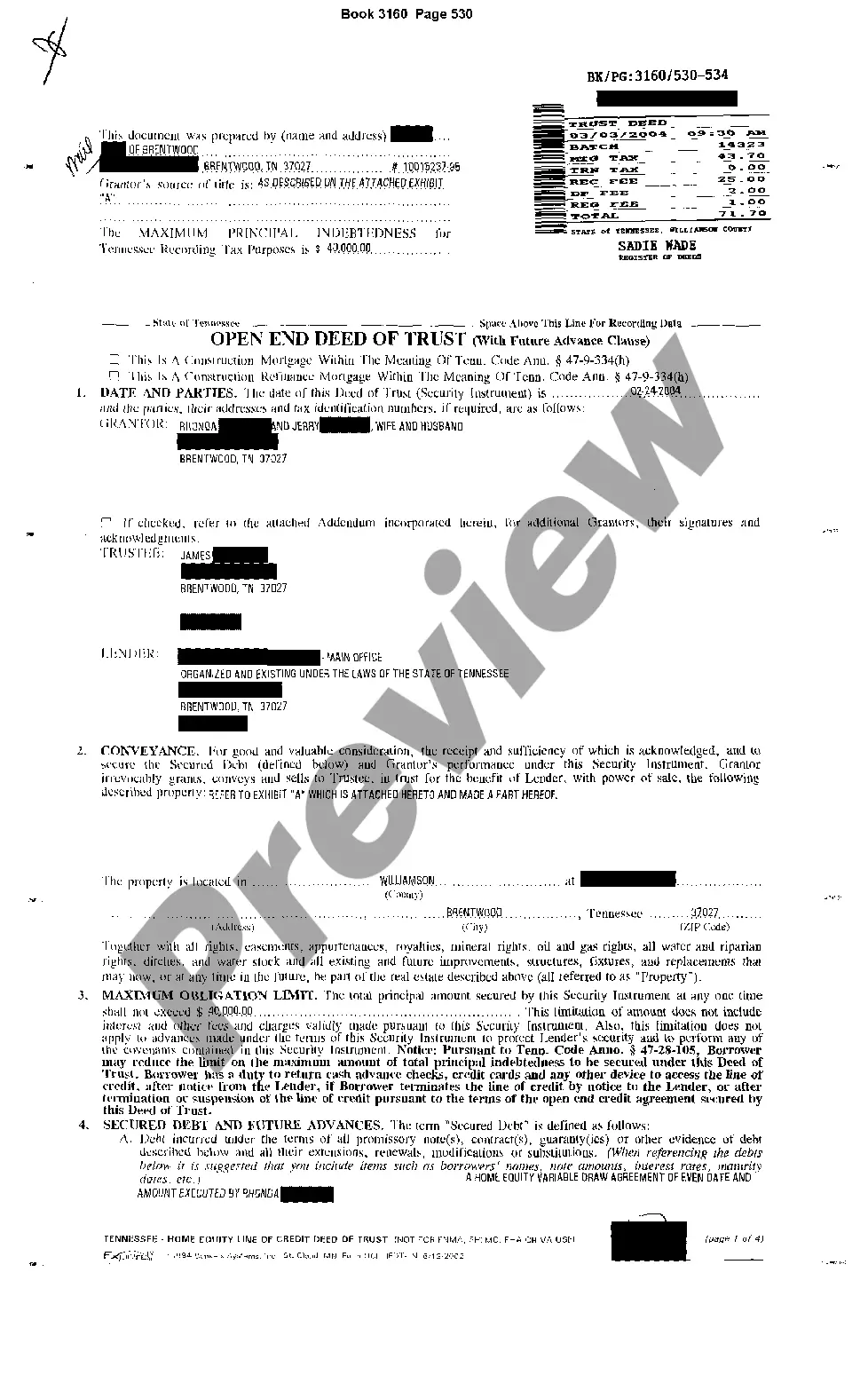

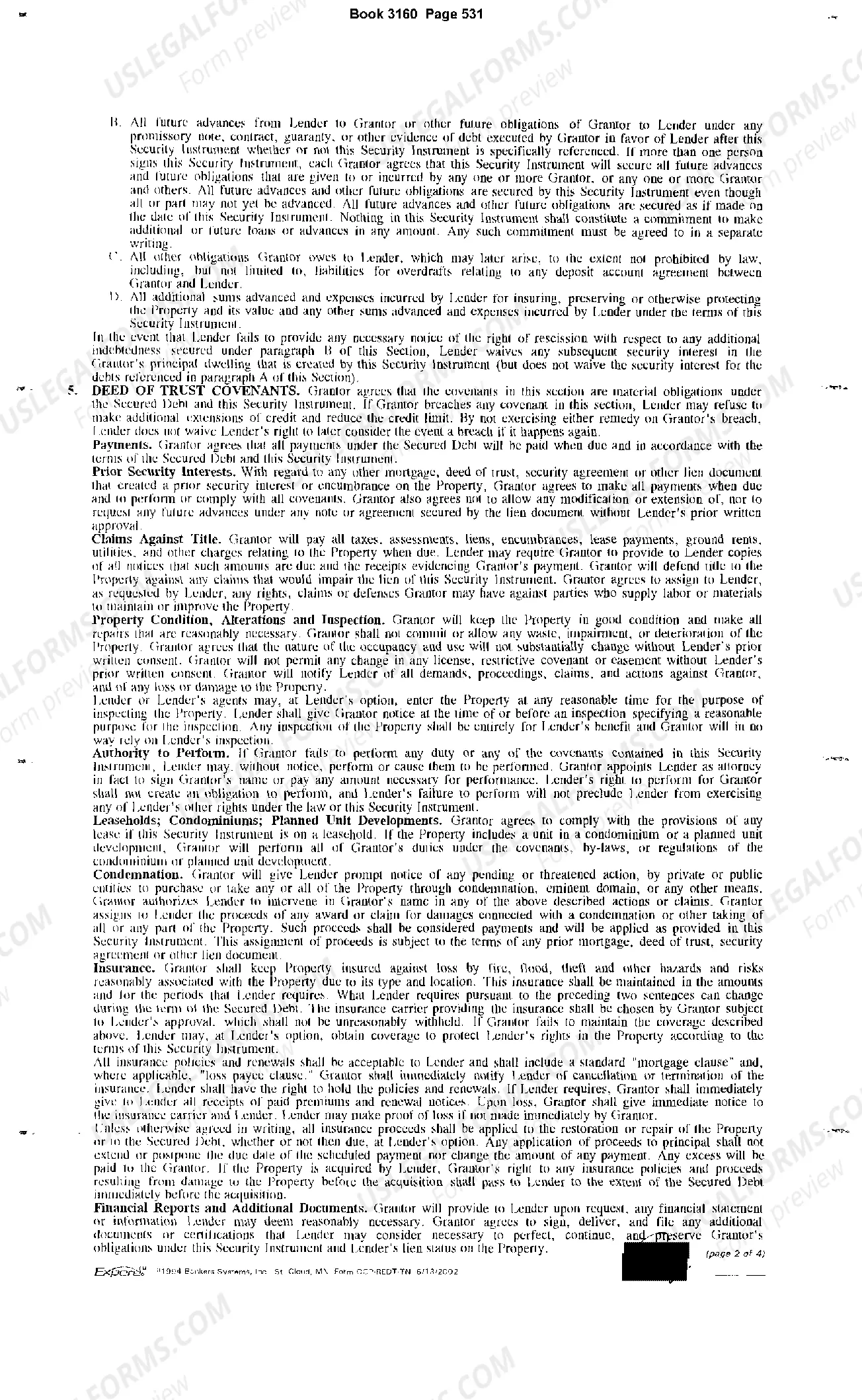

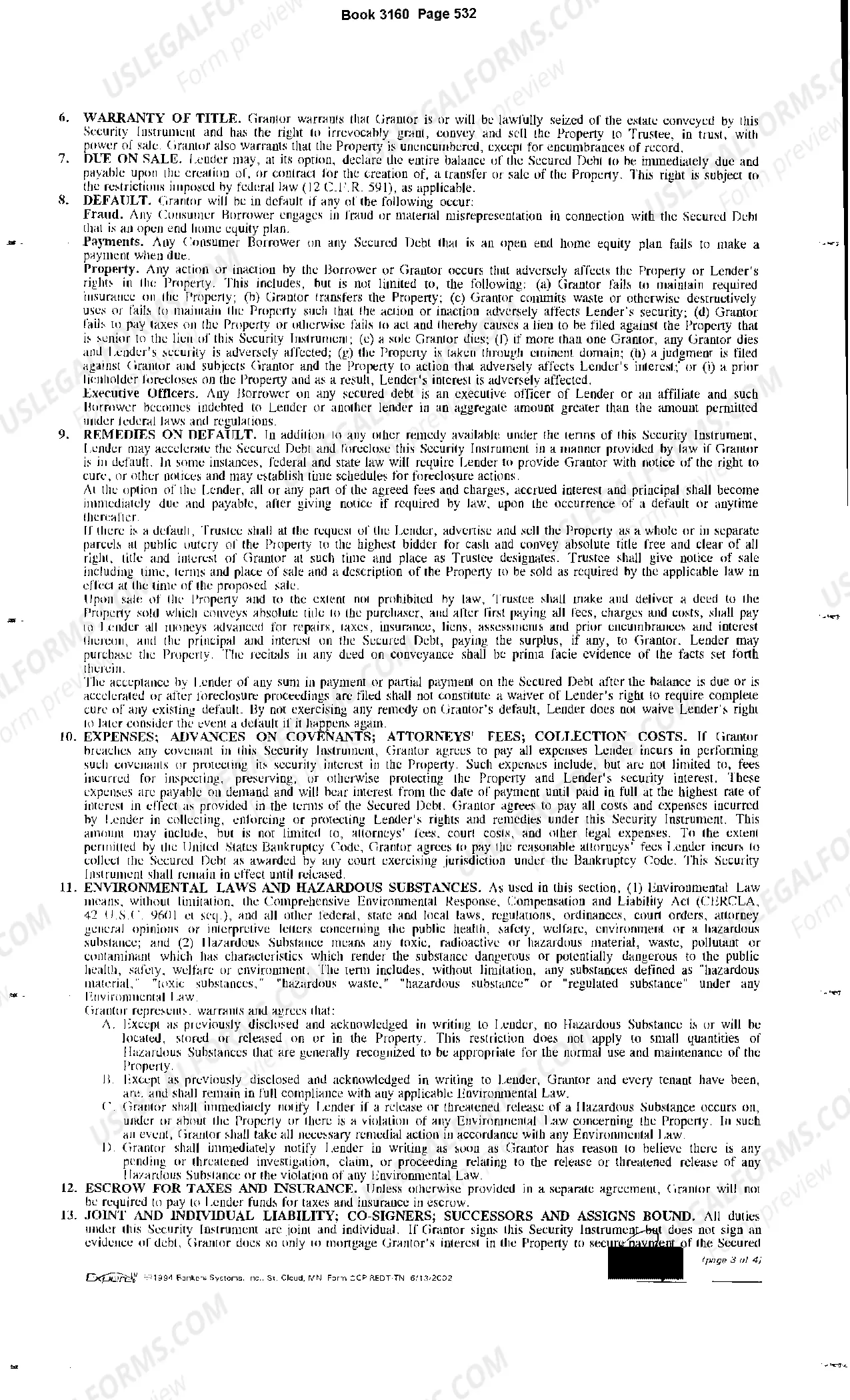

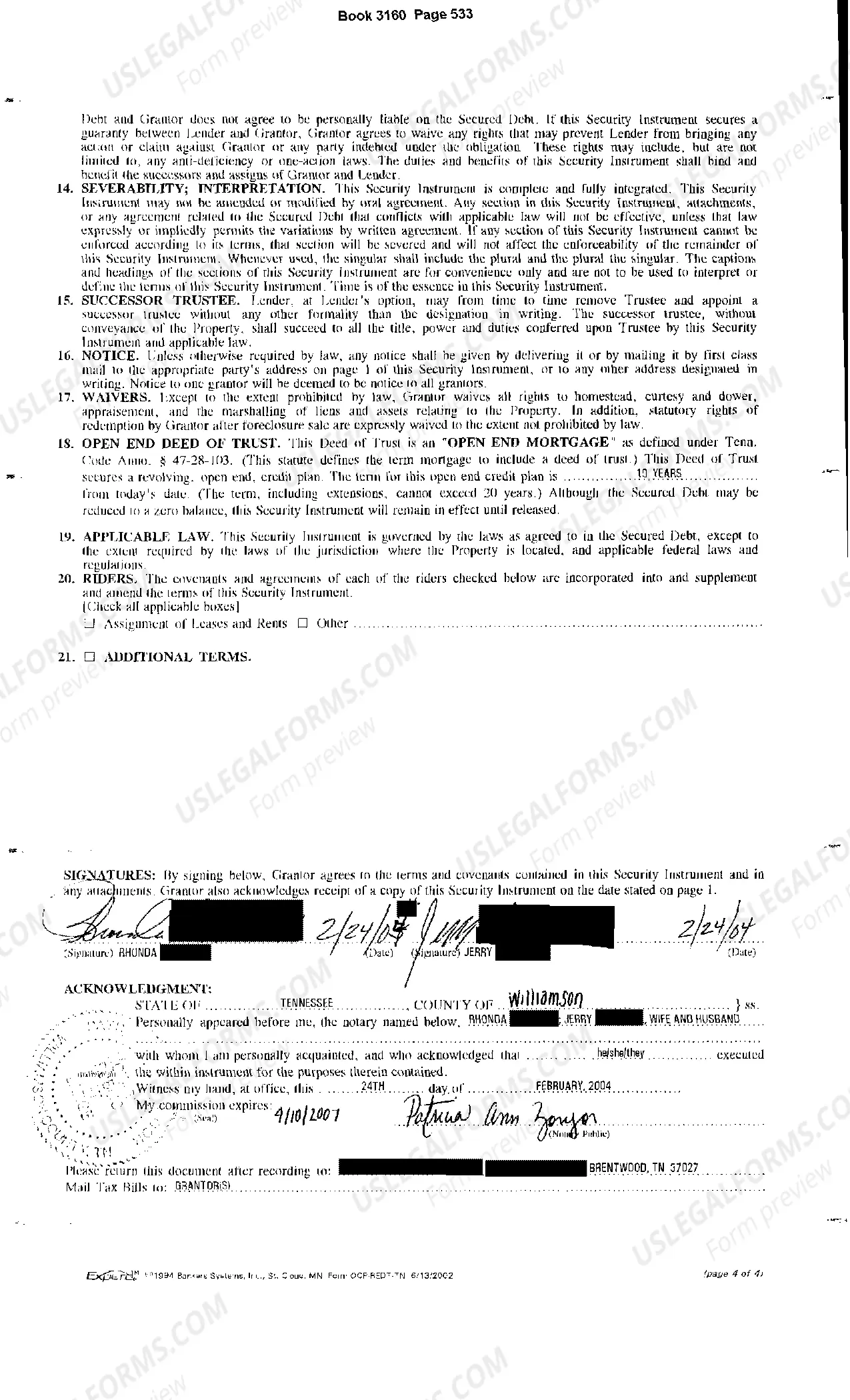

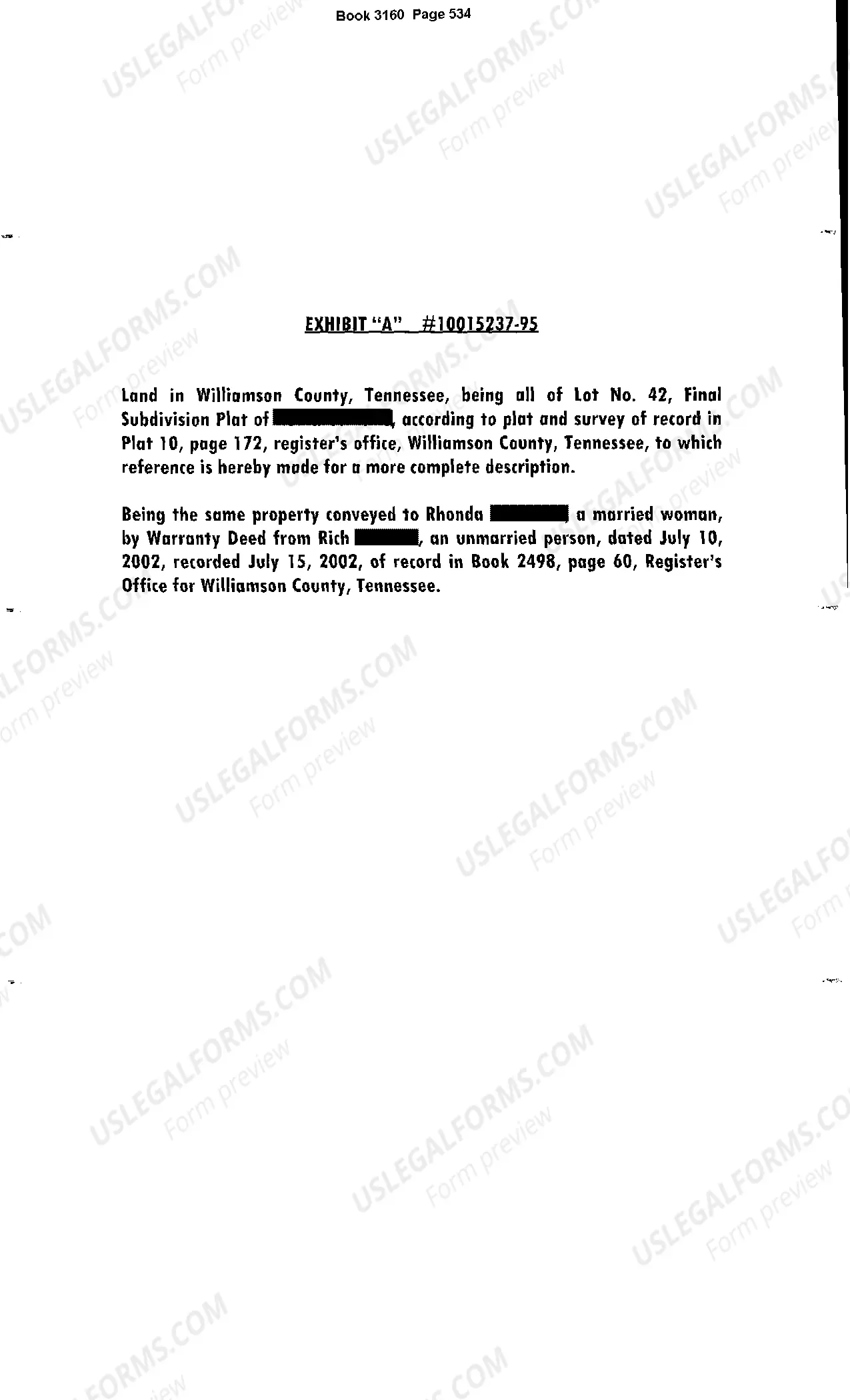

Clarksville Tennessee Deed of Trust With Future Advance is a legal document commonly used in real estate transactions in Clarksville, Tennessee. This type of deed of trust provides comprehensive protection for lenders and borrowers by securing the loan with the property itself. It involves the borrower granting a trust deed to the lender, who then holds a lien on the property until the loan is fully repaid. Keyword: Clarksville Tennessee Deed of Trust With Future Advance There are different types of Clarksville Tennessee Deed of Trust With Future Advance that are commonly utilized: 1. Open-end Deed of Trust: This type allows the borrower to receive multiple future advances from the lender, often up to a predetermined credit limit. It is useful for ongoing projects or when additional financing may be needed in the future. 2. Closed-end Deed of Trust: In contrast to the open-end deed of trust, the closed-end deed of trust only covers a specific loan amount agreed upon at the time of closing. No further advances can be made under this type of deed of trust. 3. Construction Loan Deed of Trust: This type of deed of trust is used when financing the construction of a property. It allows for future advances to be made at different stages of the construction process, ensuring the necessary funds are available when needed. 4. Refinance Deed of Trust: When refinancing an existing loan, a refinancing deed of trust is used. It enables the lender to secure the refinanced loan with the property, typically replacing the original deed of trust. 5. Second Deed of Trust: This type of deed of trust is taken out when a borrower seeks a second mortgage on a property that already has a primary mortgage. It ranks second in priority to the first deed of trust and allows for future advances to be made against the property. Clarksville Tennessee Deed of Trust With Future Advance is a crucial legal document that protects both lenders and borrowers in real estate transactions. By understanding the different types of deed of trust available, borrowers can choose the most suitable option based on their specific financing needs.

Clarksville Tennessee Deed of Trust With Future Advance

Description

How to fill out Clarksville Tennessee Deed Of Trust With Future Advance?

If you are looking for a relevant form template, it’s difficult to find a better platform than the US Legal Forms site – one of the most considerable libraries on the web. With this library, you can get a huge number of document samples for business and individual purposes by types and regions, or key phrases. With our advanced search function, getting the most recent Clarksville Tennessee Deed of Trust With Future Advance is as elementary as 1-2-3. In addition, the relevance of each and every document is proved by a team of professional attorneys that regularly check the templates on our website and update them in accordance with the newest state and county requirements.

If you already know about our platform and have a registered account, all you should do to receive the Clarksville Tennessee Deed of Trust With Future Advance is to log in to your profile and click the Download option.

If you use US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have found the form you need. Look at its explanation and make use of the Preview feature to explore its content. If it doesn’t meet your needs, utilize the Search option near the top of the screen to get the appropriate file.

- Confirm your decision. Click the Buy now option. Following that, pick your preferred subscription plan and provide credentials to register an account.

- Make the transaction. Make use of your bank card or PayPal account to complete the registration procedure.

- Receive the template. Choose the file format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the obtained Clarksville Tennessee Deed of Trust With Future Advance.

Every template you add to your profile has no expiry date and is yours permanently. You can easily access them via the My Forms menu, so if you want to have an extra copy for modifying or printing, feel free to return and save it once more whenever you want.

Make use of the US Legal Forms extensive collection to get access to the Clarksville Tennessee Deed of Trust With Future Advance you were seeking and a huge number of other professional and state-specific samples on one website!

Form popularity

FAQ

To get a copy of the deed to your house in Tennessee, visit your local county clerk's office or check their website for online access. Most counties allow you to search by address or name, making it easier to find your Clarksville Tennessee Deed of Trust With Future Advance. If you face any challenges, consider reaching out to uslegalforms for assistance in navigating the process.

Yes, property deeds are considered public records in Tennessee. This means anyone can access these documents, including the Clarksville Tennessee Deed of Trust With Future Advance, by visiting the county clerk’s office or using their online services. Public access promotes transparency regarding property ownership and agreements.

After closing on your home, the deed is usually recorded at the county clerk’s office. You can either request a copy directly from them or, in some cases, your closing agent may provide it to you. If you need information related to the Clarksville Tennessee Deed of Trust With Future Advance, ensure you have your closing documents handy for easy reference.

If you need a new copy of your deed, you can request it from the local county clerk's office where the property is located. Provide the necessary details such as the property address or your name associated with the Clarksville Tennessee Deed of Trust With Future Advance. This ensures a smooth process and helps you receive your deed promptly.

To obtain a copy of a deed in Tennessee, you can visit the local county clerk's office or access their online database. Many counties offer digital services where you can search and request documents like the Clarksville Tennessee Deed of Trust With Future Advance. It’s essential to have the property address or the owner’s name for accurate results.

While a deed of trust can be considered valid without being recorded, recording it provides essential protections. Recording establishes the priority of the lender’s claim in case of disputes and secures the borrower's rights. It's advisable to use the Clarksville Tennessee Deed of Trust With Future Advance for effective legal standing.

A deed of trust with a future advance clause allows a lender to provide additional funds to the borrower in the future without needing to execute a new deed. This feature is beneficial for ongoing financial needs and can streamline access to funds. Knowing about the Clarksville Tennessee Deed of Trust With Future Advance empowers borrowers with financial flexibility.

Recording a deed of trust in Tennessee generally takes a few days to a couple of weeks, depending on the local recording office's workflow. Once submitted, the office will process the deed and make it part of the public record. Using platforms like uslegalforms can expedite your experience with the Clarksville Tennessee Deed of Trust With Future Advance.

A trust deed and a deed of trust are similar but serve different functions. A trust deed usually involves a three-party arrangement, while a deed of trust involves a borrower, a lender, and a trustee. Understanding the Clarksville Tennessee Deed of Trust With Future Advance can help you navigate this distinction more effectively.

In Tennessee, anyone who is legally competent can serve as a trustee on a deed of trust, provided they maintain an impartial stance. This includes private individuals and entities like banks or title companies. However, it is essential to choose someone with the expertise to manage the responsibilities effectively. This choice impacts how well your Clarksville Tennessee Deed of Trust With Future Advance functions over time.