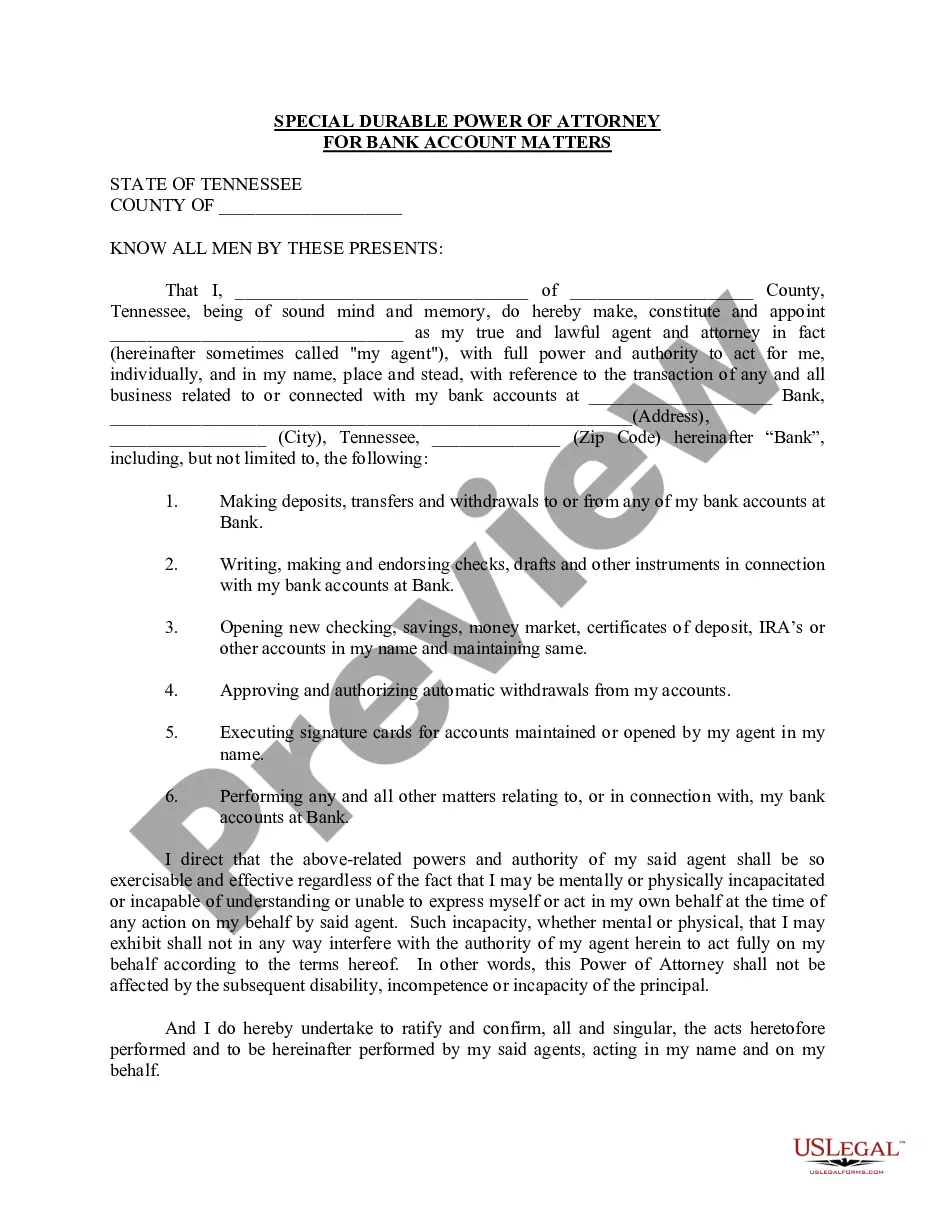

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

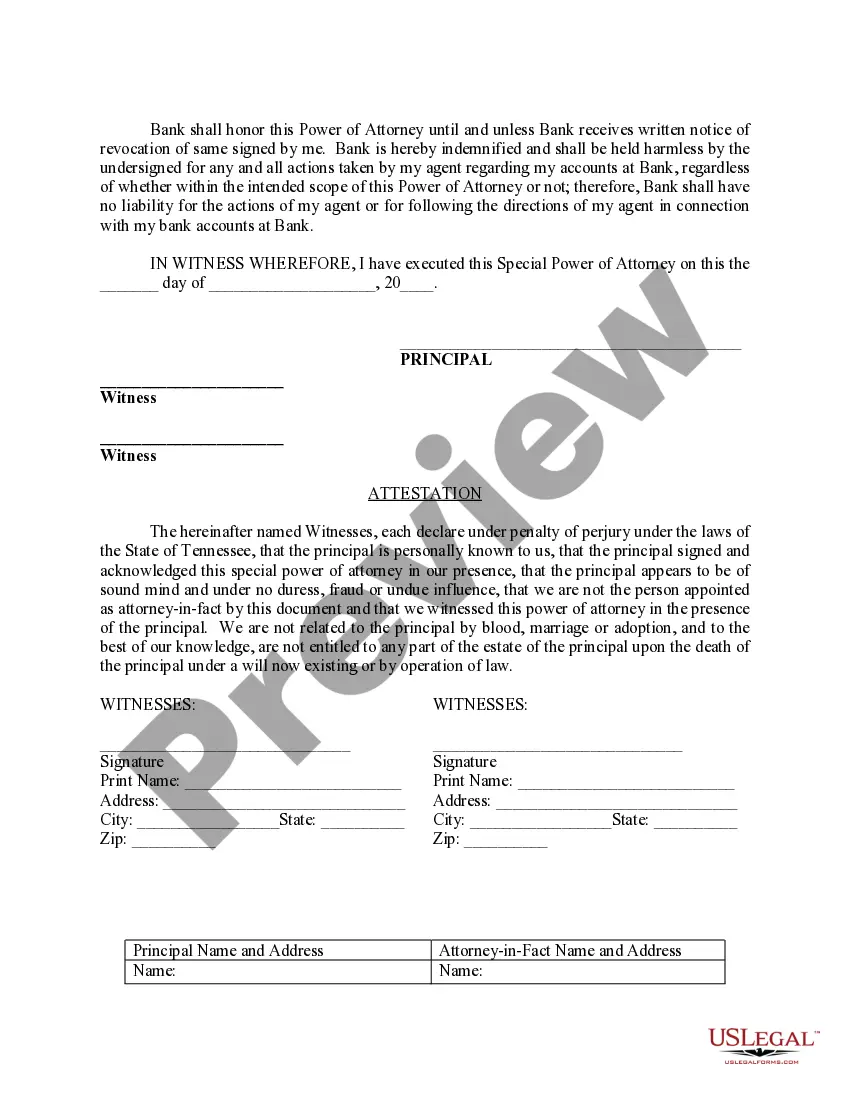

Title: Knoxville Tennessee Special Durable Power of Attorney for Bank Account Matters: A Comprehensive Overview Introduction: A special durable power of attorney for bank account matters in Knoxville, Tennessee grants specific powers to an appointed individual, known as the attorney-in-fact or agent, to act on behalf of the principal (the person granting authority) in managing, accessing, and making decisions related to their bank accounts. This legal instrument plays a vital role in ensuring financial affairs are properly handled, especially in situations where the principal becomes incapacitated or is unable to manage their bank account matters independently. Let's delve into the details and understand the various types of Knoxville Tennessee Special Durable Power of Attorney for Bank Account Matters: 1. General Overview: A Knoxville Tennessee Special Durable Power of Attorney for Bank Account Matters is designed to address specific financial transactions. It allows the agent to handle a range of tasks related to the principal's bank accounts, including but not limited to depositing funds, withdrawing money, transferring funds between accounts, paying bills, and managing investments. 2. Agent's Roles and Responsibilities: The agent appointed under this special power of attorney assumes several key responsibilities, such as monitoring bank account activity, reconciling statements, maintaining account records, and representing the principal's interests when dealing with financial institutions. 3. Durable Power of Attorney: The inclusion of the term "durable" ensures that the power of attorney remains effective even if the principal becomes mentally or physically incapacitated. This feature becomes particularly important in circumstances where the principal requires long-term care or faces a sudden health crisis. 4. Bank-Specific Special Power of Attorney: Sometimes, a Knoxville Tennessee Special Durable Power of Attorney for Bank Account Matters may be tailored to cater to the requirements of a specific bank or financial institution. This approach aims to grant the agent authority specifically over the concerned bank account(s), ensuring smooth and efficient management. 5. Limited Special Power of Attorney: While the overarching purpose of a special durable power of attorney for bank account matters is to grant comprehensive authority to the agent, it is worth noting that the principal can also create a limited special power of attorney. This narrower scope restricts the powers of the agent to specific transactions or a limited timeframe. 6. Benefits and Protections: The Knoxville Tennessee Special Durable Power of Attorney for Bank Account Matters provides several benefits, including convenience, protection, and peace of mind for individuals and families by ensuring continuous financial management and safeguarding against potential abuse or mismanagement. Conclusion: In Knoxville, Tennessee, a Special Durable Power of Attorney for Bank Account Matters serves as a crucial legal tool in entrusting the management of one's financial affairs to a trusted agent. By granting specific powers, this power of attorney enables the agent to conduct various bank-related transactions, ensuring seamless and efficient financial management. Whether through a general or bank-specific special power of attorney, individuals can take proactive steps to safeguard their financial interests and maintain control even in challenging circumstances.Title: Knoxville Tennessee Special Durable Power of Attorney for Bank Account Matters: A Comprehensive Overview Introduction: A special durable power of attorney for bank account matters in Knoxville, Tennessee grants specific powers to an appointed individual, known as the attorney-in-fact or agent, to act on behalf of the principal (the person granting authority) in managing, accessing, and making decisions related to their bank accounts. This legal instrument plays a vital role in ensuring financial affairs are properly handled, especially in situations where the principal becomes incapacitated or is unable to manage their bank account matters independently. Let's delve into the details and understand the various types of Knoxville Tennessee Special Durable Power of Attorney for Bank Account Matters: 1. General Overview: A Knoxville Tennessee Special Durable Power of Attorney for Bank Account Matters is designed to address specific financial transactions. It allows the agent to handle a range of tasks related to the principal's bank accounts, including but not limited to depositing funds, withdrawing money, transferring funds between accounts, paying bills, and managing investments. 2. Agent's Roles and Responsibilities: The agent appointed under this special power of attorney assumes several key responsibilities, such as monitoring bank account activity, reconciling statements, maintaining account records, and representing the principal's interests when dealing with financial institutions. 3. Durable Power of Attorney: The inclusion of the term "durable" ensures that the power of attorney remains effective even if the principal becomes mentally or physically incapacitated. This feature becomes particularly important in circumstances where the principal requires long-term care or faces a sudden health crisis. 4. Bank-Specific Special Power of Attorney: Sometimes, a Knoxville Tennessee Special Durable Power of Attorney for Bank Account Matters may be tailored to cater to the requirements of a specific bank or financial institution. This approach aims to grant the agent authority specifically over the concerned bank account(s), ensuring smooth and efficient management. 5. Limited Special Power of Attorney: While the overarching purpose of a special durable power of attorney for bank account matters is to grant comprehensive authority to the agent, it is worth noting that the principal can also create a limited special power of attorney. This narrower scope restricts the powers of the agent to specific transactions or a limited timeframe. 6. Benefits and Protections: The Knoxville Tennessee Special Durable Power of Attorney for Bank Account Matters provides several benefits, including convenience, protection, and peace of mind for individuals and families by ensuring continuous financial management and safeguarding against potential abuse or mismanagement. Conclusion: In Knoxville, Tennessee, a Special Durable Power of Attorney for Bank Account Matters serves as a crucial legal tool in entrusting the management of one's financial affairs to a trusted agent. By granting specific powers, this power of attorney enables the agent to conduct various bank-related transactions, ensuring seamless and efficient financial management. Whether through a general or bank-specific special power of attorney, individuals can take proactive steps to safeguard their financial interests and maintain control even in challenging circumstances.