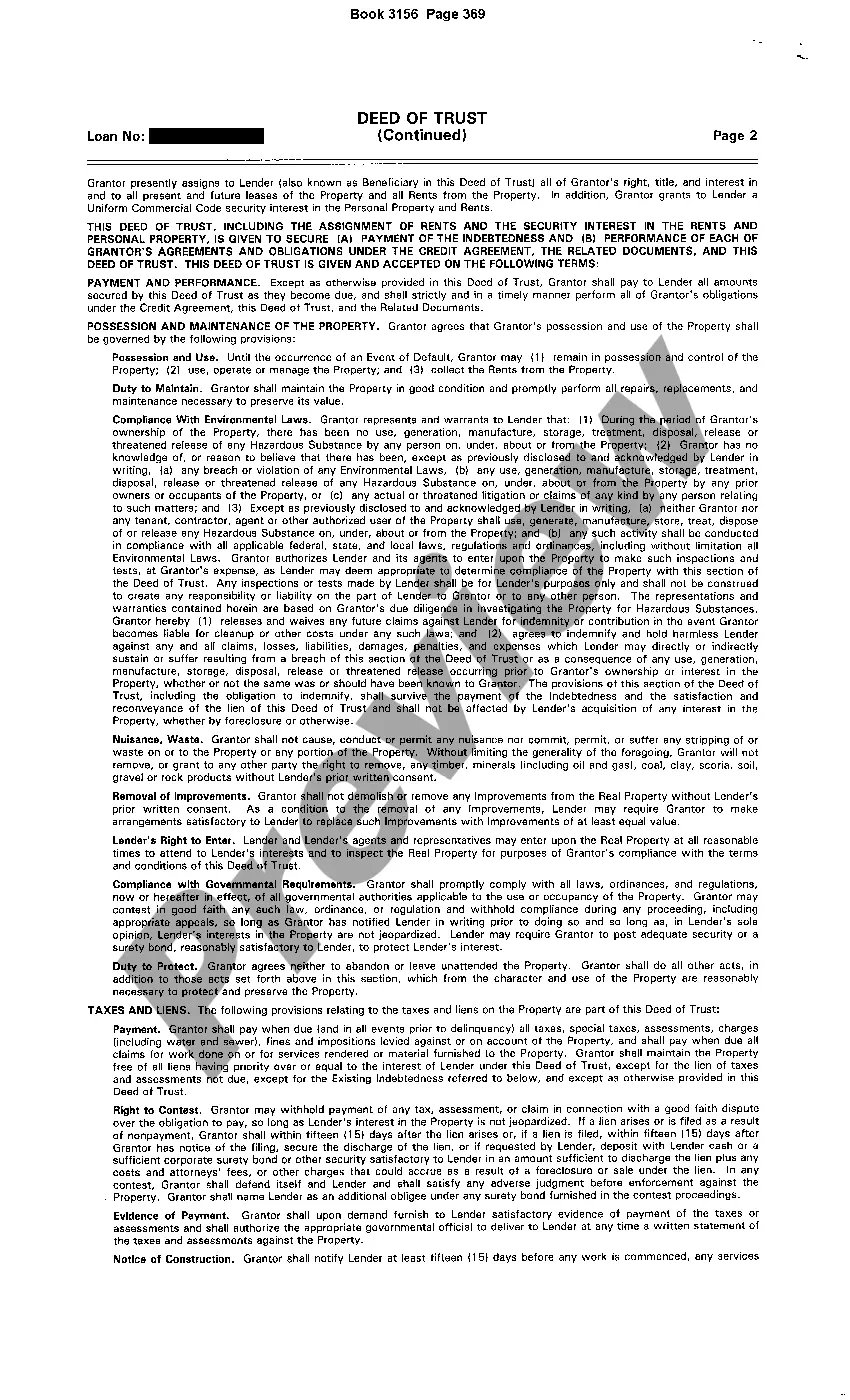

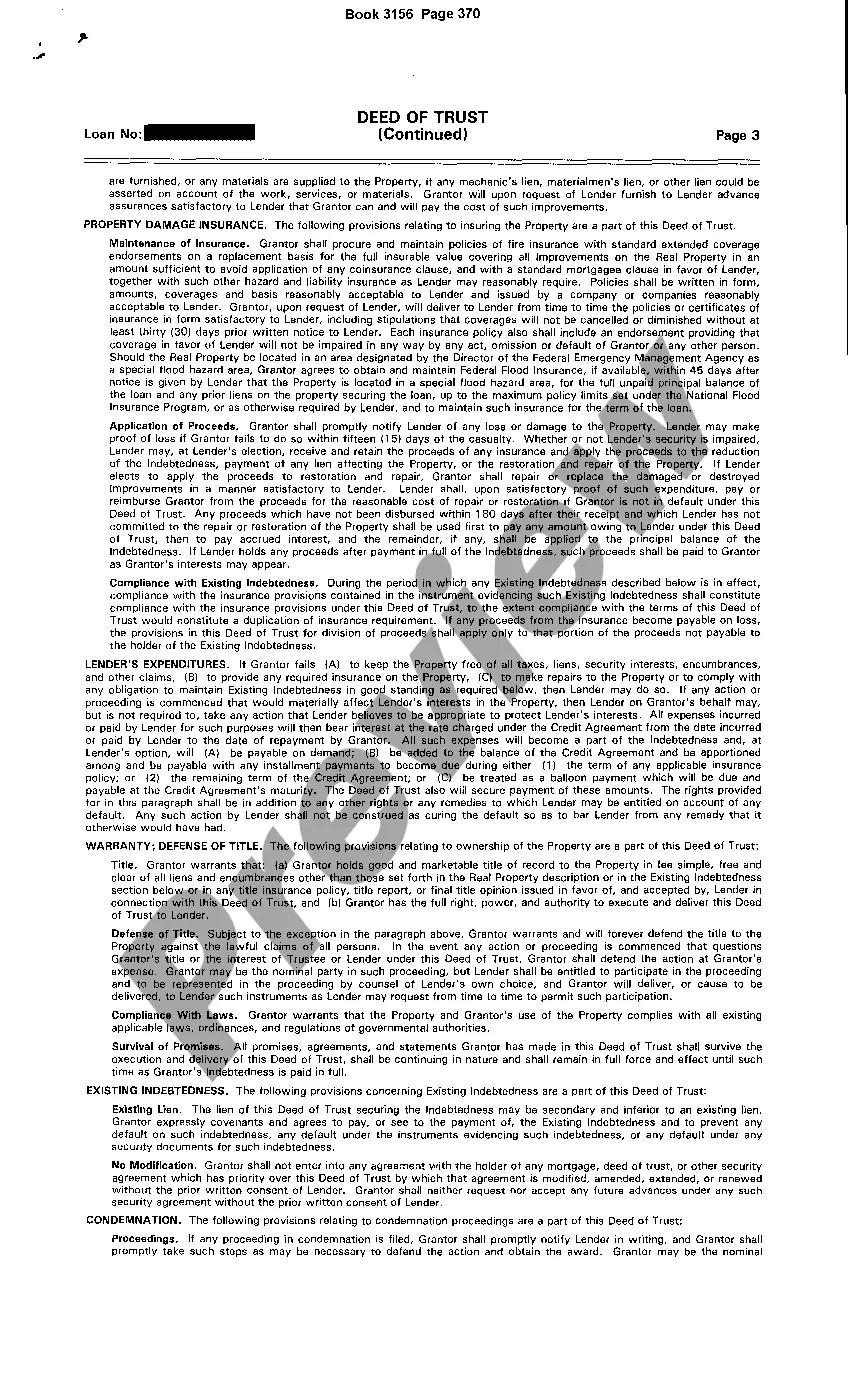

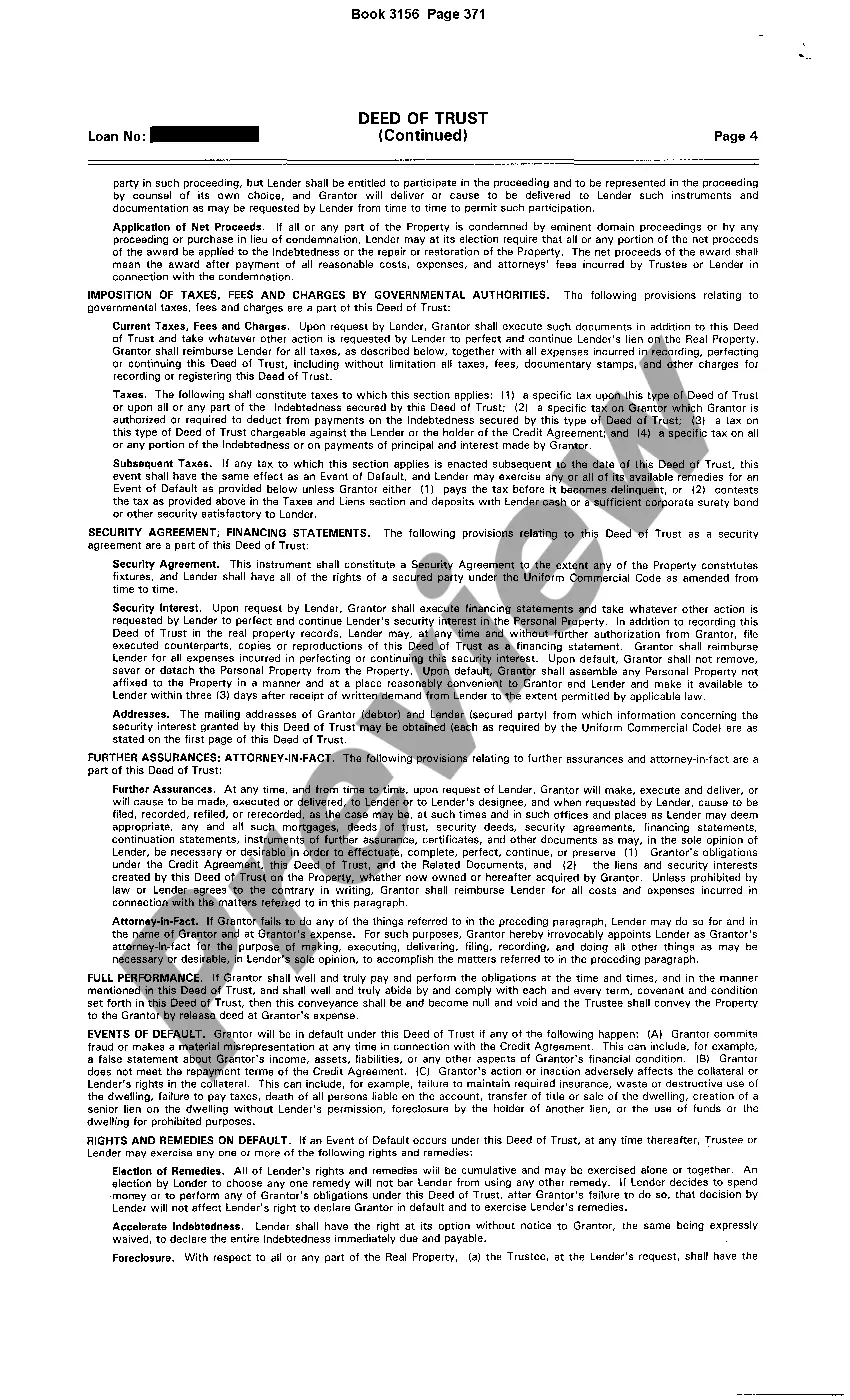

A Chattanooga Tennessee Deed of Trust Open End Mortgage is a legal and binding document that serves as a security instrument for a loan agreement. It is commonly used in real estate transactions when a borrower seeks financing for the purchase or refinancing of a property in Chattanooga, Tennessee. This mortgage gives the lender a security interest in the property, allowing them to foreclose and recoup their investment in case the borrower defaults on the loan. The key elements of a Chattanooga Tennessee Deed of Trust Open End Mortgage include the identification of the parties involved, namely the borrower (also known as the trust or), the lender (also known as the beneficiary), and the trustee, who acts as a neutral third party to hold the legal title to the property until the loan is satisfied. The trust deed also specifies the property being encumbered, including its legal description and address. One of the distinguishing features of an open-end mortgage is its ability to secure additional loans or advances made by the lender to the borrower. This flexibility allows the borrower to tap into the equity of their property without the need for a new mortgage or refinancing. By using an open-end mortgage, borrowers in Chattanooga, Tennessee, have the advantage of accessing funds for various purposes, such as home improvements, debt consolidation, or emergencies, under the same mortgage terms. Several types of Open End Mortgages exist in Chattanooga, Tennessee, tailored to meet different requirements: 1. Standard Open End Mortgage: This is the most common type, securing the initial loan and providing the option for additional loans or advances by the lender. 2. Construction Open End Mortgage: Designed specifically for borrowers who plan to build a new property or undertake significant renovations, this type of mortgage allows the lender to disburse funds at different stages of construction. 3. Home Equity Line of Credit (HELOT): Similar to a credit card, this mortgage enables homeowners to borrow against the equity built up in their property as needed, making it a popular choice for ongoing expenses or unexpected costs. It is worth noting that a Chattanooga Tennessee Deed of Trust Open End Mortgage should always be executed with proper legal advice from a qualified professional to ensure compliance with state laws and to protect the rights and interests of all parties involved.

Chattanooga Tennessee Deed of Trust Open End Mortgage

Description

How to fill out Chattanooga Tennessee Deed Of Trust Open End Mortgage?

Locating verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so locating the Chattanooga Tennessee Deed of Trust Open End Mortgage gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Chattanooga Tennessee Deed of Trust Open End Mortgage takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. The process will take just a couple of additional steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

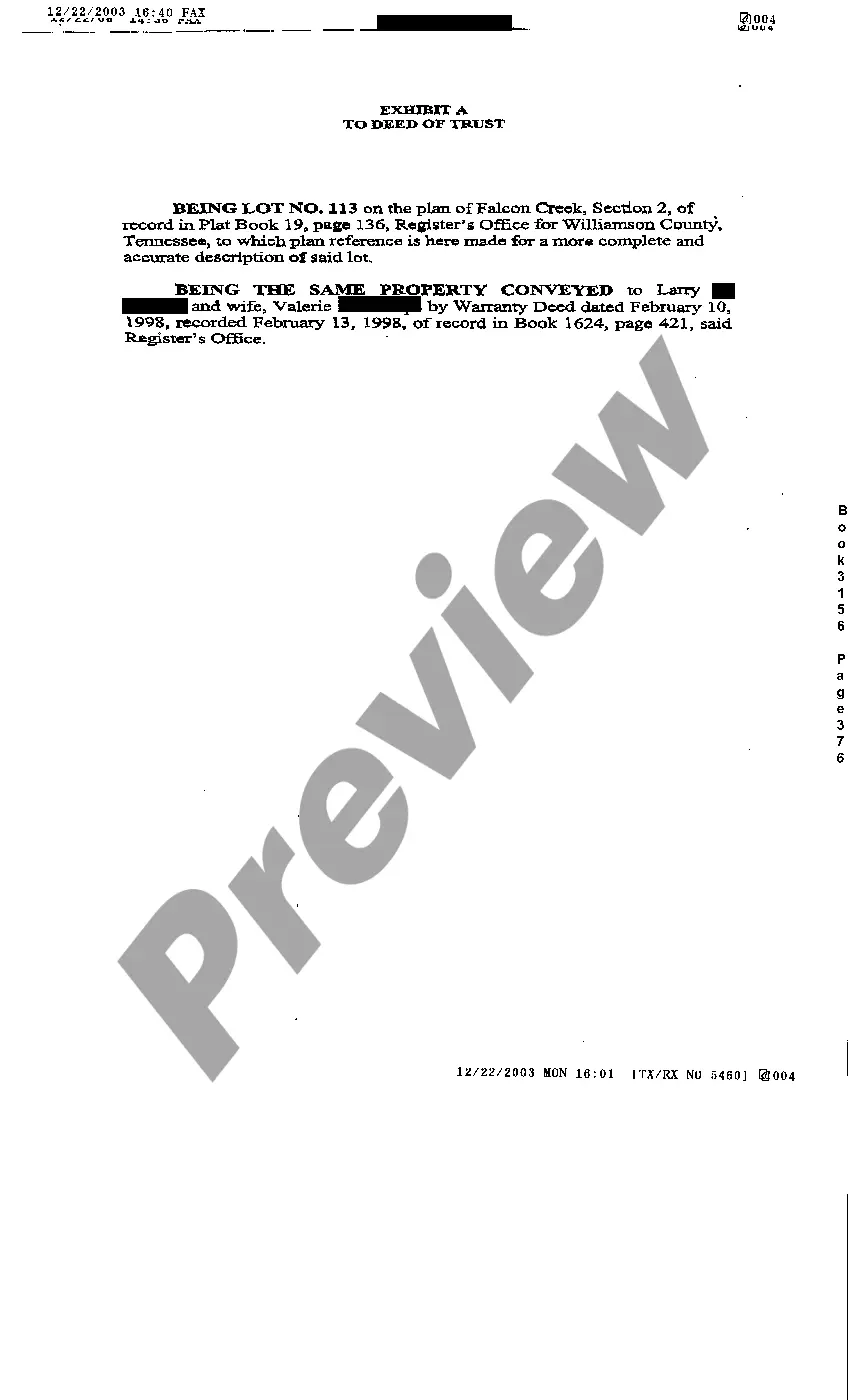

- Look at the Preview mode and form description. Make certain you’ve selected the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, utilize the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should create an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Chattanooga Tennessee Deed of Trust Open End Mortgage. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!