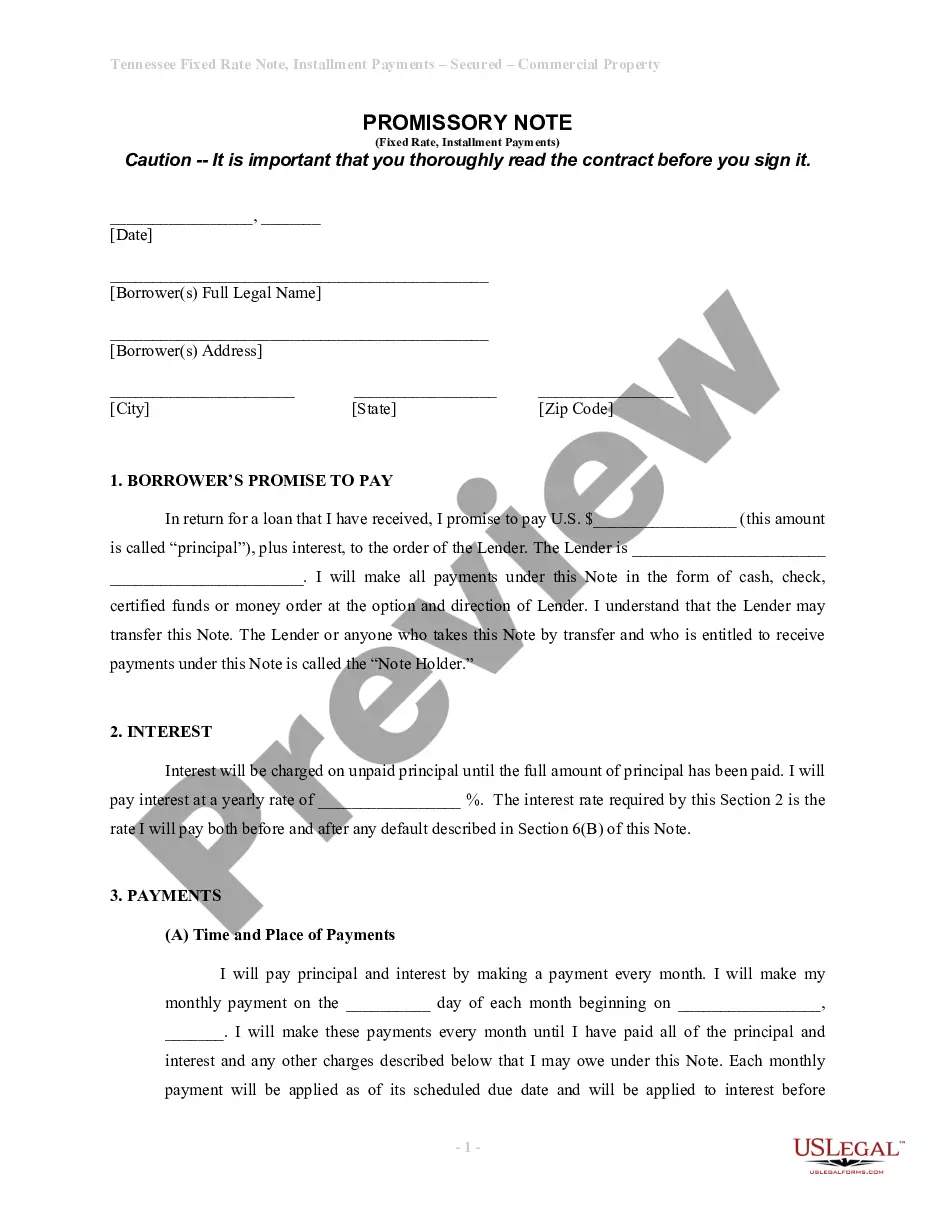

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

Chattanooga Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Tennessee Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

We consistently aim to reduce or avert legal complications when managing intricate legal or financial matters.

To achieve this, we enroll in legal services that are typically very costly.

However, not every legal issue is as simply intricate.

Many can be handled independently.

Utilize US Legal Forms whenever you need to find and download the Chattanooga Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate or any other document swiftly and securely. Simply Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always download it again from the My documents tab. The procedure is equally straightforward for newcomers! You can create your account in just a few minutes.

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our platform enables you to manage your affairs independently without the need for an attorney's services.

- We provide access to legal document templates that may not always be publicly available.

- Our templates are tailored to specific states and regions, which greatly eases the searching process.

Form popularity

FAQ

Filling out a promissory demand note involves stating the lender's and borrower's names, the borrowed amount, and mentioning that repayment is due upon demand. It is crucial to clarify any specific terms relating to the demand, such as interest rates or fees. Utilizing a Chattanooga Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate can provide additional security for the lender and establish clear repayment expectations.

The structure of a promissory note generally consists of an introduction, body details, and signatures. Initially, the note will identify the parties and the amount borrowed. The body includes interest rates, repayment terms, and clauses related to default and collateral, such as in the case of the Chattanooga Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate, where the property acts as a safeguard.

While promissory notes, like the Chattanooga Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate, offer benefits, they also have drawbacks. For instance, if the borrower defaults, they may lose their property. Additionally, ambiguity in the terms can lead to legal disputes, underscoring the importance of clear agreements.

A promissory note can be either secured or unsecured, depending on whether it is backed by collateral. In the case of a Chattanooga Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the note is secured by the property. This means that if the borrower defaults, the lender has the right to take ownership of the secured asset.

You can obtain a promissory note by visiting a local bank, credit union, or legal service provider. Alternatively, platforms like USLegalForms offer ready-made templates for a Chattanooga Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate. These resources simplify the process, ensuring you have a legally binding document tailored to your needs.

Promissory notes must be written clearly and include essential details like the amount borrowed, interest rate, and repayment date. Both parties should sign the document to acknowledge their agreement. When preparing a Chattanooga Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate, ensure compliance with local laws to protect both the lender and the borrower.

A promissory note is typically secured by collateral, such as residential real estate. In the case of a Chattanooga Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the property itself serves as a guarantee for the debt. This means if obligations are not fulfilled, the lender can take possession of the property to recover losses.

A promissory note can be considered a form of security when it is issued under conditions that meet regulatory standards. This classification allows investors to trade or sell the note on secondary markets. When dealing with a Chattanooga Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate, understanding its potential as a security can enhance your investment strategy.

To turn a promissory note into a security, it needs to comply with the securities laws and regulations. This often involves registering the note with the SEC or ensuring that it qualifies for an exemption. If you hold a Chattanooga Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate, consider consulting with legal experts to navigate this process.

In Tennessee, a promissory note does not typically require notarization to be valid. However, notarization can add an extra layer of security, especially for a Chattanooga Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate. It ensures that all parties acknowledge and agree to the terms, reducing the potential for disputes.