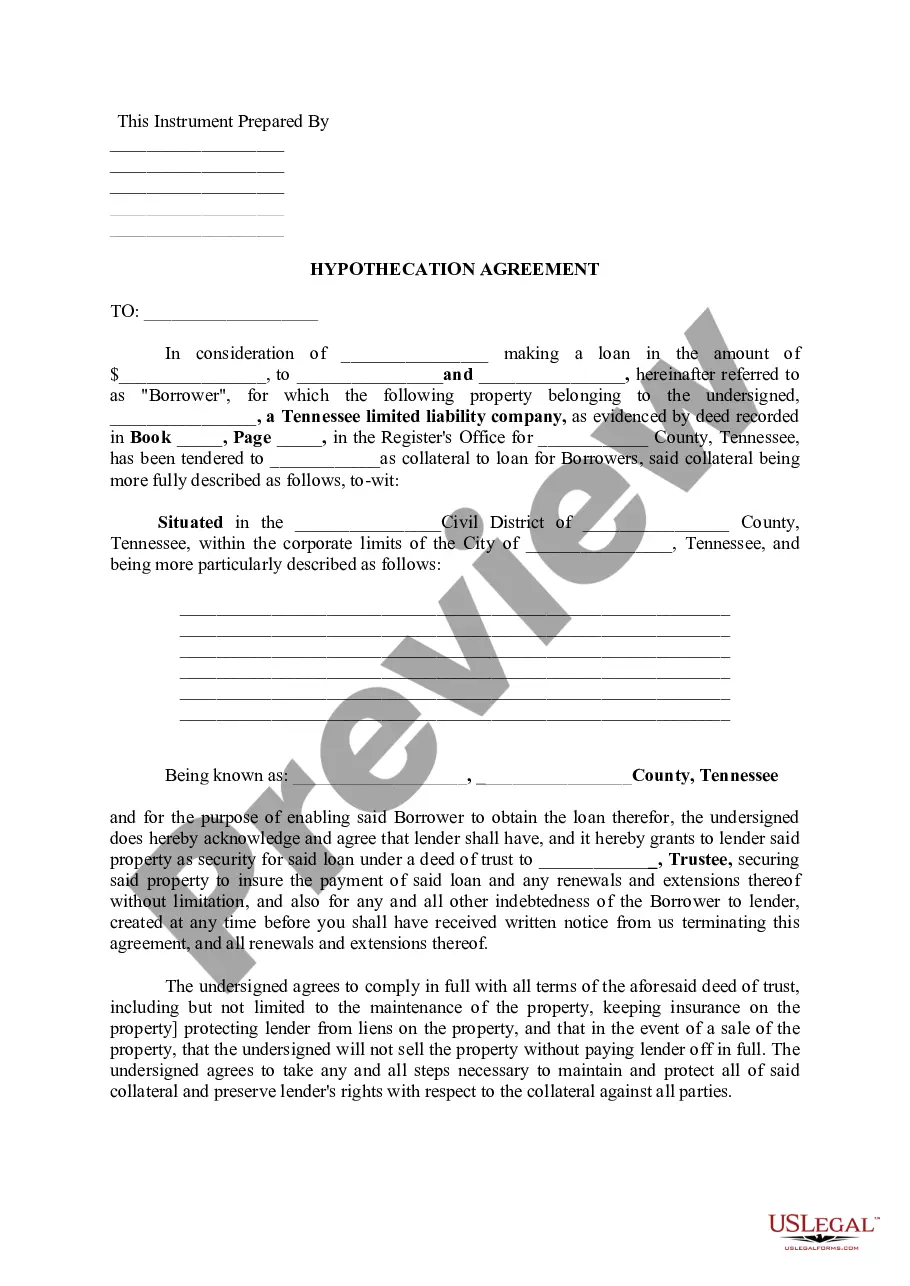

The Memphis Tennessee Hyphenation Agreement refers to a legal document that outlines an arrangement between a borrower and a lender, where the borrower uses a specific asset as collateral for a loan. This agreement is prevalent in Memphis, Tennessee, and is utilized in various financial transactions. In a typical hyphenation agreement, the borrower pledges a specific asset of value, such as real estate, vehicles, or securities, as security for the loan. This implies that if the borrower fails to repay the loan as agreed, the lender has the legal right to seize and sell the collateral to recover the outstanding debt. The lender's interest in the collateral is referred to as a lien. The Memphis Tennessee Hyphenation Agreement is crucial for protecting the lender's interests by creating a legally binding contract that specifies the terms and conditions of the loan. It typically includes details such as the loan amount, interest rate, repayment terms, consequences of default, and the rights and responsibilities of both parties involved. In Memphis, there are various types of hyphenation agreements catering to different types of assets. These include: 1. Real Estate Hyphenation Agreement: This type of agreement is used when the borrower pledges a property, such as a house or commercial building, as collateral for the loan. It ensures that the lender has a legal claim on the property if the borrower fails to fulfill their repayment obligations. 2. Vehicle Hyphenation Agreement: If a borrower wishes to obtain a loan and use their vehicle, such as a car or motorcycle, as collateral, they would enter into a vehicle hyphenation agreement. This agreement specifies the details of the loan and the lender's rights in case of default. 3. Securities Hyphenation Agreement: When a borrower pledges securities, such as stocks, bonds, or mutual funds, as collateral, they enter into a securities' hyphenation agreement. This type of agreement outlines the terms and conditions related to the securities being offered as security for the loan. 4. Equipment Hyphenation Agreement: In scenarios where a borrower wishes to pledge specific equipment, machinery, or other valuable assets in exchange for a loan, an equipment hyphenation agreement is utilized. This agreement provides the lender with a security interest in the equipment, protecting their rights if the borrower defaults on the loan. It is important to note that each Memphis Tennessee Hyphenation Agreement may have specific clauses and requirements based on the nature of the collateral involved. It is recommended for both borrowers and lenders to consult legal professionals to ensure compliance with all legal obligations and protect their rights and interests.

Memphis Tennessee Hypothecation Agreement

Description

How to fill out Memphis Tennessee Hypothecation Agreement?

If you are searching for a valid form template, it’s difficult to choose a more convenient service than the US Legal Forms site – probably the most extensive online libraries. With this library, you can get a large number of document samples for company and individual purposes by categories and states, or key phrases. With the advanced search function, getting the latest Memphis Tennessee Hypothecation Agreement is as elementary as 1-2-3. Furthermore, the relevance of every file is proved by a team of skilled attorneys that regularly review the templates on our platform and revise them based on the newest state and county laws.

If you already know about our system and have an account, all you need to get the Memphis Tennessee Hypothecation Agreement is to log in to your profile and click the Download button.

If you make use of US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have opened the form you want. Read its information and utilize the Preview feature (if available) to check its content. If it doesn’t meet your needs, utilize the Search field near the top of the screen to discover the needed file.

- Confirm your selection. Click the Buy now button. Following that, choose the preferred subscription plan and provide credentials to sign up for an account.

- Make the purchase. Utilize your credit card or PayPal account to finish the registration procedure.

- Get the form. Choose the file format and save it on your device.

- Make adjustments. Fill out, edit, print, and sign the acquired Memphis Tennessee Hypothecation Agreement.

Every single form you add to your profile has no expiration date and is yours forever. It is possible to gain access to them using the My Forms menu, so if you need to have an extra copy for enhancing or creating a hard copy, you can return and save it once again at any time.

Take advantage of the US Legal Forms extensive collection to gain access to the Memphis Tennessee Hypothecation Agreement you were looking for and a large number of other professional and state-specific templates in a single place!