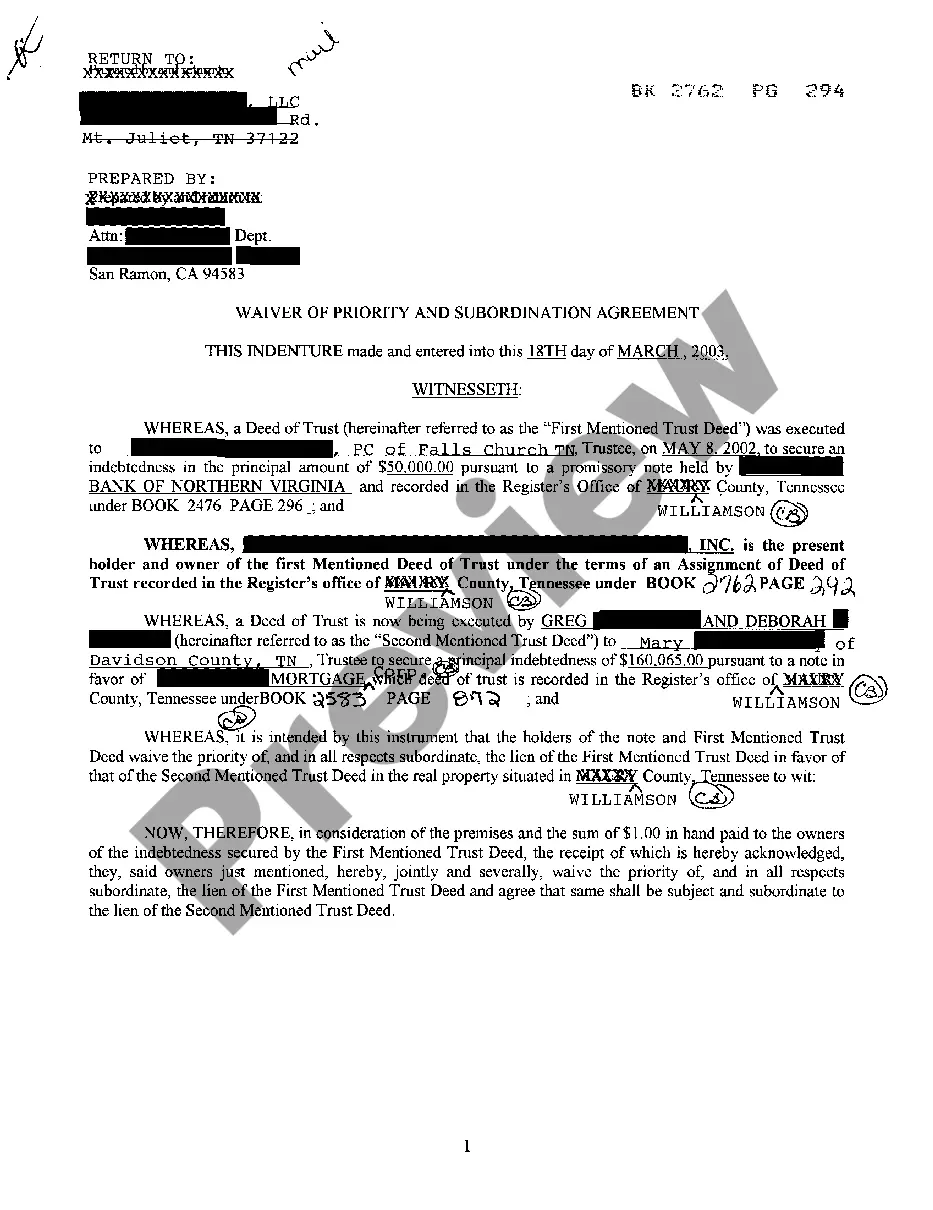

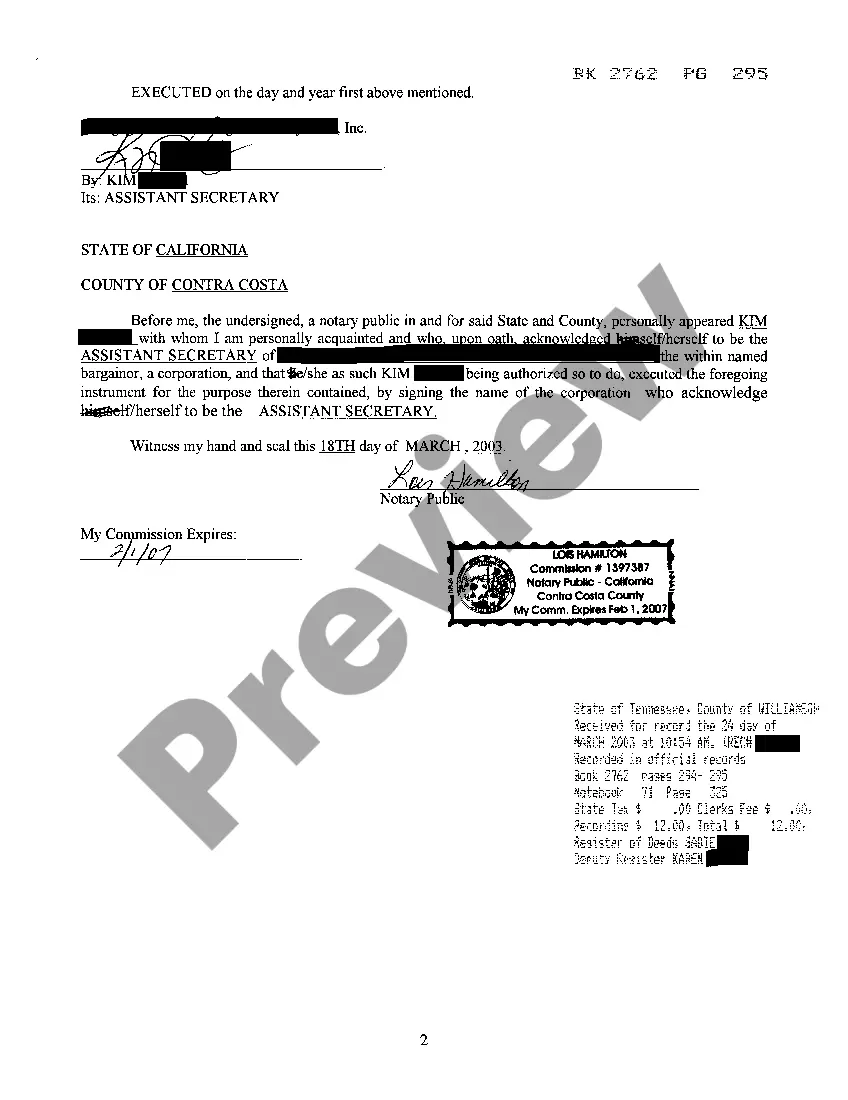

A Memphis Tennessee Waiver of Priority and Subordination Agreement is a legal document that outlines the agreement between two or more parties to waive a specific order of priority or subordination that may exist in certain circumstances. This agreement is typically used in financial or real estate transactions to provide clarity and protection to all parties involved. The purpose of a Memphis Tennessee Waiver of Priority and Subordination Agreement is to modify the traditional order of priority that may be established by law or other agreements. It allows the parties involved to establish a new order of priority or subordination that better suits their needs and specific situation. This type of agreement can be employed in various scenarios, such as mortgage refinancing, foreclosure proceedings, or when multiple lenders or creditors are involved. It helps to determine who has primary rights to certain assets or funds in case of default or liquidation. Different types of Memphis Tennessee Waiver of Priority and Subordination Agreements may exist depending on the specific circumstances and parties involved. Some common variations include: 1. Mortgage Waiver of Priority and Subordination Agreement: This agreement is used when refinancing a mortgage or when there are multiple mortgages on a property. It establishes the order of priority for the mortgage liens, ensuring that each lender's interests are protected. 2. Subordination Agreement: This type of agreement is often used in commercial real estate transactions where multiple lenders are involved. It establishes the order of priority for repayment if the property is sold or foreclosed upon. In this case, one lender may agree to subordinate their position to another lender, ensuring that the primary lender receives repayment first. 3. Intercreditor Agreement: This agreement is used when multiple creditors have a claim on the same assets or collateral. It outlines the priority of repayment in case of default and ensures that each creditor's rights are protected. In summary, a Memphis Tennessee Waiver of Priority and Subordination Agreement is a legally binding document that allows parties to establish a new order of priority or subordination, deviating from the traditional order established by law or other agreements. It is commonly used in financial and real estate transactions to protect the rights of lenders, creditors, and other parties involved.

Memphis Tennessee Waiver of Priority and Subordination Agreement

Description

How to fill out Memphis Tennessee Waiver Of Priority And Subordination Agreement?

If you are looking for a suitable document, it’s incredibly challenging to select a more convenient location than the US Legal Forms site – likely the most extensive collections available online.

Here you can discover a vast array of templates for business and personal uses categorized by type and state, or through keywords.

With our sophisticated search feature, locating the latest Memphis Tennessee Waiver of Priority and Subordination Agreement is as straightforward as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Select the format and save it to your device.

- Furthermore, the accuracy of each document is confirmed by a group of professional attorneys who routinely review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to do to access the Memphis Tennessee Waiver of Priority and Subordination Agreement is to Log In to your user profile and select the Download option.

- If you are utilizing US Legal Forms for the first time, simply adhere to the guidelines below.

- Verify that you have located the document you desire. Review its details and employ the Preview function to examine its contents. If it does not fulfill your needs, utilize the Search option at the top of the page to find the appropriate file.

- Confirm your choice. Choose the Buy now option. Following this, pick your desired pricing plan and provide the necessary information to create an account.

Form popularity

FAQ

Subordination agreements are usually carried out when property owners take a second mortgage on their property. As a result, the second loan becomes the junior debt, and the primary loan becomes the senior debt.

Subordination clauses are most commonly found in mortgage refinancing agreements. Consider a homeowner with a primary mortgage and a second mortgage. If the homeowner refinances his primary mortgage, this in effect means canceling the first mortgage and reissuing a new one.

A subordination agreement is generally used when there are two mortgages and the mortgagor needs to refinance the first mortgage. It acknowledges that one party's interest or claim is superior to another in case the borrower's assets need to be liquidated to repay debts.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

A subordination agreement is a legal document that establishes one debt as ranking behind another in priority for collecting repayment from a debtor. The priority of debts can become extremely important when a debtor defaults on payments or declares bankruptcy.

Subordination agreements are prepared by your lender. The process occurs internally if you only have one lender. When your mortgage and home equity line or loan have different lenders, both financial institutions work together to draft the necessary paperwork.

Subordination is the act or process by which one person or creditor's rights or claims are ranked below those of others, dealing with the distribution priority of debts between creditors.