Knoxville Tennessee Assumption of Certain Loan Documents refers to a legal process where an individual or entity takes over the responsibility for an existing loan that was originally obtained by another party. This agreement typically involves the borrower (original party), the lender, and the new borrower (assuming party). The Assumption of Certain Loan Documents in Knoxville Tennessee involves the transfer of the loan obligation from the original borrower to the assuming party, who becomes liable for repaying the outstanding loan balance. This transaction requires the lender's approval and is usually accompanied by the execution of specific loan documents. There are several types of Assumption of Certain Loan Documents in Knoxville Tennessee. Some common categories include: 1. Residential Real Estate Loan Assumption: This type of assumption occurs when a homebuyer purchases a property and assumes the seller's existing mortgage. The buyer agrees to take over the loan payments and becomes the new borrower, while the seller is released from further liability. 2. Commercial Real Estate Loan Assumption: In commercial real estate transactions, a buyer may assume the existing loan secured by the property being purchased. By assuming the loan, the new owner takes over the loan terms, payment responsibilities, and any associated collateral. 3. Business Loan Assumption: In some cases, a business entity may assume an existing loan from another business. This could happen, for example, during a merger or acquisition when one company agrees to take on the other's outstanding debts and liabilities. 4. Student Loan Assumption: While less common, assumption arrangements may also apply to certain types of student loans. In this case, a new borrower would agree to assume responsibility for an existing student loan, taking over the repayment obligations and terms originally agreed upon by the initial borrower. It is important to note that the Assumption of Certain Loan Documents in Knoxville Tennessee typically requires the lender's consent and involves a thorough due diligence process. The assuming party must demonstrate their creditworthiness, financial stability, and ability to service the loan before the lender approves the assumption request. In conclusion, the Assumption of Certain Loan Documents in Knoxville Tennessee involves the transfer of an existing loan from one party to another. This arrangement can occur in various contexts, such as residential and commercial real estate transactions, business acquisitions, and even student loans. Each type of assumption has its specific requirements and considerations, necessitating careful evaluation and approval from the lender.

Knoxville Tennessee Assumption of Certain Loan Documents

Description

How to fill out Knoxville Tennessee Assumption Of Certain Loan Documents?

If you have previously employed our service, sign in to your account and retrieve the Knoxville Tennessee Assumption of Certain Loan Documents onto your device by clicking the Download button. Ensure your subscription is active. If not, renew it as per your payment plan.

If this is your initial interaction with our service, follow these straightforward steps to acquire your document.

You retain ongoing access to every document you have acquired: you can access it in your profile within the My documents menu whenever you need to use it again. Leverage the US Legal Forms service to conveniently locate and save any template for your personal or professional requirements!

- Ensure you’ve located the appropriate document. Review the description and utilize the Preview feature, if available, to verify it aligns with your requirements. If it’s not suitable, use the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and choose either a monthly or yearly subscription plan.

- Establish an account and finalize your payment. Enter your credit card information or opt for the PayPal method to complete the purchase.

- Obtain your Knoxville Tennessee Assumption of Certain Loan Documents. Choose the file format for your document and save it to your device.

- Finalize your template. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

Rule 60 in Tennessee allows parties to seek relief from a judgment or order under certain circumstances. It applies when there are reasons such as clerical mistakes, newly discovered evidence, or other valid reasons that justify overturning a decision. Familiarizing yourself with this rule can be crucial if you face a default judgment. Leverage platforms like US Legal Forms to obtain the documents and information needed for navigating this rule effectively.

Yes, you can amend a default judgment in Tennessee, but you typically need to file a motion with the court. The reasons for amending should be clearly stated, along with any evidence that supports your request. It's important to act promptly to avoid complications. US Legal Forms can provide the necessary forms and advice to navigate this process effectively.

To set aside a default judgment in Tennessee, you must file a motion in the court where the judgment was entered. This motion needs to provide a valid reason for why you did not respond initially, such as not receiving proper notice. You should include any supporting documents that underline your case. Utilizing resources like US Legal Forms can help streamline this process by providing the necessary templates and guidance.

In consideration of the assumption of the Debtor's Liabilities, the Creditor (a) agrees to look solely to the Assuming Party for the payment and the performance of the Liabilities; and (b) forever releases and discharges the Debtor from the Liabilities.

You're limited to the current lender ? If you'd like to assume a mortgage, you must still apply for the loan and meet all of the lender's requirements as if the loan were newly originated. Without the lender's consent, the assumption cannot happen.

You're limited to the current lender ? If you'd like to assume a mortgage, you must still apply for the loan and meet all of the lender's requirements as if the loan were newly originated. Without the lender's consent, the assumption cannot happen.

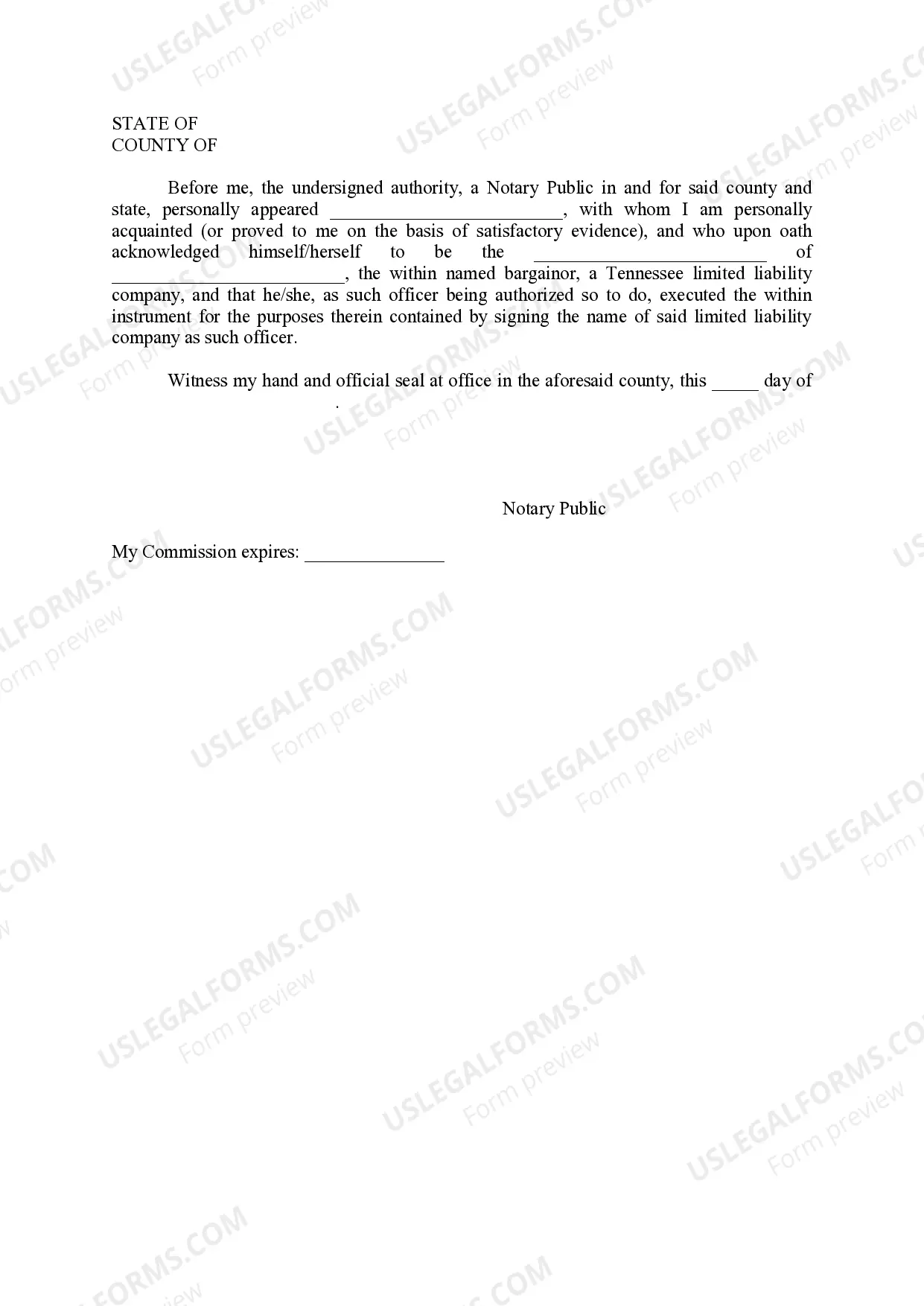

Assumption agreements are prepared by the existing lender of record with their knowledge and approval, and they are signed by the buyer during escrow. Sometimes, the seller is also required to sign the assumption agreement in order to fully release them from any responsibility.

An assumable mortgage allows someone to find a house they want to buy and take over the seller's existing home loan without applying for a new mortgage. This means the remaining balance, mortgage rate, repayment period and other loan terms stay the same, but the responsibility for the debt is transferred to the buyer.

Assumption Loans: An assumption agreement is prepared by the existing lender of record and signed by the buyer as part of the escrow process. The seller may also be required to sign the assumption agreement and the terms may release the seller from responsibility.

To qualify for an assumable mortgage, lenders will check a buyer's credit score and debt-to-income ratio (DTI) to meet loan requirements. Additional information such as employment history, income information, and asset verification for a down payment may be needed to process the loan.