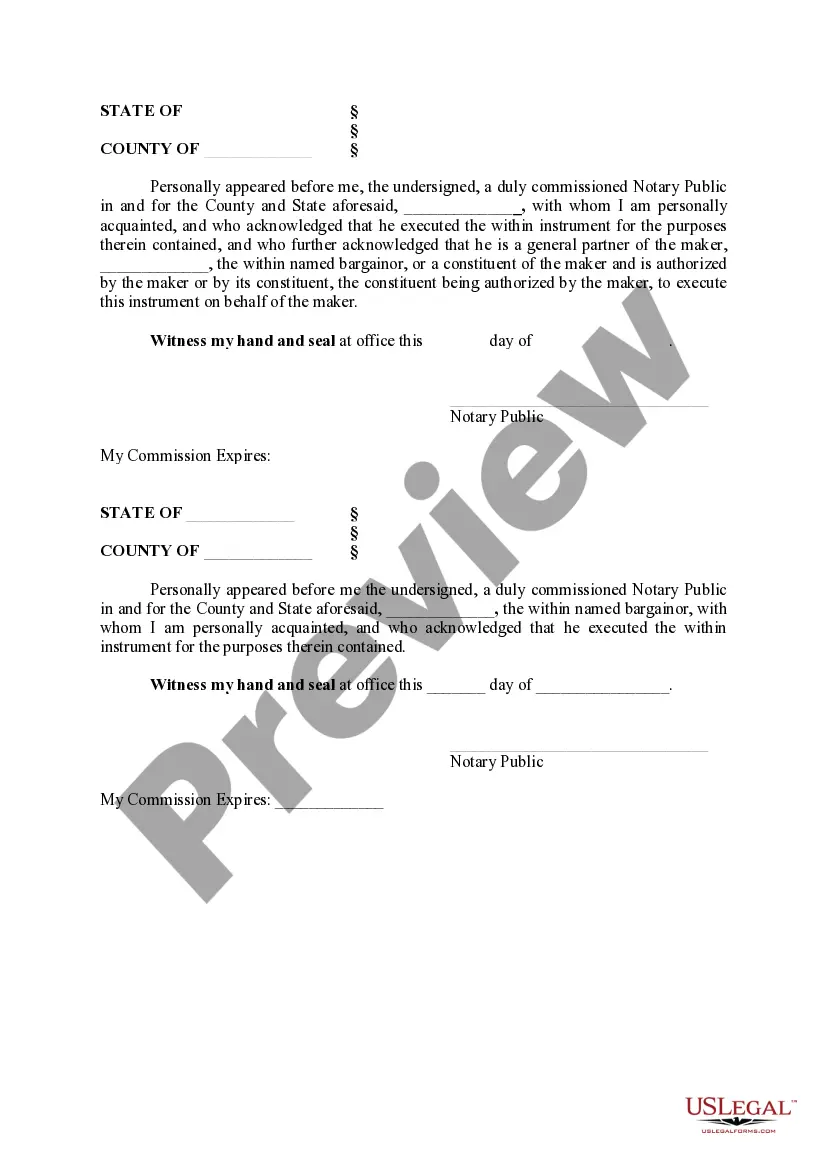

Clarksville Tennessee Assumption Agreement is a legal document that outlines the transfer of real estate property in Clarksville, Tennessee, from one party to another while assuming the existing mortgage or loan on the property. It is essential for buyers and sellers to understand the terms and conditions of this agreement to ensure a smooth and lawful transaction. The Clarksville Tennessee Assumption Agreement typically includes information about the property being transferred, the names of the buyer and seller, the loan or mortgage details, and any additional terms and conditions agreed upon by both parties. This agreement protects the interests of all parties involved and ensures that the mortgage payments are handled properly during the transfer of ownership. There are a few different types of Clarksville Tennessee Assumption Agreements that may be used depending on the specific circumstances: 1. Full Assumption Agreement: This agreement allows the buyer to assume full responsibility for the existing mortgage and all related obligations. The seller is completely released from any liability once the transfer is complete. 2. Subject to Assumption Agreement: In this scenario, the buyer agrees to take over the mortgage payments but without assuming full responsibility for the loan. The seller may still retain some liability in case of default by the buyer. 3. Novation Assumption Agreement: This agreement involves substituting the original borrower with a new borrower, effectively releasing the original borrower from any liability. It requires the approval of the lender and ensures a seamless transition of the loan obligation. 4. Wraparound Assumption Agreement: This agreement allows the buyer to assume the existing mortgage while also receiving additional financing from the seller. The buyer makes a single payment to the seller, who then distributes the funds to the lender and retains the remaining amount. It is crucial for all parties involved in a Clarksville Tennessee Assumption Agreement to seek legal advice to ensure compliance with local laws and regulations. Additionally, it is important to conduct a thorough review of the property's title, loan terms, and financial obligations to avoid any potential complications during the transfer of ownership.

Clarksville Tennessee Assumption Agreement

Description

How to fill out Clarksville Tennessee Assumption Agreement?

No matter what social or professional status, completing law-related forms is an unfortunate necessity in today’s professional environment. Very often, it’s virtually impossible for someone without any legal education to draft such paperwork from scratch, mainly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms comes in handy. Our service provides a huge library with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also serves as a great asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you require the Clarksville Tennessee Assumption Agreement or any other document that will be valid in your state or county, with US Legal Forms, everything is on hand. Here’s how to get the Clarksville Tennessee Assumption Agreement quickly employing our trusted service. If you are already a subscriber, you can go ahead and log in to your account to get the needed form.

Nevertheless, if you are unfamiliar with our library, make sure to follow these steps before downloading the Clarksville Tennessee Assumption Agreement:

- Be sure the form you have found is good for your location since the regulations of one state or county do not work for another state or county.

- Review the document and read a quick description (if provided) of cases the paper can be used for.

- In case the form you picked doesn’t meet your requirements, you can start over and look for the suitable document.

- Click Buy now and choose the subscription plan you prefer the best.

- with your credentials or register for one from scratch.

- Select the payment gateway and proceed to download the Clarksville Tennessee Assumption Agreement once the payment is done.

You’re good to go! Now you can go ahead and print out the document or fill it out online. If you have any issues locating your purchased forms, you can quickly access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.

Form popularity

FAQ

In Tennessee, the grantor of the deed typically signs the oath of consideration. This section verifies the exchange that occurs in the transaction, ensuring the agreement is binding. To streamline your transaction, consider using US Legal Forms for your Clarksville Tennessee Assumption Agreement, as it provides a straightforward way to manage all necessary details.

In Tennessee, a quit claim deed must be in writing, signed by the grantor, and include the property description. It is also important to have the deed notarized to ensure its validity. When preparing your Clarksville Tennessee Assumption Agreement, using a service like US Legal Forms can help you meet all the necessary requirements without confusion.

To add your wife to your deed in Tennessee, you will typically need to file a new deed, such as a quit claim deed, to transfer ownership. It is crucial to accurately document your consent and intention to include her in the property's ownership. Utilizing US Legal Forms can provide you with the tools and templates necessary to create your Clarksville Tennessee Assumption Agreement efficiently.

Yes, you can create a quit claim deed yourself in Clarksville, Tennessee. However, it is essential to ensure that you follow all legal requirements to avoid potential issues later. Using a reliable platform like US Legal Forms can guide you through the process, making it easier to understand what needs to be included in your Clarksville Tennessee Assumption Agreement.

While assumable mortgages offer several benefits, there can be potential drawbacks. Lenders might impose specific requirements or fees in Clarksville, Tennessee, which can affect the affordability and practicality of the agreement. It is vital to review these aspects and understand any ramifications. Consulting the details in the Clarksville Tennessee Assumption Agreement can help ensure you are making the right choices.

Assuming a mortgage can be a wise choice if the mortgage terms are favorable and interest rates are low. In Clarksville, Tennessee, buyers can seamlessly transition into a mortgage with potentially better conditions than new loans. However, it is crucial to assess the property value and your long-term financial goals first. A Clarksville Tennessee Assumption Agreement can help you secure advantageous terms.

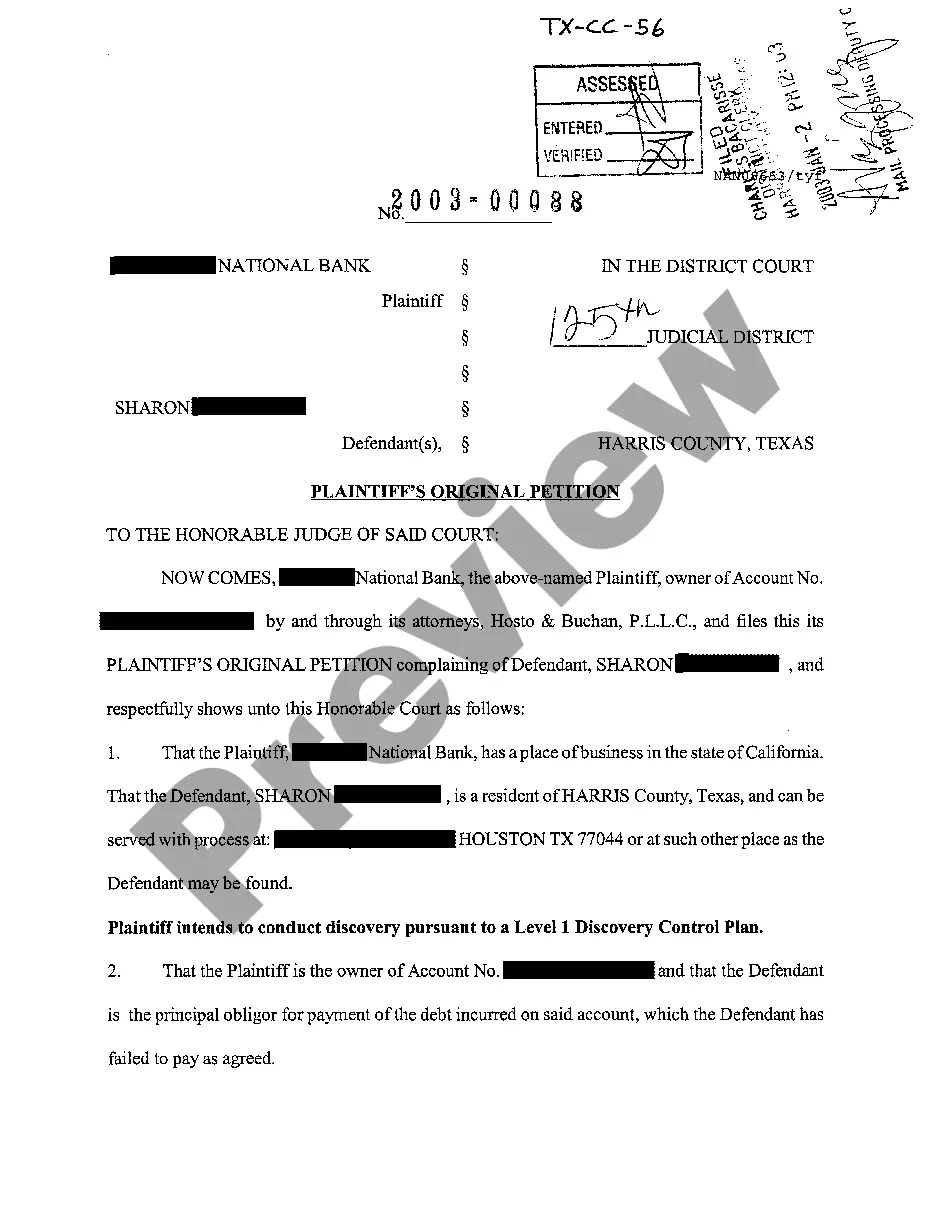

A mortgage assumption agreement allows a buyer to take over the existing mortgage of a seller. In Clarksville, Tennessee, this means that the buyer steps into the seller's shoes, assuming their terms and repayment schedule. This can simplify the buying process and may offer better interest rates. It is important to review the specifics of the Clarksville Tennessee Assumption Agreement to understand your commitments.

The indebtedness tax in Tennessee applies to the total outstanding debt of certain companies based on their property. This tax is vital for businesses and could also influence personal financial decisions linked to property ownership. Knowing about this tax becomes particularly important when dealing with a Clarksville Tennessee Assumption Agreement, as it can affect both your obligations and potential benefits.

The 9.75% tax in Tennessee refers to the combined state and local sales tax rate. This rate can vary depending on the county and city, so it is crucial to check local regulations. If you are purchasing property or other significant assets related to a Clarksville Tennessee Assumption Agreement, understanding this tax can help you factor it into your financial calculations.

Tennessee primarily imposes two significant taxes: the sales tax and the franchise and excise tax. Sales tax applies to most goods and services sold in the state, while the franchise tax targets businesses based on their net worth and gross receipts. Both taxes play a role in Tennessee's economy, and being aware of them can be essential if you're navigating a Clarksville Tennessee Assumption Agreement.