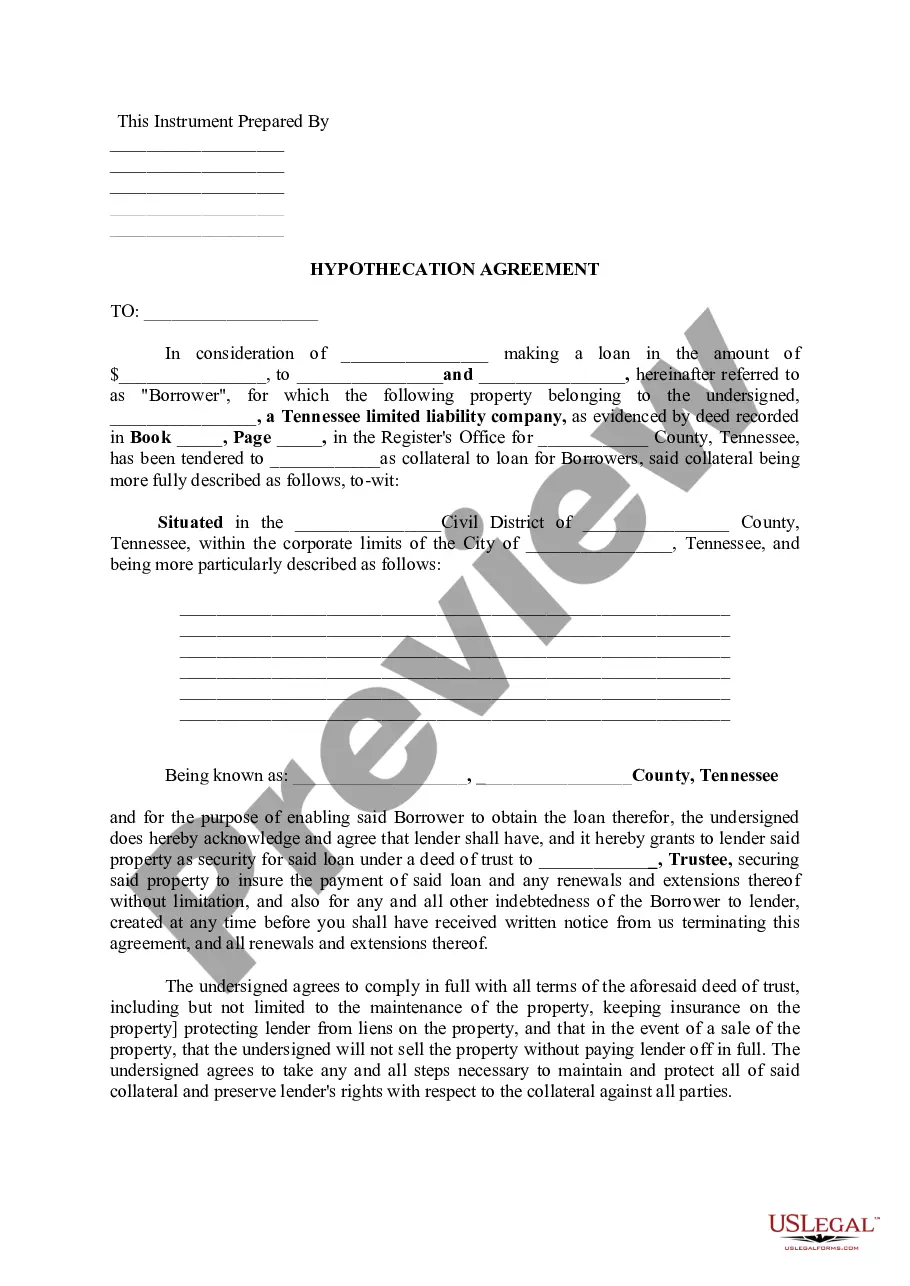

Chattanooga Tennessee Hypothecation Agreement

Description

How to fill out Tennessee Hypothecation Agreement?

Are you in need of a reliable and budget-friendly provider of legal documents to obtain the Chattanooga Tennessee Hypothecation Agreement? US Legal Forms is your preferred option.

Whether you require a straightforward contract to establish guidelines for living with your partner or a collection of paperwork to process your divorce in court, we have you covered. Our site features more than 85,000 current legal document templates for individual and business purposes. All templates that we provide are not generic and are tailored based on the specific needs of particular states and counties.

To retrieve the form, you must Log In, find the required template, and click the Download button adjacent to it. Please remember that you can download your previously acquired form templates at any time from the My documents section.

Is this your first time visiting our website? No problem. You can establish an account in just a few minutes, but first, ensure you do the following.

Now, you can set up your account. Then, choose a subscription plan and proceed to payment. After the payment is completed, download the Chattanooga Tennessee Hypothecation Agreement in any format available. You can return to the website at any time to redownload the form without any cost.

Locating current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to spending countless hours researching legal forms online once and for all.

- Verify that the Chattanooga Tennessee Hypothecation Agreement adheres to your state and local regulations.

- Review the details of the form (if available) to understand who the form is meant for and its purpose.

- Restart the search if the template does not fit your legal circumstances.

Form popularity

FAQ

In Hamilton County, the sales tax on a car is currently set at 7%. This rate includes both state and local taxes, making it essential for buyers to consider this tax when purchasing a vehicle. Knowing the sales tax is crucial when finalizing a Chattanooga Tennessee Hypothecation Agreement, as it may affect your overall financing costs. Staying informed about these rates helps you make better purchasing decisions.

To determine if Airbnb is allowed in your area, check with your local city or county regulations. Review zoning ordinances and short-term rental policies, which may vary by location. You can also consult a Chattanooga Tennessee Hypothecation Agreement for specific insights on property legality and compliance in your neighborhood.

Chattanooga has gained popularity as a desirable Airbnb market due to its vibrant culture and beautiful scenery. The demand for unique accommodations can create great opportunities for hosts. Utilizing a Chattanooga Tennessee Hypothecation Agreement can assist you in maximizing your investment while navigating local regulations effectively.

Tennessee has specific rules regarding short-term rentals, including registration, insurance, and tax requirements. Each city, including Chattanooga, may have its regulations, so it’s crucial to stay updated. A Chattanooga Tennessee Hypothecation Agreement can guide you through these rules and help ensure that you meet all legal requirements.

Yes, you can operate an Airbnb in Chattanooga, Tennessee. However, hosts must adhere to local zoning laws and obtain any necessary permits. Using a Chattanooga Tennessee Hypothecation Agreement will help you understand your obligations and protect your property legally during your hosting journey.

Airbnb is permitted in Chattanooga, Tennessee, but hosts must comply with local regulations. It’s important to register your property and follow any specific guidelines set by the city. A Chattanooga Tennessee Hypothecation Agreement may be required as part of your registration process to ensure compliance with city laws and protect your interests.

Tennessee law does not mandate that LLCs have an operating agreement; however, having one is considered a best practice. This document allows members to define their roles and how the business will be managed. In conjunction with a Chattanooga Tennessee Hypothecation Agreement, an operating agreement can protect your business interests, especially during financial transactions.

Yes, Tennessee requires all LLCs to designate a registered agent who will handle legal documents on behalf of the business. This agent can be an individual or a business entity authorized to do business in Tennessee. By establishing a Chattanooga Tennessee Hypothecation Agreement, you may also ensure that the handling of any financial obligations is clearly defined, aligning with your registered agent's responsibilities.

While the state of Tennessee does not legally require an LLC to have an operating agreement, it is highly recommended. An operating agreement outlines the management structure and operational procedures of your LLC. Utilizing a Chattanooga Tennessee Hypothecation Agreement alongside your operating agreement can provide additional clarity on financial dealings within the business.

In Tennessee, an agreement becomes binding once all parties involved show mutual consent, typically through signatures. It is crucial that the terms discussed are clear and unambiguous. To strengthen this, using a Chattanooga Tennessee Hypothecation Agreement can reinforce obligations, ensuring all parties are on the same page regarding the agreement's conditions.