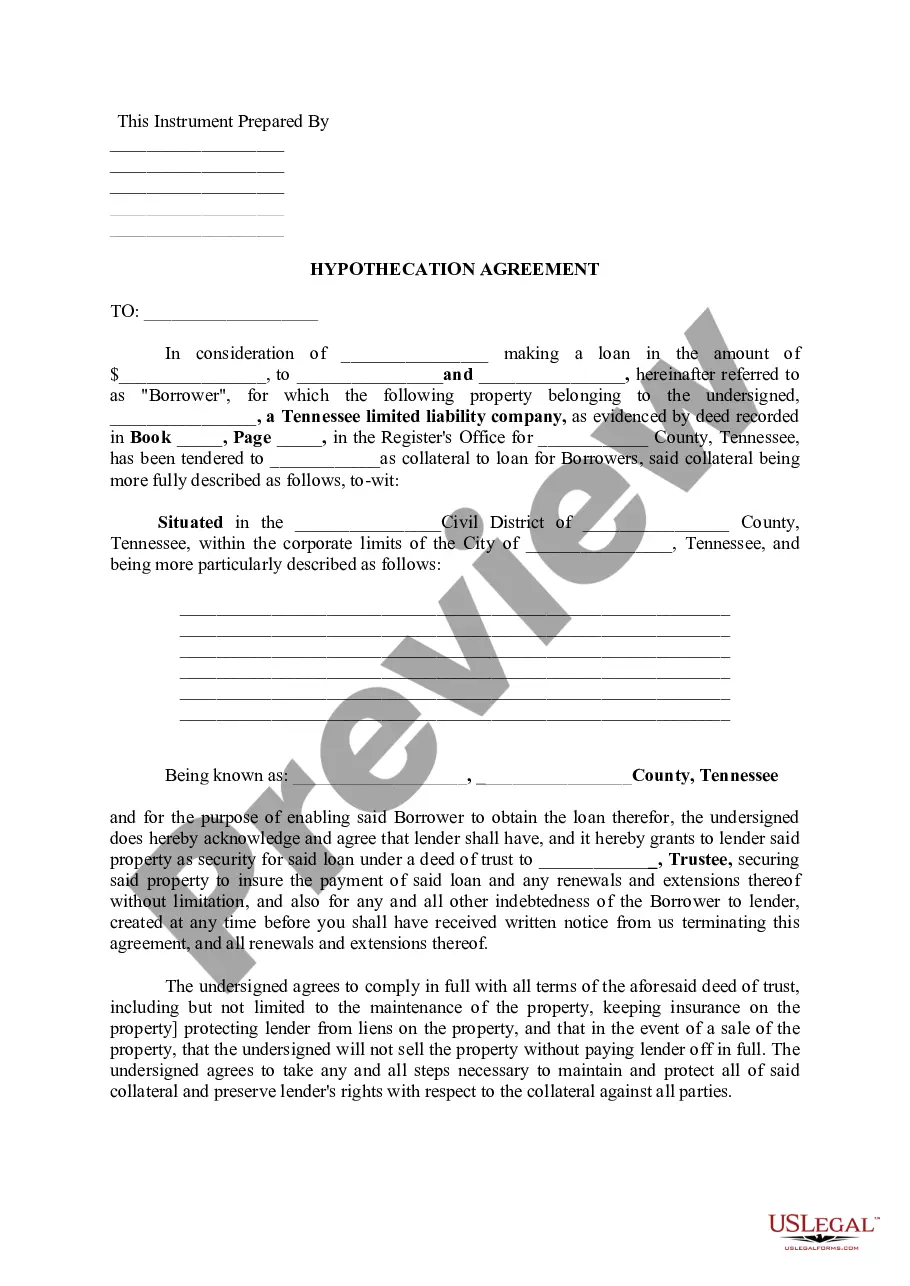

A Murfreesboro Tennessee Hyphenation Agreement refers to a legal contract that allows individuals or businesses to secure a loan by using their assets, typically a vehicle or equipment, as collateral. This agreement serves as a crucial document that outlines the specific terms and conditions governing the lender-borrower relationship. The Murfreesboro Tennessee Hyphenation Agreement ensures that the lender, who provides the loan, has a legal claim to the collateralized asset until the borrower repays the loan amount in full. This agreement protects the lender's interests in case the borrower defaults on the loan, allowing them to seize and sell the asset to recoup the remaining balance. In Murfreesboro, Tennessee, there may be different types of Hyphenation Agreements commonly utilized: 1. Auto Hyphenation Agreement: This type of agreement is prevalent when securing a loan with an automobile as collateral. Individuals or businesses in Murfreesboro can use this agreement to obtain funds by pledging their vehicle ownership rights against the loan amount. 2. Equipment Hyphenation Agreement: In Murfreesboro, businesses that require funds for purchasing or upgrading equipment can opt for an Equipment Hyphenation Agreement. By pledging their equipment, such as machinery, technology, or specialized tools, businesses can obtain loans and continue operations while repaying the lender over an agreed period. 3. Personal Property Hyphenation Agreement: This agreement is versatile and can include various assets such as furniture, electronics, or other valuable possessions. By using personal property as collateral, individuals in Murfreesboro can secure loans for personal use or smaller business ventures. It is important to note that each Hyphenation Agreement in Murfreesboro Tennessee will contain specific terms, interest rates, repayment schedules, and conditions unique to the borrower-lender relationship. These agreements undergo legal scrutiny before approval, ensuring that both parties understand their responsibilities and protecting the interests of both the borrower and the lender.

Murfreesboro Tennessee Hypothecation Agreement

Description

How to fill out Murfreesboro Tennessee Hypothecation Agreement?

Do you need a trustworthy and inexpensive legal forms supplier to get the Murfreesboro Tennessee Hypothecation Agreement? US Legal Forms is your go-to choice.

Whether you require a basic arrangement to set regulations for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our platform provides more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of separate state and area.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased document templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Find out if the Murfreesboro Tennessee Hypothecation Agreement conforms to the laws of your state and local area.

- Read the form’s description (if available) to learn who and what the form is intended for.

- Restart the search if the template isn’t good for your specific situation.

Now you can register your account. Then choose the subscription option and proceed to payment. As soon as the payment is completed, download the Murfreesboro Tennessee Hypothecation Agreement in any available format. You can return to the website at any time and redownload the form free of charge.

Getting up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting hours researching legal paperwork online once and for all.