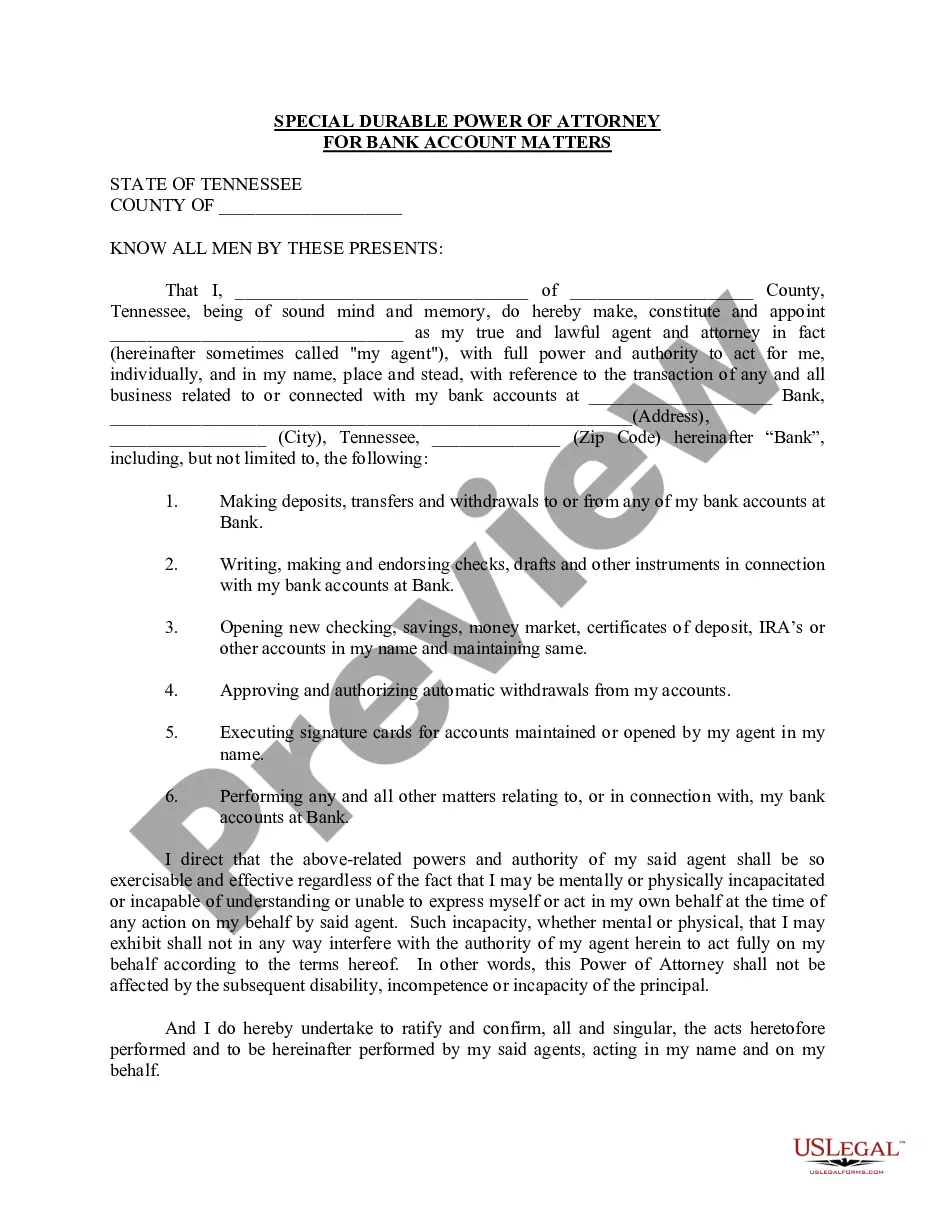

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

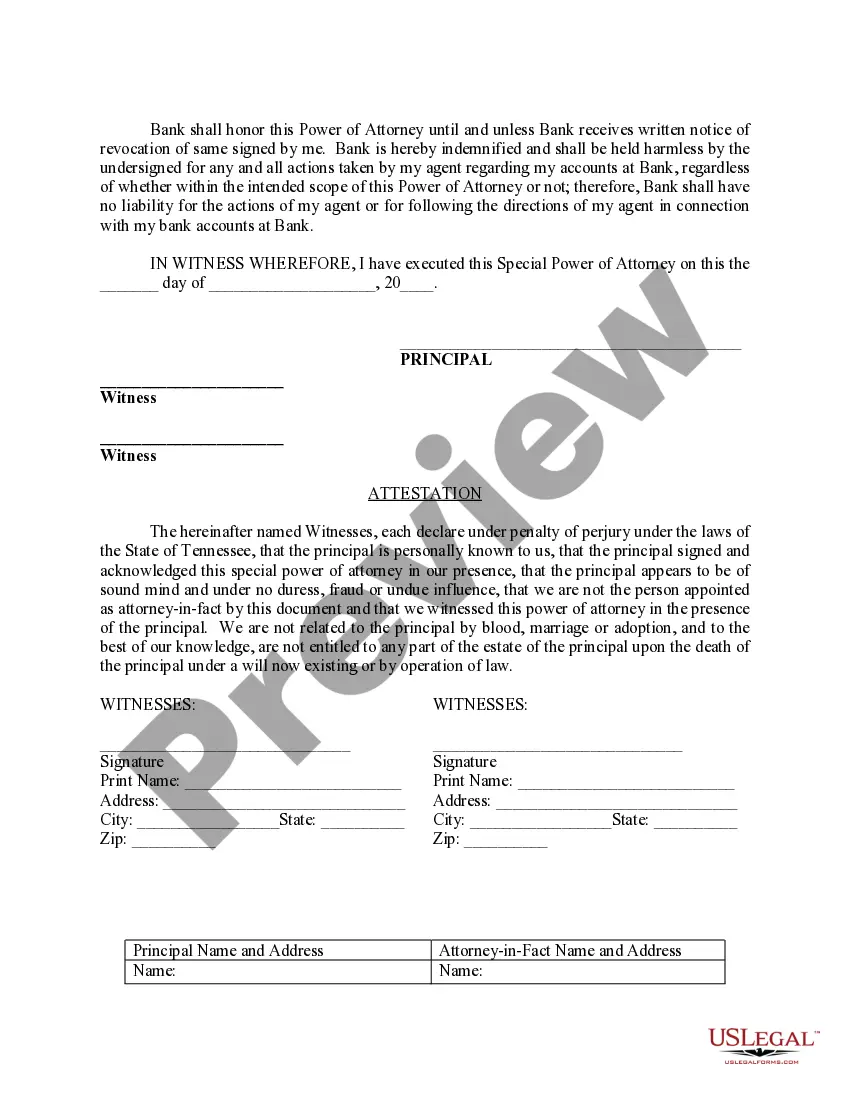

Nashville Tennessee Special Durable Power of Attorney for Bank Account Matters is a legally binding document that grants an individual the authority to make financial decisions and take action on behalf of another person specifically related to their bank accounts. This special power of attorney is often used when the account holder becomes incapacitated or unable to manage their own finances. In Nashville, there are various types of Special Durable Power of Attorney for Bank Account Matters, each serving different purposes and addressing specific scenarios. Some main types include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type limits the authority granted to the agent to perform specific tasks or for a defined period. It allows the agent to handle only certain financial matters, such as depositing checks, making withdrawals, or paying bills, on behalf of the account holder. 2. General Special Durable Power of Attorney for Bank Account Matters: This grants broad authority to the agent, allowing them to handle all financial matters on behalf of the account holder. The agent can manage the account, make investments, and handle banking transactions as necessary. 3. Medical Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney is specifically designed to address situations where the account holder is unable to make financial decisions due to medical conditions or incapacitation. The appointed agent can manage the account solely for medical-related expenses, including payments for medical bills, insurance premiums, and related expenses. It is important to consult with an attorney or legal expert in Nashville to ensure that the Special Durable Power of Attorney for Bank Account Matters is drafted appropriately, clearly defining the agent's authority and responsibilities. The document should adhere to the laws and regulations specific to Nashville and Tennessee, considering any additional requirements or provisions required by local authorities. Note: It is always recommended seeking professional legal advice and have the document reviewed by an attorney to ensure compliance with local laws and individual circumstances.Nashville Tennessee Special Durable Power of Attorney for Bank Account Matters is a legally binding document that grants an individual the authority to make financial decisions and take action on behalf of another person specifically related to their bank accounts. This special power of attorney is often used when the account holder becomes incapacitated or unable to manage their own finances. In Nashville, there are various types of Special Durable Power of Attorney for Bank Account Matters, each serving different purposes and addressing specific scenarios. Some main types include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type limits the authority granted to the agent to perform specific tasks or for a defined period. It allows the agent to handle only certain financial matters, such as depositing checks, making withdrawals, or paying bills, on behalf of the account holder. 2. General Special Durable Power of Attorney for Bank Account Matters: This grants broad authority to the agent, allowing them to handle all financial matters on behalf of the account holder. The agent can manage the account, make investments, and handle banking transactions as necessary. 3. Medical Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney is specifically designed to address situations where the account holder is unable to make financial decisions due to medical conditions or incapacitation. The appointed agent can manage the account solely for medical-related expenses, including payments for medical bills, insurance premiums, and related expenses. It is important to consult with an attorney or legal expert in Nashville to ensure that the Special Durable Power of Attorney for Bank Account Matters is drafted appropriately, clearly defining the agent's authority and responsibilities. The document should adhere to the laws and regulations specific to Nashville and Tennessee, considering any additional requirements or provisions required by local authorities. Note: It is always recommended seeking professional legal advice and have the document reviewed by an attorney to ensure compliance with local laws and individual circumstances.