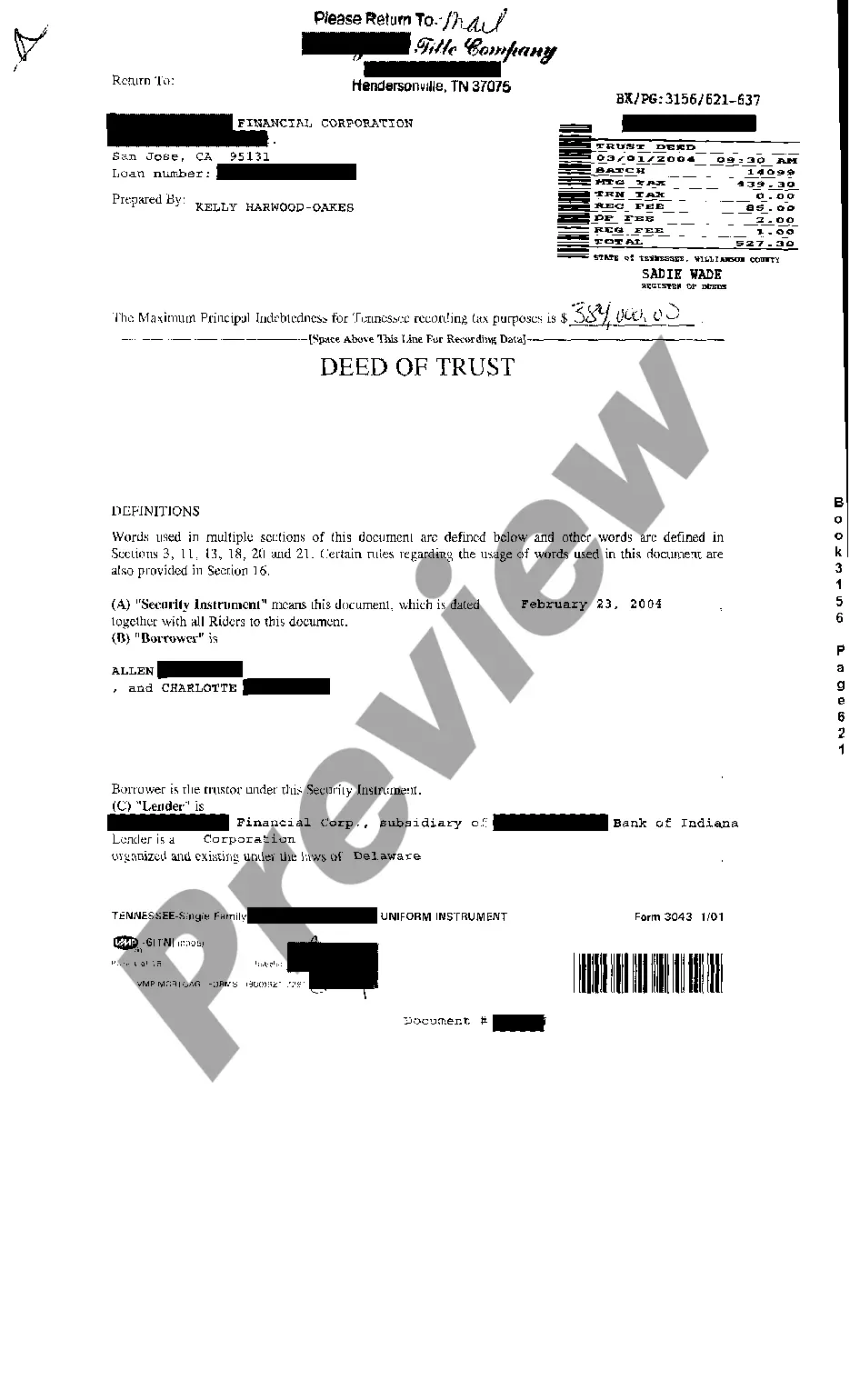

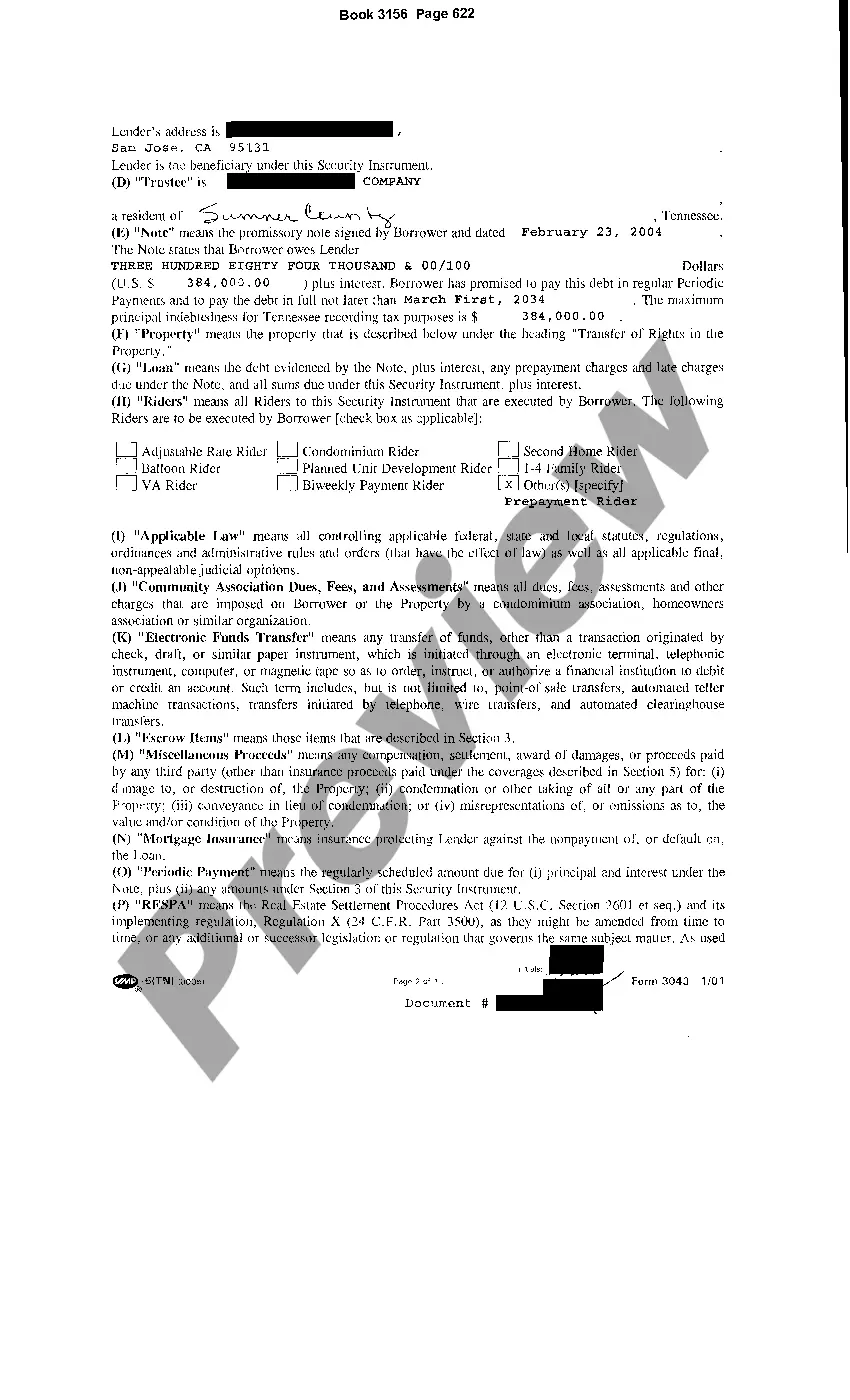

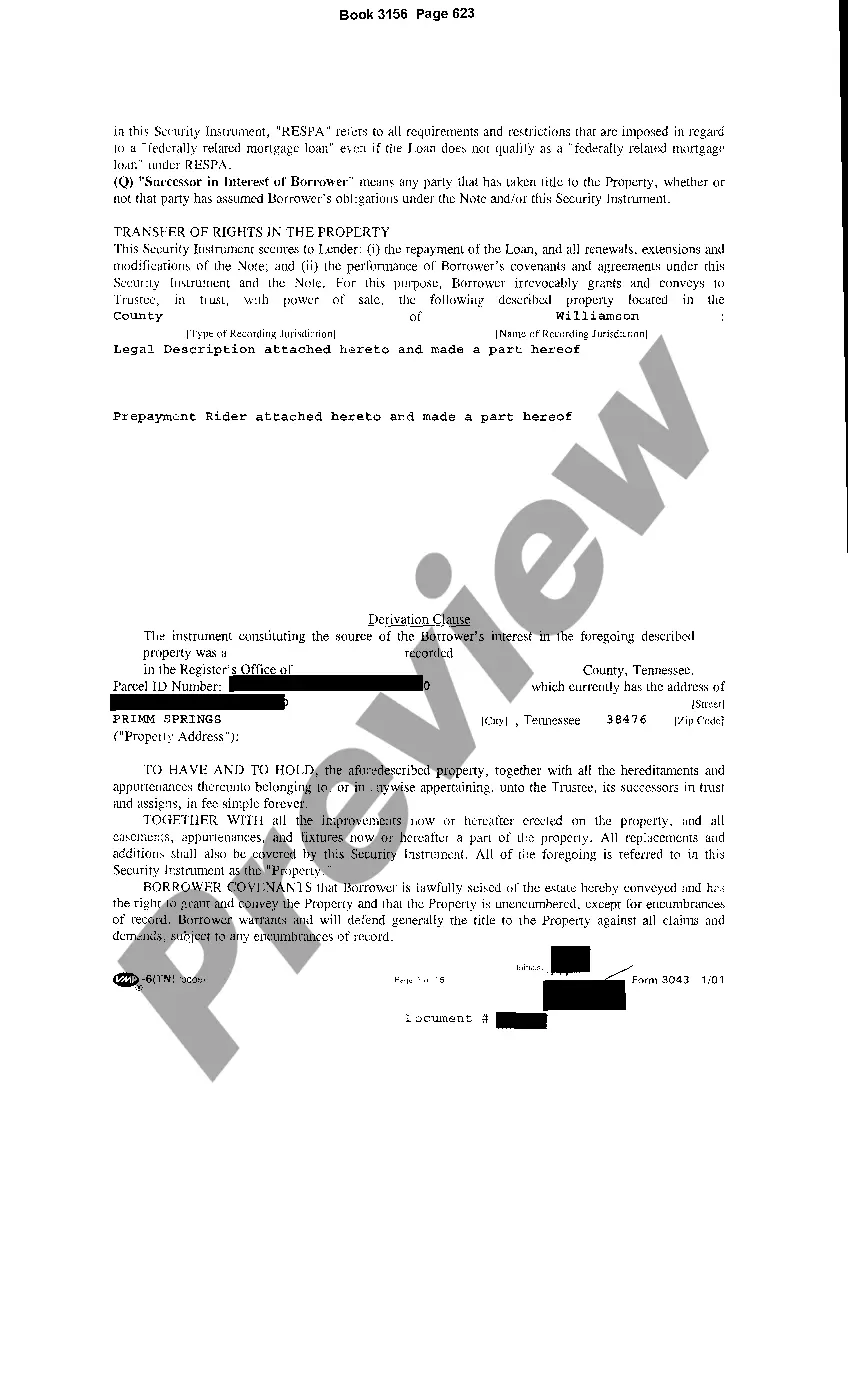

A Memphis Tennessee Sample Deed of Trust is a legal document that outlines the terms and conditions of a loan secured by real estate in Memphis, Tennessee. It serves as a security instrument between a lender, borrower, and trustee, providing the lender with a lien against the property as collateral for the loan. The deed of trust typically includes relevant details such as the names and addresses of the parties involved, the property description, the loan amount, interest rate, and repayment terms. It also clarifies the rights and responsibilities of each party involved in the transaction. There are different types of Memphis Tennessee Sample Deed of Trust, including: 1. General Sample Deed of Trust: This is the most common type of deed of trust used in Tennessee. It outlines the basic terms and conditions of the loan, including the repayment schedule and interest rate. 2. Construction Sample Deed of Trust: This type of deed of trust is used when the loan is specifically for construction or renovation purposes. It includes additional clauses and provisions related to the construction process, disbursement of funds, and completion timeframes. 3. Modification Sample Deed of Trust: If any changes need to be made to the original loan terms, a modification deed of trust is used. It outlines the specific modifications agreed upon by both parties, such as an interest rate adjustment or an extension of the loan term. 4. Assignment Sample Deed of Trust: This type of deed of trust is used when the lender transfers the loan to another party. It outlines the details of the loan transfer, including the rights and obligations of the new lender. 5. Subordination Sample Deed of Trust: When multiple loans are secured by the same property, a subordination deed of trust is used to establish the priority of repayment in case of default. It outlines the ranking of the different loans and the order in which they will be satisfied. It is important to note that a Memphis Tennessee Sample Deed of Trust should be drafted and executed by licensed professionals, such as a real estate attorney or a title company, to ensure its compliance with local laws and regulations.

Memphis Tennessee Sample Deed of Trust

Description

How to fill out Memphis Tennessee Sample Deed Of Trust?

Regardless of social or professional standing, finalizing law-related documentation is an unfortunate requirement in today’s society.

Frequently, it’s nearly impossible for someone without a legal background to create such documents from scratch, mainly due to the intricate terminology and legal nuances they entail.

This is where US Legal Forms can come to the rescue.

Ensure that the template you have located is appropriate for your region since the laws of one state or area do not apply to another.

Review the document and go through a brief overview (if available) of the situations the paper can be used for.

- Our service offers a vast library with over 85,000 ready-to-use state-specific documents suited for nearly any legal circumstance.

- US Legal Forms is also an excellent resource for associates or legal advisors who aim to enhance their efficiency by using our DIY papers.

- Regardless of whether you require the Memphis Tennessee Sample Deed of Trust or any other document appropriate for your state or region, with US Legal Forms, everything is readily available.

- Here’s how you can quickly obtain the Memphis Tennessee Sample Deed of Trust using our reliable service.

- If you are already a registered customer, you can proceed to Log In to your account to access the needed form.

- If you are new to our platform, make sure to follow these steps before acquiring the Memphis Tennessee Sample Deed of Trust.

Form popularity

FAQ

The difference between a deed and a deed of trust is the type of ownership interest each document conveys. A deed is a full ownership interest. A deed of trust is a security interest.

(a) Liens on realty, equitable or retained in favor of vendor on the face of the deed, also liens of mortgages, deeds of trust, and assignments of realty executed to secure debts, shall be barred, and the liens discharged, unless suits to enforce the same be brought within ten (10) years from the maturity of the debt.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. It states that the home buyer will repay the loan and that the mortgage lender will hold the legal title to the property until the loan is fully paid.

If it meets legal requirements for validity, the deed of trust has no automatic expiration. It will be valid until either the borrower repays the loan the trust deed is security for or if the property is sold in a foreclosure action.

Tennessee is a title theory state with respect to real property security interests, meaning that legal title to real property is conveyed by the borrower via a deed of trust to a trustee on behalf of the lender.

The Register of Deeds files certain legal documents mainly pertaining to or affecting real estate and provides public access to these records.

?When someone finances a home, the lender secures the loan to the home by having the borrower sign either a mortgage or a deed of trust....Mortgage States and Deed of Trust States. StateMortgage StateDeed of Trust StateTennesseeYTexasYUtahYVermontY47 more rows

The Tennessee State Library and Archives has microfilmed copies of older deeds for every county in Tennessee. The deeds records are arranged by the name of the seller/buyer (grantor/grantee).

In either case, you can contact your local county Assessor with questions about ownership. You can find the contact information for your local Assessor at this link.

Most states, including Tennessee and Virginia, utilize the deed of trust. Lenders prefer the deed of trust because in the event of a foreclosure, the neutral trustee conducts the sale, not the lender. This frees up the lender to bid on the property, which is common.