The Knoxville Tennessee Intercreditor Agreement is a legally binding contract used in lending transactions within the realm of secured financing. It outlines the interrelationship between different creditors and their respective rights in regard to a specific debtor or asset in Knoxville, Tennessee. This agreement aims to establish a clear framework for the order of payment, collateral priority, and overall resolution of potential disputes among the creditors involved. One type of Knoxville Tennessee Intercreditor Agreement is the first-lien and second-lien intercreditor agreement. This agreement governs the relationship between a first-lien lender, holding the primary position in terms of asset priority, and a second-lien lender, holding a subordinate position. It defines the conditions under which the second-lien lender can exercise its rights, such as taking control of the collateral or initiating legal actions, as well as the coordination between the two lenders in case of default or bankruptcy. Another type is the senior and subordinated intercreditor agreement. In this agreement, a senior lender, typically representing a larger portion of the debt, and a subordinated lender, holding a lower-ranking position, establish their respective rights and obligations. This agreement addresses issues of payments, restrictions on subordinated lender actions, and the order in which the lenders can access the collateral to satisfy their claims. Furthermore, the Knoxville Tennessee Intercreditor Agreement may also include provisions for mezzanine debt intercreditor agreements. These agreements exist in cases when the debtor has obtained mezzanine financing, which falls between senior and subordinated debt. Mezzanine lenders usually have a higher risk-reward profile and require specific terms, such as conversion rights, exit strategies, and priority in handling the collateral in default scenarios. Key points often addressed in a Knoxville Tennessee Intercreditor Agreement include the rights of each creditor in enforcing remedies, sharing collateral proceeds, consent requirements for actions affecting the collateral, and the overall priority of claims in the event of default. This agreement is widely used in various industries, including real estate, construction, and corporate financing, where multiple creditors and complex debt structures are involved. In conclusion, the Knoxville Tennessee Intercreditor Agreement is an essential legal document that ensures effective coordination and resolution among multiple creditors operating within the Knoxville, Tennessee area. By establishing the rights and priorities of different lenders, this agreement minimizes potential conflicts and provides a clear framework for debt recovery.

Knoxville Tennessee Intercreditor Agreement

Description

How to fill out Knoxville Tennessee Intercreditor Agreement?

Getting verified templates specific to your local regulations can be challenging unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Knoxville Tennessee Intercreditor Agreement becomes as quick and easy as ABC.

For everyone already familiar with our library and has used it before, getting the Knoxville Tennessee Intercreditor Agreement takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. This process will take just a few additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

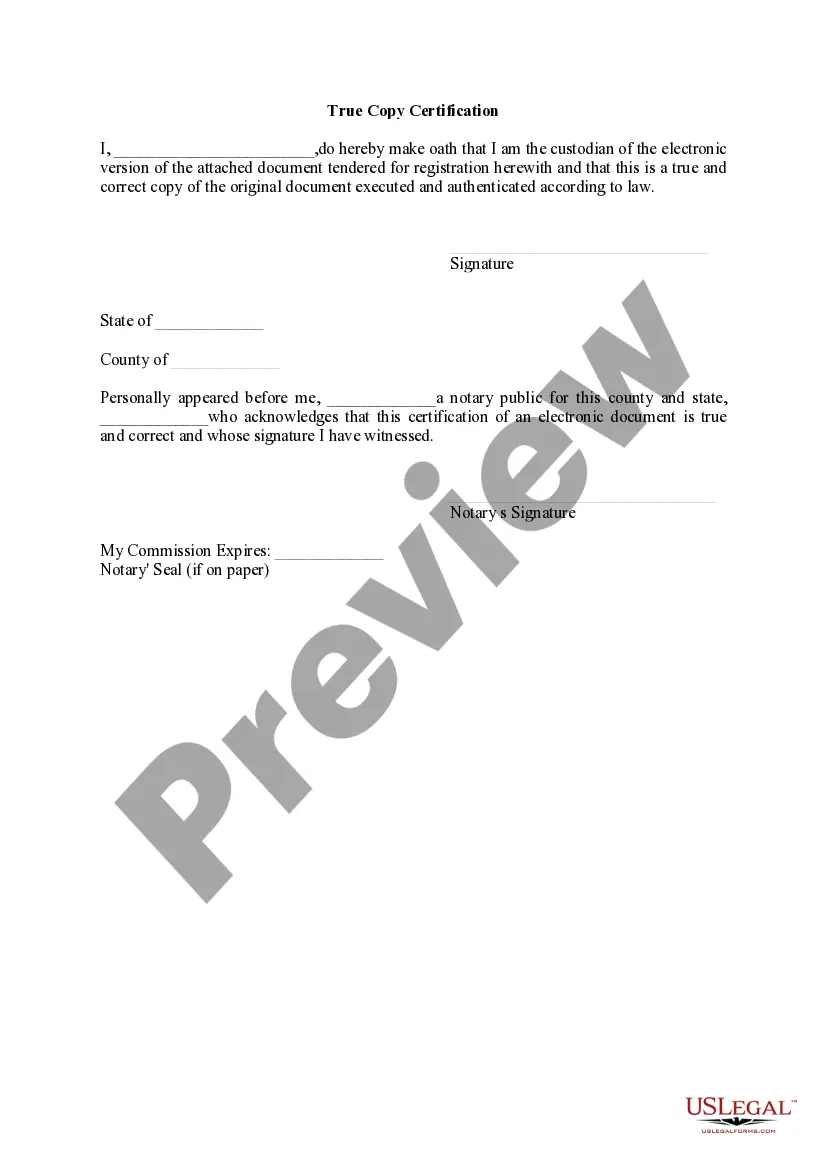

- Check the Preview mode and form description. Make certain you’ve selected the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you see any inconsistency, use the Search tab above to find the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Knoxville Tennessee Intercreditor Agreement. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!