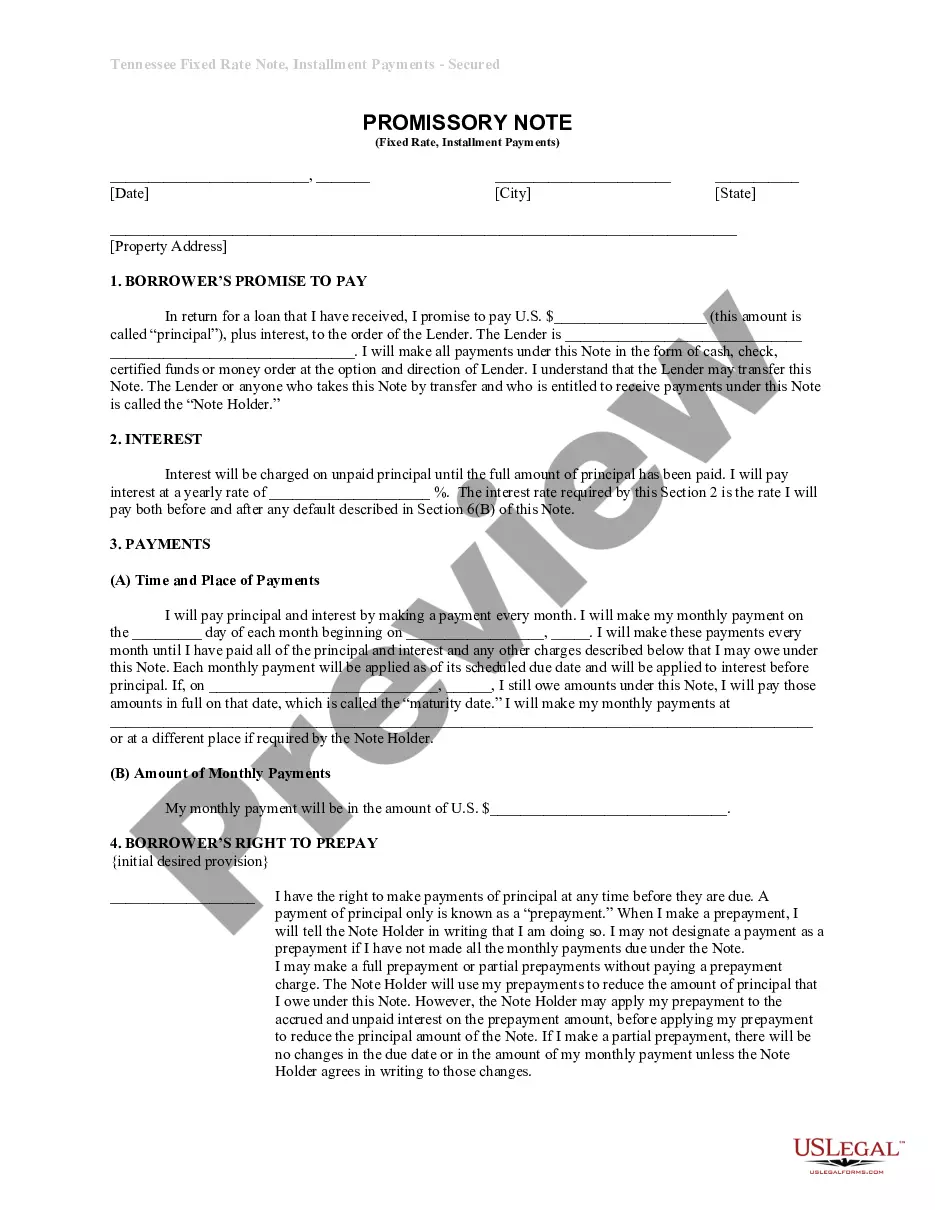

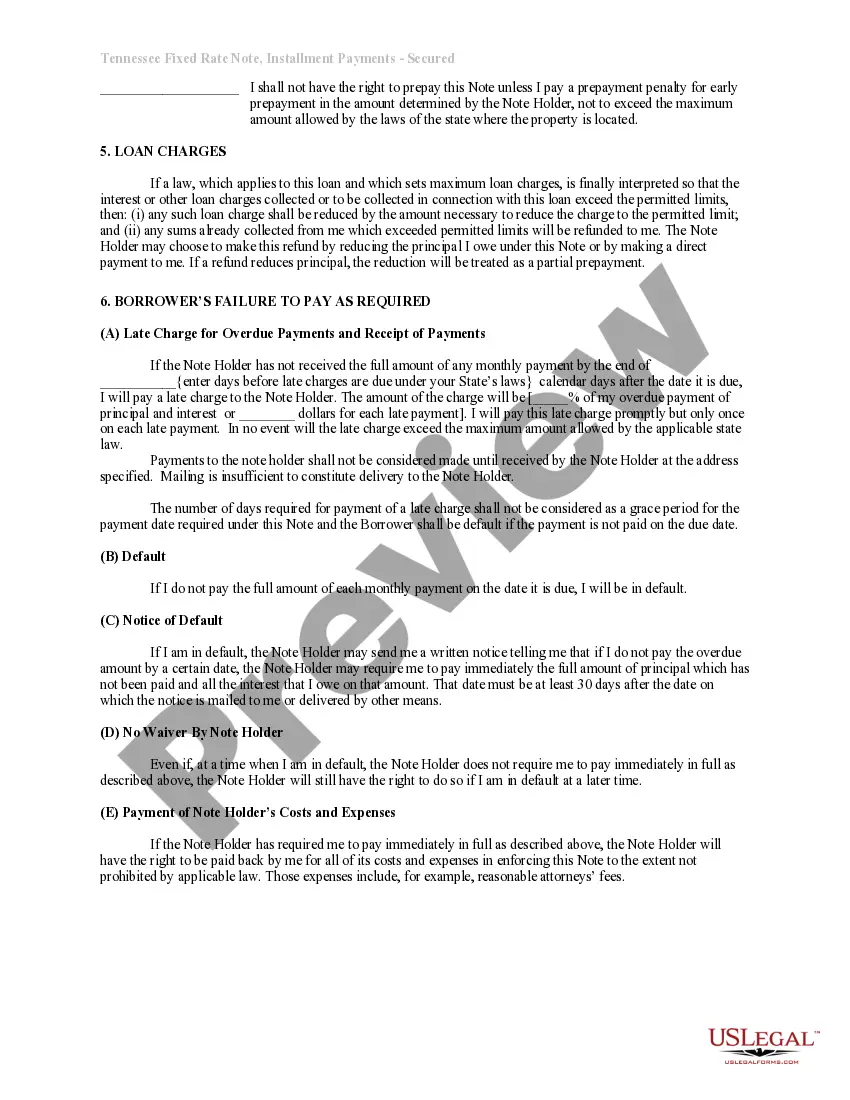

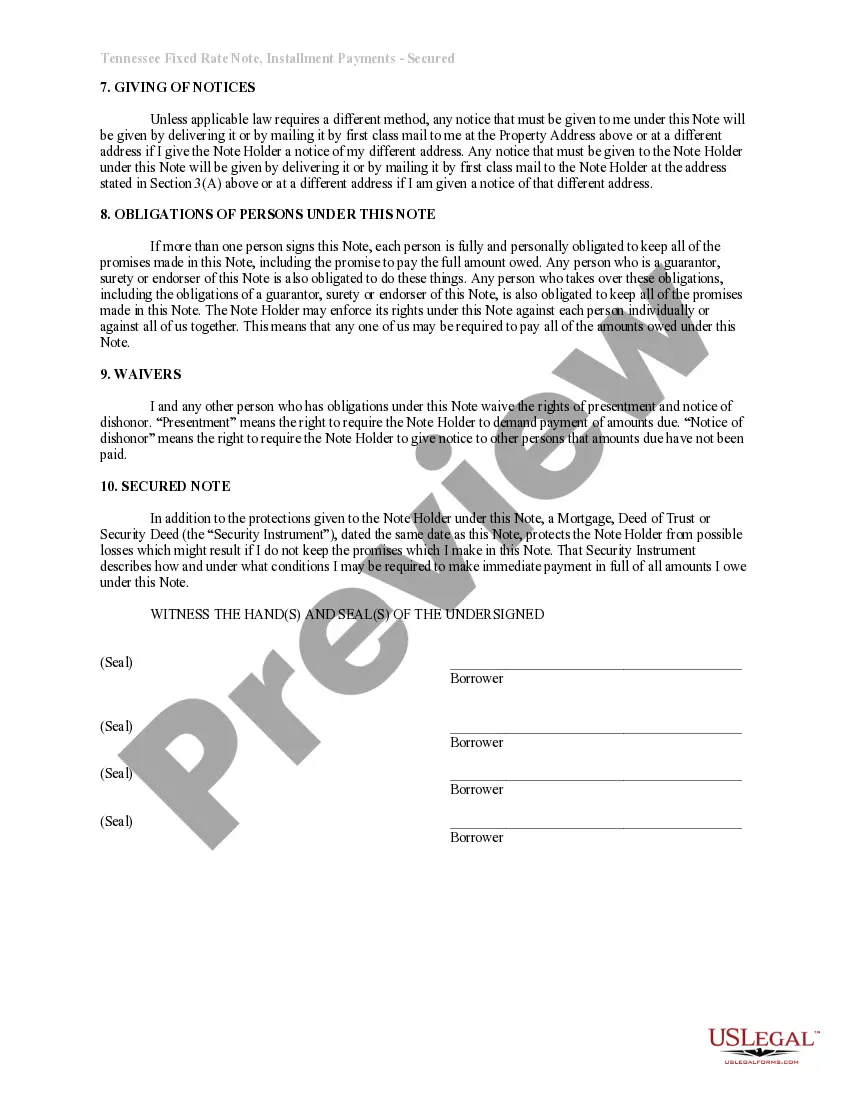

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

A Memphis Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note is specifically designed for real estate transactions in Memphis, Tennessee, where the borrower pledges their residential property as collateral to secure the loan. The note is structured as an installment loan, which means that the borrower agrees to repay the loan amount, along with interest, in regular payments over a specified period of time. The fixed rate nature of the note ensures that the interest rate remains constant throughout the repayment period, providing stability and predictability to both parties. By offering residential real estate as security, the borrower significantly reduces the risk for the lender, as the property serves as a guarantee for the repayment of the loan. In the event of default, where the borrower is unable to fulfill their payment obligations, the lender has the legal right to foreclose on the property and recover the outstanding debt through its sale. Different types of Memphis Tennessee Installments Fixed Rate Promissory Notes Secured by Residential Real Estate may exist based on the specific terms and conditions of each agreement. These may include variations in the repayment schedule, loan amount, interest rate, and the inclusion of additional clauses or stipulations. Some possible types of these promissory notes could be: 1. Short-term fixed-rate promissory note: This note has a shorter repayment period, typically less than five years, and is ideal for borrowers seeking to pay off the loan quickly. 2. Long-term fixed-rate promissory note: This note extends the repayment period to a longer term, often more than five years, allowing borrowers to spread out their payments over a more extended period. 3. Balloon payment fixed-rate promissory note: This note involves regular installment payments for a specific period, followed by a large "balloon" payment at the end, which includes the remaining unpaid balance of the loan. 4. Interest-only fixed-rate promissory note: This note allows the borrower to make interest-only payments for a defined period, after which they are required to start repaying both principal and interest. It is important for both lenders and borrowers to carefully review the terms and conditions outlined in the Memphis Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate before entering into any agreement. Seeking legal advice or the assistance of professionals specializing in real estate and lending is recommended to ensure compliance with applicable laws and to protect the interests of both parties involved.A Memphis Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This type of promissory note is specifically designed for real estate transactions in Memphis, Tennessee, where the borrower pledges their residential property as collateral to secure the loan. The note is structured as an installment loan, which means that the borrower agrees to repay the loan amount, along with interest, in regular payments over a specified period of time. The fixed rate nature of the note ensures that the interest rate remains constant throughout the repayment period, providing stability and predictability to both parties. By offering residential real estate as security, the borrower significantly reduces the risk for the lender, as the property serves as a guarantee for the repayment of the loan. In the event of default, where the borrower is unable to fulfill their payment obligations, the lender has the legal right to foreclose on the property and recover the outstanding debt through its sale. Different types of Memphis Tennessee Installments Fixed Rate Promissory Notes Secured by Residential Real Estate may exist based on the specific terms and conditions of each agreement. These may include variations in the repayment schedule, loan amount, interest rate, and the inclusion of additional clauses or stipulations. Some possible types of these promissory notes could be: 1. Short-term fixed-rate promissory note: This note has a shorter repayment period, typically less than five years, and is ideal for borrowers seeking to pay off the loan quickly. 2. Long-term fixed-rate promissory note: This note extends the repayment period to a longer term, often more than five years, allowing borrowers to spread out their payments over a more extended period. 3. Balloon payment fixed-rate promissory note: This note involves regular installment payments for a specific period, followed by a large "balloon" payment at the end, which includes the remaining unpaid balance of the loan. 4. Interest-only fixed-rate promissory note: This note allows the borrower to make interest-only payments for a defined period, after which they are required to start repaying both principal and interest. It is important for both lenders and borrowers to carefully review the terms and conditions outlined in the Memphis Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate before entering into any agreement. Seeking legal advice or the assistance of professionals specializing in real estate and lending is recommended to ensure compliance with applicable laws and to protect the interests of both parties involved.