A Murfreesboro Tennessee Intercreditor Agreement is a legal document that outlines the agreement between two or more creditors who have provided financing to a borrower in Murfreesboro, Tennessee. This agreement is essential in situations where multiple lenders have provided loans or credit facilities to a borrower and need to establish their rights and priorities in the event of default or insolvency. The purpose of the intercreditor agreement is to establish a clear and organized relationship among the lenders, ensuring that each party understands their rights, obligations, and possible remedies. The Murfreesboro Tennessee Intercreditor Agreement typically defines the hierarchy of creditor claims and establishes the order of priority for distributing the borrower's assets in the event of default or bankruptcy. It outlines the respective responsibilities and entitlements of the different lenders, and it serves as a comprehensive guide for resolving disputes and coordinating actions among them. By having such an agreement in place, lenders can avoid conflicts and confusion that may arise from competing claims, and it provides a framework for efficient and effective decision-making. There are various types of Murfreesboro Tennessee Intercreditor Agreements, depending on the specific circumstances and parties involved. Some common types include: 1. First Lien/Second Lien Intercreditor Agreement: This type of agreement governs the relationship between a primary lender holding a first lien position and a secondary lender with a second lien position. It determines the rights and priorities of each lender in case of default or bankruptcy, clarifying the order in which assets will be distributed. 2. Senior/Subordinated Intercreditor Agreement: This agreement governs the relationship between a senior lender and a subordinated lender. The senior lender usually holds a higher priority claim on the borrower's assets and is thus entitled to repayment before the subordinated lender. The agreement sets out the conditions under which the subordinated lender may receive payment and defines its limited recourse and rights. 3. Mezzanine Intercreditor Agreement: This type of agreement primarily applies to mezzanine financing, which is a hybrid form of debt and equity. It establishes the relationship between the mezzanine lender and other senior lenders. The agreement defines the respective rights and obligations of these lenders, including aspects such as priority of payment, enforcement action, and subordination. In conclusion, a Murfreesboro Tennessee Intercreditor Agreement is a crucial document that helps coordinate the actions and rights of multiple lenders in relation to a borrower. By delineating the hierarchy of creditor claims and establishing clear guidelines, it ensures a structured and orderly process in case of default or insolvency. Different types of intercreditor agreements exist to cater to specific lender arrangements and requirements, such as first lien/second lien, senior/subordinated, and mezzanine agreements. The agreement plays a vital role in mitigating potential disputes and maintaining efficient lending practices.

Murfreesboro Tennessee Intercreditor Agreement

Description

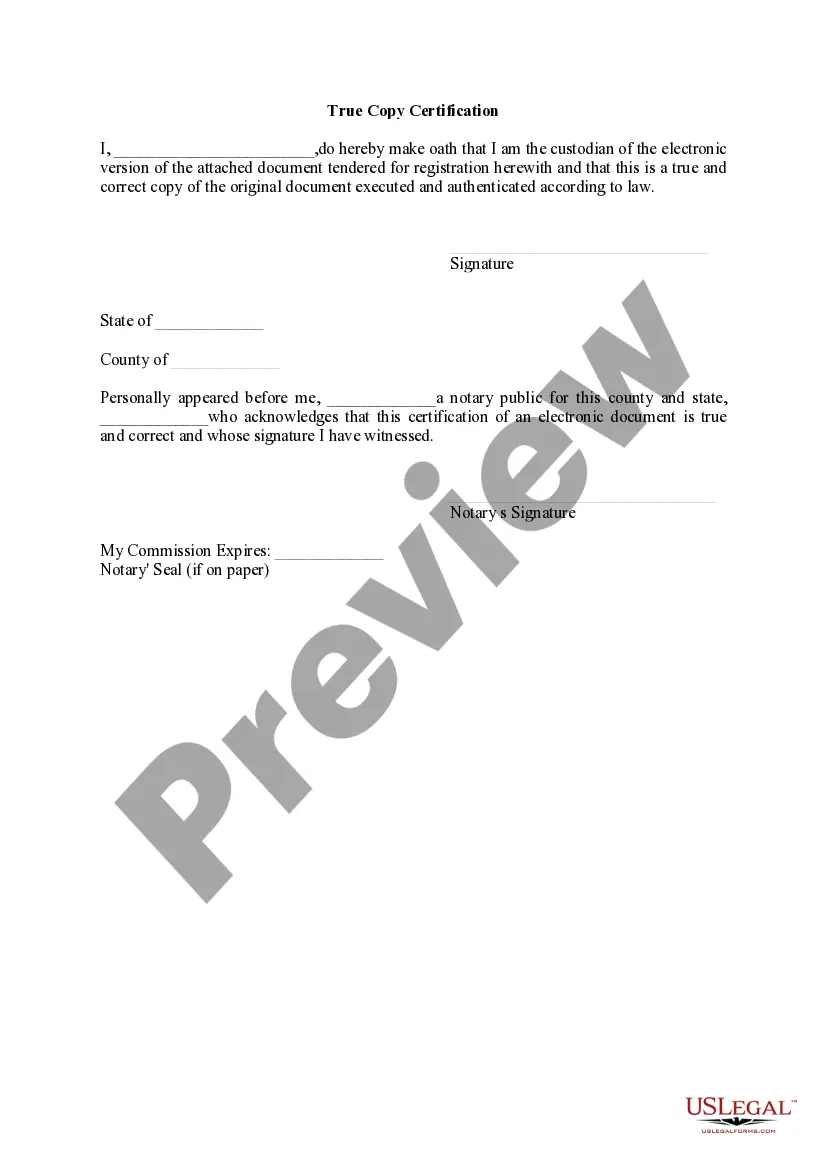

How to fill out Murfreesboro Tennessee Intercreditor Agreement?

No matter what social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for a person without any law background to draft such paperwork from scratch, mainly due to the convoluted terminology and legal nuances they entail. This is where US Legal Forms can save the day. Our platform offers a massive library with more than 85,000 ready-to-use state-specific documents that work for almost any legal situation. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you need the Murfreesboro Tennessee Intercreditor Agreement or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the Murfreesboro Tennessee Intercreditor Agreement in minutes employing our trusted platform. If you are already a subscriber, you can go on and log in to your account to download the appropriate form.

Nevertheless, in case you are new to our library, ensure that you follow these steps before obtaining the Murfreesboro Tennessee Intercreditor Agreement:

- Ensure the template you have found is specific to your location since the rules of one state or county do not work for another state or county.

- Review the form and read a quick outline (if provided) of scenarios the paper can be used for.

- If the one you picked doesn’t meet your needs, you can start again and look for the suitable form.

- Click Buy now and choose the subscription option you prefer the best.

- with your login information or create one from scratch.

- Choose the payment gateway and proceed to download the Murfreesboro Tennessee Intercreditor Agreement as soon as the payment is done.

You’re good to go! Now you can go on and print the form or complete it online. If you have any problems locating your purchased documents, you can easily access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.