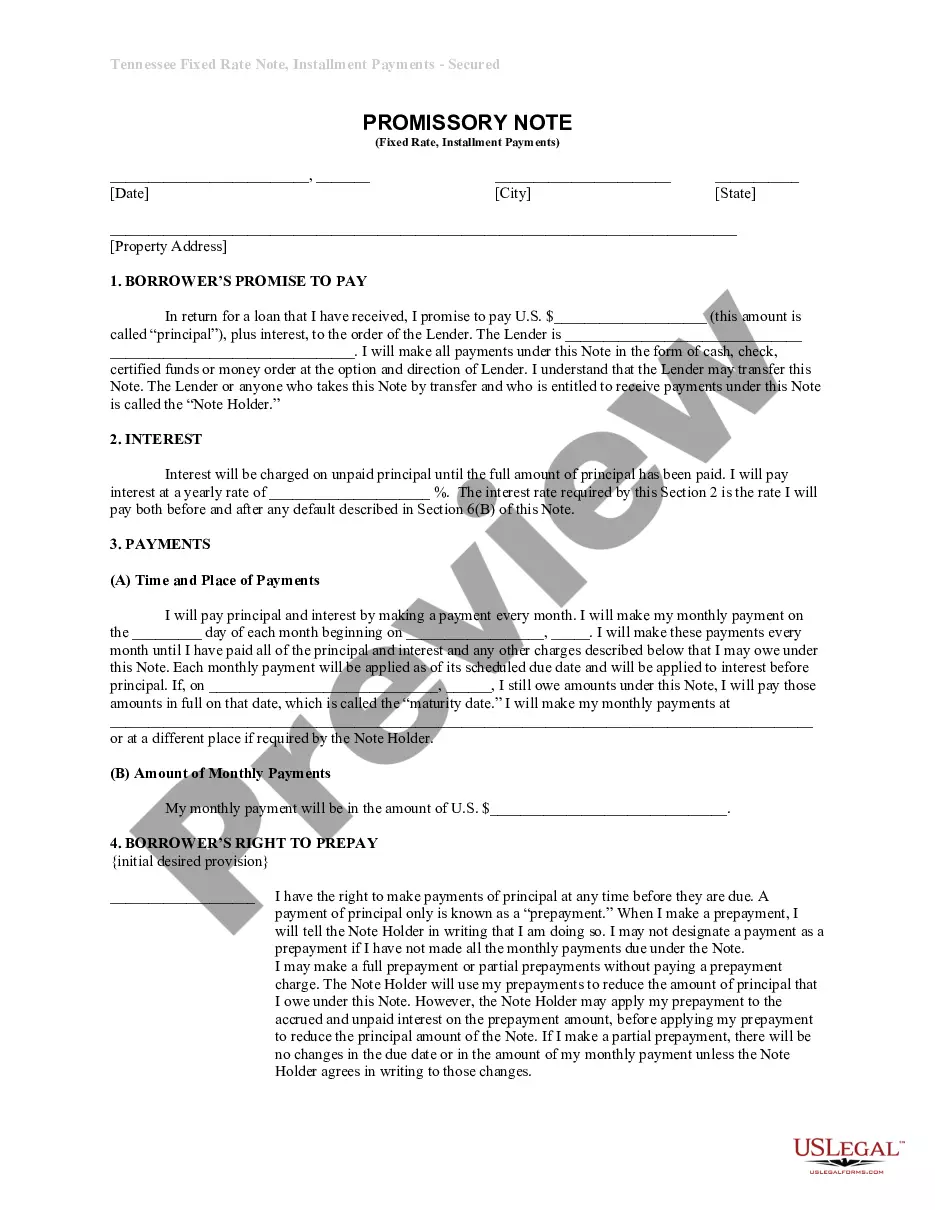

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

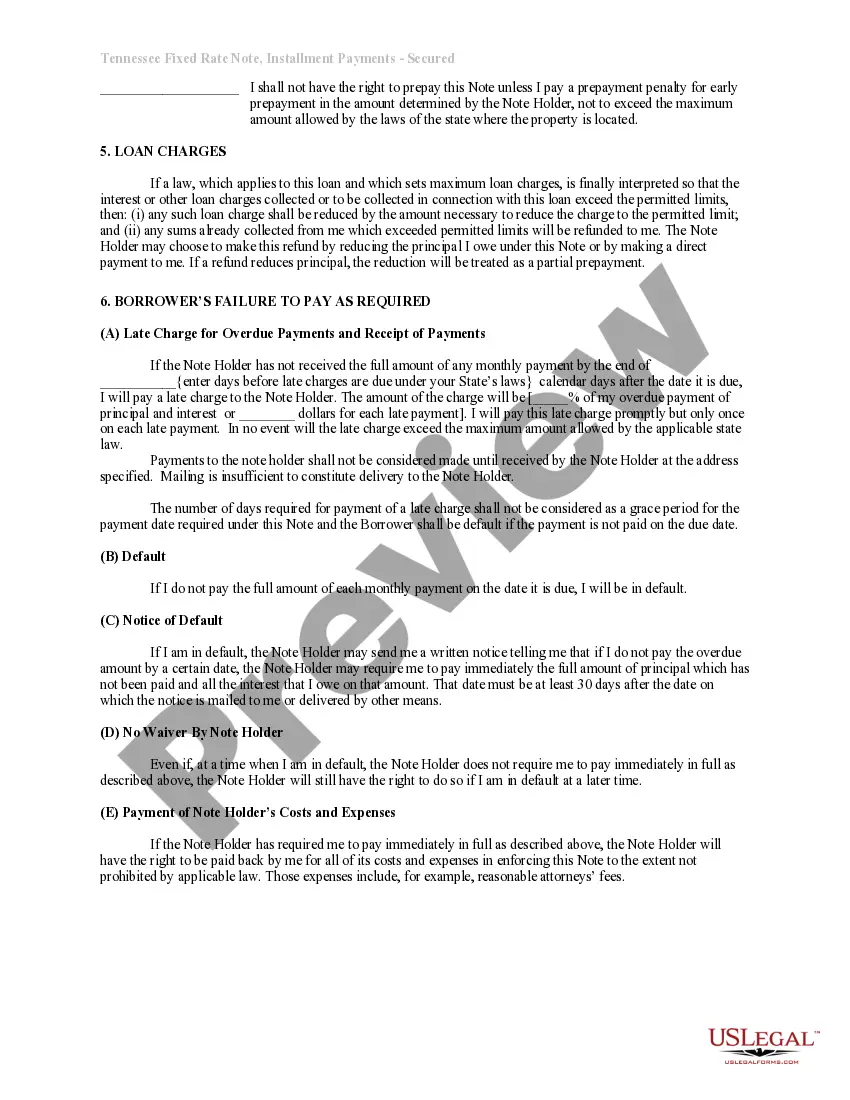

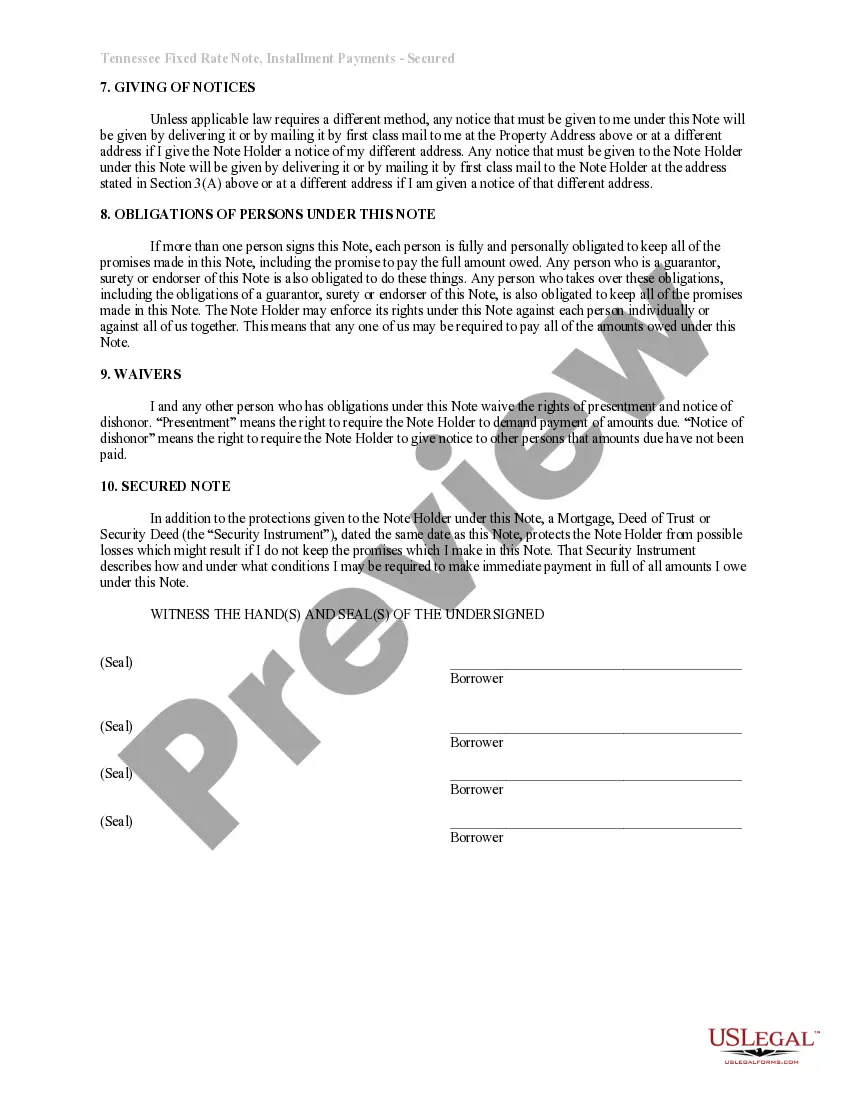

A Murfreesboro Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal contract that outlines the terms and conditions of a loan agreement between a lender and a borrower, specifically tailored for individuals residing in the Murfreesboro, Tennessee area. This promissory note specifies the repayment structure, interest rate, and other crucial details related to borrowing money for purchasing or refinancing residential real estate in Murfreesboro. Keywords: Murfreesboro Tennessee, Installments Fixed Rate, Promissory Note, Secured, Residential Real Estate. 1. Purpose and Structure: The Murfreesboro Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate is designed to facilitate financing options for potential homeowners in Murfreesboro. This legal document outlines the terms and conditions agreed upon by the lender and borrower to carry out the loan. It is typically structured to ensure a fixed monthly repayment plan with a pre-determined interest rate. 2. Loan Repayment Structure: This promissory note establishes the repayment structure by dividing the loan amount into equal installments, payable on a monthly basis. It ensures that the borrower repays the loan amount in predefined increments over a set period, typically for residential real estate purposes in Murfreesboro, Tennessee. 3. Fixed Interest Rate: The Murfreesboro Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate stipulates a fixed interest rate agreed upon by the lender and borrower. This ensures that the borrower will pay a consistent interest rate throughout the loan term, regardless of market fluctuations. 4. Residential Real Estate Collateral: To secure the loan, the borrower pledges residential real estate as collateral. This collateral serves as security, allowing the lender to foreclose on the property in the event of loan default or non-payment. The specific details of the property, such as its address, description, and value, would be documented in the promissory note. Types of Murfreesboro Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate: 1. Purchase Loan Promissory Note: A purchase loan promissory note is used when the borrower seeks financing for the purchase of residential real estate in Murfreesboro, Tennessee. It outlines the loan amount and terms required to complete the purchase transaction. 2. Refinance Loan Promissory Note: A refinancing loan promissory note is applicable when the borrower aims to refinance an existing mortgage on a residential property in Murfreesboro. It outlines the terms and conditions for the new loan that will replace the existing mortgage. 3. Home Equity Loan Promissory Note: A home equity loan promissory note is utilized when the borrower wants to borrow against the equity built in their Murfreesboro residential property. This is usually done when the borrower requires additional funds for various purposes, such as home renovations, debt consolidation, or education expenses. In conclusion, a Murfreesboro Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a crucial legal document that specifies the terms and conditions of a loan agreement between a lender and a borrower for the purpose of purchasing or refinancing residential real estate in the Murfreesboro, Tennessee area.A Murfreesboro Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legal contract that outlines the terms and conditions of a loan agreement between a lender and a borrower, specifically tailored for individuals residing in the Murfreesboro, Tennessee area. This promissory note specifies the repayment structure, interest rate, and other crucial details related to borrowing money for purchasing or refinancing residential real estate in Murfreesboro. Keywords: Murfreesboro Tennessee, Installments Fixed Rate, Promissory Note, Secured, Residential Real Estate. 1. Purpose and Structure: The Murfreesboro Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate is designed to facilitate financing options for potential homeowners in Murfreesboro. This legal document outlines the terms and conditions agreed upon by the lender and borrower to carry out the loan. It is typically structured to ensure a fixed monthly repayment plan with a pre-determined interest rate. 2. Loan Repayment Structure: This promissory note establishes the repayment structure by dividing the loan amount into equal installments, payable on a monthly basis. It ensures that the borrower repays the loan amount in predefined increments over a set period, typically for residential real estate purposes in Murfreesboro, Tennessee. 3. Fixed Interest Rate: The Murfreesboro Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate stipulates a fixed interest rate agreed upon by the lender and borrower. This ensures that the borrower will pay a consistent interest rate throughout the loan term, regardless of market fluctuations. 4. Residential Real Estate Collateral: To secure the loan, the borrower pledges residential real estate as collateral. This collateral serves as security, allowing the lender to foreclose on the property in the event of loan default or non-payment. The specific details of the property, such as its address, description, and value, would be documented in the promissory note. Types of Murfreesboro Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate: 1. Purchase Loan Promissory Note: A purchase loan promissory note is used when the borrower seeks financing for the purchase of residential real estate in Murfreesboro, Tennessee. It outlines the loan amount and terms required to complete the purchase transaction. 2. Refinance Loan Promissory Note: A refinancing loan promissory note is applicable when the borrower aims to refinance an existing mortgage on a residential property in Murfreesboro. It outlines the terms and conditions for the new loan that will replace the existing mortgage. 3. Home Equity Loan Promissory Note: A home equity loan promissory note is utilized when the borrower wants to borrow against the equity built in their Murfreesboro residential property. This is usually done when the borrower requires additional funds for various purposes, such as home renovations, debt consolidation, or education expenses. In conclusion, a Murfreesboro Tennessee Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a crucial legal document that specifies the terms and conditions of a loan agreement between a lender and a borrower for the purpose of purchasing or refinancing residential real estate in the Murfreesboro, Tennessee area.