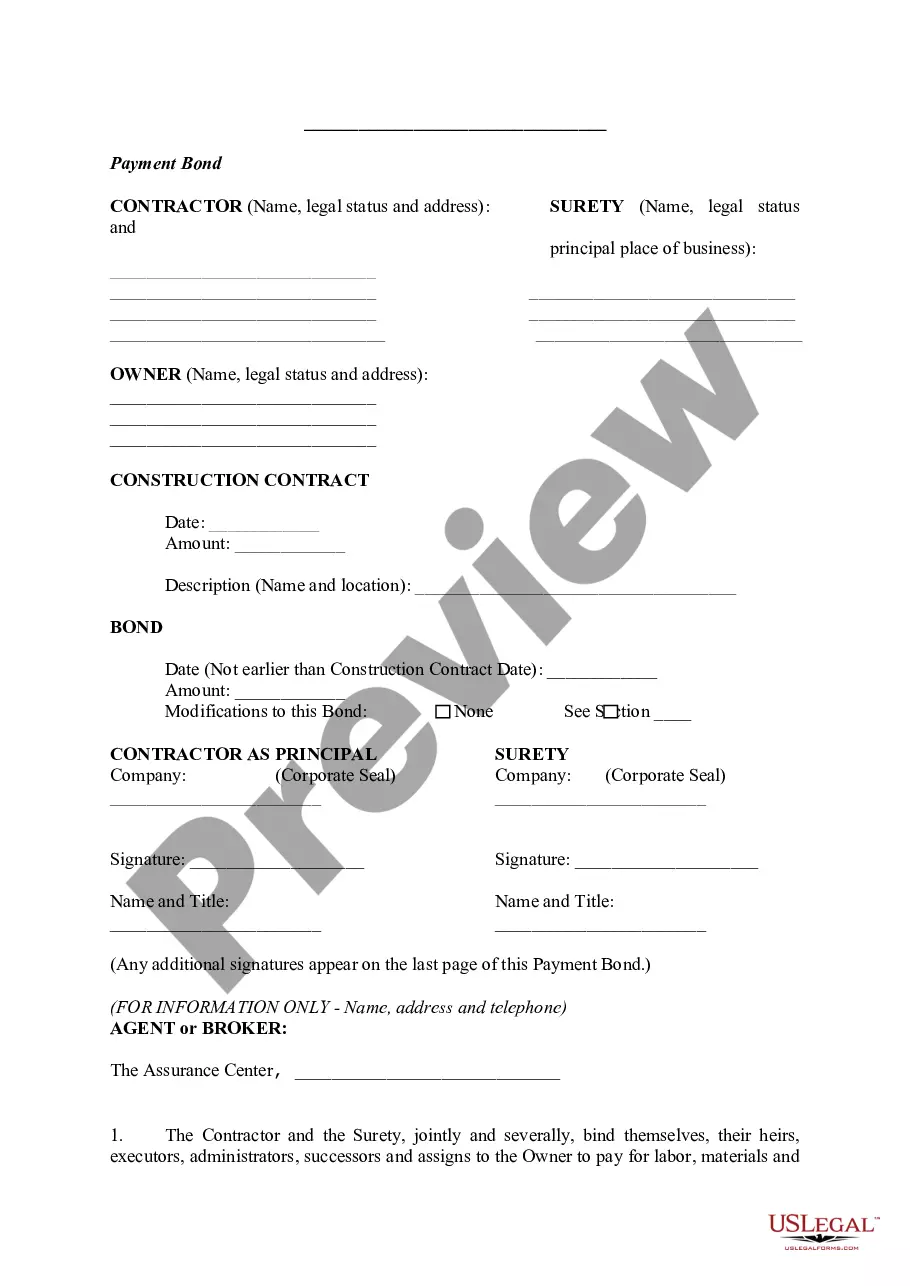

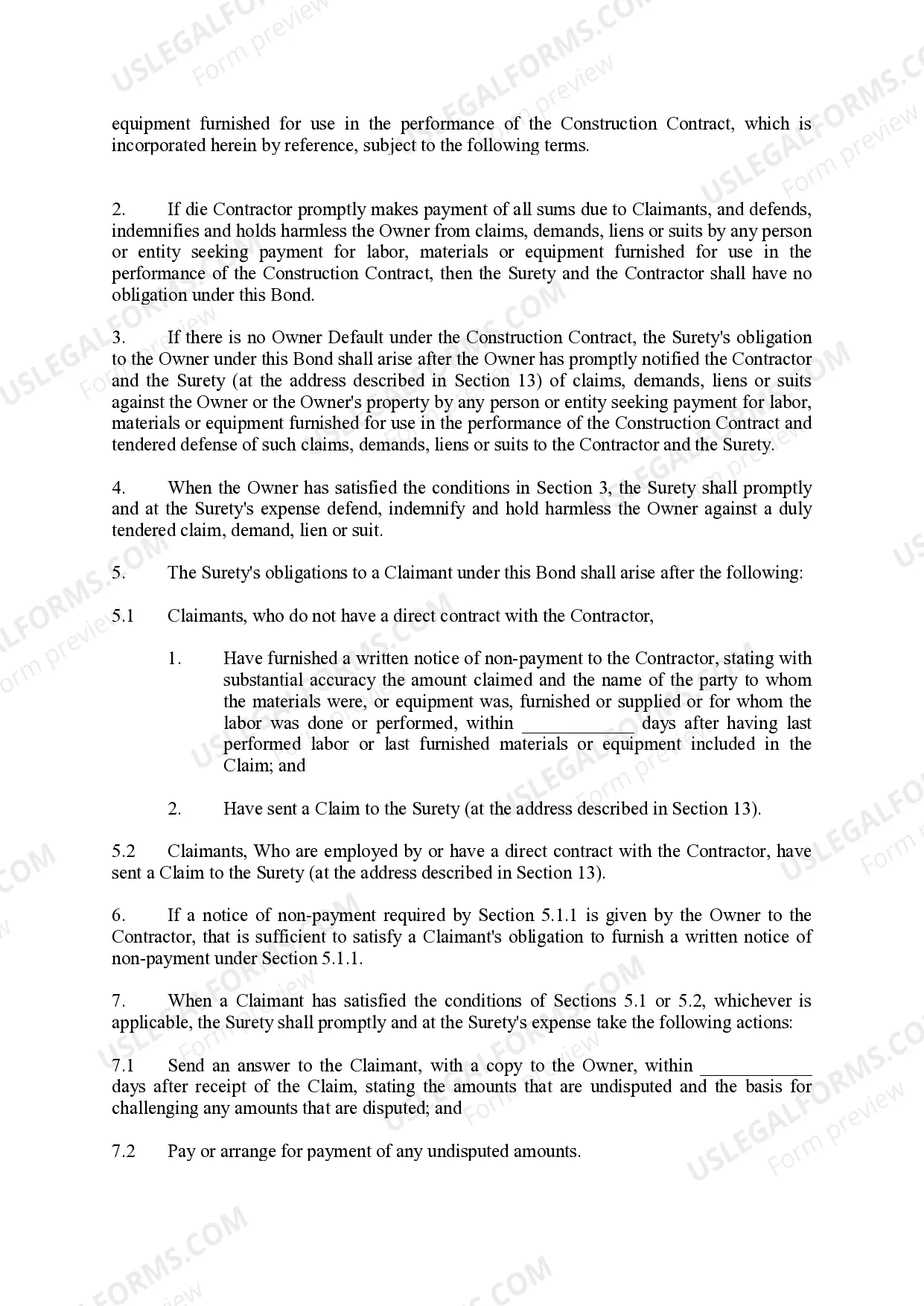

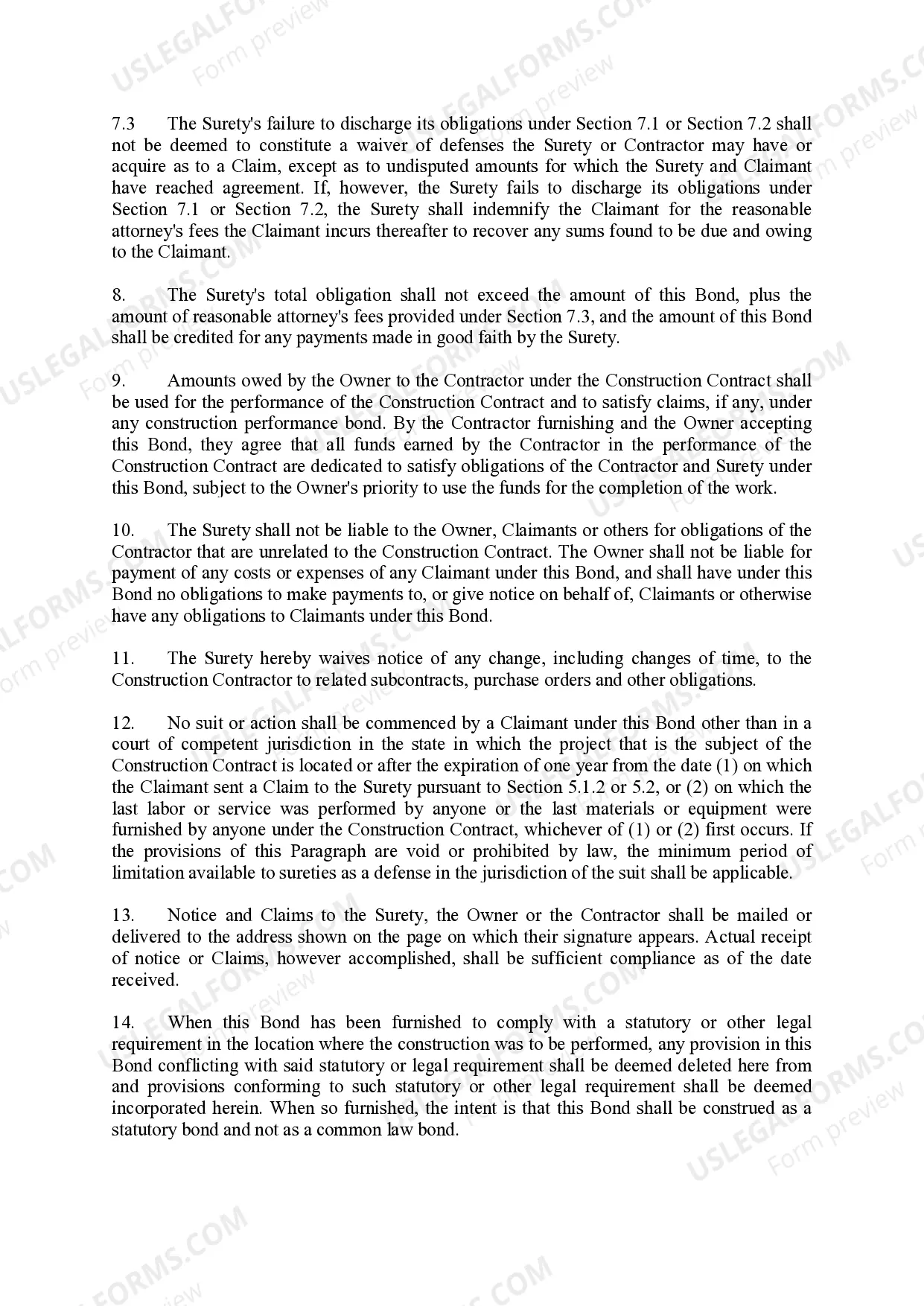

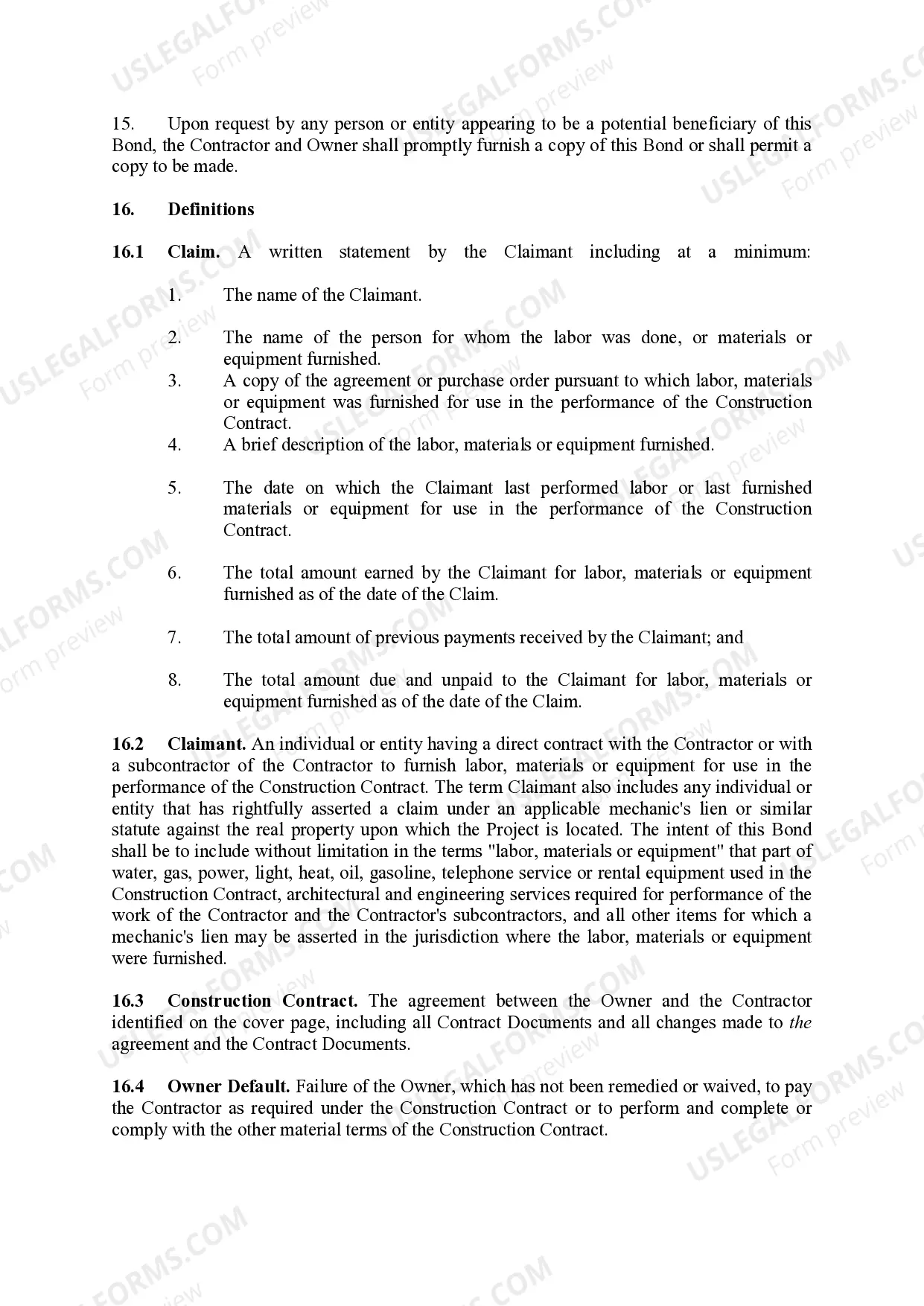

A Memphis Tennessee Payment Bond is a type of surety bond that ensures the payment of subcontractors, laborers, and suppliers on public construction projects in the city of Memphis, Tennessee. It is required by the City of Memphis to protect the rights of those who provide labor or materials on a public construction project. The purpose of this bond is to offer financial protection to subcontractors, laborers, and suppliers who have not been paid for their work or materials on a public project. If the general contractor fails to pay these parties, they can file a claim against the payment bond to recover their rightful dues. There are different types of Memphis Tennessee Payment Bonds that may be required depending on the specific project. These include: 1. Construction Payment Bond: This bond guarantees that subcontractors, laborers, and suppliers providing materials and services on a public construction project will be compensated for their work. 2. Performance and Payment Bond: In addition to guaranteeing payment to subcontractors, laborers, and suppliers, this bond also ensures that the general contractor will complete the project according to the terms of the contract. 3. Maintenance Bond: This bond ensures that the contractor will maintain and repair the completed project for a specified period of time after its completion. Obtaining a Memphis Tennessee Payment Bond is typically the responsibility of the general contractor working on a public construction project in the city. They must secure the bond from a surety company licensed to operate in Tennessee. The bond amount is usually a percentage of the contract value and is determined by the City of Memphis. The process of obtaining a Memphis Tennessee Payment Bond involves submitting an application to the surety company, providing relevant project and financial information, and paying a premium based on the bond amount and the contractor's creditworthiness. Once the bond is issued, it must be submitted to the City of Memphis before work can commence on the public project. In summary, a Memphis Tennessee Payment Bond is a legal requirement for public construction projects in Memphis, Tennessee. It ensures that subcontractors, laborers, and suppliers are paid for their work and provides financial protection for these parties. Different types of bonds may be required, including construction payment bonds, performance and payment bonds, and maintenance bonds. General contractors are responsible for obtaining the bond and complying with the city's requirements.

Memphis Tennessee Payment Bond

Description

How to fill out Memphis Tennessee Payment Bond?

No matter what social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for a person without any law background to draft such papers from scratch, mostly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms can save the day. Our platform provides a massive collection with over 85,000 ready-to-use state-specific forms that work for almost any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

Whether you want the Memphis Tennessee Payment Bond or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Memphis Tennessee Payment Bond in minutes using our trustworthy platform. In case you are already an existing customer, you can go ahead and log in to your account to get the appropriate form.

However, if you are a novice to our library, ensure that you follow these steps prior to downloading the Memphis Tennessee Payment Bond:

- Ensure the form you have chosen is good for your area considering that the rules of one state or county do not work for another state or county.

- Preview the document and go through a short description (if provided) of cases the document can be used for.

- If the one you picked doesn’t meet your needs, you can start over and search for the needed form.

- Click Buy now and pick the subscription option that suits you the best.

- utilizing your login information or register for one from scratch.

- Choose the payment gateway and proceed to download the Memphis Tennessee Payment Bond once the payment is completed.

You’re all set! Now you can go ahead and print the document or fill it out online. Should you have any problems getting your purchased forms, you can quickly access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.