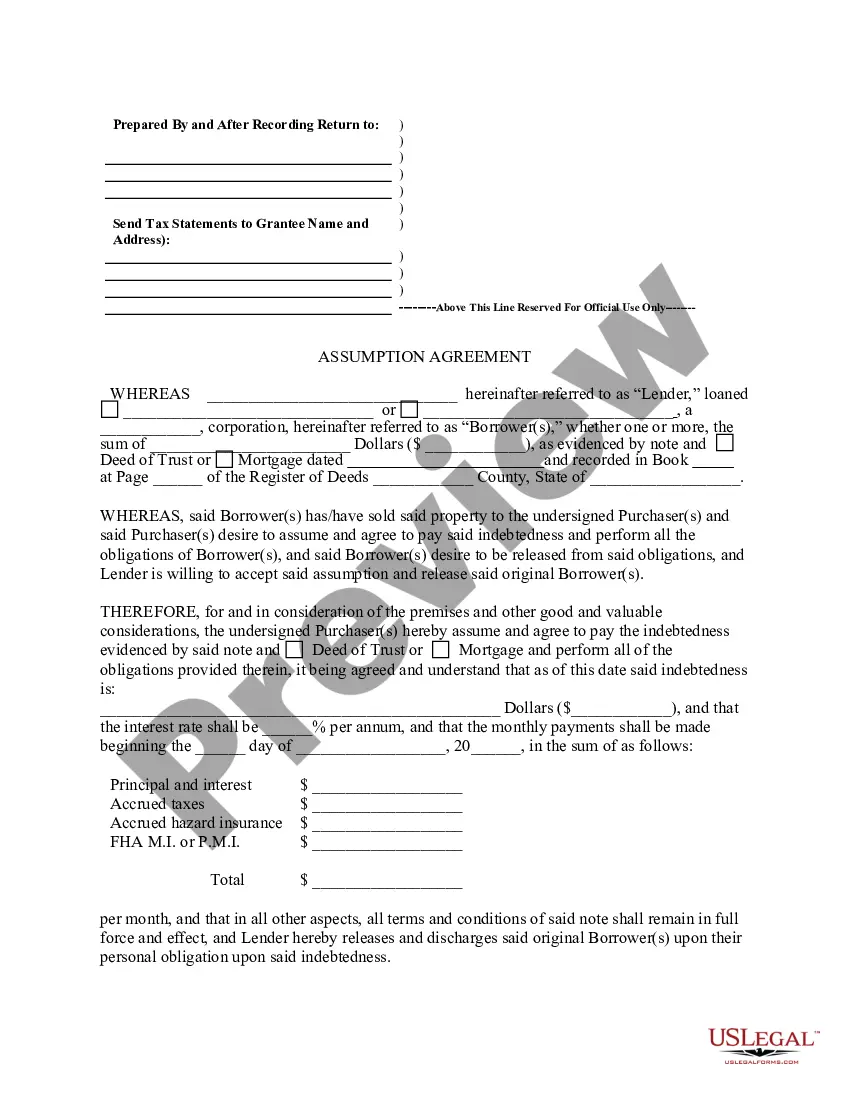

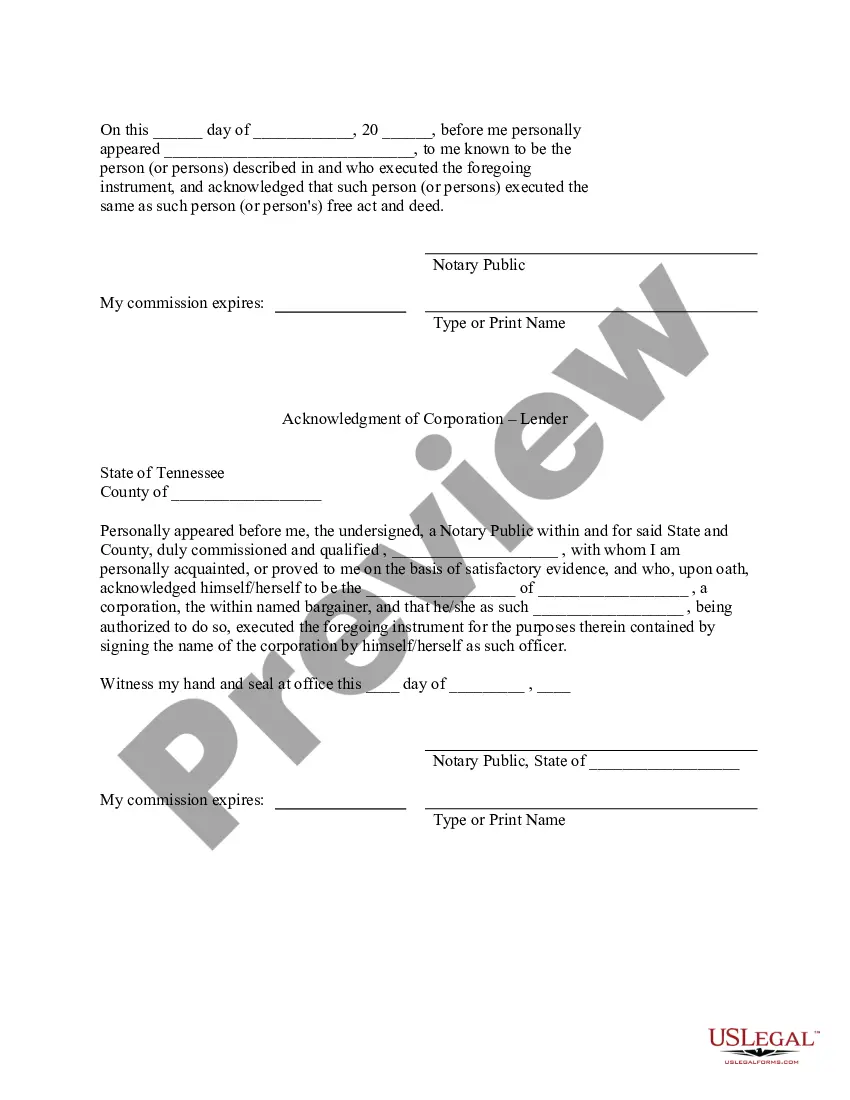

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Title: Understanding the Chattanooga Tennessee Assumption Agreement of Deed of Trust and Release of Original Mortgagors Keywords: Chattanooga Tennessee, Assumption agreement, Deed of Trust, Release, Original Mortgagors Introduction: The Chattanooga Tennessee Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that plays a vital role in real estate transactions. It allows a new party to assume the responsibilities and obligations of an original mortgage, while also relinquishing the rights and liabilities of the original mortgagors. This article will delve into the details of this agreement, highlighting its purpose, types, and implications under the Chattanooga Tennessee legal framework. 1. Purpose and Overview: The Assumption Agreement of Deed of Trust and Release of Original Mortgagors is designed to facilitate the transfer of mortgage obligations from the original mortgagors to a new party. This agreement effectively transfers the rights and duties associated with the mortgage, allowing the new party to take over payments and assume liability for the property. 2. Types of Chattanooga Tennessee Assumption Agreements: a) Simple Assumption Agreement: This type of assumption agreement involves a straightforward transfer of mortgage obligations. The new party assumes full responsibility for the mortgage, including repayment and adherence to the original terms and conditions. b) Subject to Assumption Agreement: In this type, the original mortgagors remain jointly and severally liable with the new party assuming the mortgage. While the new party pays the mortgage, the original mortgagors still face potential liabilities in case of default. c) Qualifying Assumption Agreement: Chattanooga Tennessee allows qualifying assumption agreements that enable the new party to assume the mortgage while releasing the original mortgagors from further liability. This type generally requires satisfying certain financial and creditworthiness conditions. 3. Key Elements of the Assumption Agreement: a) Parties Involved: The agreement should clearly state the names and contact details of both the original mortgagors and the new party assuming the mortgage. b) Property Description: A detailed description of the property, including its address, legal description, and any additional relevant information, should be included. c) Mortgage Details: The agreement must provide the mortgage specifics, such as the original mortgage amount, interest rate, repayment terms, and any applicable penalties or fees. d) Assumption Terms: The agreement should outline the terms and conditions of the assumption, including the date of transfer, responsibilities of the new party, and any financial considerations involved. e) Release of the Original Mortgagors: If applicable, the agreement must include a release clause that absolves the original mortgagors from further liability once the assumption is complete. 4. Legal Implications: It is crucial for all parties involved in a Chattanooga Tennessee Assumption Agreement of Deed of Trust and Release of Original Mortgagors to consult with legal professionals to ensure compliance with all local regulations. Failure to complete this agreement correctly may result in serious legal consequences for both the original mortgagors and the new party assuming the mortgage. Conclusion: The Chattanooga Tennessee Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a critical legal document that enables the transfer of mortgage responsibilities from the original mortgagors to a new party. By understanding the different types of assumption agreements and the essential elements involved, individuals can proceed with real estate transactions in Chattanooga Tennessee confidently. Seeking legal counsel and guidance during these processes is strongly recommended guaranteeing compliance and protect the interests of all parties involved.Title: Understanding the Chattanooga Tennessee Assumption Agreement of Deed of Trust and Release of Original Mortgagors Keywords: Chattanooga Tennessee, Assumption agreement, Deed of Trust, Release, Original Mortgagors Introduction: The Chattanooga Tennessee Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that plays a vital role in real estate transactions. It allows a new party to assume the responsibilities and obligations of an original mortgage, while also relinquishing the rights and liabilities of the original mortgagors. This article will delve into the details of this agreement, highlighting its purpose, types, and implications under the Chattanooga Tennessee legal framework. 1. Purpose and Overview: The Assumption Agreement of Deed of Trust and Release of Original Mortgagors is designed to facilitate the transfer of mortgage obligations from the original mortgagors to a new party. This agreement effectively transfers the rights and duties associated with the mortgage, allowing the new party to take over payments and assume liability for the property. 2. Types of Chattanooga Tennessee Assumption Agreements: a) Simple Assumption Agreement: This type of assumption agreement involves a straightforward transfer of mortgage obligations. The new party assumes full responsibility for the mortgage, including repayment and adherence to the original terms and conditions. b) Subject to Assumption Agreement: In this type, the original mortgagors remain jointly and severally liable with the new party assuming the mortgage. While the new party pays the mortgage, the original mortgagors still face potential liabilities in case of default. c) Qualifying Assumption Agreement: Chattanooga Tennessee allows qualifying assumption agreements that enable the new party to assume the mortgage while releasing the original mortgagors from further liability. This type generally requires satisfying certain financial and creditworthiness conditions. 3. Key Elements of the Assumption Agreement: a) Parties Involved: The agreement should clearly state the names and contact details of both the original mortgagors and the new party assuming the mortgage. b) Property Description: A detailed description of the property, including its address, legal description, and any additional relevant information, should be included. c) Mortgage Details: The agreement must provide the mortgage specifics, such as the original mortgage amount, interest rate, repayment terms, and any applicable penalties or fees. d) Assumption Terms: The agreement should outline the terms and conditions of the assumption, including the date of transfer, responsibilities of the new party, and any financial considerations involved. e) Release of the Original Mortgagors: If applicable, the agreement must include a release clause that absolves the original mortgagors from further liability once the assumption is complete. 4. Legal Implications: It is crucial for all parties involved in a Chattanooga Tennessee Assumption Agreement of Deed of Trust and Release of Original Mortgagors to consult with legal professionals to ensure compliance with all local regulations. Failure to complete this agreement correctly may result in serious legal consequences for both the original mortgagors and the new party assuming the mortgage. Conclusion: The Chattanooga Tennessee Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a critical legal document that enables the transfer of mortgage responsibilities from the original mortgagors to a new party. By understanding the different types of assumption agreements and the essential elements involved, individuals can proceed with real estate transactions in Chattanooga Tennessee confidently. Seeking legal counsel and guidance during these processes is strongly recommended guaranteeing compliance and protect the interests of all parties involved.