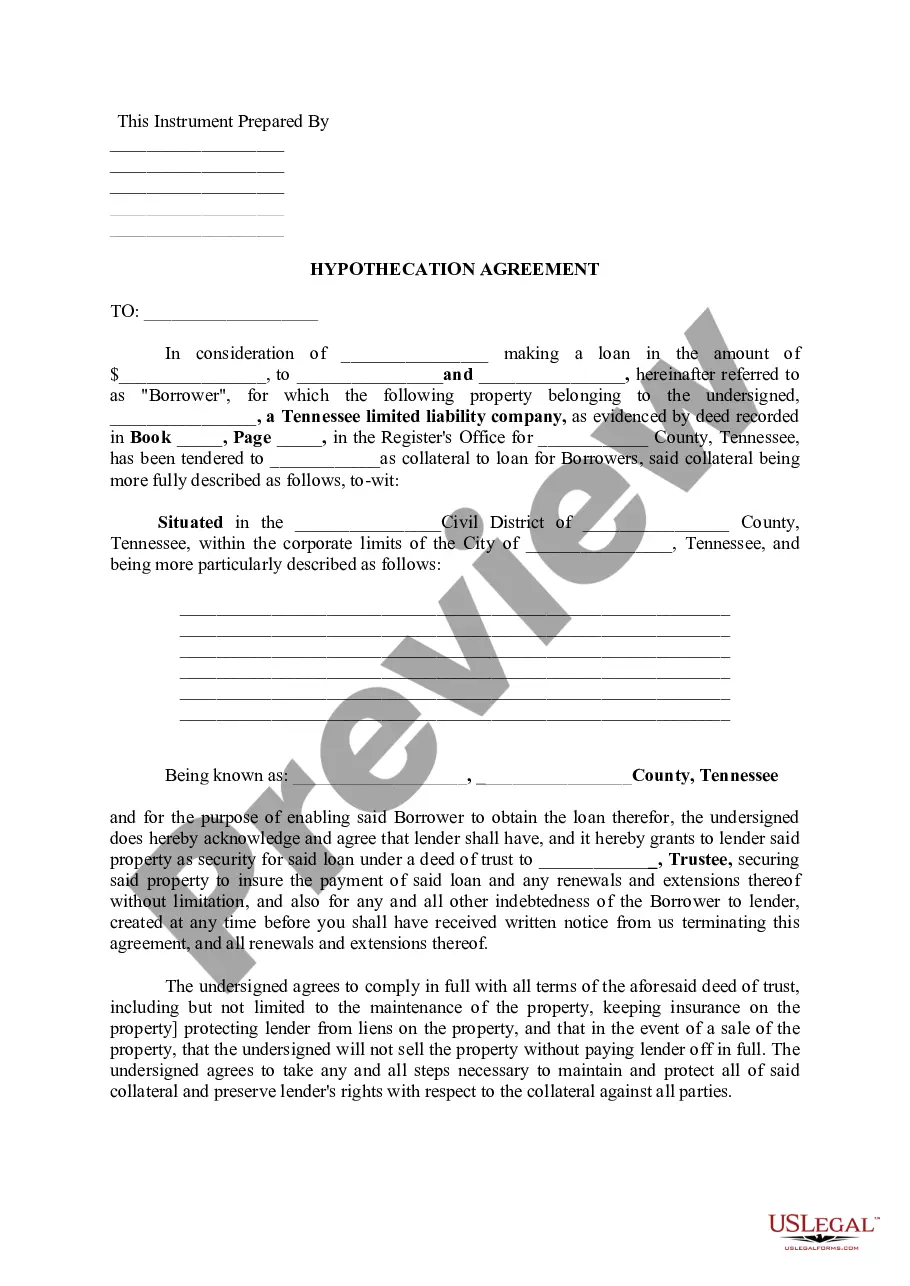

Clarksville Tennessee Hypothecation Agreement

Description

How to fill out Tennessee Hypothecation Agreement?

If you have previously availed yourself of our service, Log In to your account and download the Clarksville Tennessee Hypothecation Agreement onto your device by clicking the Download button. Ensure that your subscription is active. If not, renew it in line with your payment plan.

If this is your initial encounter with our service, adhere to these straightforward steps to acquire your document.

You have ongoing access to every document you have acquired: you can find it in your profile under the My documents section whenever you need to retrieve it again. Utilize the US Legal Forms service to swiftly locate and save any template for your personal or business requirements!

- Ensure you’ve located an appropriate document. Browse through the description and utilize the Preview feature, if available, to verify whether it satisfies your needs. If it’s unsuitable, utilize the Search function above to locate the correct one.

- Purchase the template. Hit the Buy Now button and select either a monthly or yearly subscription plan.

- Create an account and make a payment. Use your credit card information or the PayPal option to finalize the transaction.

- Receive your Clarksville Tennessee Hypothecation Agreement. Choose the file format for your document and save it onto your device.

- Complete your form. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

The purpose of a letter of hypothecation is to formally communicate the arrangement between the borrower and lender regarding collateral. In a Clarksville Tennessee Hypothecation Agreement, this letter provides clear documentation of the borrowed asset, ensuring both parties understand the terms. It acts as an additional layer of security for the lender.

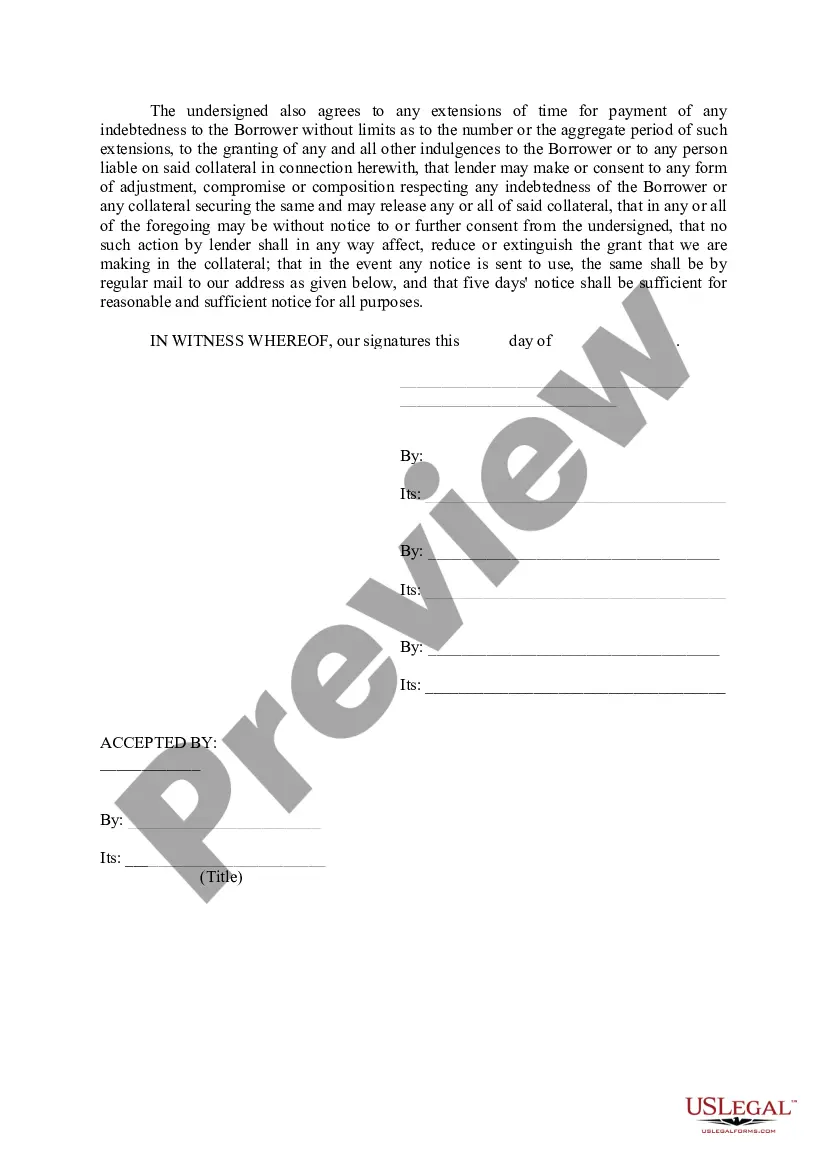

In a hypothecation agreement, both the borrower and the lender sign to validate the document. For a Clarksville Tennessee Hypothecation Agreement, this may involve individuals or representatives from financial institutions. It’s essential for both parties to understand their rights and obligations clearly before signing.

A hypothecation form is a legal document that outlines the terms of the hypothecation agreement between parties. When executing a Clarksville Tennessee Hypothecation Agreement, this form typically includes details about the collateral, the obligations of both parties, and the conditions under which the lender can claim the collateral. Using precise language in this form helps avoid misunderstandings.

To file a quitclaim deed in Tennessee, ensure you have completed the deed form correctly, with the grantor and grantee details clearly outlined. Next, sign the form in front of a notary and file it at the county register of deeds office where the property is located. USLegalForms offers user-friendly instructions and templates that can help you efficiently create your hypothecation agreement and file your quitclaim deed.

Transferring a deed in Tennessee involves selecting the right type of deed based on your needs, completing the deed with accurate information, and ensuring it is properly notarized. Once completed, you must file the deed with your county's register of deeds office. Using resources like USLegalForms simplifies this process and ensures your hypothecation agreement meets all legal standards.

To transfer a property deed in Tennessee, begin by preparing the appropriate deed, such as a warranty or quitclaim deed, and then sign it in front of a notary. After the deed is notarized, file it with the county's register of deeds office. For guidance, USLegalForms provides templates and instructions that can assist you with your hypothecation agreement.

People typically use a quitclaim deed in Clarksville, Tennessee, to transfer property between family members or to resolve legal disputes. This type of deed is simple and does not require extensive legal knowledge. If you're considering a hypothecation agreement, it is often a helpful tool for transferring rights swiftly and effectively.

The quickest way to transfer a deed in Clarksville, Tennessee, is to use a quitclaim deed, which allows the transfer of property rights without warranties. You should prepare the necessary documents and file them with the local register of deeds. Utilizing services from USLegalForms can streamline the process by providing easy access to the specific forms you need for a hypothecation agreement.

Yes, you can transfer a deed without an attorney in Clarksville, Tennessee. However, it's important to ensure you follow the correct procedures and meet all legal requirements. If you choose to do it yourself, consider using resources like USLegalForms to guide you through the process of creating a valid hypothecation agreement. This ensures your transfer is handled correctly and efficiently.