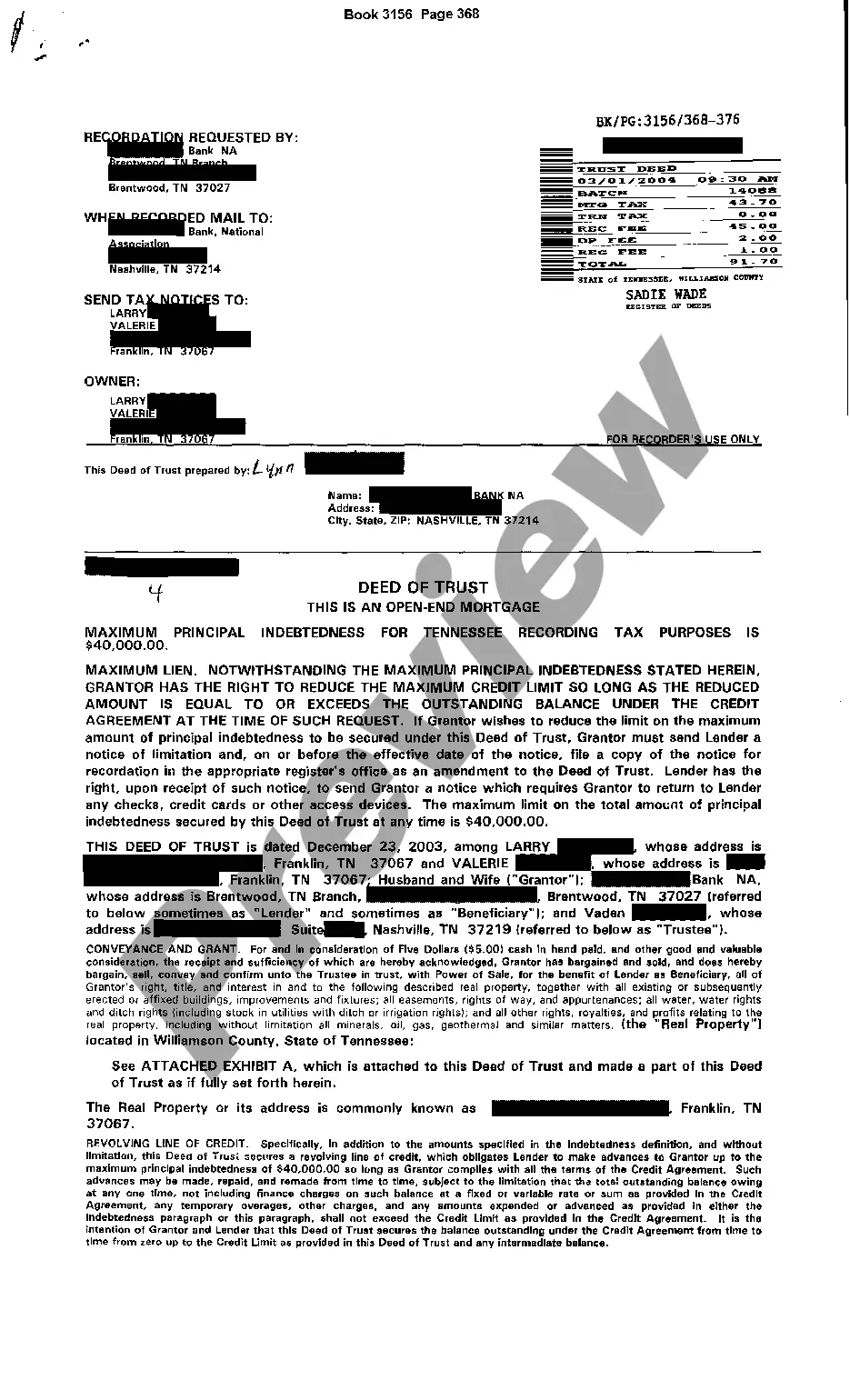

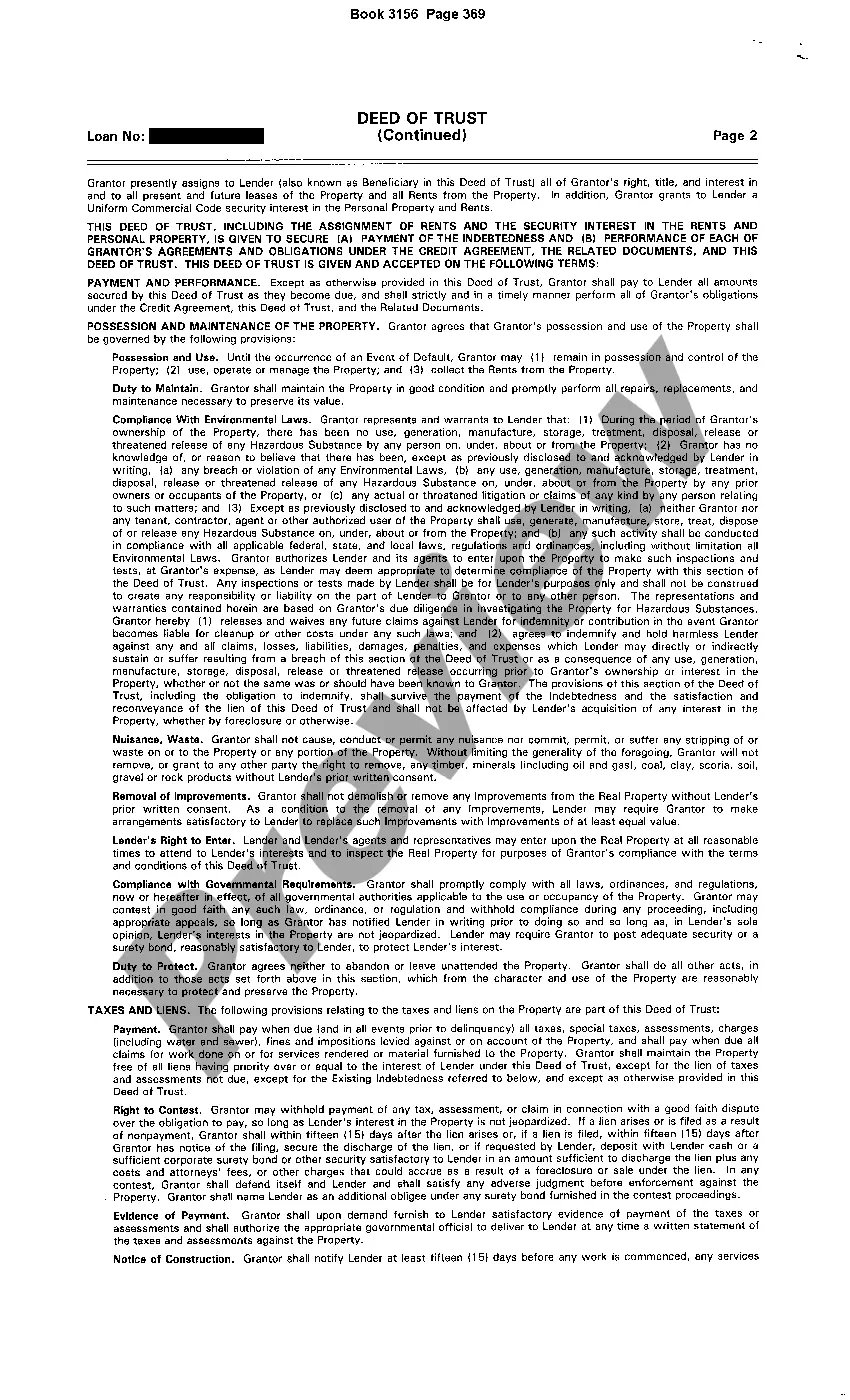

Memphis, Tennessee Deed of Trust Open End Mortgage is a legal document commonly used in real estate transactions within the state of Tennessee. It serves as a security instrument that allows a lender to secure a loan by placing a lien on the borrower's property. The Open End Mortgage feature provides flexibility for the borrower to borrow additional funds in the future without needing to go through the process of executing a new mortgage. The Memphis Tennessee Deed of Trust Open End Mortgage includes several important components. Firstly, it identifies the parties involved, including the borrower (also known as the trust or), the lender (also known as the beneficiary), and the trustee, who holds legal title to the property until the loan is fully repaid. The mortgage also contains a legal description of the property being used as collateral for the loan. Furthermore, the document outlines the terms and conditions of the loan, including the principal amount, interest rate, payment schedule, and any applicable fees or penalties. It also specifies the rights and obligations of both the borrower and the lender throughout the duration of the mortgage. In addition to the primary Memphis Tennessee Deed of Trust Open End Mortgage, there may be different types or variations based on specific circumstances or requirements. One such variation is a Home Equity Line of Credit (HELOT), which allows the borrower to access a revolving line of credit secured by the property's equity. With a HELOT, the borrower can draw funds when needed, up to a predetermined limit, and pay interest only on the amount borrowed. Another type of variation is the Construction Loan Open End Mortgage. This type of mortgage is utilized when financing the construction of a new property. It enables the borrower to obtain funds for the construction process and potentially allows for additional financing if needed during the construction phase. These are just a few examples of potential variations or types of Memphis Tennessee Deed of Trust Open End Mortgages. However, it is essential to consult with legal and financial professionals to fully understand the specific terms and conditions applicable to individual situations.

Memphis Tennessee Deed of Trust Open End Mortgage

Description

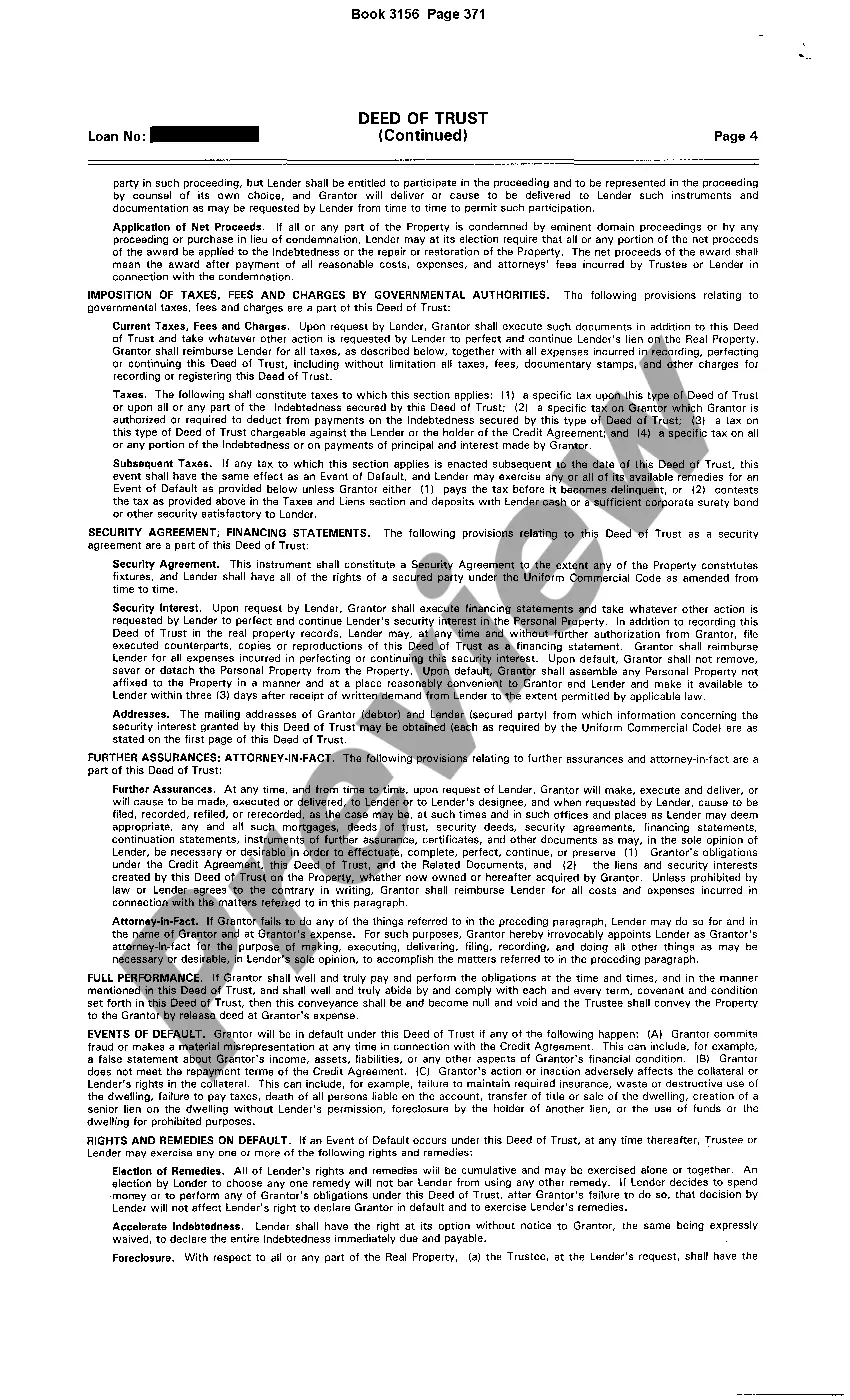

How to fill out Memphis Tennessee Deed Of Trust Open End Mortgage?

Finding authenticated templates tailored to your regional laws can be difficult unless you utilize the US Legal Forms collection.

It’s an online repository of over 85,000 legal documents for both personal and professional requirements and various real-world scenarios.

All the paperwork is properly classified by area of application and jurisdiction zones, making it simple and quick to search for the Memphis Tennessee Deed of Trust Open End Mortgage.

Maintaining documentation organized and compliant with legal requirements is crucial. Take advantage of the US Legal Forms collection to always have vital document templates available at your fingertips!

- Verify the Preview mode and document description.

- Ensure you've selected the correct one that meets your specifications and aligns fully with your local jurisdiction standards.

- Look for another template if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the accurate one.

- If it fits your needs, proceed to the next stage.

Form popularity

FAQ

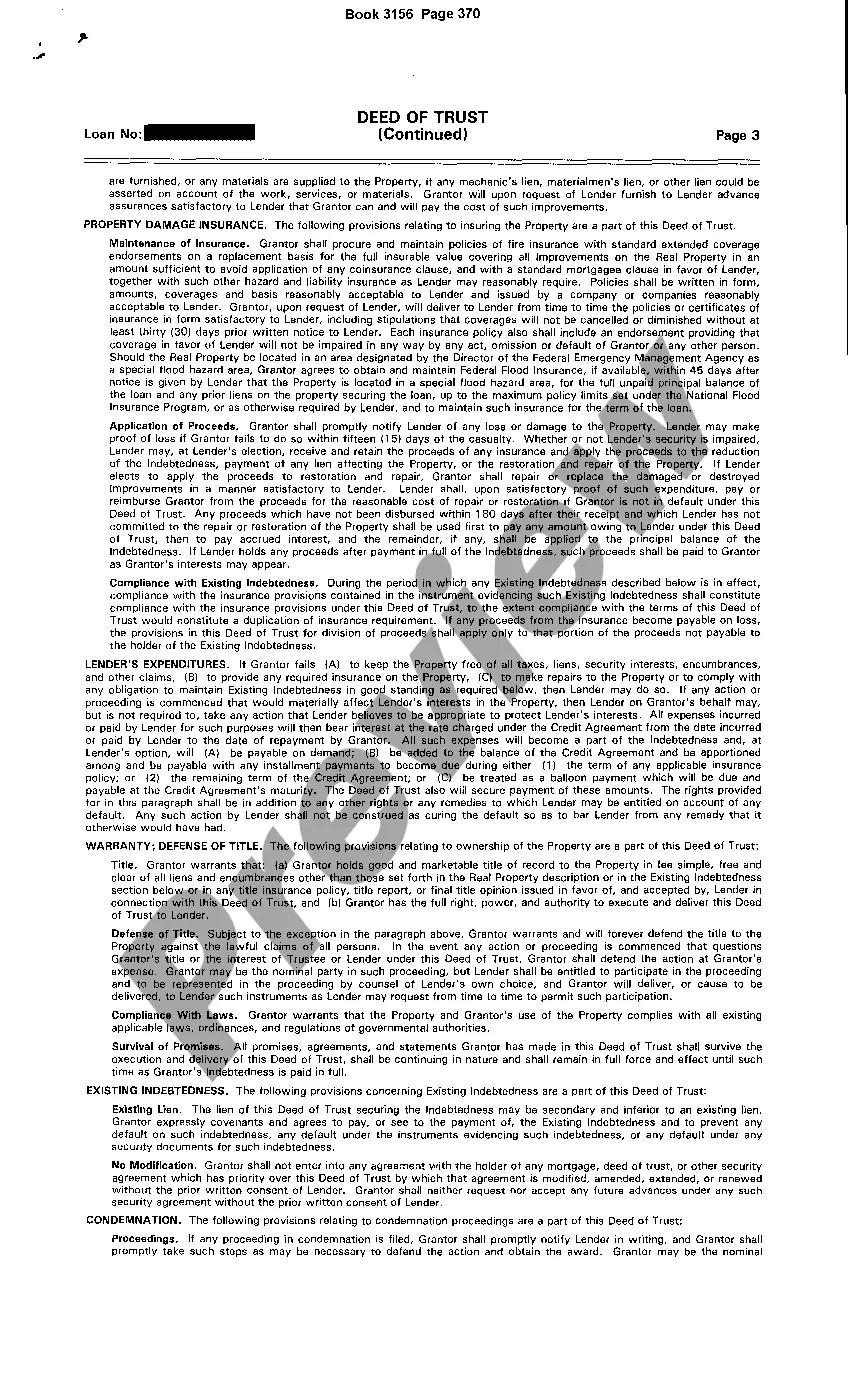

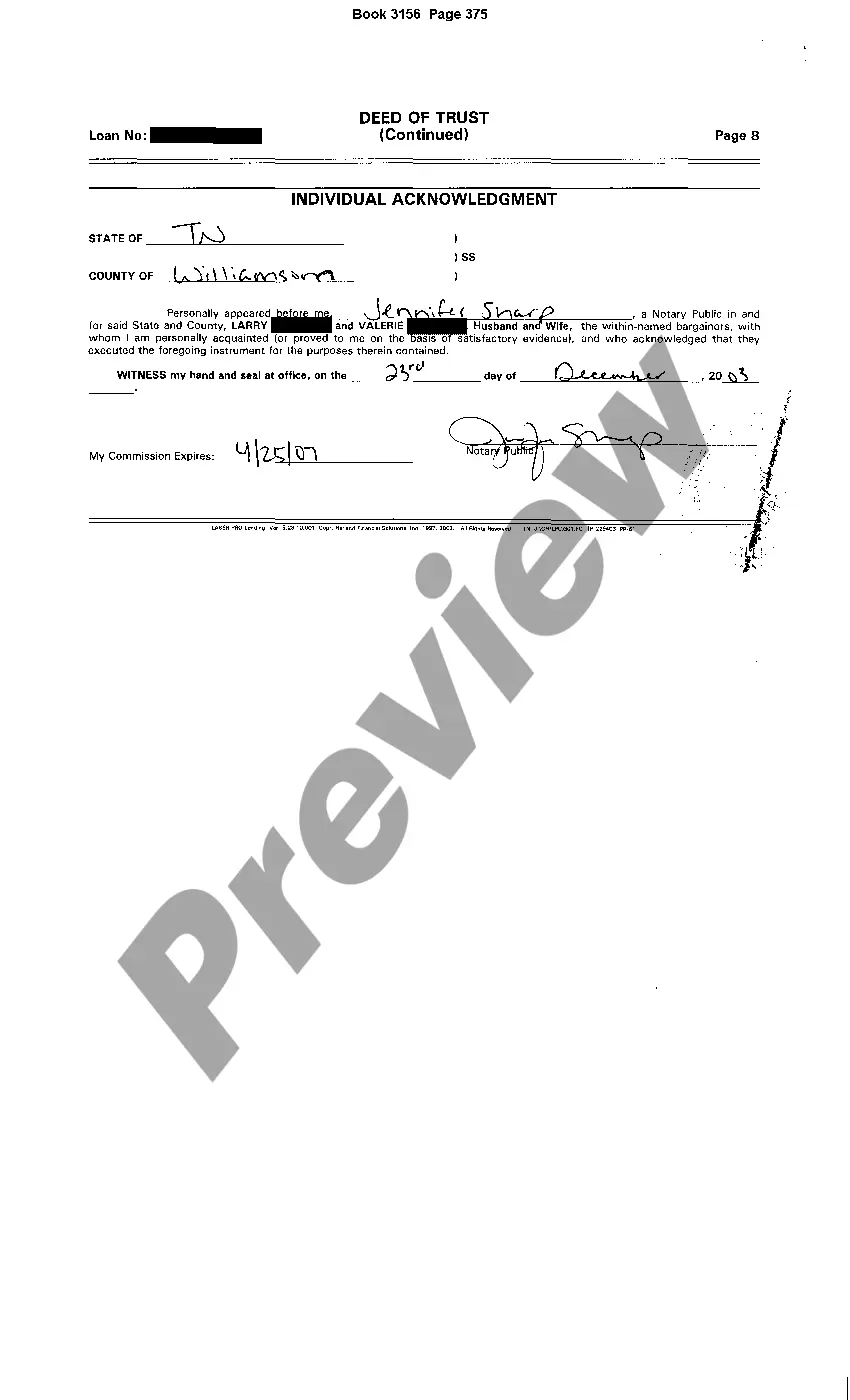

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. It states that the home buyer will repay the loan and that the mortgage lender will hold the legal title to the property until the loan is fully paid.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. It states that the home buyer will repay the loan and that the mortgage lender will hold the legal title to the property until the loan is fully paid.

If it meets legal requirements for validity, the deed of trust has no automatic expiration. It will be valid until either the borrower repays the loan the trust deed is security for or if the property is sold in a foreclosure action.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. Open-end mortgages permit the borrower to go back to the lender and borrow more money. There is usually a set dollar limit on the additional amount that can be borrowed.

A traditional mortgage provides you with a single lump sum. Ordinarily, all of this money is used to purchase the home. An open-end mortgage provides you with a lump sum that is used to purchase the home. But the open-end mortgage is for more than the purchase amount.

If it meets legal requirements for validity, the deed of trust has no automatic expiration. It will be valid until either the borrower repays the loan the trust deed is security for or if the property is sold in a foreclosure action.

Tennessee is a title theory state with respect to real property security interests, meaning that legal title to real property is conveyed by the borrower via a deed of trust to a trustee on behalf of the lender.

Unlike a traditional mortgage between a borrower and a bank or other lending institution, an open deed of trust has a third party involved--a trustee. The trustee holds the property in a trust as security for the lender.