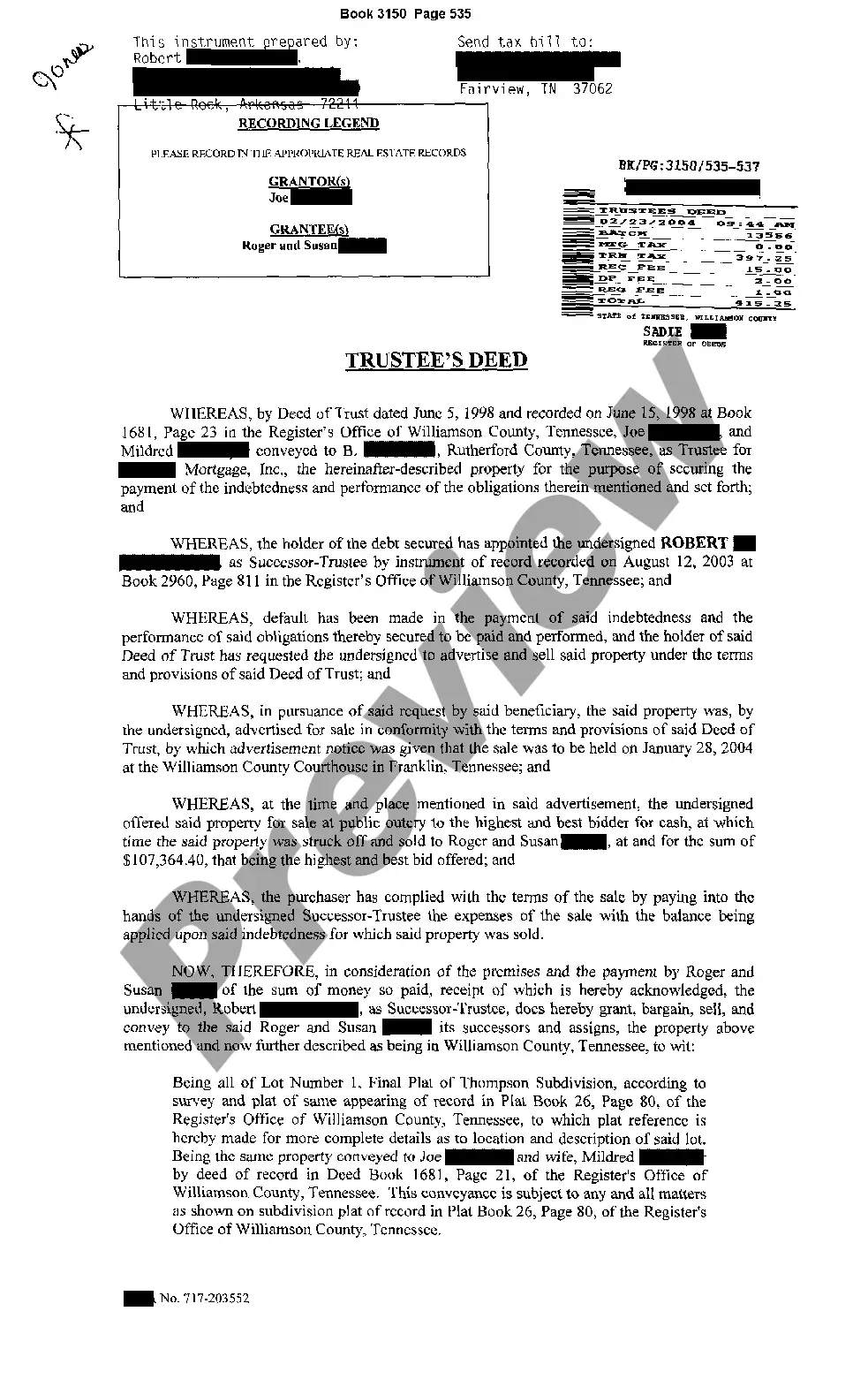

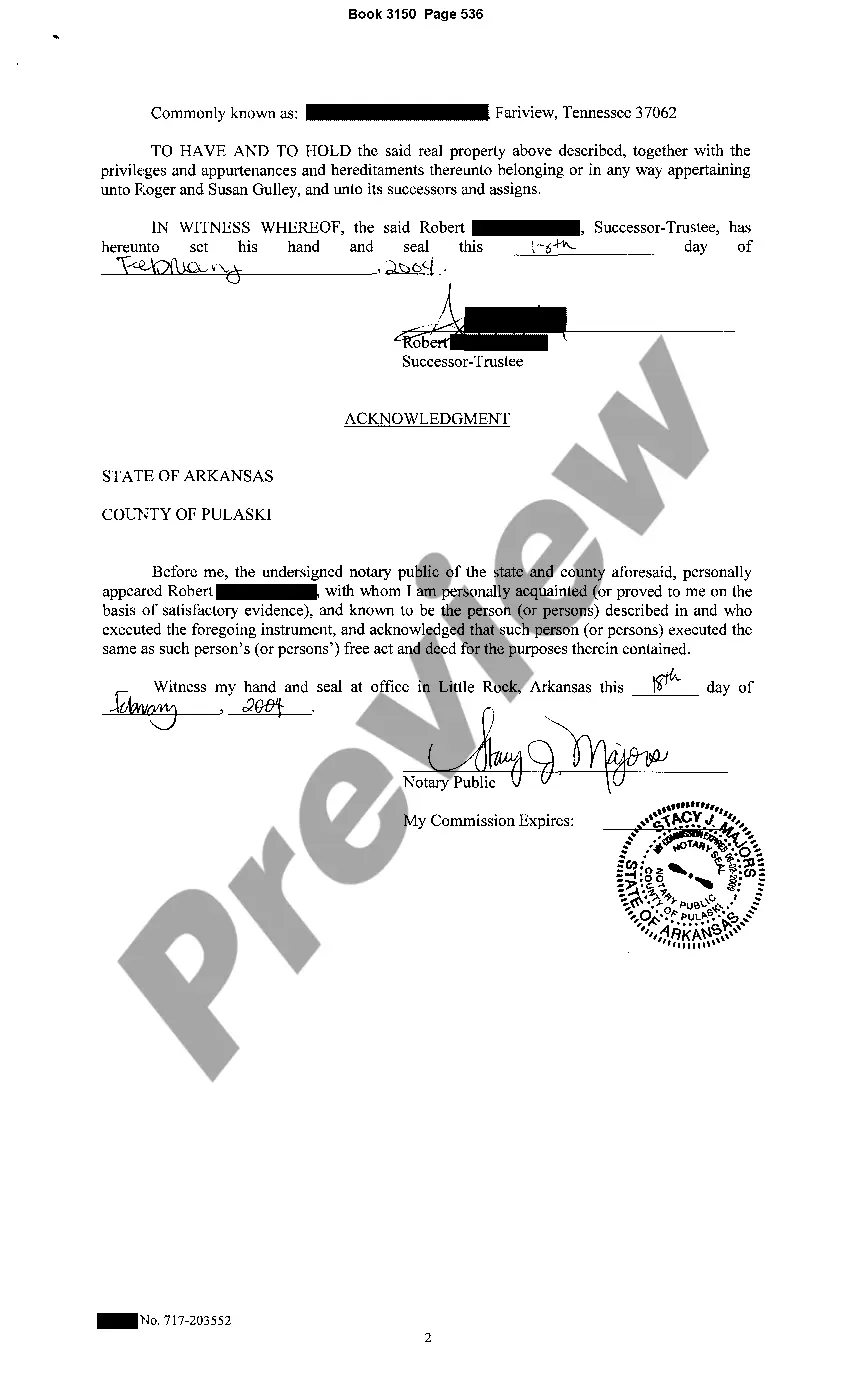

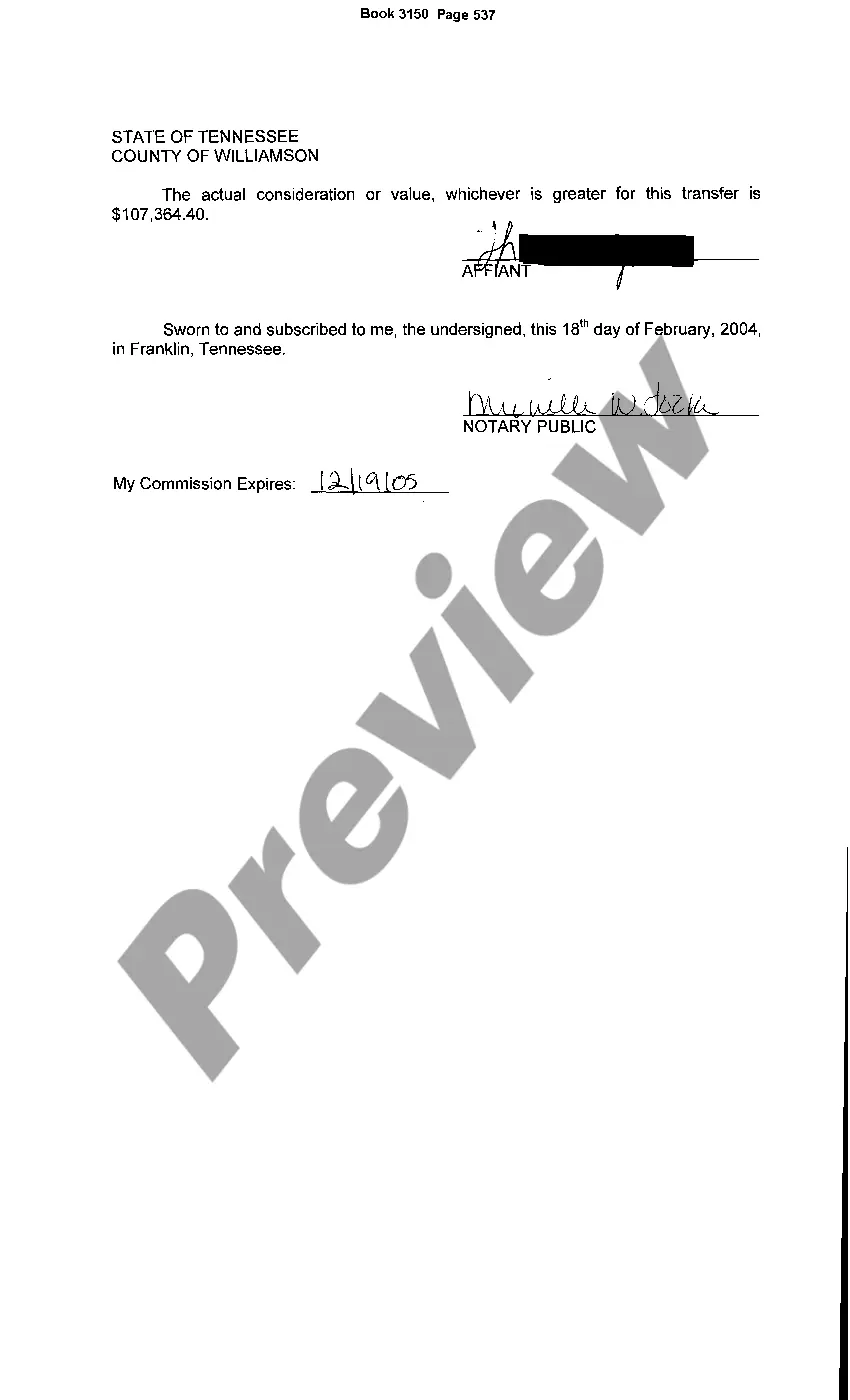

A Memphis Tennessee Trustee's Deed is a legal document that transfers ownership of real property from a trust to a beneficiary. It is typically utilized in situations where a property is held in a trust and needs to be transferred to a designated beneficiary. The Trustee's Deed is an important legal instrument that ensures the proper transfer of property rights and protects the interests of both the trustee and beneficiary. This document serves as proof of the transfer of ownership from the trust to the beneficiary and provides a clear title to the property. There are various types of Memphis Tennessee Trustee's Deeds, each serving different purposes based on the specific circumstances of the trust and the beneficiaries involved. Some common types of Trustee's Deeds in Memphis, Tennessee, include: 1. Absolute Trustee's Deed: This type of deed is used when the trustee has the authority to convey the property to a beneficiary without any conditions or limitations. It signifies a complete transfer of ownership to the beneficiary. 2. Quitclaim Trustee's Deed: This deed is used when the trustee wants to transfer any interest they may have in the property to the beneficiary. It does not guarantee that the trustee owns any specific interest in the property. 3. Special Trustee's Deed: This type of deed is utilized when the transfer of property occurs under specific conditions defined in the trust agreement. It may outline specific terms or conditions that need to be met before the property is transferred to the beneficiary. 4. Life Estate Trustee's Deed: In cases where a trust grants a beneficiary the right to live in a property for their lifetime, a Life Estate Trustee's Deed is used. This deed transfers the property to the beneficiary with the provision that upon their death, it will pass to another designated beneficiary. When executing a Memphis Tennessee Trustee's Deed, it is essential to follow proper legal procedures and record the deed with the appropriate county recorder's office. This ensures that the transfer of ownership is legally binding and will be recognized by all parties involved. It is also advisable to consult with a legal professional experienced in real estate and trusts to ensure compliance with all applicable laws and regulations.

Memphis Tennessee Trustee's Deed

Description

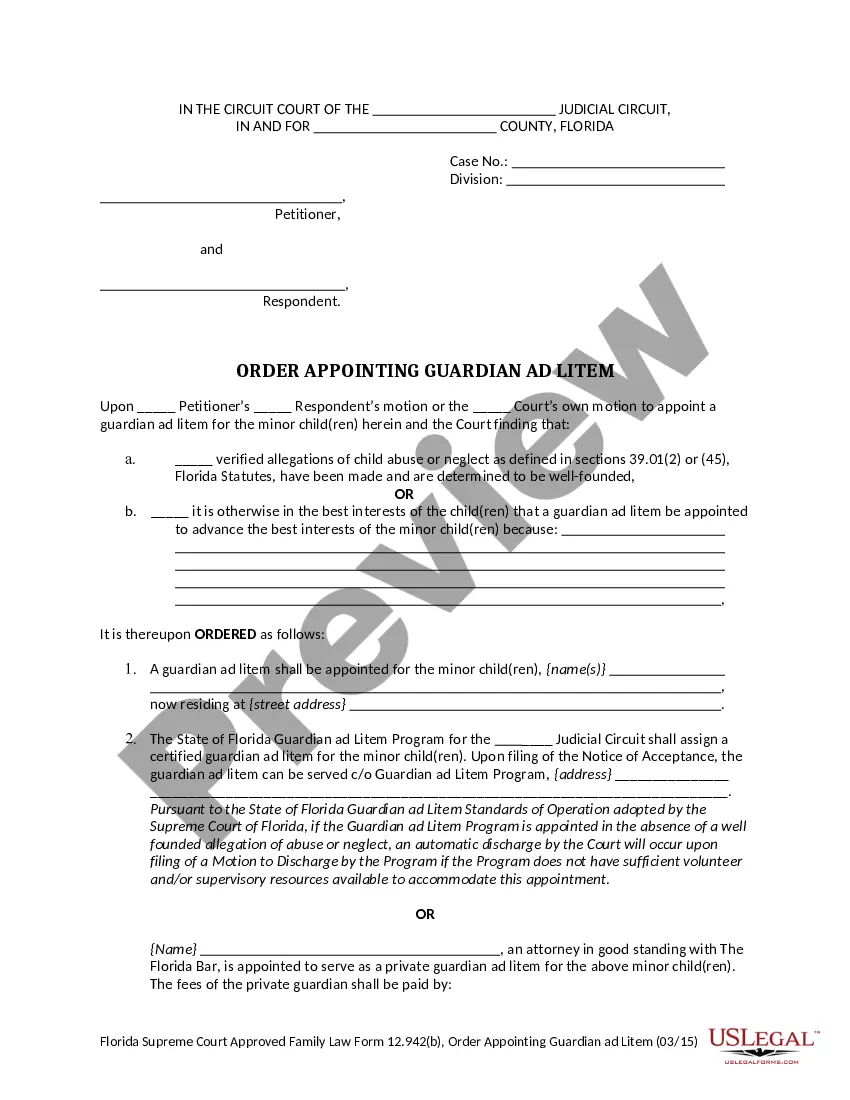

How to fill out Memphis Tennessee Trustee's Deed?

We consistently aim to minimize or evade legal complications when managing intricate legal or financial matters.

To achieve this, we seek attorney services which are often quite costly.

However, not all legal issues possess the same level of complexity. Many can be resolved by ourselves.

US Legal Forms is an online repository of current DIY legal documents concerning everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button beside it. If you happen to misplace the document, you can always re-download it from the My documents section. The process is equally straightforward if you are not familiar with the site! You can set up your account in just a few minutes. Ensure to verify if the Memphis Tennessee Trustee's Deed adheres to the laws and regulations of your state and area. Additionally, it’s crucial that you review the form’s outline (if available), and if you notice any inconsistencies with what you initially sought, look for a different form. Once you’ve confirmed that the Memphis Tennessee Trustee's Deed is suitable for your situation, you can select the subscription option and move forward to payment. Subsequently, you can download the document in any available format. For over 24 years in the market, we’ve assisted millions of individuals by providing customizable and up-to-date legal forms. Take advantage of US Legal Forms now to conserve time and resources!

- Our collection enables you to take control of your affairs without the need for legal counsel services.

- We provide access to legal form templates that are not always readily available.

- Our templates are specific to states and regions, making the search significantly easier.

- Utilize US Legal Forms whenever you require to access and download the Memphis Tennessee Trustee's Deed or any other form swiftly and securely.

Form popularity

FAQ

To calculate the amount of your taxes multiply the assessed value of your property times the tax rate (divided by 100). The 2022 tax rate in Shelby County is $3.39 per $100 of assessed value for ALL Shelby County property owners....Additional Information. Residential= 25%Farm= 25%3 more rows

In either case, you can contact your local county Assessor with questions about ownership. You can find the contact information for your local Assessor at this link.

If Your Deed Is Not Recorded, the Property Could Be Sold Out From Under You (and Other Scary Scenarios) In practical terms, failure to have your property deed recorded would mean that, if you ever wanted to sell, refinance your mortgage, or execute a home equity line of credit, you could not do so.

As the banker for Shelby County, the Trustee offers tax benefit programs to senior citizens, veterans and disabled taxpayers.

The trustee disburses sales tax revenues and may collect municipal property taxes and other state and local taxes. The trustee generally acts as treasurer for the county, receiving and paying out funds. The trustee must keep a detailed account of these transactions.

The 2021 tax rate is $2.713049 per $100 Assessed Value. If you disagree with your assessment values you can seek to resolve the discrepancies with the Shelby County Assessor's Office or file an appeal with the Shelby County Board of Equalization (BOE).

The Tennessee State Library and Archives has microfilmed copies of older deeds for every county in Tennessee. The deeds records are arranged by the name of the seller/buyer (grantor/grantee).

The title deeds to a property with a mortgage are usually kept by the mortgage lender. They will only be given to you once the mortgage has been paid in full. But, you can request copies of the deeds at any time.

In either case, you can contact your local county Assessor with questions about ownership. You can find the contact information for your local Assessor at this link.

The Register of Deeds files certain legal documents mainly pertaining to or affecting real estate and provides public access to these records.