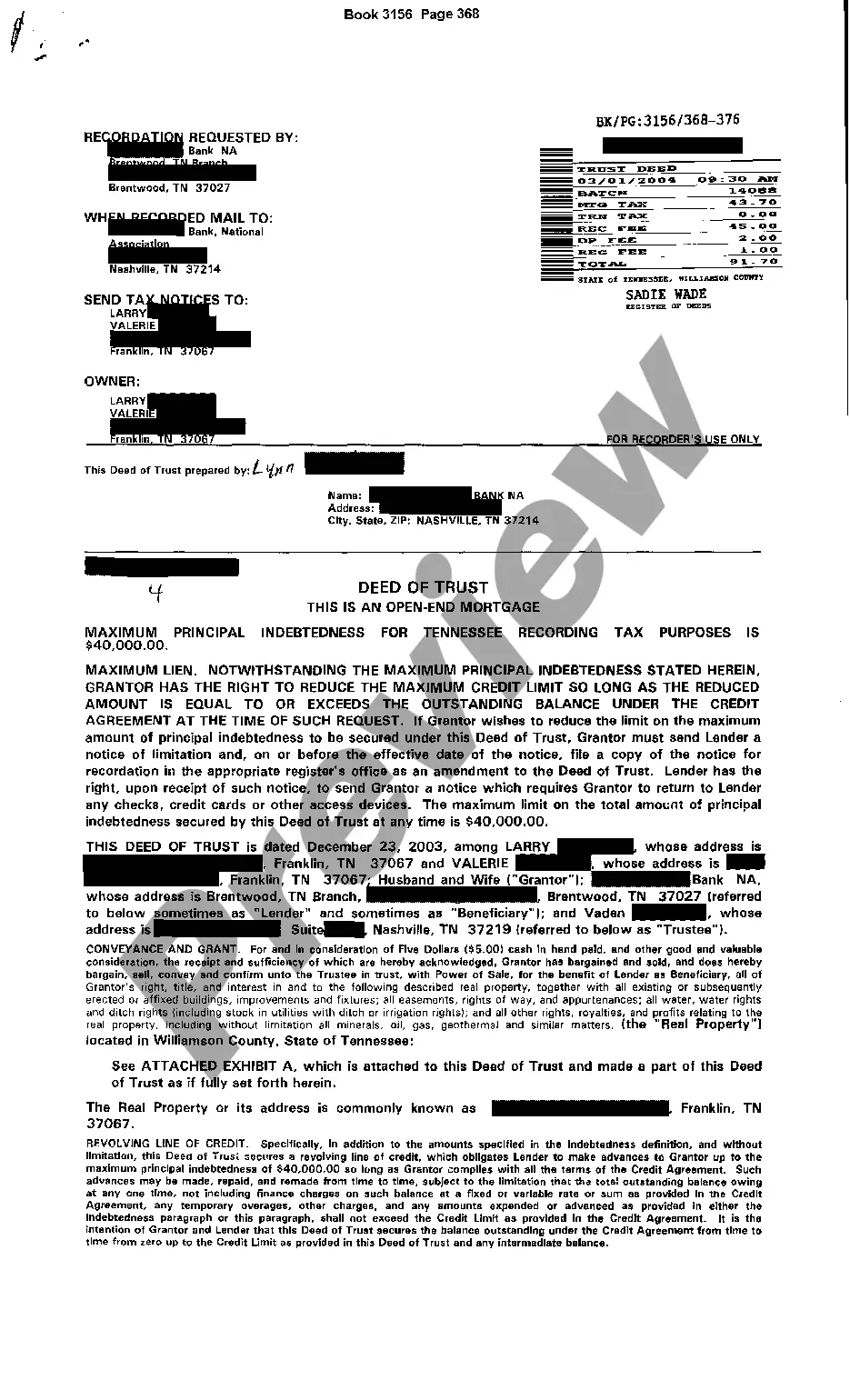

The Clarksville Tennessee Deed of Trust Open End Mortgage is a legal document that serves as a security instrument in real estate transactions within Clarksville, Tennessee. It establishes a lien on a property as collateral for a loan, providing lenders with added protection in case of default. This mortgage is considered an open-end mortgage, meaning it allows the borrower to access additional funds over time, making it a flexible financing option. Key components of the Clarksville Tennessee Deed of Trust Open End Mortgage include the borrower (also known as the trust or mortgagor), the lender (also known as the beneficiary or mortgagee), and the trustee who holds legal title to the property until the loan is paid in full. Additionally, the mortgage outlines the terms and conditions of the loan, including interest rates, repayment schedule, and any associated fees or penalties. There are several types of Clarksville Tennessee Deed of Trust Open End Mortgages available to borrowers, each offering different benefits suited to specific financing needs: 1. Standard Open End Mortgage: This is the most common type of open-end mortgage, where borrowers can qualify for a loan and secure it with their property. It allows them to utilize their equity over time, making improvements, or using funds for other purposes. 2. Construction Open End Mortgage: For individuals or developers seeking financing for new construction or major property renovations, this type of open-end mortgage provides funds in stages as the construction progresses. This allows borrowers to manage expenses related to the project effectively. 3. Home Equity Line of Credit (HELOT): This type of open-end mortgage enables homeowners to tap into their home equity for various purposes, such as home renovations, debt consolidation, and educational expenses. It functions similarly to a credit card, allowing borrowers to access funds as needed, up to a predetermined limit. 4. Reverse Mortgage: Especially designed for senior citizens, this type of open-end mortgage allows homeowners aged 62 or older to convert their home equity into cash, providing a regular income stream during retirement. The loan is paid back when the homeowner sells the property or passes away. The Clarksville Tennessee Deed of Trust Open End Mortgage provides homeowners and real estate investors with flexible financing options and the ability to tap into their property's equity over time. It is important for borrowers to thoroughly review and understand the terms and conditions outlined in this legal document before entering into any mortgage agreement.

Clarksville Tennessee Deed of Trust Open End Mortgage

Description

How to fill out Tennessee Deed Of Trust Open End Mortgage?

We consistently strive to reduce or avert legal repercussions while managing complex legal or financial matters.

In order to achieve this, we seek legal assistance that is often quite expensive.

However, not all legal issues are similarly complicated.

Many of them can be handled by ourselves.

Utilize US Legal Forms whenever you need to locate and download the Clarksville Tennessee Deed of Trust Open End Mortgage or any other forms conveniently and securely. Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always re-download it from the My documents section. The process is similarly simple even if you are not familiar with the platform! You can set up your account in just a few minutes. Ensure that the Clarksville Tennessee Deed of Trust Open End Mortgage complies with your local laws and regulations. Additionally, it is vital that you review the form’s outline (if available), and if you observe any inconsistencies with what you originally needed, look for a different template. Once you have confirmed that the Clarksville Tennessee Deed of Trust Open End Mortgage suits your situation, you can choose a subscription plan and proceed to payment. Afterwards, you may download the form in any desired file format. For over 24 years, we have assisted millions of individuals by offering customizable and up-to-date legal forms. Take full advantage of US Legal Forms now to conserve time and resources!

- US Legal Forms is a digital collection of current DIY legal templates covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our resource empowers you to manage your matters independently without needing to consult legal representation.

- We provide access to legal form templates that aren't always readily accessible.

- Our templates are tailored to specific states and regions, which significantly streamlines the search process.

Form popularity

FAQ

To obtain a copy of a deed in Tennessee, you can visit the local county clerk's office or the register of deeds. Many of these offices now offer online systems for requesting copies of property documents. Additionally, if you prefer a more streamlined approach, consider using uslegalforms to request your copy of the Clarksville Tennessee Deed of Trust Open End Mortgage effortlessly.

You can find the title deed to your house at your local county clerk's office or register of deeds. Many counties in Tennessee provide online access to property records, allowing you to search by name or address. If you need additional help locating your deed, consider using uslegalforms, which can assist you in retrieving your Clarksville Tennessee Deed of Trust Open End Mortgage title deed.

After your closing, the deed is filed with the local county clerk or register of deeds. You can request a copy of the recorded deed by visiting the office where the document was filed. Many counties, including those in Tennessee, offer online services to help you access your property documents. If you prefer assistance, the uslegalforms platform can guide you through obtaining your Clarksville Tennessee Deed of Trust Open End Mortgage documents.

At closing, you won't receive the physical deed to your home immediately. Instead, the closing process involves signing various documents and transferring funds. The title company will then prepare and record the deed with the county. Therefore, while you gain ownership at closing, the official deed for your Clarksville Tennessee Deed of Trust Open End Mortgage will come later after recording.

After buying a house in Clarksville, Tennessee, the deed typically takes a few weeks to be processed. Once you close on your home, the title company files the deed with the local authorities. This process usually involves a title search and recording, ensuring that your deed reflects your ownership. You can expect to receive your deed around two to four weeks after closing on your Clarksville Tennessee Deed of Trust Open End Mortgage.

Using a deed of trust offers several advantages, including a faster foreclosure process and greater flexibility in terms of borrowing. In a deed of trust, the lender can quickly exercise rights through the trustee, which can benefit both parties. By opting for a Clarksville Tennessee Deed of Trust Open End Mortgage, you position yourself for effective management of your property financing.

The time it takes to record a deed of trust in Tennessee can vary by county, but it usually happens within a few days after submission. Once recorded, the deed becomes part of the public record, providing legal notice of the encumbrance. If you are using a Clarksville Tennessee Deed of Trust Open End Mortgage, expect a smooth recording process with careful planning.

Typically, the borrower is responsible for paying the recording fees to record the deed and the deed of trust in Tennessee. It's common for these costs to be outlined in the closing documents. By understanding this detail, you can better plan for your expenses related to a Clarksville Tennessee Deed of Trust Open End Mortgage.

Tennessee primarily uses a deed of trust, which acts similarly to a mortgage but involves a third-party trustee. This structure allows for a more streamlined foreclosure process if needed. When you choose a Clarksville Tennessee Deed of Trust Open End Mortgage, you benefit from this efficient system.

Yes, a deed of trust must be recorded to be valid against third parties in Tennessee. Recording gives public notice of the deed and protects the lender's rights. If you are considering a Clarksville Tennessee Deed of Trust Open End Mortgage, timely recording is essential to ensure your legal protection regarding the property.