mortgage or deed of trust. The Affidavit is made for the protection and benefit of all parties dealing with or who may acquire any

interest in the property described in the aforesaid deed

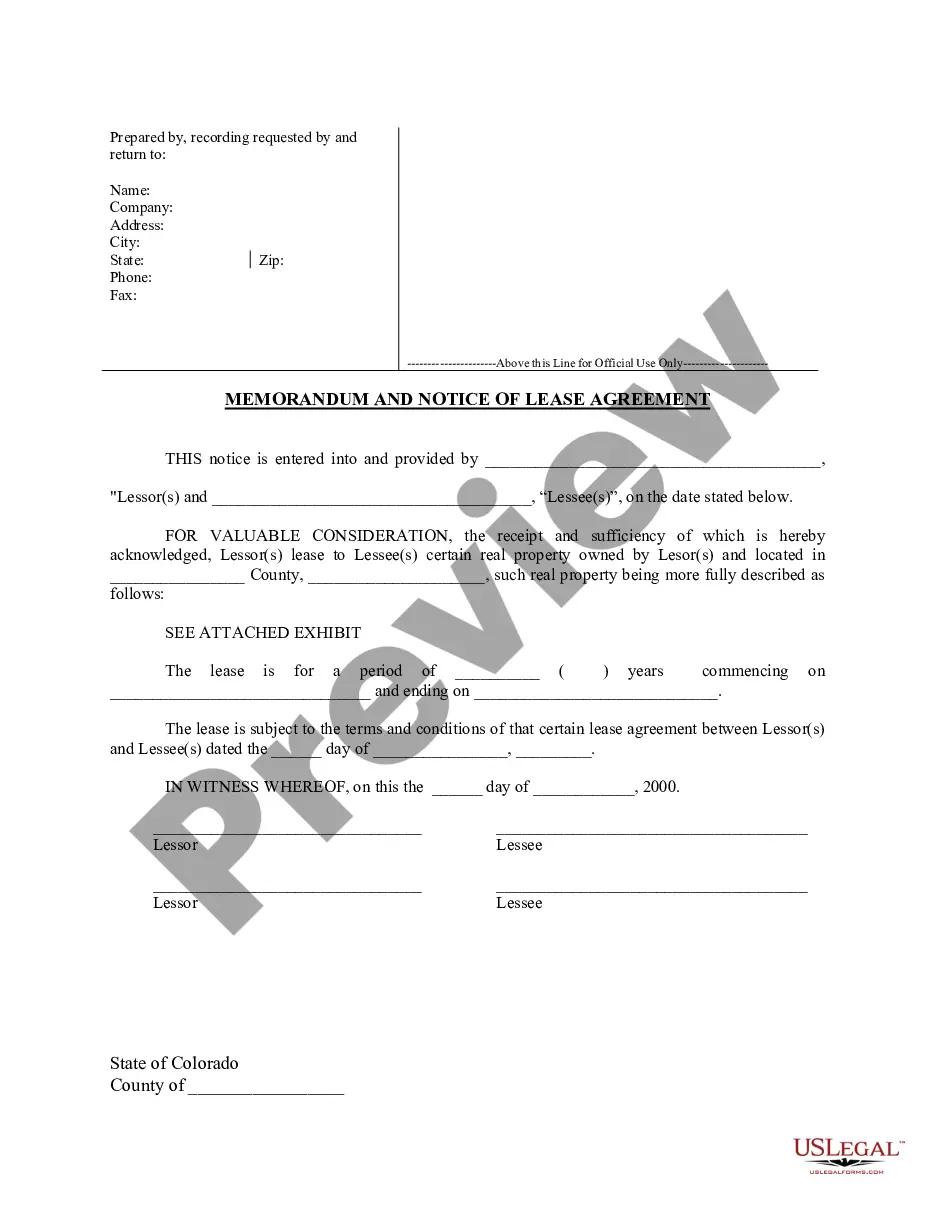

Nashville, Tennessee Agreement for Deed is a legal document outlining the terms and conditions of a real estate transaction between a buyer and a seller. The agreement enables the buyer to make regular payments towards owning the property while being granted possession and use of it during the payment period. It essentially serves as an alternative financing option to traditional mortgages. The Agreement for Deed involves several key elements, such as the identification of the buyer and seller, property details including address and legal description, purchase price, down payment amount, interest rate, payment schedule, and any applicable late fees or penalties. In Nashville, Tennessee, there are a few different types of Agreement for Deed arrangements. One is the "Straight Agreement for Deed," where the buyer ultimately obtains legal title to the property after fulfilling all the payment obligations. This type of agreement provides the buyer with a sense of security and the ability to build up equity in the property over time. Another type is the "Lease with Option to Purchase Agreement for Deed." This option allows the buyer to lease the property for a specified period while having the option to purchase it at a predetermined price within a certain timeframe. This arrangement provides flexibility to the buyer, allowing them to assess the property before committing to a final purchase. When it comes to Estoppel and Solvency Affidavit, these are additional legal documents associated with Nashville Agreement for Deed transactions. An Estoppel Affidavit is a statement signed by the buyer and seller, confirming the accuracy of all the terms and conditions outlined in the Agreement for Deed. This document ensures that both parties are on the same page regarding the agreed-upon details of the transaction. On the other hand, a Solvency Affidavit is used to establish the financial stability and solvency of the buyer. It requires the buyer to provide a sworn statement, disclosing their assets, liabilities, and overall financial situation. This affidavit helps the seller assess the buyer's ability to fulfill their payment obligations over the course of the agreement. In summary, the Nashville, Tennessee Agreement for Deed is a legal arrangement between a buyer and seller for real estate transactions. It offers alternative financing options and possesses various types, including the Straight Agreement for Deed and Lease with Option to Purchase Agreement for Deed. Additionally, the Estoppel Affidavit ensures agreement validity, while the Solvency Affidavit verifies the buyer's financial stability.