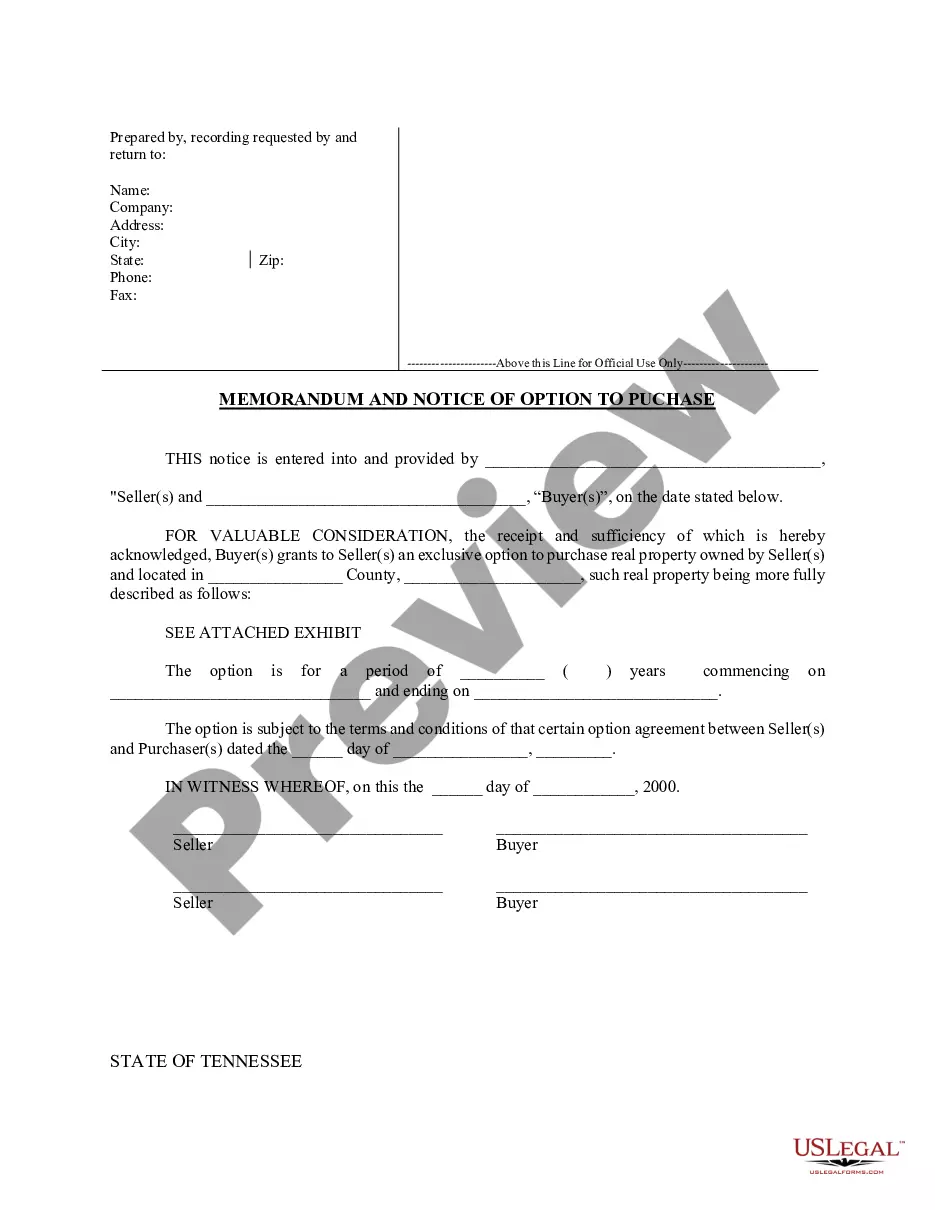

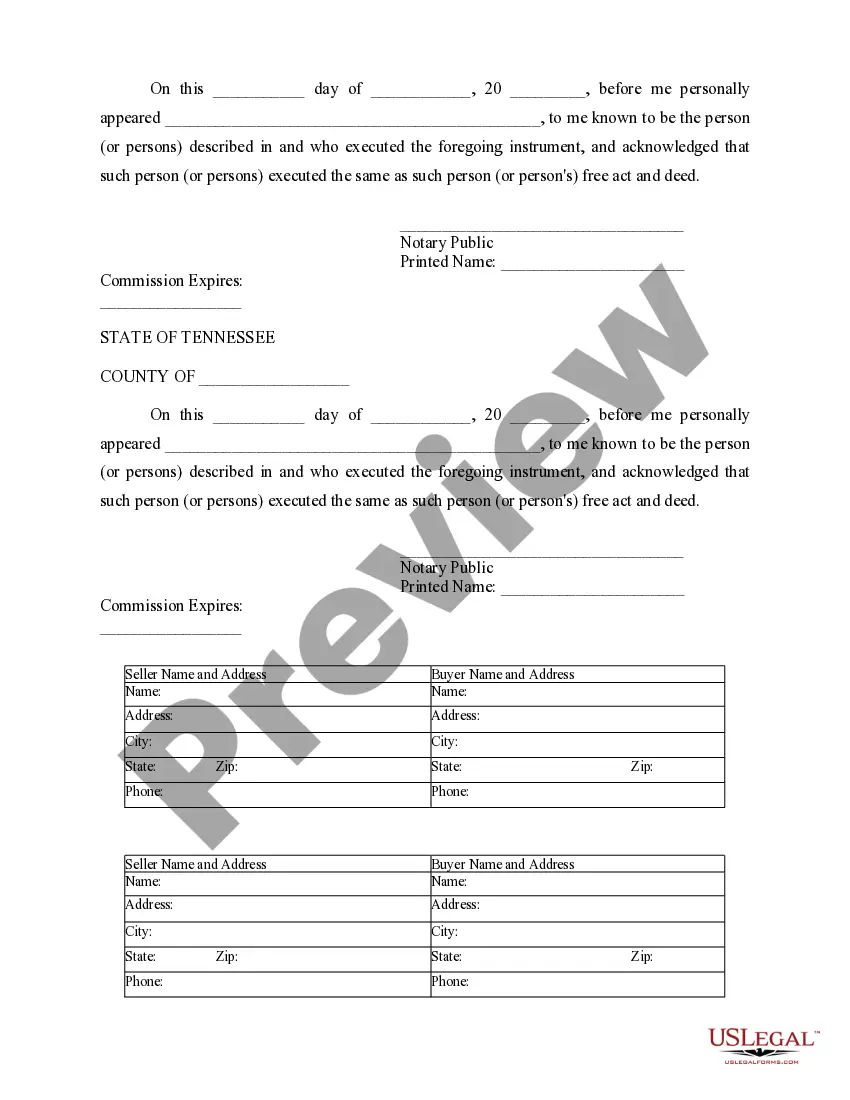

This Memorandum and Notice of Option Agreement is for recording in the official records in order to provide notice that an Option to Purchase exists on a certain parcel of real estate. It is used in lieu of recording the entire Option Agreement.

Nashville Tennessee Notice of Option for Recording

Description

How to fill out Tennessee Notice Of Option For Recording?

Utilize the US Legal Forms to gain instant access to any template sample you require.

Our valuable platform featuring thousands of documents makes it easy to locate and obtain nearly any document sample you seek.

You can download, complete, and validate the Nashville Tennessee Notice of Option for Recording in a matter of minutes instead of spending hours online searching for an appropriate template.

Using our library is an excellent method to enhance the security of your document submissions.

If you do not yet have an account, follow the instructions below.

Feel free to take full advantage of our form library and simplify your document experience!

- Our knowledgeable legal experts consistently review all documents to ensure that the forms are suitable for a specific state and adhere to current laws and regulations.

- How can you acquire the Nashville Tennessee Notice of Option for Recording.

- If you possess an account, simply Log In to your profile.

- The Download button will be activated on all the samples you examine.

- Furthermore, you can find all previously saved documents in the My documents section.

Form popularity

FAQ

How long does a judgment lien last in Tennessee? A judgment lien in Tennessee will remain attached to the debtor's property (even if the property changes hands) for ten years.

The Tennessee State Library and Archives has microfilmed copies of older deeds for every county in Tennessee. The deeds records are arranged by the name of the seller/buyer (grantor/grantee).

The Tennessee State Library and Archives has microfilmed copies of older deeds for every county in Tennessee. The deeds records are arranged by the name of the seller/buyer (grantor/grantee).

The Tennessee State Library and Archives has microfilmed copies of older deeds for every county in Tennessee. The deeds records are arranged by the name of the seller/buyer (grantor/grantee).

The documents can be prepared by anyone as long as the required information is written in the deed as outlined in § 66-5-103. Once the forms have been prepared, along with the Legal Description of the property, it may be signed with two (2) witnesses or a notary public.

The best way to know if a property has a lien is to conduct a title deed search online via the county recorder, county assessor, county clerk's website, or visit their office. Also, real estate buyers can choose to work with a title agent to conduct a lien search on the property.

Due Date and Tax Rates Recordation tax is based on the greater of the consideration paid for the transfer of the property or the fair market value of the property. Mortgage tax: $0.115 per $100 of indebtedness.

Can a lien be placed on your property without you knowing? Yes, it happens. Sometimes a court decision or settlement results in a lien being placed on a property, and for some reason the owner doesn't know about it? initially.

$12.00 first two (2) pages. $ 5.00 each additional page. $ 5.00 each additional reference.

Per Tennessee Code § 67-4-409, the state imposes a Realty Transfer Tax on most transfers of real property. For quitclaim deeds, the amount of the tax is at a rate of $0.37 per $100 of the property's purchase price.