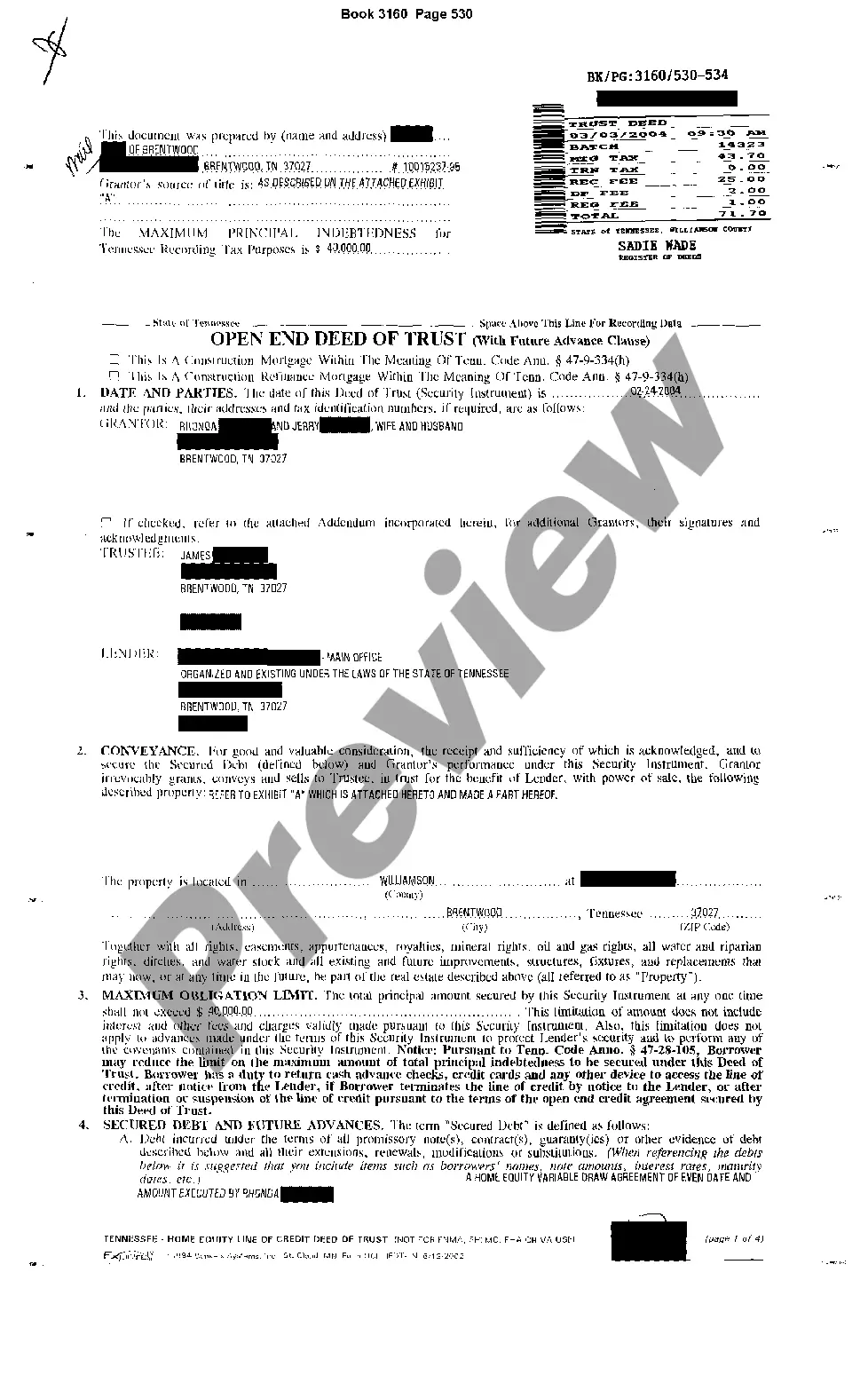

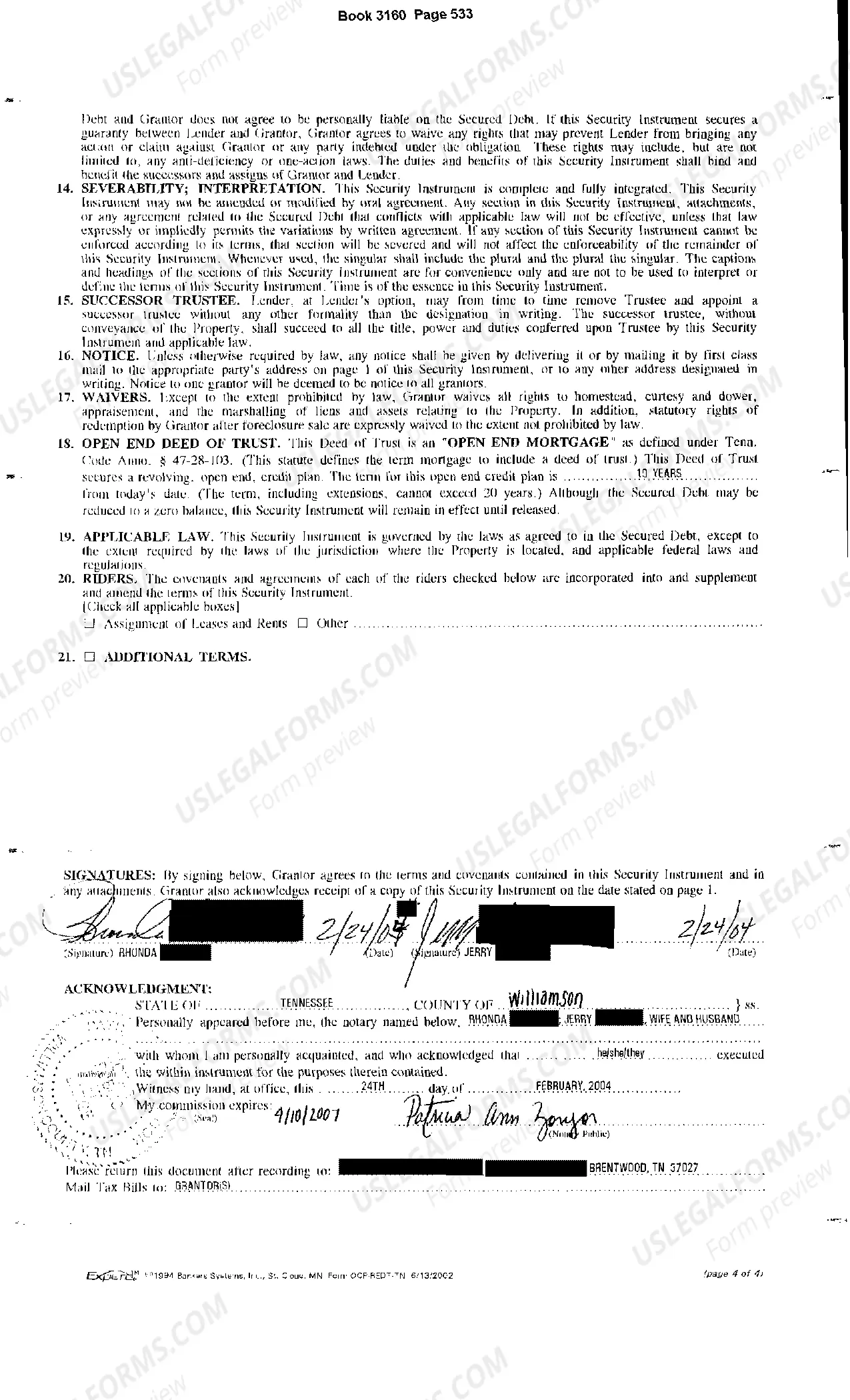

Memphis Tennessee Deed of Trust With Future Advance is a legal document that pertains to real estate transactions in the city of Memphis, Tennessee. This agreement is typically used when a borrower is obtaining a loan that will be secured by a property through a deed of trust arrangement. The Deed of Trust With Future Advance outlines the terms and conditions of the loan, including the amount borrowed, interest rate, repayment schedule, and any additional fees or charges. It also establishes the property being used as collateral for the loan, which will be described in detail within the document. One important aspect of the Memphis Tennessee Deed of Trust With Future Advance is the inclusion of future advances. This provision allows the lender to provide additional funds to the borrower in the future, secured by the same property and subject to the terms and conditions of the original loan. This can be beneficial for borrowers who may require additional funds for renovations, repairs, or other purposes without needing to initiate a new loan application process. Different types of Deed of Trust With Future Advance may exist depending on the specific needs of the borrower and lender. These variations may include fixed-rate or adjustable-rate loans, with or without a balloon payment, and specific terms regarding the future advance provisions. It is essential for all parties involved in a Memphis Tennessee Deed of Trust With Future Advance to understand their rights and obligations under the agreement. The borrower must make timely payments as specified in the loan documents, while the lender has the right to foreclose on the property in the event of default. To ensure the validity and enforceability of the Memphis Tennessee Deed of Trust With Future Advance, it must be executed in writing, signed by the borrower, and notarized. It is also generally recorded in the county where the property is located to provide public notice of the lien on the property. Overall, the Memphis Tennessee Deed of Trust With Future Advance is a crucial legal document that establishes the terms of a loan and the property's collateral in real estate transactions. It provides the necessary framework for both borrowers and lenders to protect their interests and fulfill their respective obligations.

Memphis Tennessee Deed of Trust With Future Advance

Description

How to fill out Memphis Tennessee Deed Of Trust With Future Advance?

Are you searching for a reliable and affordable provider of legal document templates to obtain the Memphis Tennessee Deed of Trust With Future Advance? US Legal Forms is your ideal choice.

Whether you need a basic agreement to establish rules for living with your partner or a collection of documents to facilitate your divorce proceedings, we have you covered. Our site offers over 85,000 current legal document templates for both personal and business purposes. All templates we provide are not generic and are designed to meet the regulations of particular states and counties.

To obtain the document, you must Log In to your account, find the required template, and click the Download button next to it. Please bear in mind that you can download your previously acquired document templates anytime from the My documents section.

Are you unfamiliar with our platform? No problem. You can create an account in a matter of minutes, but first, ensure you do the following.

Now, you can set up your account. Then select the subscription plan and proceed with the payment. After the payment is processed, download the Memphis Tennessee Deed of Trust With Future Advance in any format you desire. You can return to the website whenever needed and redownload the document without any cost.

Obtaining current legal forms has never been simpler. Give US Legal Forms a try today, and say goodbye to wasting your precious time searching for legal documents online.

- Confirm that the Memphis Tennessee Deed of Trust With Future Advance adheres to the rules of your state and locality.

- Review the form’s description (if available) to understand who and what the document is meant for.

- Restart your search if the template does not fit your particular circumstances.

Form popularity

FAQ

If it meets legal requirements for validity, the deed of trust has no automatic expiration. It will be valid until either the borrower repays the loan the trust deed is security for or if the property is sold in a foreclosure action.

What Is a Future Advance? A future advance is a clause in a loan contract that allows the borrower to receive additional funds after the loan is initially disbursed. Future advances are secured by collateral, which may include a home, business property, or other assets.

Generally speaking, beneficiaries have a right to see trust documents which set out the terms of the trusts, the identity of the trustees and the assets within the trust as well as the trust deed, any deeds of appointment/retirement and trust accounts.

Tennessee's probate period is considered long and it does not use the Uniform Probate Code. So a living trust is likely a good call if your estate is worth more than $50,000. At or below that amount, Tennessee allows for a simplified small estate process, which makes a living trust unnecessary.

Most states, including Tennessee and Virginia, utilize the deed of trust. Lenders prefer the deed of trust because in the event of a foreclosure, the neutral trustee conducts the sale, not the lender. This frees up the lender to bid on the property, which is common.

Key estate planning documents that might be impacted include trusts, wills, living wills, and durable or healthcare power of attorney. All of these legal documents require the signatory, witnesses, and notary to be physically present in order to execute the document.

Once you die, your living trust becomes irrevocable, which means that your wishes are now set in stone. The person you named to be the successor trustee now steps up to take an inventory of the trust assets and eventually hand over property to the beneficiaries named in the trust.

If it meets legal requirements for validity, the deed of trust has no automatic expiration. It will be valid until either the borrower repays the loan the trust deed is security for or if the property is sold in a foreclosure action.

A trust is not public record. A will is always made public record when it is probated. No one need know what assets are in your trust, who your beneficiaries are, or when the assets are distributed.

(a) Liens on realty, equitable or retained in favor of vendor on the face of the deed, also liens of mortgages, deeds of trust, and assignments of realty executed to secure debts, shall be barred, and the liens discharged, unless suits to enforce the same be brought within ten (10) years from the maturity of the debt.