Nashville Tennessee Intercreditor Agreement

Category:

State:

Tennessee

City:

Nashville

Control #:

TN-LR015T

Format:

Word;

Rich Text

Instant download

Description

This form is used when agreements are established between one or more creditors and sets forth the various lien positions, the rights, liabilities and obligations of each creditor relating to to property of their common interests.

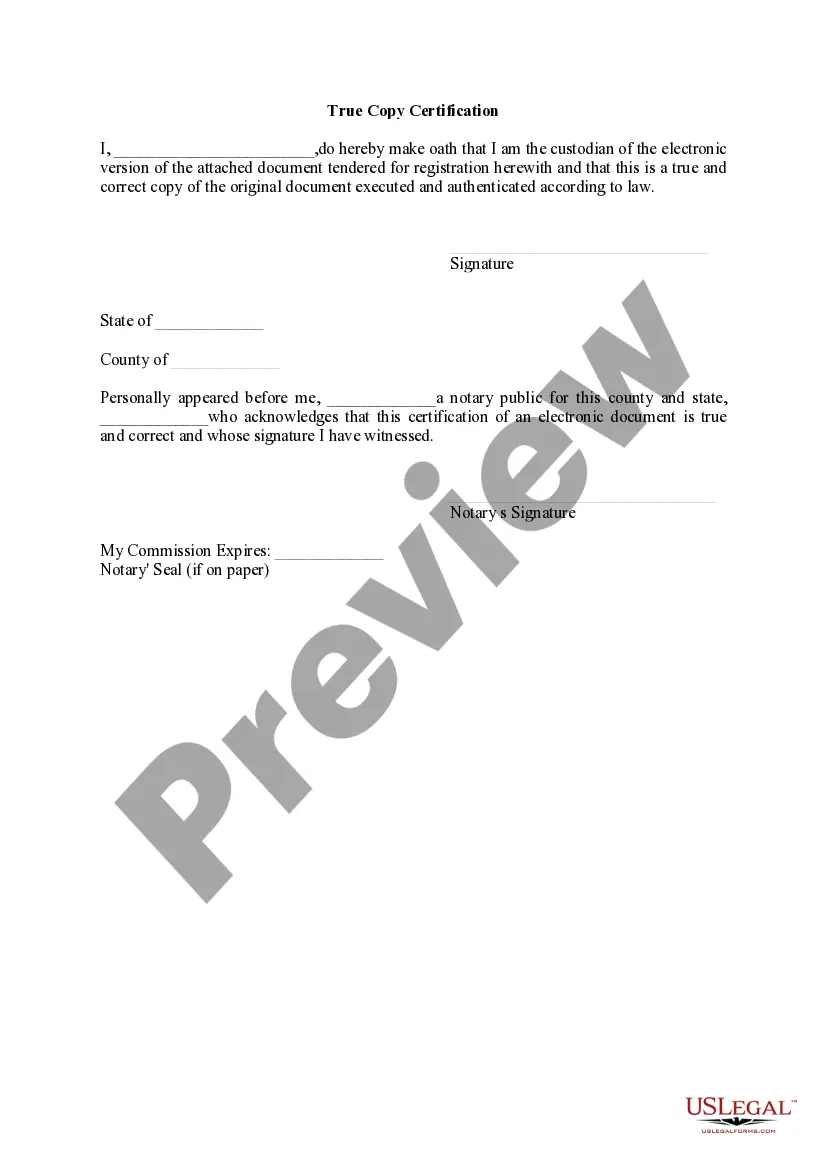

Free preview

How to fill out Nashville Tennessee Intercreditor Agreement?

If you’ve already used our service before, log in to your account and download the Nashville Tennessee Intercreditor Agreement on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make sure you’ve located a suitable document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Nashville Tennessee Intercreditor Agreement. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!