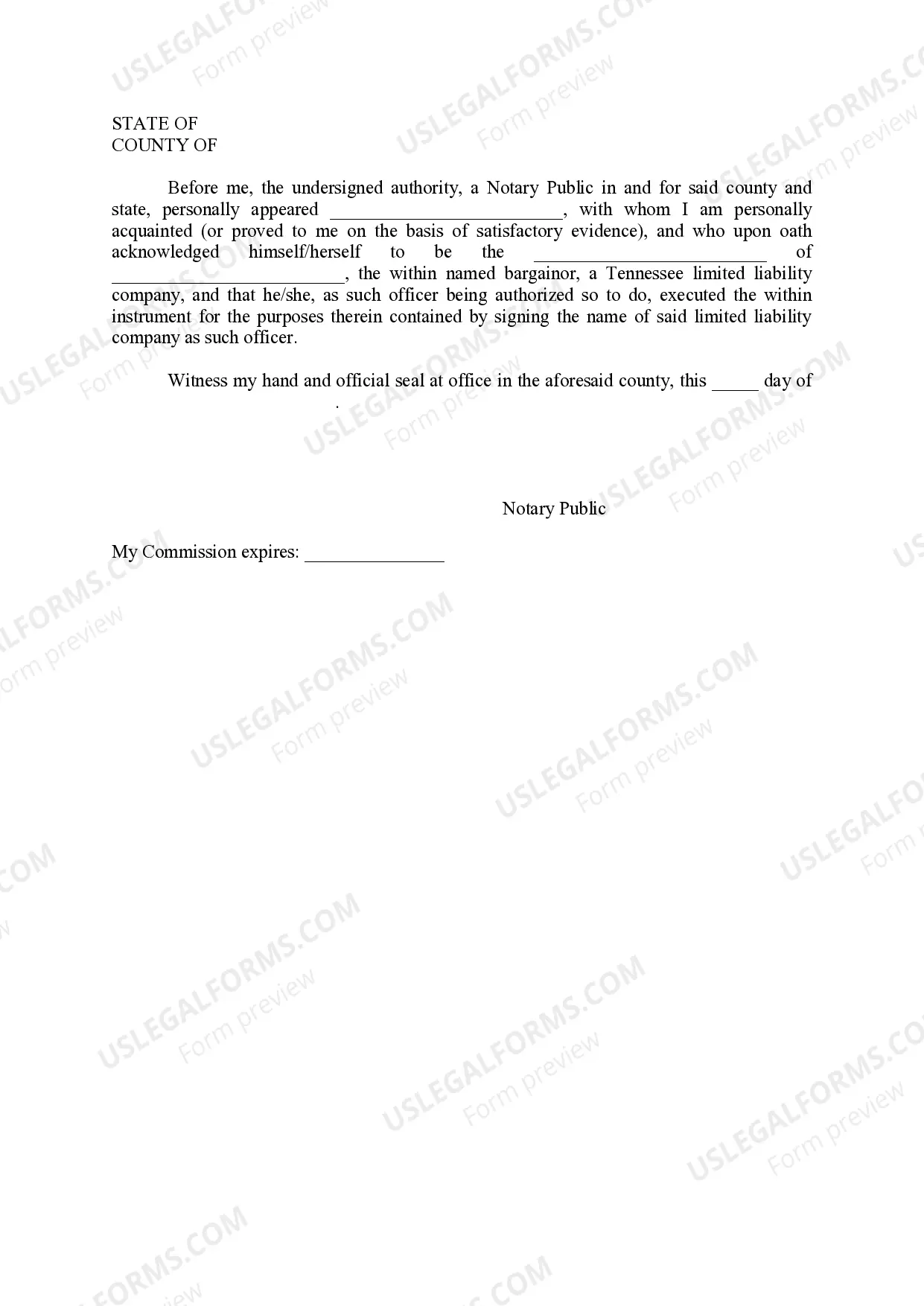

The Assumption of Certain Loan Documents in Clarksville, Tennessee is a legal process that occurs when a borrower transfers their existing loan obligations to another party. This typically takes place when a property is sold or transferred to a new owner, who agrees to assume the existing loan and take responsibility for the repayment. The Clarksville Tennessee Assumption of Certain Loan Documents encompasses various loan types and legal agreements. Here are the different types of loan assumption documents commonly encountered in Clarksville, Tennessee: 1. Residential Mortgage Assumption: This refers to the transfer of a residential mortgage loan from one borrower to another. When a homeowner sells their property, the buyer may assume the existing mortgage, assuming they meet the lender's qualification requirements and agree to fulfill the remaining loan terms. 2. Commercial Loan Assumption: In the case of commercial properties, such as office buildings, retail spaces, or industrial facilities, the assumption of commercial loan documents is common during property acquisitions or business transfers. This process involves the transfer of the loan responsibilities from the previous owner to the new owner. 3. Assumption Agreement: This document outlines the terms and conditions agreed upon between the original borrower, the new borrower assuming the loan, and the lender. It includes details such as the loan balance, interest rate, repayment schedule, and any additional provisions or contingencies. 4. Due-on-Sale Clause: Many loan agreements include a due-on-sale clause, which states that the full loan balance becomes due upon the sale or transfer of the property. However, the lender may allow an assumption of the loan under certain circumstances, subject to approval and fulfillment of specific criteria. 5. Lender Approval Process: Assumption of certain loan documents in Clarksville, Tennessee typically requires the lender's approval. The lender evaluates the creditworthiness and financial stability of the new borrower, ensuring their ability to repay the loan. The process may involve submitting financial documents, credit reports, and other supporting information. 6. Release of Liability: When a loan assumption occurs, the original borrower seeks to be released from any further liability and obligations related to the loan. The assumption agreement should clearly define the terms of this release, ensuring that the original borrower is no longer responsible for the loan repayment. The Clarksville Tennessee Assumption of Certain Loan Documents is a complex legal process, often involving multiple parties and meticulous paperwork. It is crucial for all parties involved to seek legal guidance and thoroughly understand their rights, responsibilities, and the potential implications of assuming such loans.

Clarksville Tennessee Assumption of Certain Loan Documents

Description

How to fill out Clarksville Tennessee Assumption Of Certain Loan Documents?

Make use of the US Legal Forms and have instant access to any form sample you want. Our useful website with a huge number of documents makes it easy to find and get almost any document sample you require. It is possible to save, fill, and sign the Clarksville Tennessee Assumption of Certain Loan Documents in a matter of minutes instead of browsing the web for several hours seeking the right template.

Utilizing our catalog is a superb strategy to increase the safety of your record filing. Our professional lawyers regularly check all the documents to make sure that the forms are appropriate for a particular region and compliant with new laws and regulations.

How do you obtain the Clarksville Tennessee Assumption of Certain Loan Documents? If you have a subscription, just log in to the account. The Download option will be enabled on all the samples you view. Additionally, you can get all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, follow the tips below:

- Open the page with the form you require. Make sure that it is the template you were hoping to find: check its title and description, and utilize the Preview option if it is available. Otherwise, make use of the Search field to find the appropriate one.

- Launch the saving process. Click Buy Now and select the pricing plan that suits you best. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Download the file. Select the format to get the Clarksville Tennessee Assumption of Certain Loan Documents and edit and fill, or sign it for your needs.

US Legal Forms is probably the most significant and trustworthy template libraries on the internet. Our company is always happy to help you in any legal case, even if it is just downloading the Clarksville Tennessee Assumption of Certain Loan Documents.

Feel free to make the most of our service and make your document experience as convenient as possible!