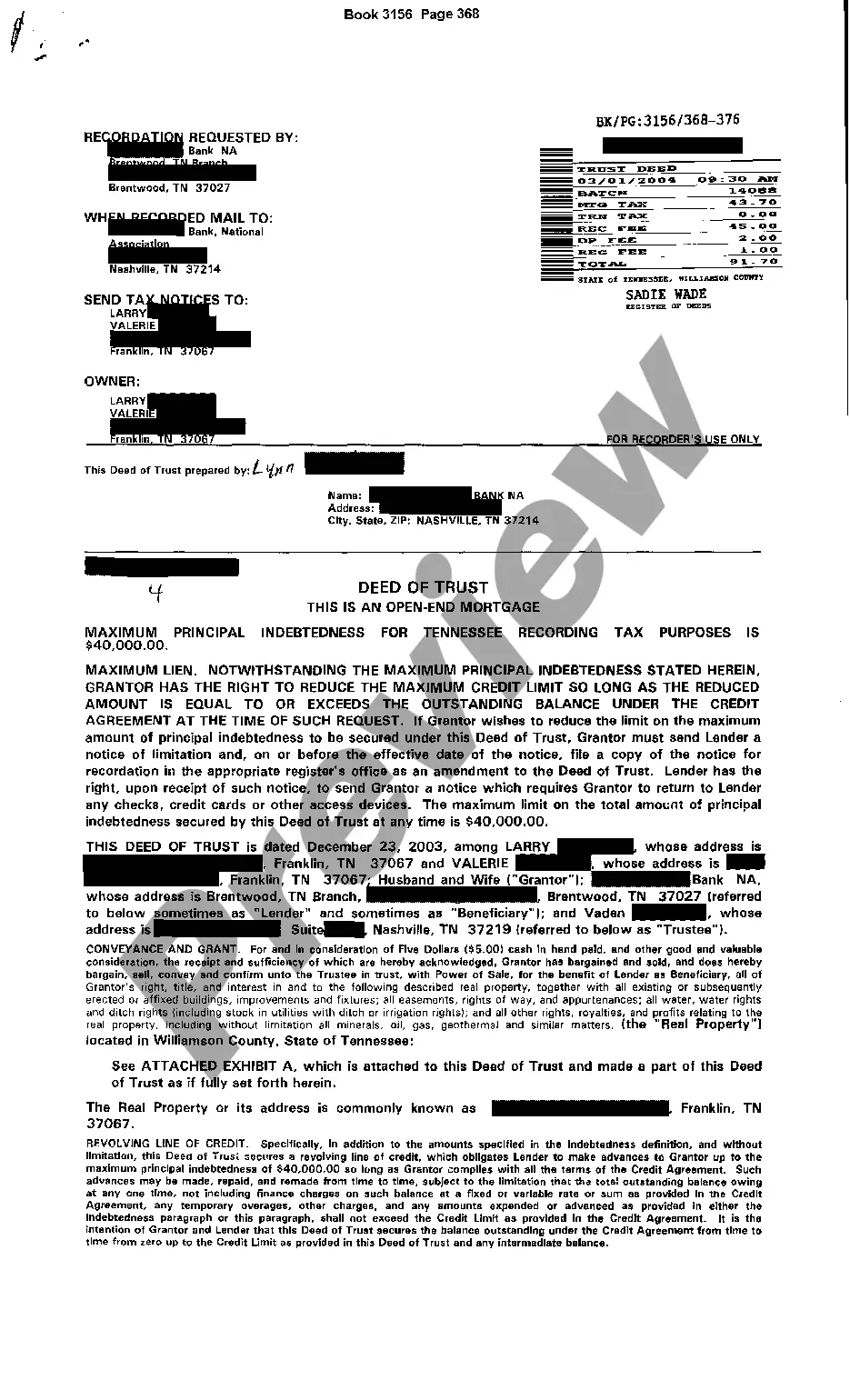

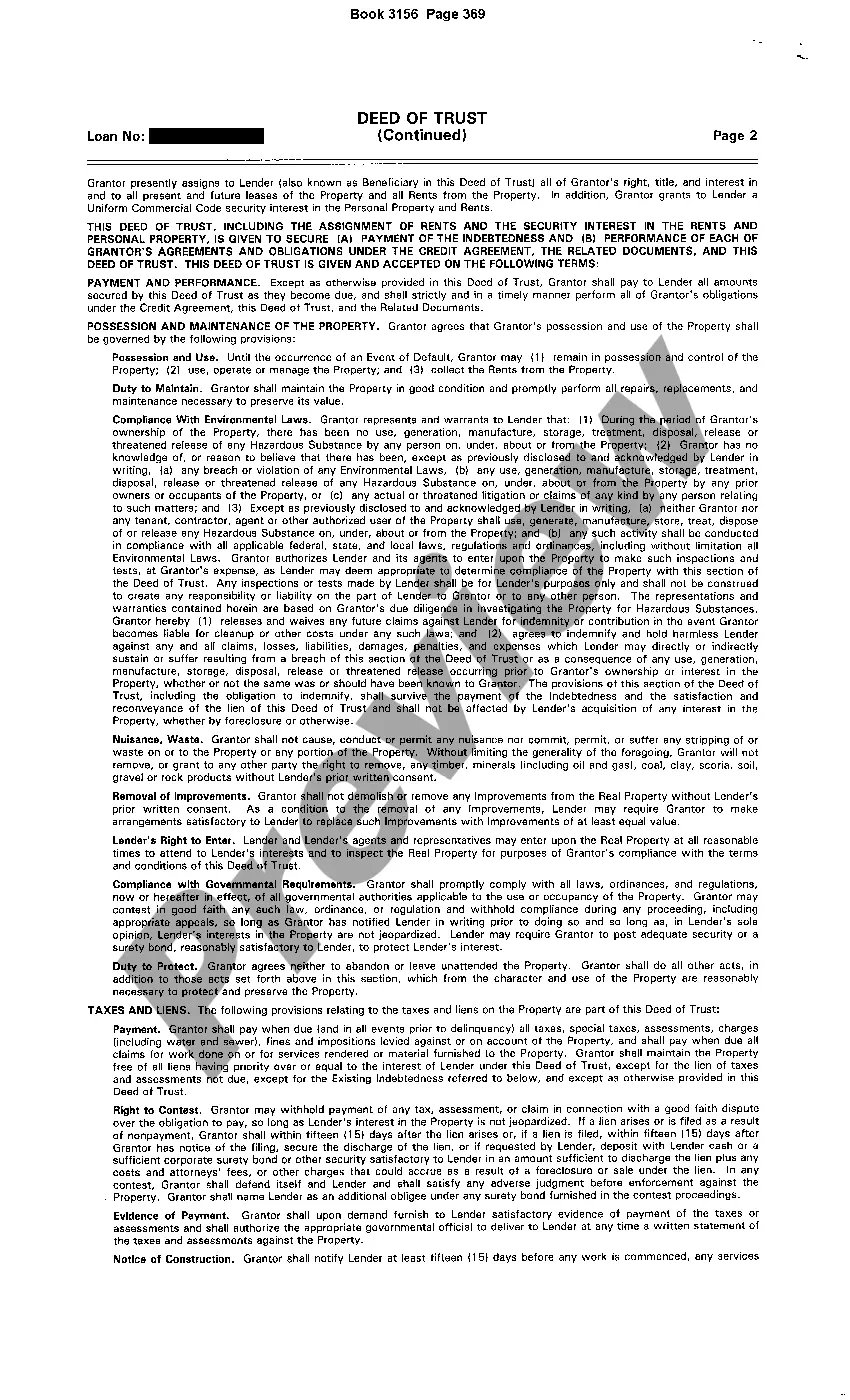

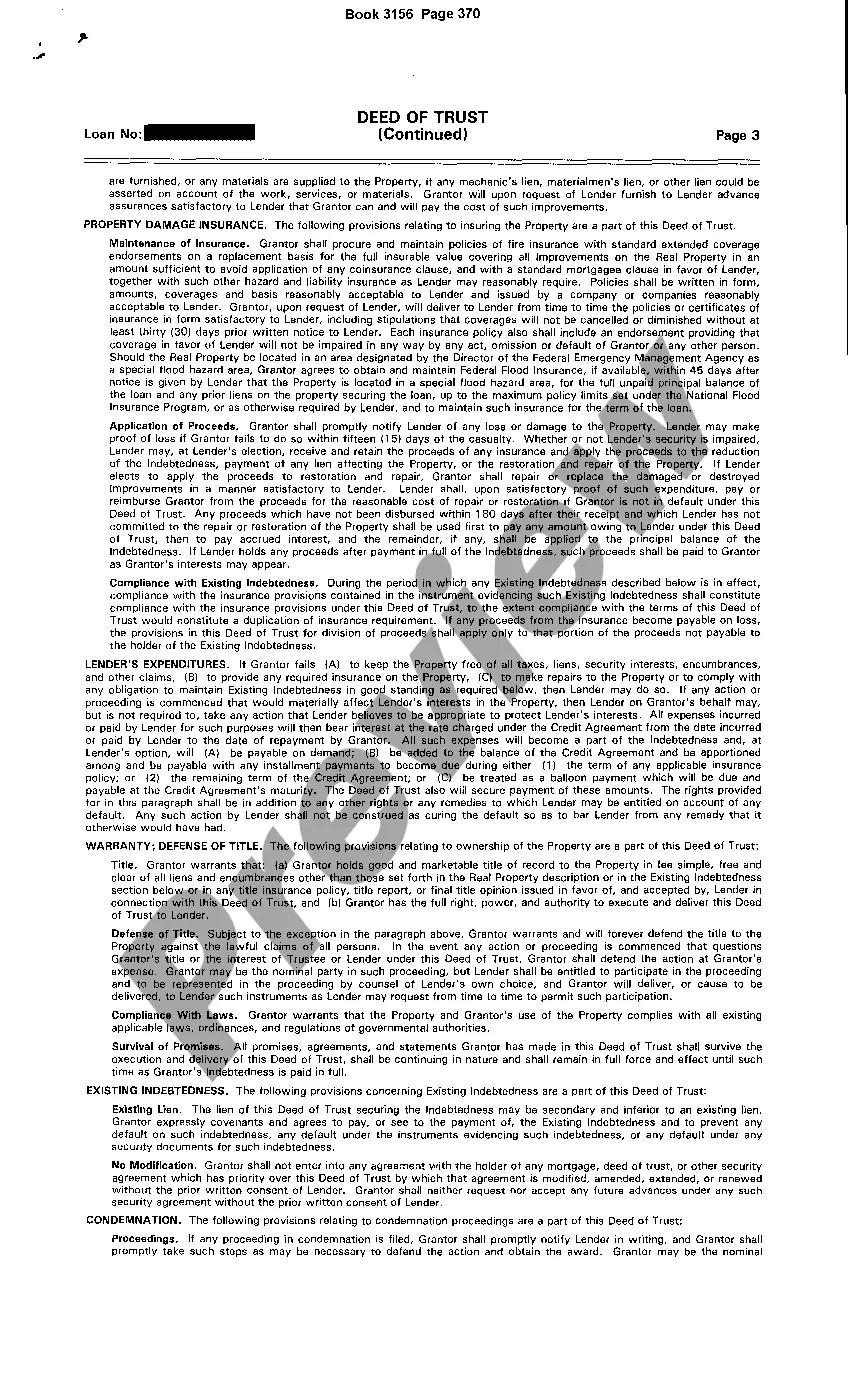

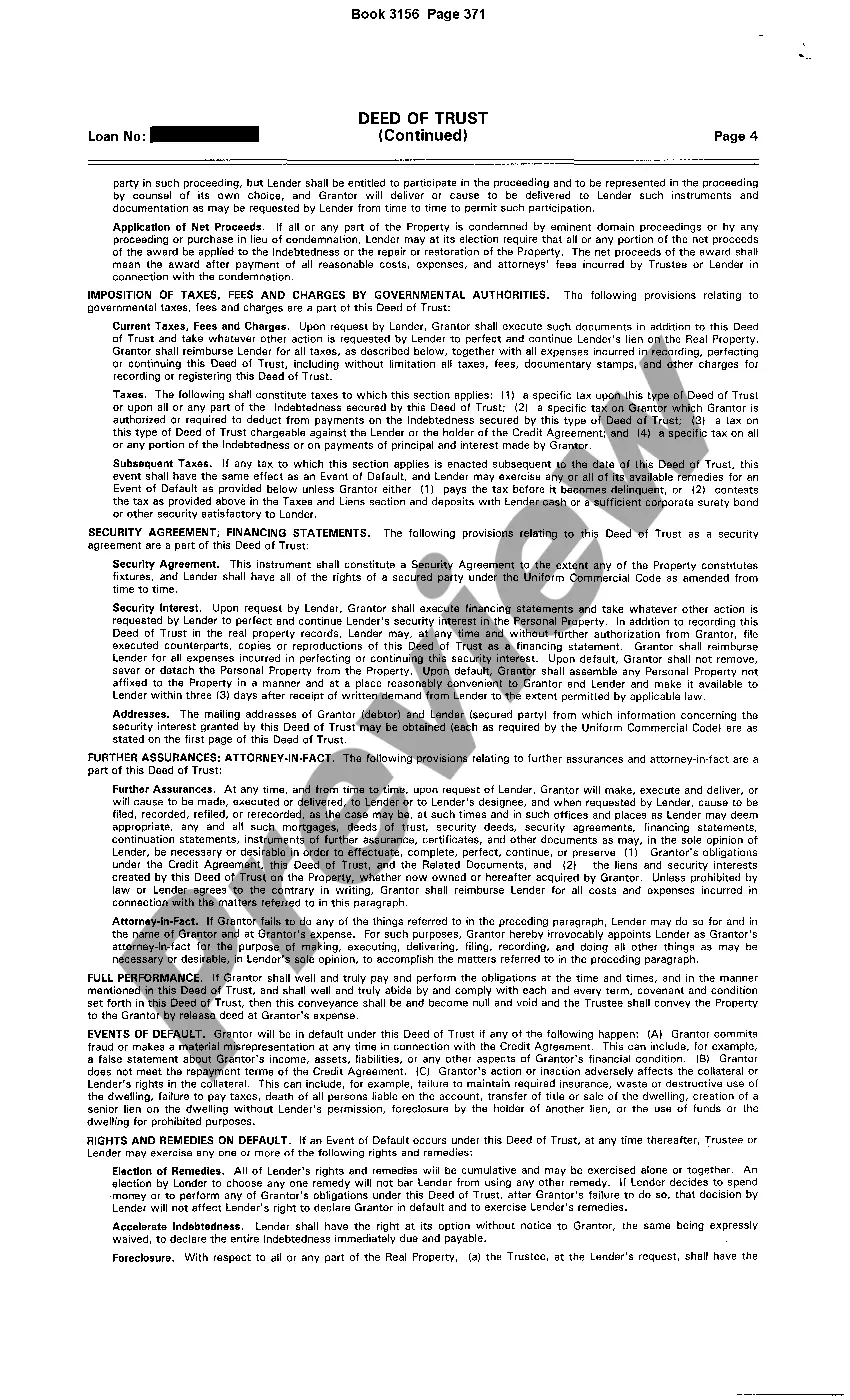

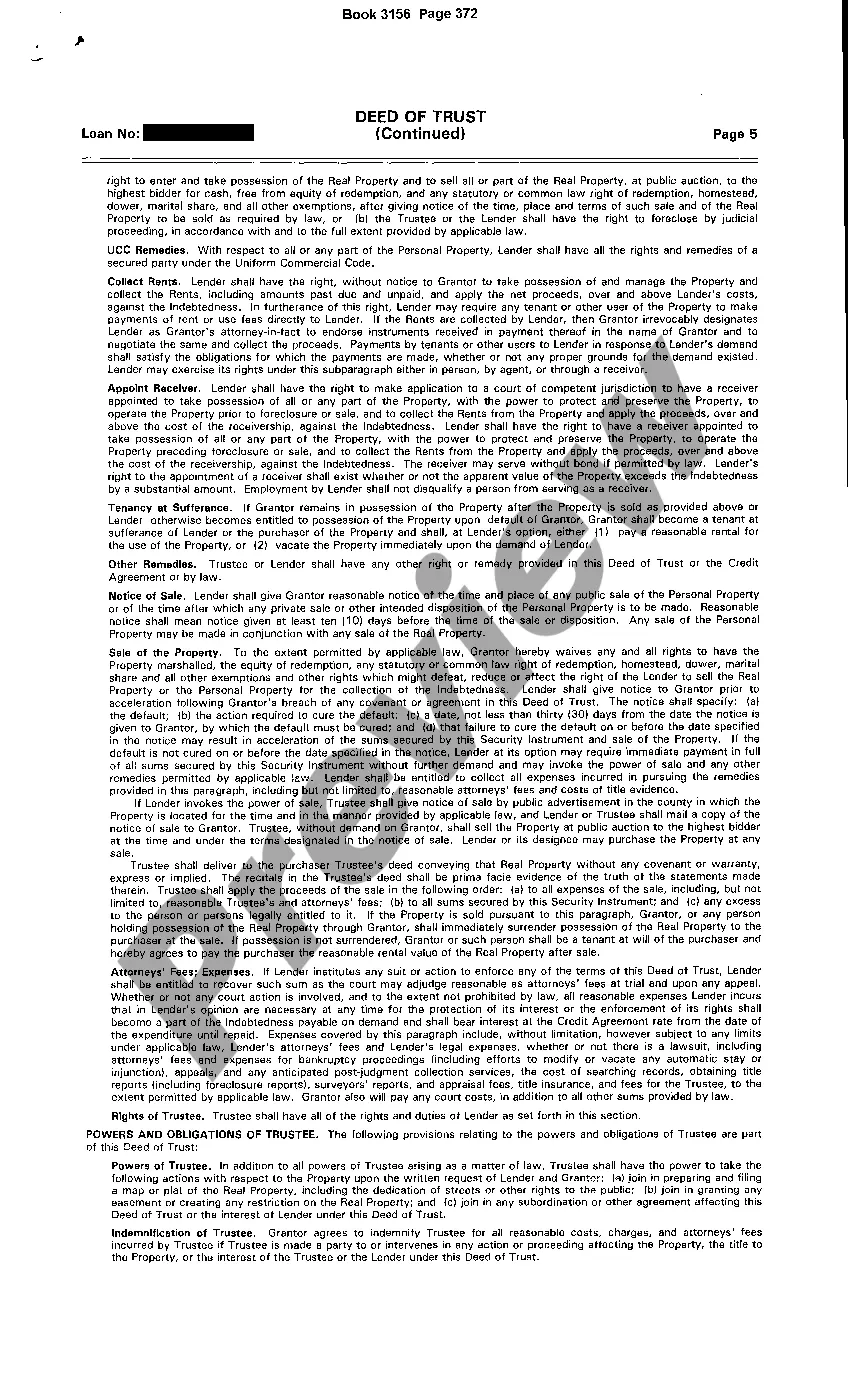

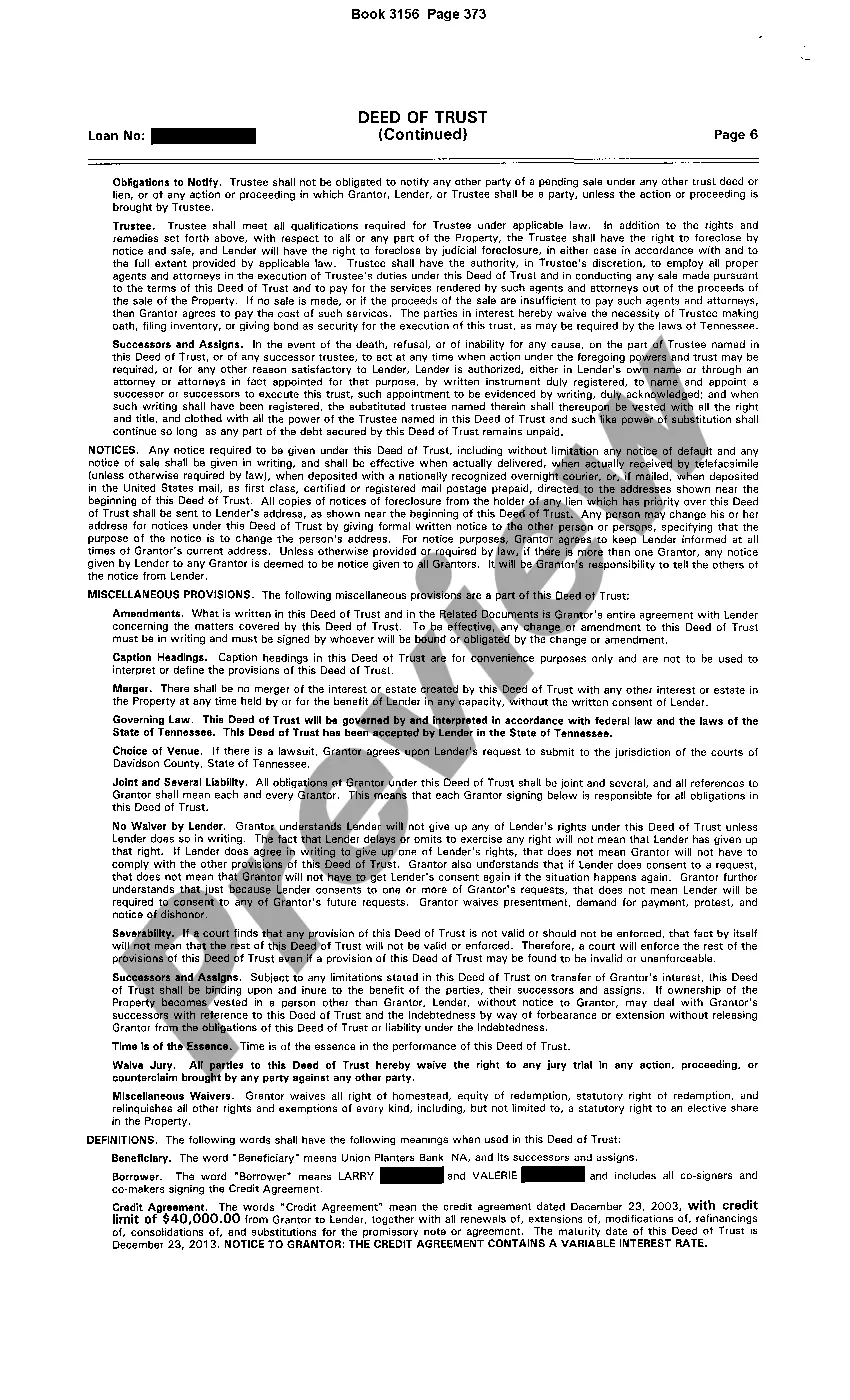

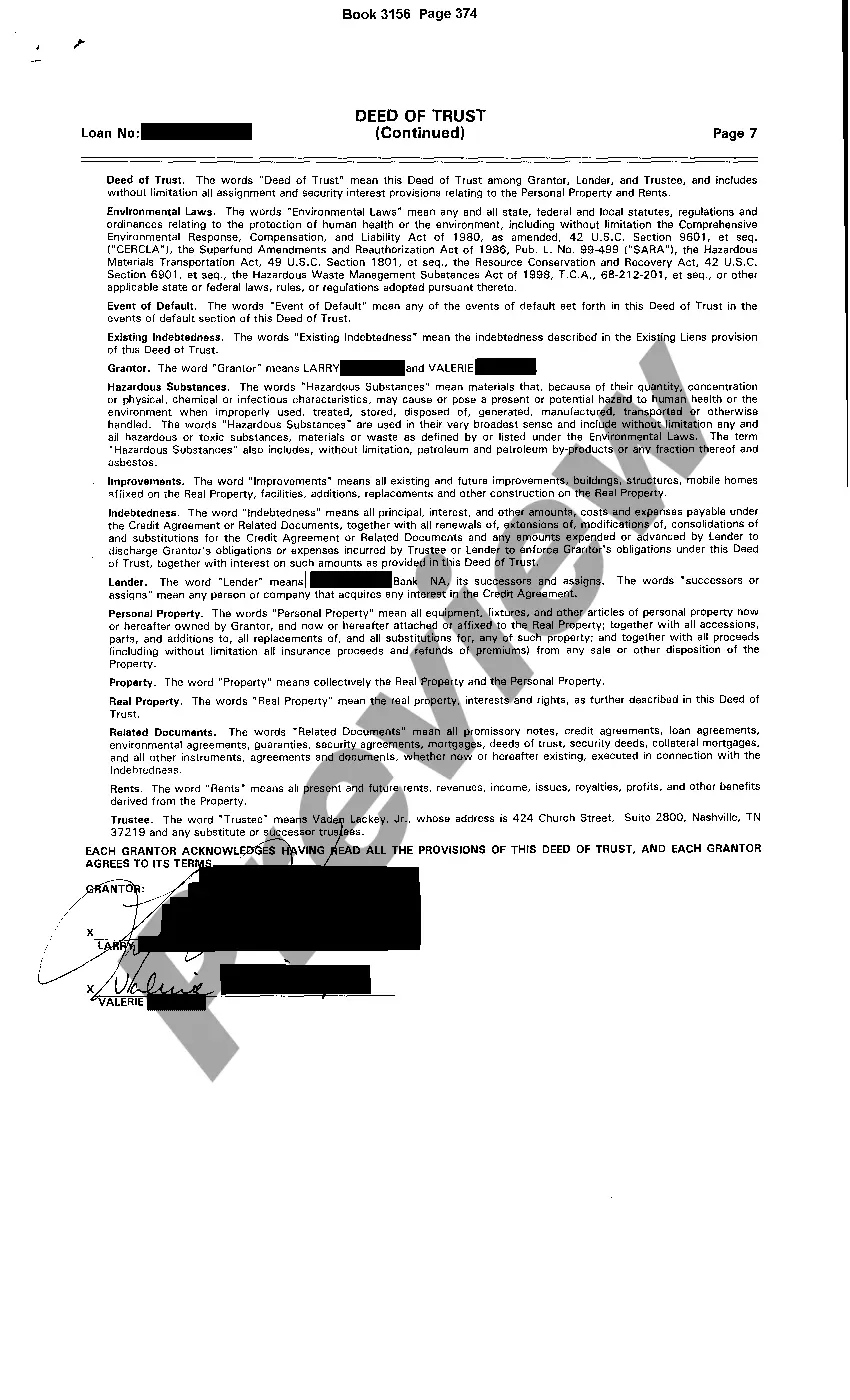

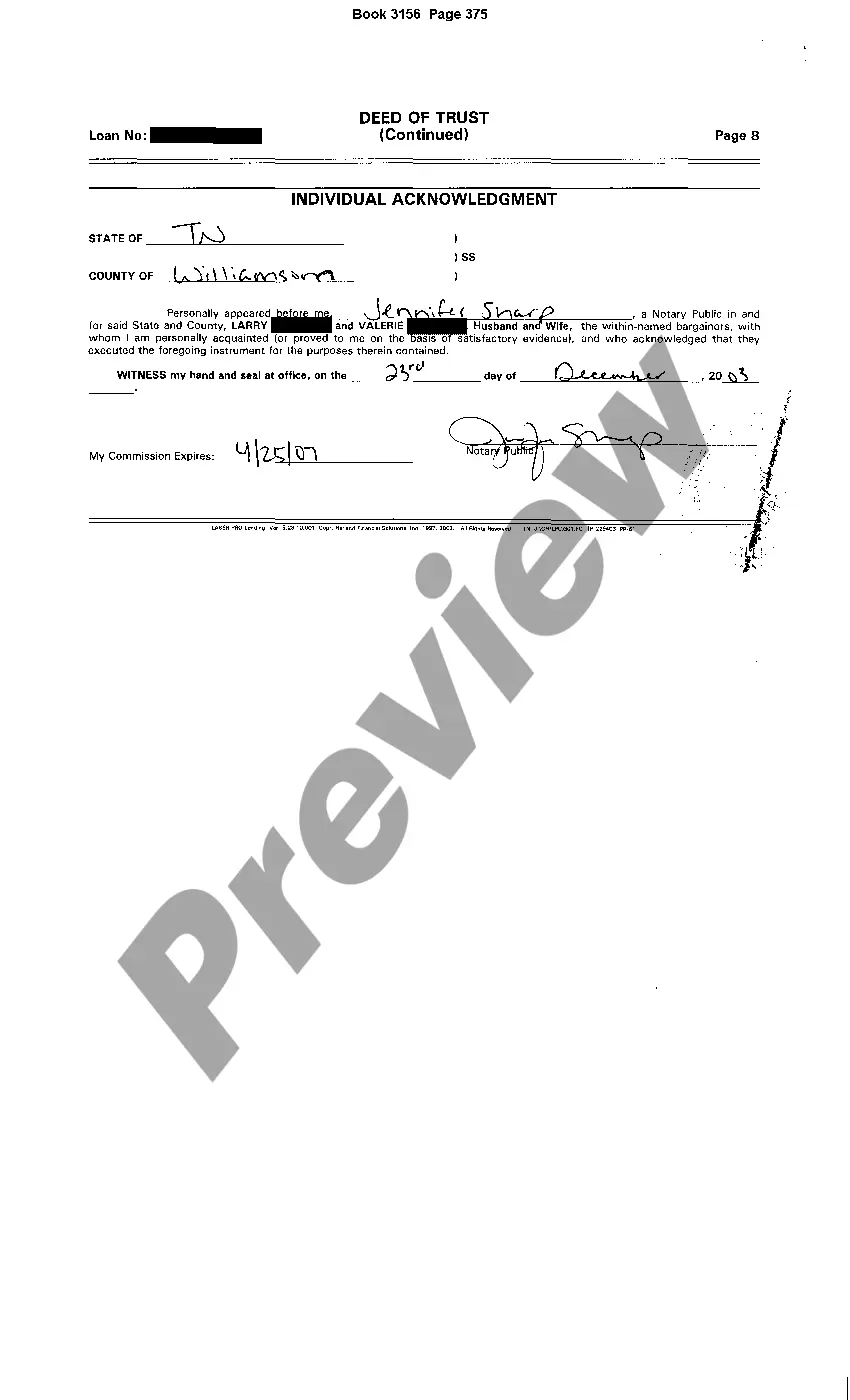

The Knoxville Tennessee Deed of Trust Open End Mortgage is a legal document used in real estate transactions to secure a loan with a property. It is a commonly used instrument in Tennessee's mortgage industry, providing protection to lenders and allowing borrowers to use their property as collateral. This type of mortgage consists of two key components: the deed of trust and the open end mortgage clause. The deed of trust serves as a security instrument, transferring the legal title of the property to a trustee, who holds it on behalf of the lender until the loan is fully paid off. It gives the lender the right to initiate foreclosure proceedings if the borrower defaults on the loan. The open end mortgage clause is an important feature of this type of mortgage. It allows the borrower to borrow additional funds against the same property in the future, without having to create a new mortgage or go through the lengthy process of refinancing. This flexibility makes it advantageous for homeowners who may need access to additional funds for remodeling, renovations, or other purposes. There are several types of Knoxville Tennessee Deed of Trust Open End Mortgages available, each catering to different needs and circumstances: 1. Conventional Open End Mortgage: This is the most common type of open end mortgage in Knoxville. It is typically offered by traditional lenders and follows the guidelines set by Fannie Mae or Freddie Mac. 2. Government-backed Open End Mortgage: These mortgages are insured or guaranteed by government entities such as the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). They often have more lenient qualification requirements and can be beneficial for first-time homebuyers or military veterans. 3. Adjustable Rate Open End Mortgage: This type of mortgage offers an adjustable interest rate that can fluctuate over time. The initial rate is usually lower than that of a fixed-rate mortgage, making it attractive to borrowers who plan to sell or refinance in the near future. 4. Hybrid Open End Mortgage: A hybrid mortgage combines the features of both fixed-rate and adjustable-rate mortgages. It usually starts with a fixed interest rate for an initial period (e.g., 5 or 7 years) and then converts to an adjustable rate for the remaining term. Regardless of the type, the Knoxville Tennessee Deed of Trust Open End Mortgage provides lenders with a level of security and borrowers with the flexibility to access additional funds when needed. It is crucial for both parties to understand the terms, obligations, and risks associated with this type of mortgage before entering into any agreement. Consulting with a knowledgeable real estate attorney or mortgage professional is highly recommended ensuring a smooth and successful transaction.

Knoxville Tennessee Deed of Trust Open End Mortgage

State:

Tennessee

City:

Knoxville

Control #:

TN-E516

Format:

PDF

Instant download

This form is available by subscription

Description

Deed of Trust Open End Mortgage

The Knoxville Tennessee Deed of Trust Open End Mortgage is a legal document used in real estate transactions to secure a loan with a property. It is a commonly used instrument in Tennessee's mortgage industry, providing protection to lenders and allowing borrowers to use their property as collateral. This type of mortgage consists of two key components: the deed of trust and the open end mortgage clause. The deed of trust serves as a security instrument, transferring the legal title of the property to a trustee, who holds it on behalf of the lender until the loan is fully paid off. It gives the lender the right to initiate foreclosure proceedings if the borrower defaults on the loan. The open end mortgage clause is an important feature of this type of mortgage. It allows the borrower to borrow additional funds against the same property in the future, without having to create a new mortgage or go through the lengthy process of refinancing. This flexibility makes it advantageous for homeowners who may need access to additional funds for remodeling, renovations, or other purposes. There are several types of Knoxville Tennessee Deed of Trust Open End Mortgages available, each catering to different needs and circumstances: 1. Conventional Open End Mortgage: This is the most common type of open end mortgage in Knoxville. It is typically offered by traditional lenders and follows the guidelines set by Fannie Mae or Freddie Mac. 2. Government-backed Open End Mortgage: These mortgages are insured or guaranteed by government entities such as the Federal Housing Administration (FHA) or the Department of Veterans Affairs (VA). They often have more lenient qualification requirements and can be beneficial for first-time homebuyers or military veterans. 3. Adjustable Rate Open End Mortgage: This type of mortgage offers an adjustable interest rate that can fluctuate over time. The initial rate is usually lower than that of a fixed-rate mortgage, making it attractive to borrowers who plan to sell or refinance in the near future. 4. Hybrid Open End Mortgage: A hybrid mortgage combines the features of both fixed-rate and adjustable-rate mortgages. It usually starts with a fixed interest rate for an initial period (e.g., 5 or 7 years) and then converts to an adjustable rate for the remaining term. Regardless of the type, the Knoxville Tennessee Deed of Trust Open End Mortgage provides lenders with a level of security and borrowers with the flexibility to access additional funds when needed. It is crucial for both parties to understand the terms, obligations, and risks associated with this type of mortgage before entering into any agreement. Consulting with a knowledgeable real estate attorney or mortgage professional is highly recommended ensuring a smooth and successful transaction.

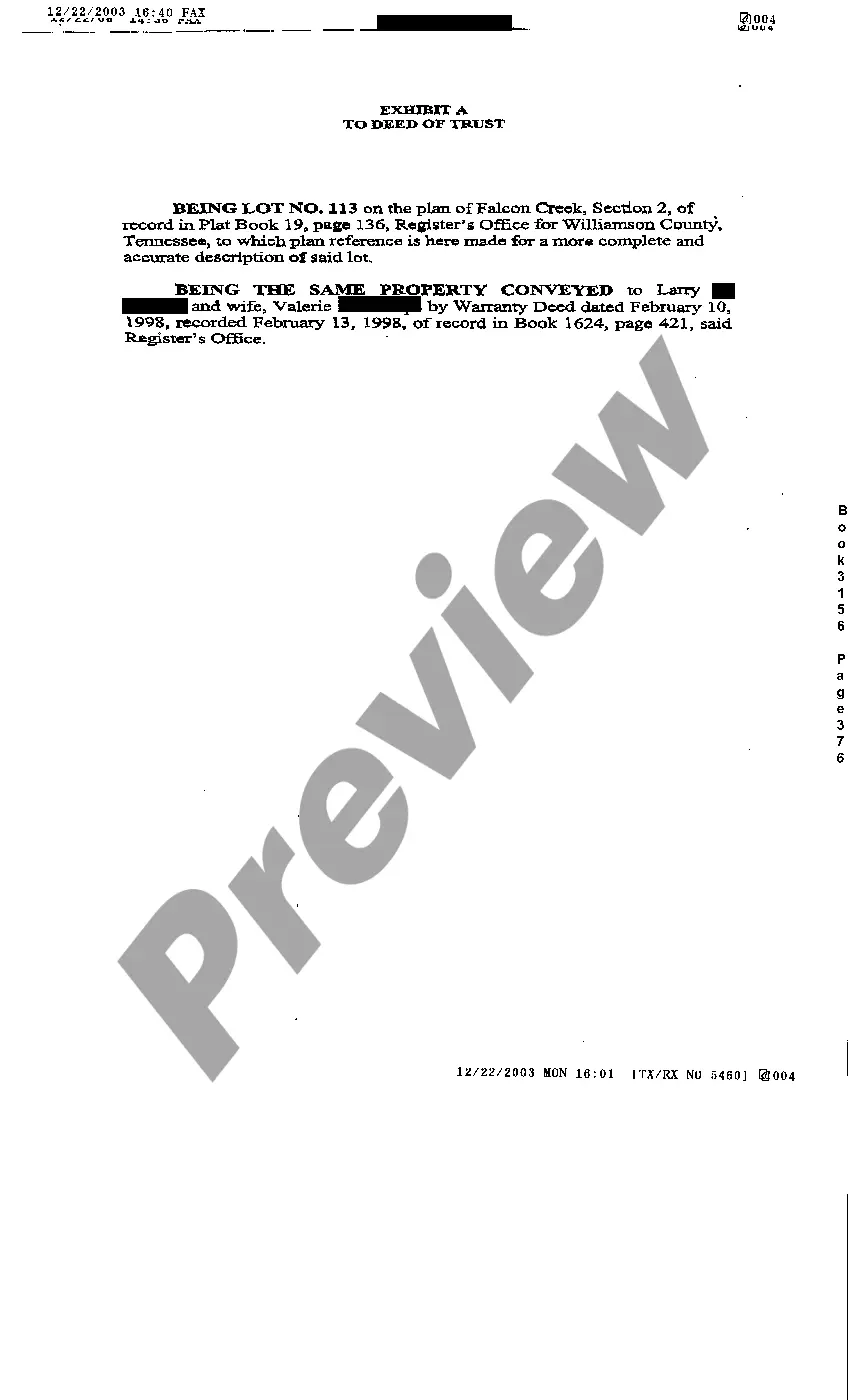

Free preview

How to fill out Knoxville Tennessee Deed Of Trust Open End Mortgage?

If you’ve already utilized our service before, log in to your account and save the Knoxville Tennessee Deed of Trust Open End Mortgage on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make certain you’ve located an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Get your Knoxville Tennessee Deed of Trust Open End Mortgage. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!