Nashville Tennessee Payment Bond: A Comprehensive Overview A Nashville Tennessee Payment Bond is a type of surety bond commonly used in the construction industry to ensure that contractors and subcontractors are paid for their work and materials. It serves as protection for project owners and reduces the risk of financial loss due to non-payment or disputes. In Nashville, Tennessee, payment bonds are regulated by state laws and are usually required for public construction projects exceeding a certain cost threshold. They provide a safety net for unpaid parties involved in the construction project, such as laborers, suppliers, subcontractors, and material providers. The Nashville Tennessee Payment Bond guarantees that the contractor will fulfill its financial obligations by compensating all the parties involved in the project promptly. If the contractor fails to pay any party, the unpaid parties can make a claim against the payment bond to recover their due payments, up to the bond amount. There are different types of Nashville Tennessee Payment Bonds, including: 1. Public Works Payment Bond: Required for public construction projects initiated by federal, state, or local government entities. These bonds protect the project owner and taxpayers from potential financial losses. 2. Private Construction Payment Bond: Sometimes requested by private project owners to ensure timely payments to all parties involved in the construction process. Although not mandatory in private projects, many owners opt for this bond to mitigate risks and promote fair business practices. 3. Subcontractor Payment Bond: Often required by general contractors to ensure that subcontractors and suppliers are paid for their work and materials. It offers protection to lower-tiered parties involved in the project who may face payment issues due to the contractor's financial instability. 4. Material Supplier Payment Bond: Specific to material suppliers, this bond guarantees that they will receive payment for the materials they provide on the construction project. It provides an additional layer of security, ensuring that suppliers can continue supplying materials without the fear of non-payment. Nashville Tennessee Payment Bonds are typically issued by surety bond companies or insurers who assess the financial stability, experience, and reputation of the contractor before issuing the bond. The bond may require collateral and a premium from the contractor, which is usually a percentage of the bond amount. By requiring a Nashville Tennessee Payment Bond, project owners can ensure that contractors fulfill their payment obligations, protecting the project from delays, disruptions, and legal complications. This bond promotes transparency, fairness, and trust among all parties involved in the construction process, fostering a smoother and less risky project execution.

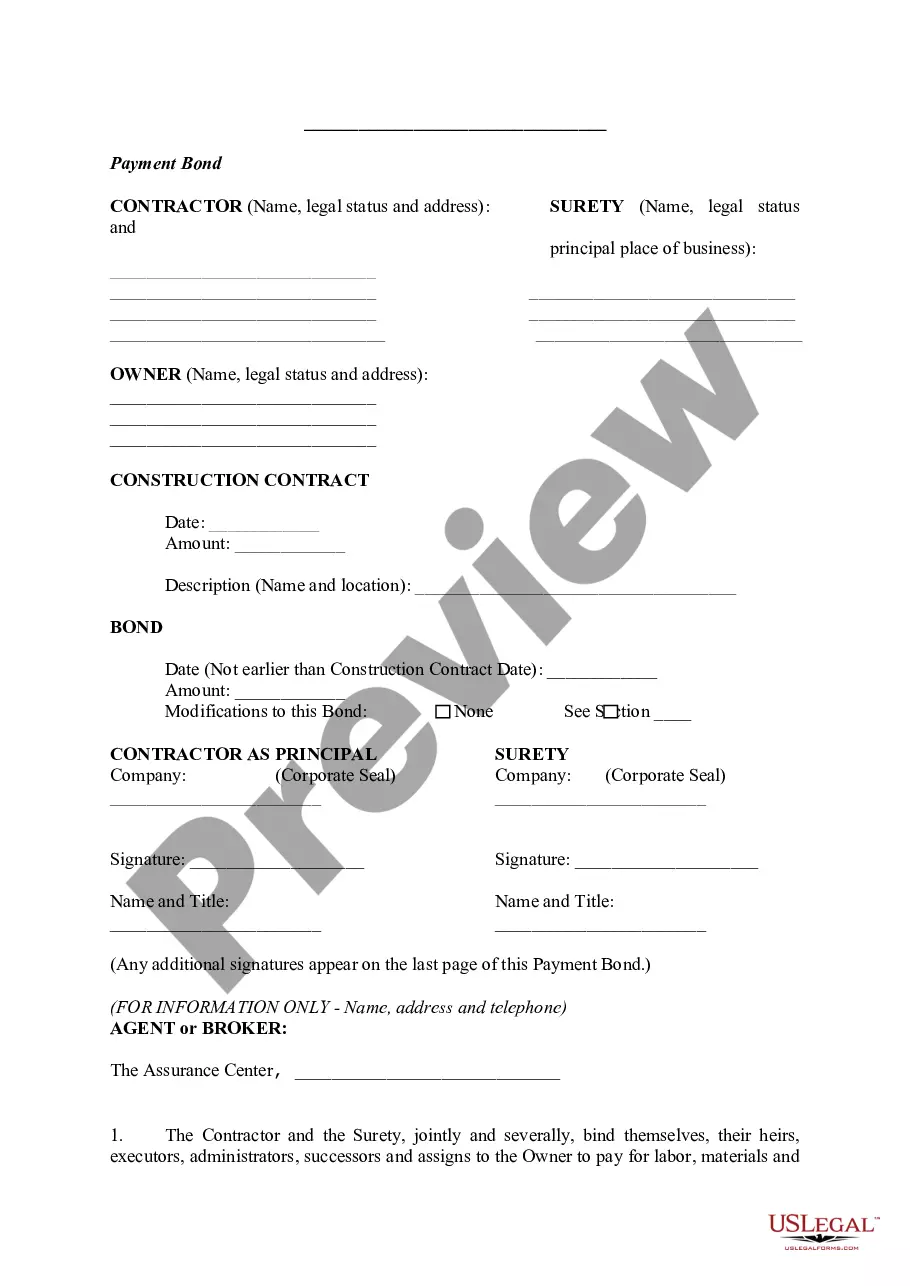

Payment Bond

Description

How to fill out Nashville Tennessee Payment Bond?

We always strive to minimize or avoid legal damage when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney solutions that, usually, are extremely costly. Nevertheless, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of an attorney. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Nashville Tennessee Payment Bond or any other form easily and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is just as effortless if you’re new to the website! You can register your account within minutes.

- Make sure to check if the Nashville Tennessee Payment Bond complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Nashville Tennessee Payment Bond is suitable for you, you can pick the subscription plan and make a payment.

- Then you can download the form in any available format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!