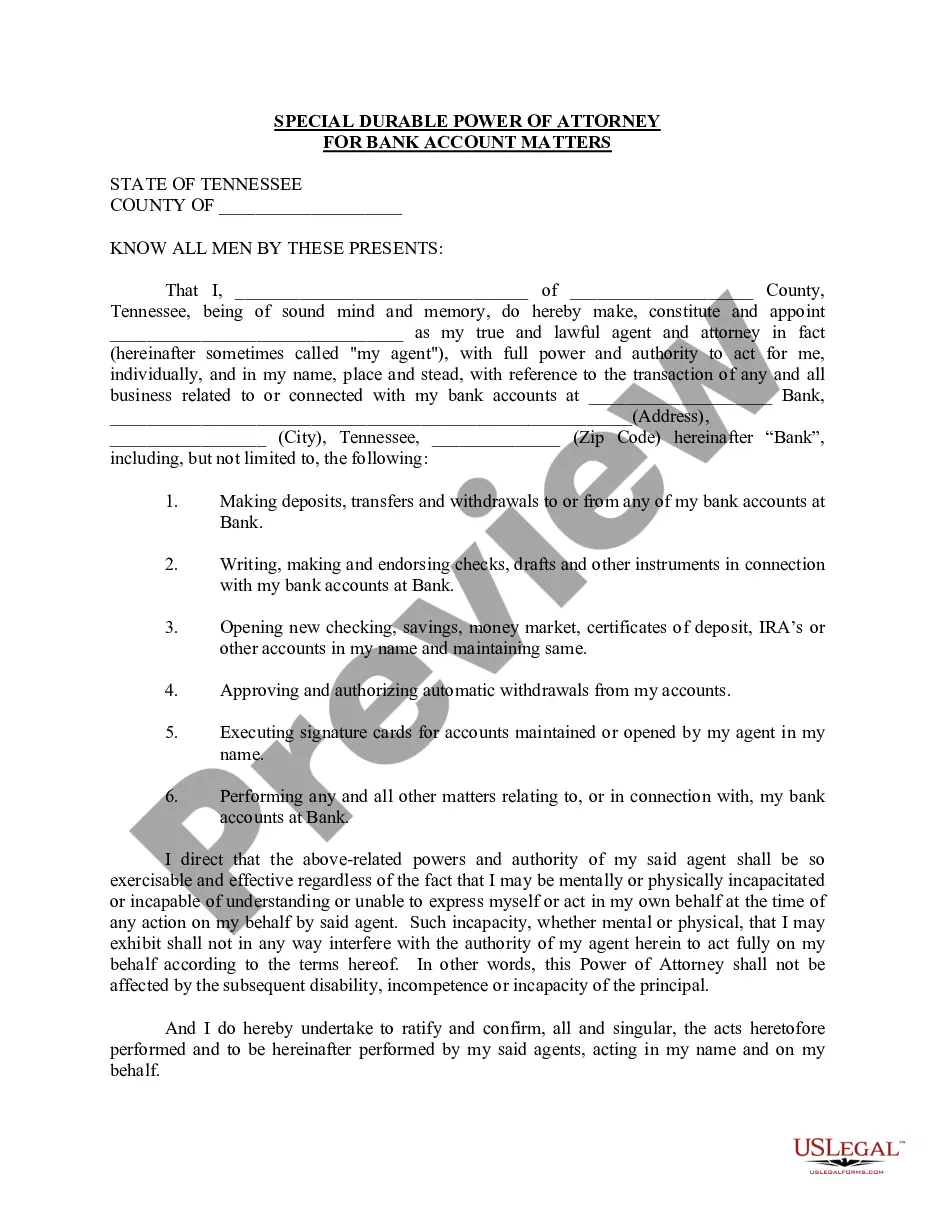

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

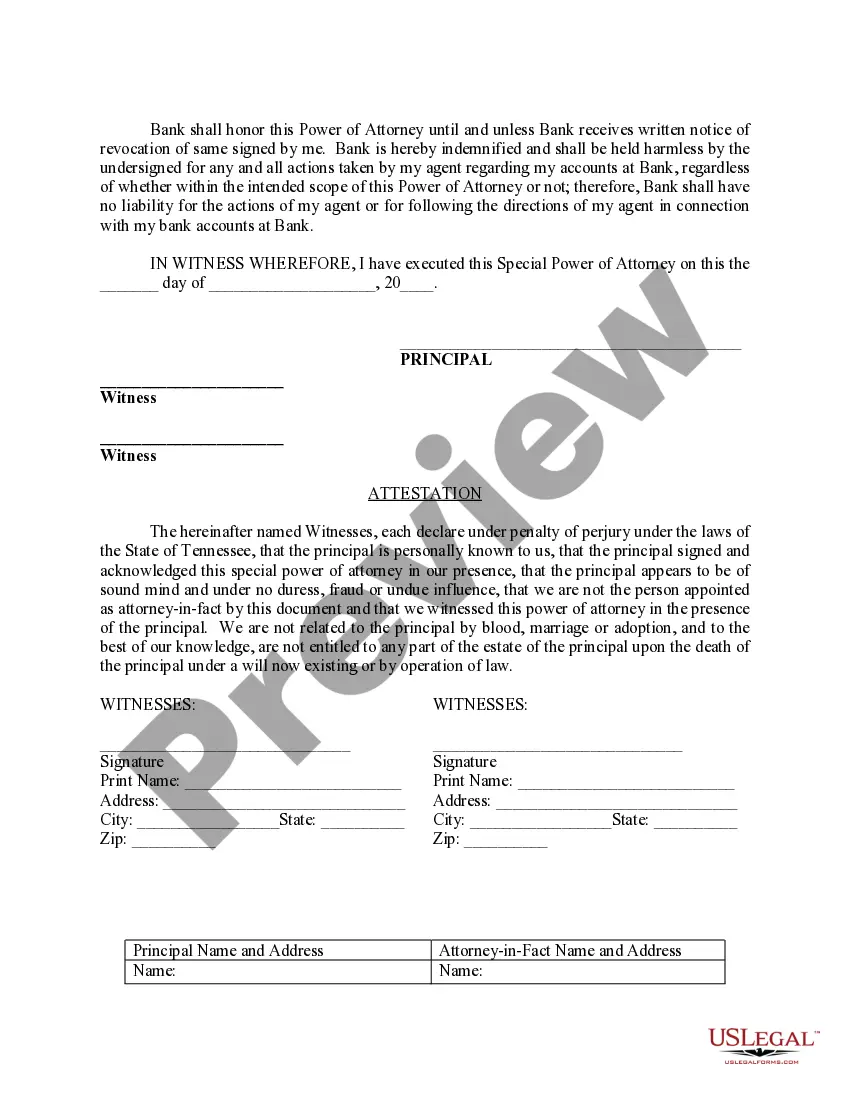

A Memphis Tennessee Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated person (known as the attorney-in-fact or agent) the authority to manage and make decisions regarding the bank accounts of another individual (known as the principal). This type of power of attorney is specifically designed to address banking matters and can be essential in situations where the principal becomes incapacitated or is no longer able to manage their own financial affairs. Keywords: 1. Power of Attorney: This refers to the legal instrument by which the principal confers authority to the designated agent to act on their behalf. 2. Bank Account Matters: This covers a wide range of financial aspects related to the management of bank accounts, including but not limited to, deposits, withdrawals, transfers, opening or closing accounts, and handling overdrafts. 3. Durable: The durable aspect of this power of attorney means that it remains in effect even if the principal becomes incapacitated or mentally incompetent. Different Types of Memphis Tennessee Special Durable Power of Attorney for Bank Account Matters: 1. General Special Durable Power of Attorney for Bank Account Matters: This grants the agent broad authority to handle all banking matters on behalf of the principal, including managing multiple accounts, making financial decisions, and executing transactions. 2. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney specifies certain limitations or restrictions on the agent's authority, such as limiting the agent's powers to handle only a specific bank account or a specific type of transaction. 3. Temporary Special Durable Power of Attorney for Bank Account Matters: This power of attorney is effective for a temporary period, often used when the principal is temporarily unable to manage their own finances due to travel, illness, or other reasons. In all cases, it is crucial to consult with an attorney in Memphis, Tennessee to ensure that the power of attorney document meets the state's specific legal requirements and address the individual needs and circumstances of the principal.