The Memphis Tennessee Assumption Agreement refers to a legal contract that transfers the responsibility for a mortgage loan from one party to another. This agreement typically involves three parties: the current borrower, the new borrower, and the lender. The assumption agreement is commonly used when the current borrower wants to transfer the mortgage to a new borrower, who agrees to take over the existing loan. The Memphis Tennessee Assumption Agreement outlines the terms and conditions of the transfer, including the remaining balance on the mortgage, the interest rate, and the repayment period. It ensures that the new borrower is aware of the financial obligations and responsibilities associated with assuming the mortgage. The lender typically assesses the creditworthiness of the new borrower before approving the assumption agreement. There are two main types of Memphis Tennessee Assumption Agreements: 1. Simple Assumption: In this type of agreement, the new borrower takes over the mortgage payments and assumes full responsibility for the loan. The original borrower is released from any further liability for the mortgage. It is important for the new borrower to qualify for the loan based on their credit history and income. 2. Novation Assumption: This type of assumption agreement requires the lender's approval and involves the substitution of the borrower. Unlike a simple assumption, the original borrower remains on the mortgage and still has some liability in case the new borrower defaults. Novation assumptions are less common and more complex than simple assumptions. The Memphis Tennessee Assumption Agreement is a legally binding contract that protects the rights and obligations of all parties involved in the transfer of a mortgage loan. It provides a framework for the seamless transfer of the loan and ensures that all parties understand their responsibilities. The assumption agreement can be a practical solution for borrowers who want to sell their property while retaining an existing mortgage or for buyers seeking to take advantage of favorable loan terms.

Memphis Tennessee Assumption Agreement

Description

How to fill out Memphis Tennessee Assumption Agreement?

Regardless of one's social or professional standing, completing law-related paperwork is a regrettable necessity in the modern world.

Often, it’s nearly impossible for individuals lacking any legal training to draft such documents from the ground up, primarily due to the complex terminology and legal intricacies they involve.

This is where US Legal Forms proves to be useful.

Confirm that the form you've selected is appropriate for your area since the laws of one state or county do not apply to another.

Examine the document and look over a brief overview (if offered) of the situations the document can be utilized for.

- Our service provides an extensive library of over 85,000 ready-to-use state-specific documents applicable for nearly any legal situation.

- US Legal Forms is also an excellent tool for associates or legal advisors aiming to enhance their time efficiency with our DYI papers.

- Whether you need the Memphis Tennessee Assumption Agreement or any other document that is valid in your jurisdiction, US Legal Forms has everything readily available.

- Here’s how to obtain the Memphis Tennessee Assumption Agreement in just minutes using our dependable service.

- If you are an existing subscriber, you can proceed to Log In to your account and access the required form.

- If you're new to our platform, please make sure to follow these steps before downloading the Memphis Tennessee Assumption Agreement.

Form popularity

FAQ

Also called an assignment and assumption. An agreement in which one party transfers its contractual rights and obligations to another party.

A letter of assumption is a written agreement between a current homeowner and a prospective buyer. The letter states that the buyer agrees to take over the homeowner's debt in the home in exchange for ownership.

In Tennessee, both written and oral contracts are generally enforceable. And because contracts often contain clauses with vague or ambiguous language that are difficult to interpret, it's important to understand any contract before you enter into a legally binding agreement and risk facing a costly lawsuit.

Like any other legal document, a written tenancy agreement becomes a legally binding contract between the two parties as soon as you have both signed it. As a landlord, your signature represents your legal agreement to uphold all of the duties outlined in the document.

In order for a contract to be considered binding, it must include the basic elements of a contract, including offer and acceptance, consideration, mutuality or intention, legality, and capacity. If a contract includes all of these elements, it is most likely a binding contract.

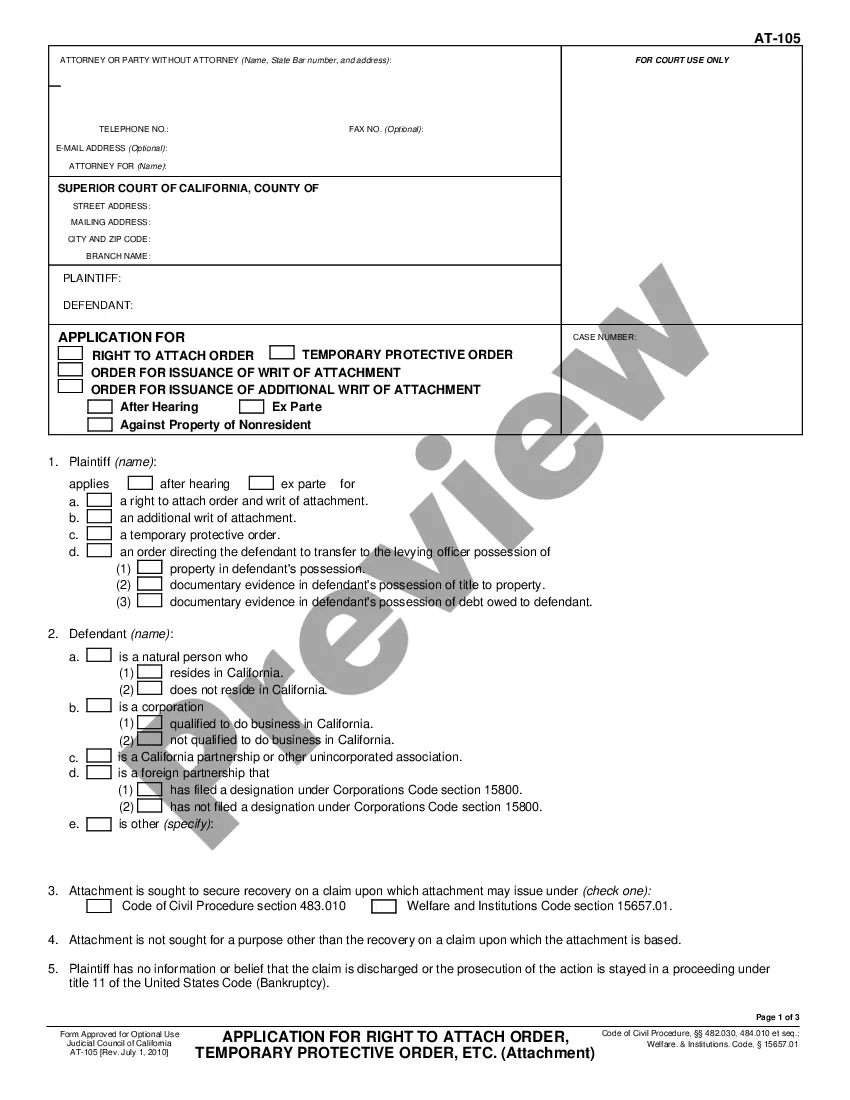

In real estate transactions, an assumption agreement allows a third party to ?assume? or take over the loan of the property's seller. Mortgages may be assumed when the house is sold, a divorcing spouse is awarded the property in a settlement or when someone inherits property.

An assumption clause is a provision in a mortgage contract that allows the seller of a home to pass responsibility for the existing mortgage to the buyer of the property. In other words, the new homeowner assumes the existing mortgage and?along with it?ownership of the property that secures the loan.

The Letter Must Contain the Essential Terms of an Agreement Even if both parties expressly intend their letter of intent to be binding and enforceable, a Tennessee court will not enforce it unless it contains the essential terms of the agreement.

An assumable mortgage allows someone to find a house they want to buy and take over the seller's existing home loan without applying for a new mortgage. This means the remaining balance, mortgage rate, repayment period and other loan terms stay the same, but the responsibility for the debt is transferred to the buyer.

(a) All contracts, including, but not limited to, notes, security agreements, deeds of trust, and installment sales contracts, in writing and signed by the party to be bound, including endorsements thereon, shall be prima facie evidence that the contract contains the true intention of the parties, and shall be enforced