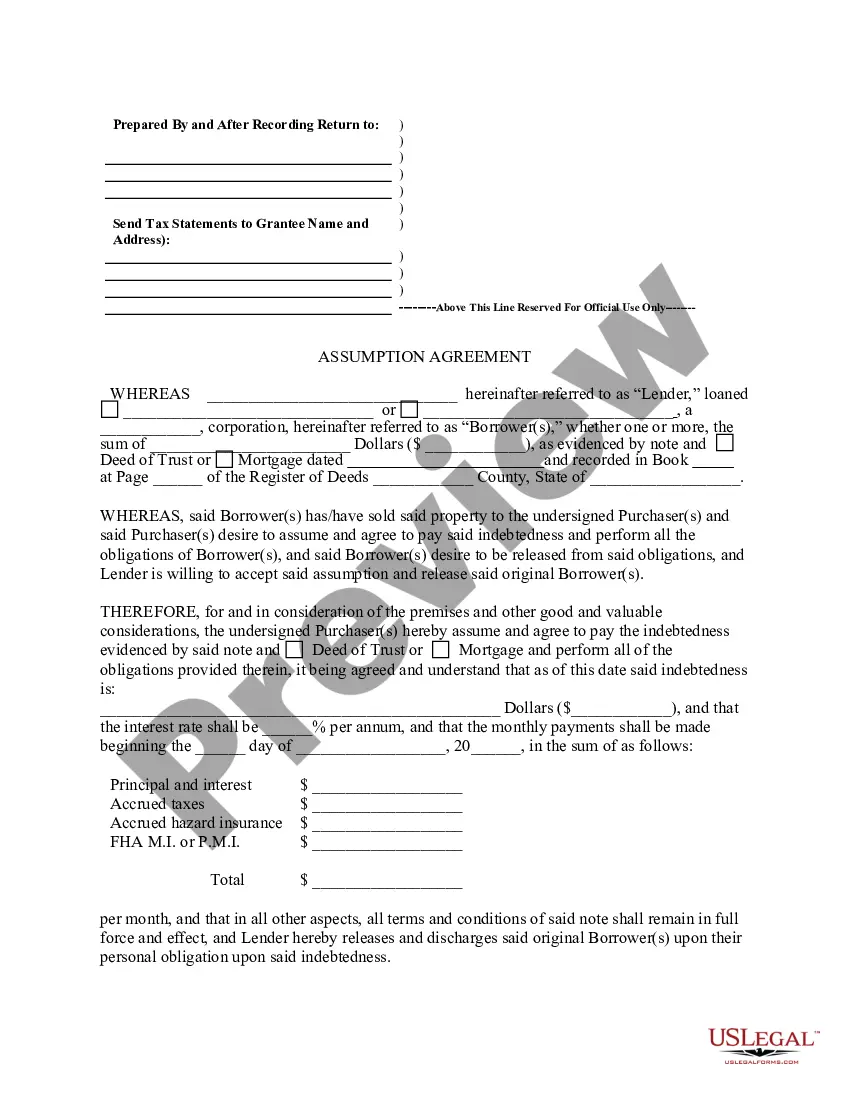

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The Memphis Tennessee Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legal document that allows a new individual or entity to assume the responsibilities and obligations of the original mortgage agreement. This agreement is commonly used when the property owner wishes to transfer the ownership of the property to someone else, and the new owner agrees to take on the existing mortgage. The Assumption Agreement outlines the terms and conditions under which the new owner agrees to assume the original mortgage obligations, including the repayment of the outstanding loan balance, interest rates, and any other terms specified in the original mortgage agreement. The document also includes provisions for the release of the original mortgagors from any further liability or responsibility for the mortgage once the assumption is completed. Moreover, the Memphis Tennessee Assumption Agreement of Deed of Trust and Release of Original Mortgagors can have different types, including: 1. Full Assumption: In this type, the new owner takes on all the rights and responsibilities of the original mortgage agreement. They become fully liable for all the loan payments and are treated as the new mortgagor. 2. Limited Assumption: In a limited assumption, the new owner assumes some, but not all, of the obligations of the original mortgage agreement. This may include partial responsibility for the loan payments or other specific terms specified in the agreement. 3. Subject to Assumption: This type of assumption agreement allows the new owner to acquire the property "subject to" the existing mortgage. In this case, the original mortgagors remain legally liable for the mortgage, but the new owner assumes possession and ownership of the property. It is important to note that the specific terms and conditions of the Memphis Tennessee Assumption Agreement of Deed of Trust and Release of Original Mortgagors may vary depending on the circumstances and the agreement reached between the parties involved. Hence, it is essential to consult with a legal professional or real estate attorney to understand the specific details and implications of the agreement before entering into it.