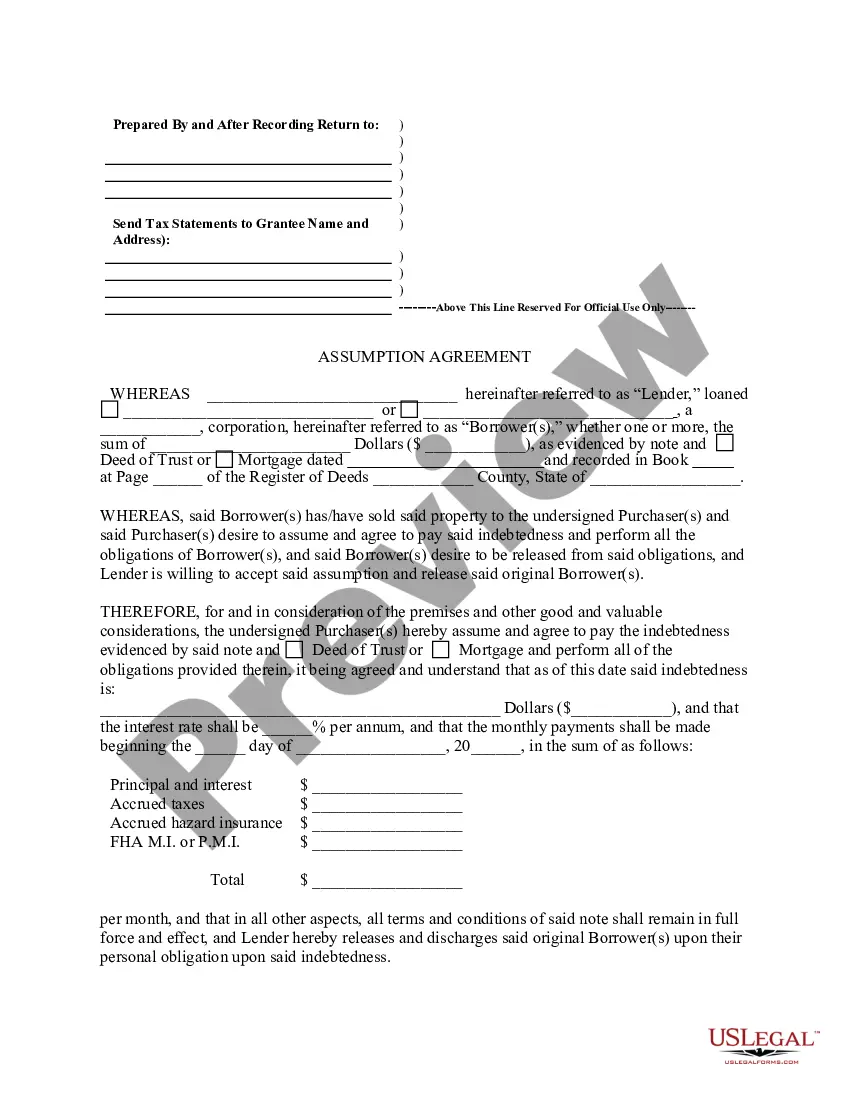

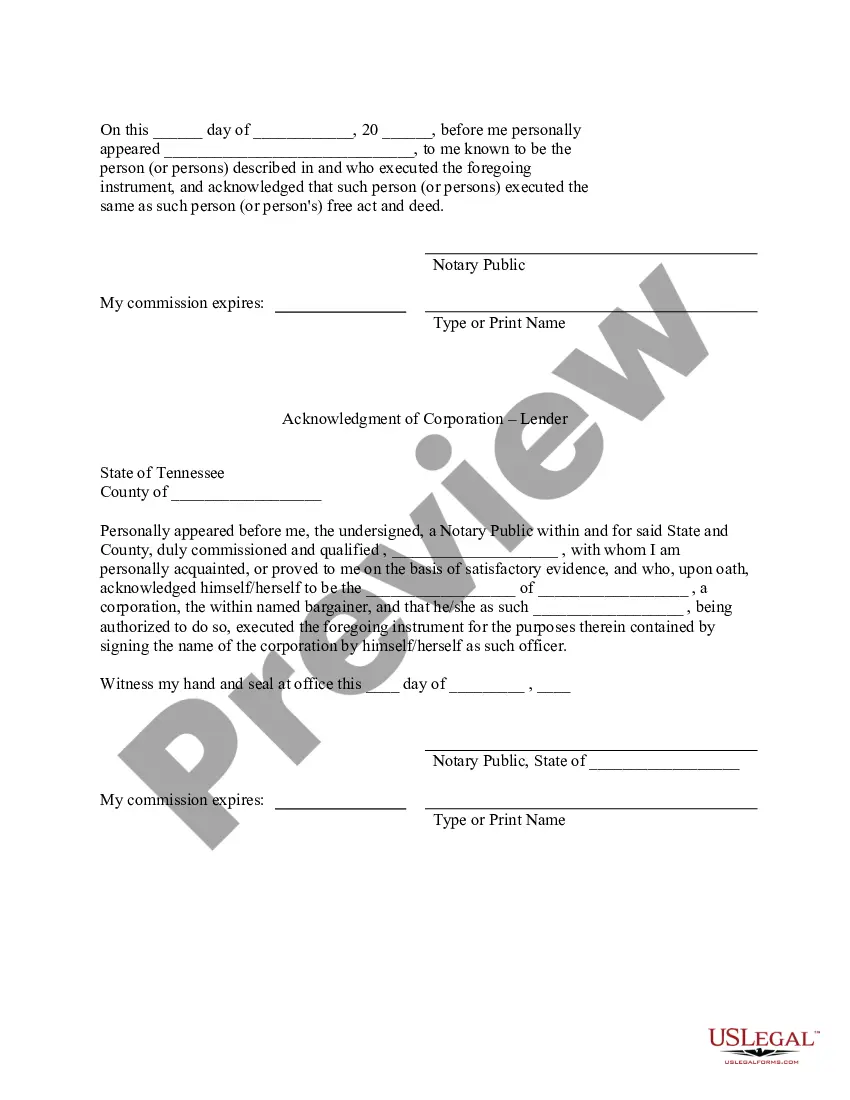

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

The Murfreesboro Tennessee Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legally binding document that outlines the terms and conditions when a property owner in Murfreesboro, Tennessee assumes the existing mortgage loan on their property. This agreement typically involves two parties: the original mortgagors (the current property owners) and the assumptions (the individuals assuming the mortgage). The Murfreesboro Tennessee Assumption Agreement specifies the terms of the assumption, including the outstanding loan balance, interest rate, and repayment period. It also highlights the responsibilities and obligations of both parties, such as the assumptions' undertaking to make timely mortgage payments and maintain the property in good condition. Keywords: Murfreesboro, Tennessee, assumption agreement, deed of trust, release, original mortgagors, property owner, mortgage loan, terms and conditions, assumptions, outstanding loan balance, interest rate, repayment period, responsibilities, obligations, timely payments, property maintenance. Types of Murfreesboro Tennessee Assumption Agreement of Deed of Trust and Release of Original Mortgagors: 1. Residential Assumption Agreement: This type of agreement pertains to residential properties, such as single-family homes, townhouses, or condominiums in Murfreesboro, Tennessee. It outlines the specific terms and conditions for the assumption of the existing mortgage on a residential property. 2. Commercial Assumption Agreement: In the case of commercial properties, such as office buildings, retail spaces, or industrial facilities in Murfreesboro, Tennessee, a commercial assumption agreement is used. This document lays out the unique terms and conditions applicable to commercial property owners assuming the mortgage. 3. Vacant Land Assumption Agreement: When the assumption involves vacant land or undeveloped property in Murfreesboro, Tennessee, a vacant land assumption agreement is employed. It addresses the particular considerations and obligations associated with assuming a mortgage for land without existing structures. 4. Multi-Family Assumption Agreement: In situations where the property involved is a multi-family residential building, such as an apartment complex or duplex, a multi-family assumption agreement comes into play. This document specifies the terms and conditions specific to mortgage assumption for multi-family properties in Murfreesboro, Tennessee. 5. Assumption Agreement with Novation: The Murfreesboro Tennessee Assumption Agreement may also include an additional clause for novation. The novation clause transfers all rights and liabilities from the original mortgagors to the assumptions, effectively releasing the original mortgagors from any further obligations related to the mortgage loan. By employing relevant keywords and highlighting various types of Murfreesboro Tennessee Assumption Agreements, this detailed description provides a comprehensive understanding of the topic.

The Murfreesboro Tennessee Assumption Agreement of Deed of Trust and Release of Original Mortgagors is a legally binding document that outlines the terms and conditions when a property owner in Murfreesboro, Tennessee assumes the existing mortgage loan on their property. This agreement typically involves two parties: the original mortgagors (the current property owners) and the assumptions (the individuals assuming the mortgage). The Murfreesboro Tennessee Assumption Agreement specifies the terms of the assumption, including the outstanding loan balance, interest rate, and repayment period. It also highlights the responsibilities and obligations of both parties, such as the assumptions' undertaking to make timely mortgage payments and maintain the property in good condition. Keywords: Murfreesboro, Tennessee, assumption agreement, deed of trust, release, original mortgagors, property owner, mortgage loan, terms and conditions, assumptions, outstanding loan balance, interest rate, repayment period, responsibilities, obligations, timely payments, property maintenance. Types of Murfreesboro Tennessee Assumption Agreement of Deed of Trust and Release of Original Mortgagors: 1. Residential Assumption Agreement: This type of agreement pertains to residential properties, such as single-family homes, townhouses, or condominiums in Murfreesboro, Tennessee. It outlines the specific terms and conditions for the assumption of the existing mortgage on a residential property. 2. Commercial Assumption Agreement: In the case of commercial properties, such as office buildings, retail spaces, or industrial facilities in Murfreesboro, Tennessee, a commercial assumption agreement is used. This document lays out the unique terms and conditions applicable to commercial property owners assuming the mortgage. 3. Vacant Land Assumption Agreement: When the assumption involves vacant land or undeveloped property in Murfreesboro, Tennessee, a vacant land assumption agreement is employed. It addresses the particular considerations and obligations associated with assuming a mortgage for land without existing structures. 4. Multi-Family Assumption Agreement: In situations where the property involved is a multi-family residential building, such as an apartment complex or duplex, a multi-family assumption agreement comes into play. This document specifies the terms and conditions specific to mortgage assumption for multi-family properties in Murfreesboro, Tennessee. 5. Assumption Agreement with Novation: The Murfreesboro Tennessee Assumption Agreement may also include an additional clause for novation. The novation clause transfers all rights and liabilities from the original mortgagors to the assumptions, effectively releasing the original mortgagors from any further obligations related to the mortgage loan. By employing relevant keywords and highlighting various types of Murfreesboro Tennessee Assumption Agreements, this detailed description provides a comprehensive understanding of the topic.